Enlarge image

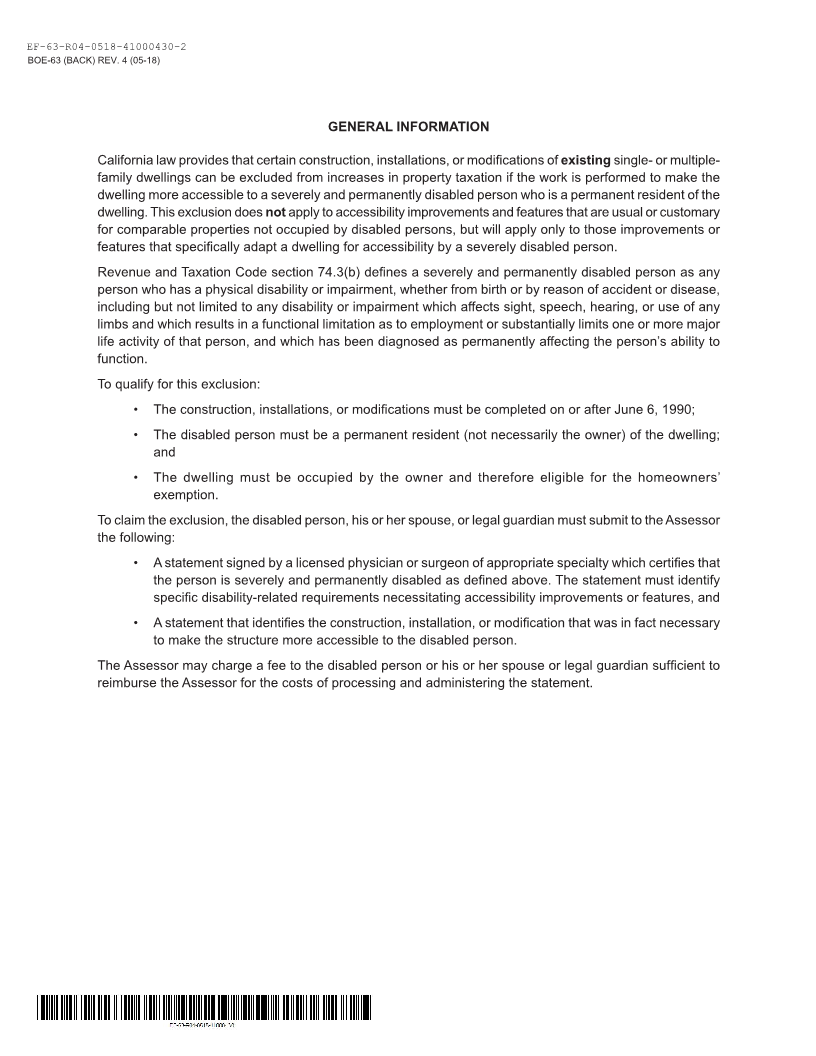

MARK CHURCH

EF-63-R04-0518-41000430-1 Assessor - County Clerk - Recorder

BOE-63 (FRONT) REV. (4 05 1- 8) 555 County Center

DISABLED PERSONS CLAIM FOR Redwood City, CA 94063

EXCLUSION OF NEW CONSTRUCTION P 650.363.4500 F 650.599.7435

FOR OCCUPIED DWELLING email assessor@smcacre.org

web www.smcacre.org

This claim is for the exclusion from reassessment of any

construction to make an existing dwelling more accessible

to a severely and permanently disabled person who is

a permanent resident of the dwelling. Only construction

completed on or after June 6, 1990 is eligible. The

exclusion does not apply to accessibility improvements

and features that are usual or customary for comparable

properties not occupied by disabled persons.

TO BE COMPLETED BY THE CLAIMANT (DISABLED PERSON, SPOUSE OR LEGAL GUARDIAN)

PRINT NAME OF CLAIMANT PRINT NAME OF DISABLED PERSON (if different)

ADDRESS OF PROPERTY WITH NEW CONSTRUCTION ASSESSOR’S PARCEL NUMBER

DESCRIBE THE IMPROVEMENTS MADE

DATE CONSTRUCTION COMPLETED

CERTIFICATION

I certify (or declare) under penalty of perjury under the laws of the State of California that the disabled person named above permanently

resides at the property address and that the construction was to make the residence more accessible to the disabled person.

CLAIMANT’S SIGNATURE DAYTIME PHONE NUMBER DATE

W ( )

E-MAIL ADDRESS

TO BE COMPLETED BY PHYSICIAN

The claimant named above is applying to have a portion or all of the construction, installation or modifi cation of a dwelling excluded from

reappraisal because it makes the dwelling more accessible to a severely and permanent disabled person. For purposes of this tax benefi t,

the law defi nes a severely and permanently disabled person as any person who has a physical disability or impairment which affects sight,

speech, hearing, or the use of any limbs and which results in a functional limitation as to employment or substantially limits one or more

major life activity of that person, and which has been diagnosed as permanently affecting the person’s ability to function.

NAME OF DISABLED PERSON (please print)

PLEASE IDENTIFY THE SPECIFIC DISABILITY-RELATED REQUIREMENTS NECESSITATING ACCESSIBILITY IMPROVEMENTS OR FEATURES

I am a licensed Physician Surgeon My specialty is

DECLARATION

I declare that the disabled person named above is severely and permanently disabled according to the defi nition

above and that the construction, installation or modifi cation makes the dwelling more accessible to that person.

PHYSICIAN’S SIGNATURE DATE

W

PHYSICIAN’S NAME (print or type) PHYSICIAN’S PHONE NUMBER

( )