Enlarge image

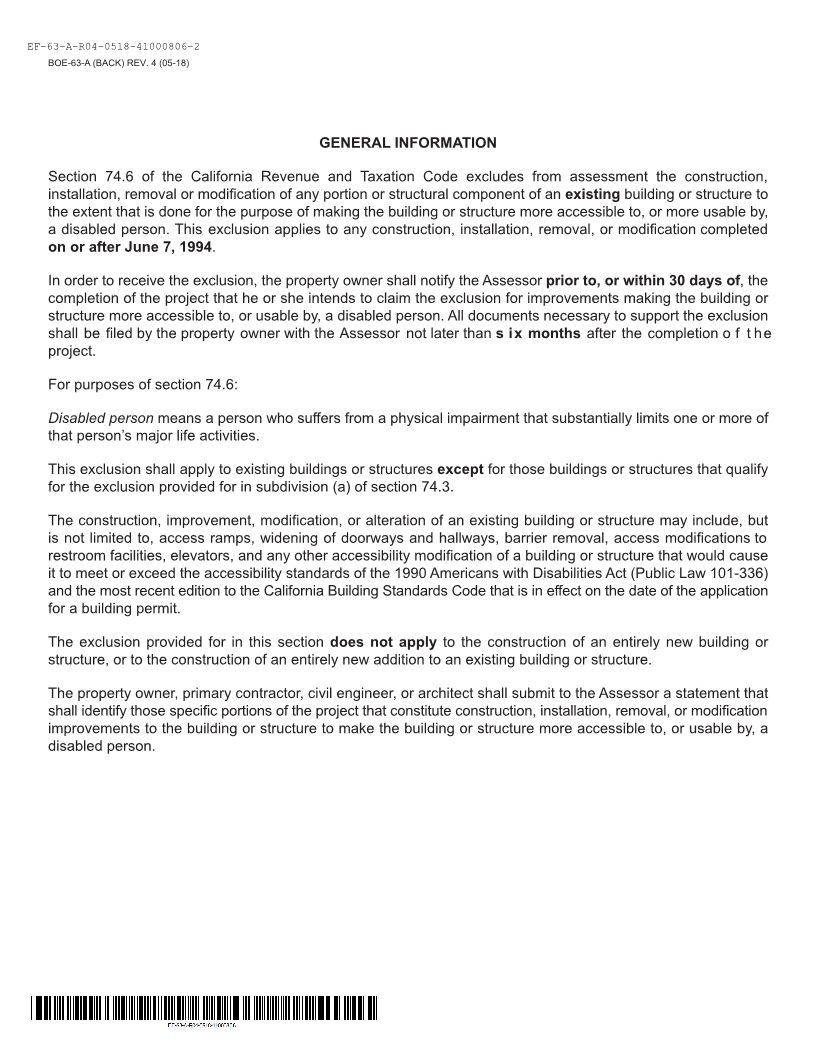

MARK CHURCH

EF-63-A-R04-0518-41000806-1 Assessor - County Clerk - Recorder

BOE-63-A (FRONT) REV. (4 05 1- 8) 555 County Center

CLAIM FOR DISABLED ACCESSIBILITY CONSTRUCTION Redwood City, CA 94063

EXCLUSION FROM ASSESSMENT FOR ADA COMPLIANCE P 650.363.4500 F 650.599.7435

email assessor@smcacre.org

web www.smcacre.org

THIS FORM MUST BE FILED WITH THE ASSESSOR

PRIOR TO, OR WITHIN 30 DAYS OF, COMPLETION

OF CONSTRUCTION.

CLAIMANT NAME ASSESSOR’S PARCEL NUMBER PERMIT NUMBER

ADDRESS OF DWELLING - STREET CITY STATE ZIP

MAILING ADDRESS - STREET CITY STATE ZIP

STATEMENTS

1. As the owner of the property described herein, I completed, or will complete, construction on this property on

, and therefore claim the construction exclusion from assessment

provided by section 74.6 of the California Revenue and Taxation Code.

2. Iundersttexclusfassessmenttconstruction,installation,modificatofany

portion or structural component of an existing building or structure to the extent that it is done for the purpose of making the

existing building or structure more accessible to, or more usable by, a disabled person.

3. I further understand this exclusion does not encompass the exclusion provided by Revenue and Taxation Code

section 74.3 for owner-occupied residences and does not apply to the construction of an entirely new building or structure, or

to the construction of an entirely new addition to an existing building or structure.

4. Thespecificportionsoftheprojectthatareeligibleforthisexclusionare:

THIS EXCLUSION EXPIRES UPON CHANGE OF OWNERSHIP OF THE PROPERTY

CERTIFICATION

I certify (or declare) under penalty of perjury under the laws of the State of California

that the foregoing statements are true and correct.

tSIGNATURE OF CLAIMANT OR LEGAL REPRESENTATIVE DATE

tSIGNATURE OF CLAIMANT OR LEGAL REPRESENTATIVE DATE

MAILING ADDRESS DAYTIME PHONE NUMBER

( )

CITY, STATE, ZIP E-MAIL ADDRESS

THE OWNER MUST SUBMIT ALL DOCUMENTS SUPPORTING THIS CLAIM TO FOR ASSESSOR’S USE ONLY

THE ASSESSOR NO LATER THAN SIX MONTHS AFTER THE COMPLETION DATE RECEIVED

STATED IN #1 ABOVE. APPROVED

DENIED

REASON FOR DENIAL

THIS CLAIM IS A PUBLIC DOCUMENT AND IS SUBJECT TO PUBLIC INSPECTION.