Enlarge image

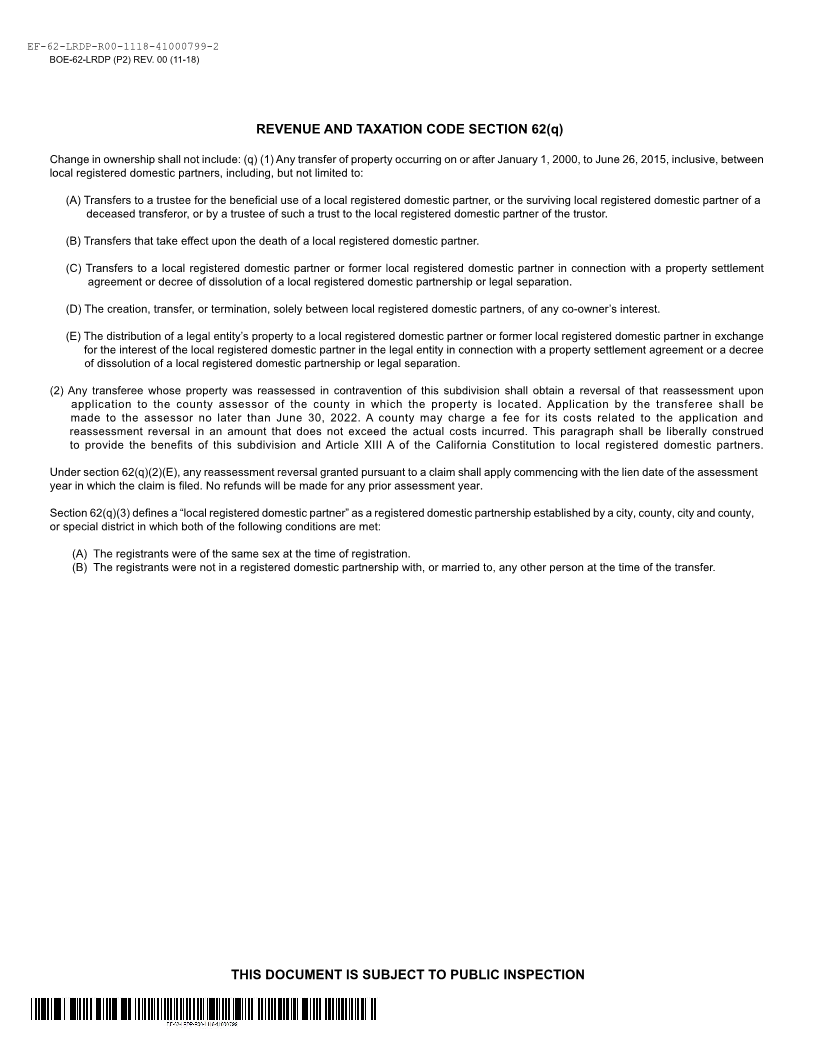

MARK CHURCH

EF-62-LRDP-R00-1118-41000799-1 Assessor - County Clerk - Recorder

BOE-62-LRDP (P1) REV. 00 (11-18) 555 County Center

Redwood City, CA 94063

P 650.363.4500 F 650.599.7435

CLAIM FOR REASSESSMENT REVERSAL FOR email assessor@smcacre.org

LOCAL REGISTERED DOMESTIC PARTNERS web www.smcacre.org

A. Description of the property that was reassessed for a change in ownership:

STREET ADDRESS ASSESSOR’S PARCEL NUMBER

CITY COUNTY RECORDER’S DOCUMENT NUMBER

DATE OF TRANSFER OF INTEREST RECORDING DATE

NOTE: Transfers eligible for this exclusion are only those that occurred during the period January 1, 2000 through June 26, 2015.

B. The parties to the transfer of interest in the above described property:

TRANSFEROR DATE OF DEATH, IF APPLICABLE:

TRANSFEREE

C. Date of the creation of the registered domestic partnership:

(NOTE: date must be prior to or concurrent with the date of transfer in item B above.)

registered

domestic partners.

CERTIFICATION

I certify (or declare) that the foregoing and all information hereon, including any accompanying statements or documents, is true and correct to

the best of my knowledge and that I was a local registered domestic partner on the date of transfer.

tSIGNATURE OF TRANSFEREE REGISTERED DOMESTIC PARTNER OR LEGAL REPRESENTATIVE DATE

PRINTED NAME OF TRANSFEREE OR LEGAL REPRESENTATIVE TITLE

MAILING ADDRESS

DAYTIME PHONE NUMBER EMAIL ADDRESS

( )

Be sure to attach a copy of the local registered domestic partnership document.

Your claim will not be processed without that certificate.

Claim must be filed with the county assessor by June 30, 2022.

THIS DOCUMENT IS SUBJECT TO PUBLIC INSPECTION