Enlarge image

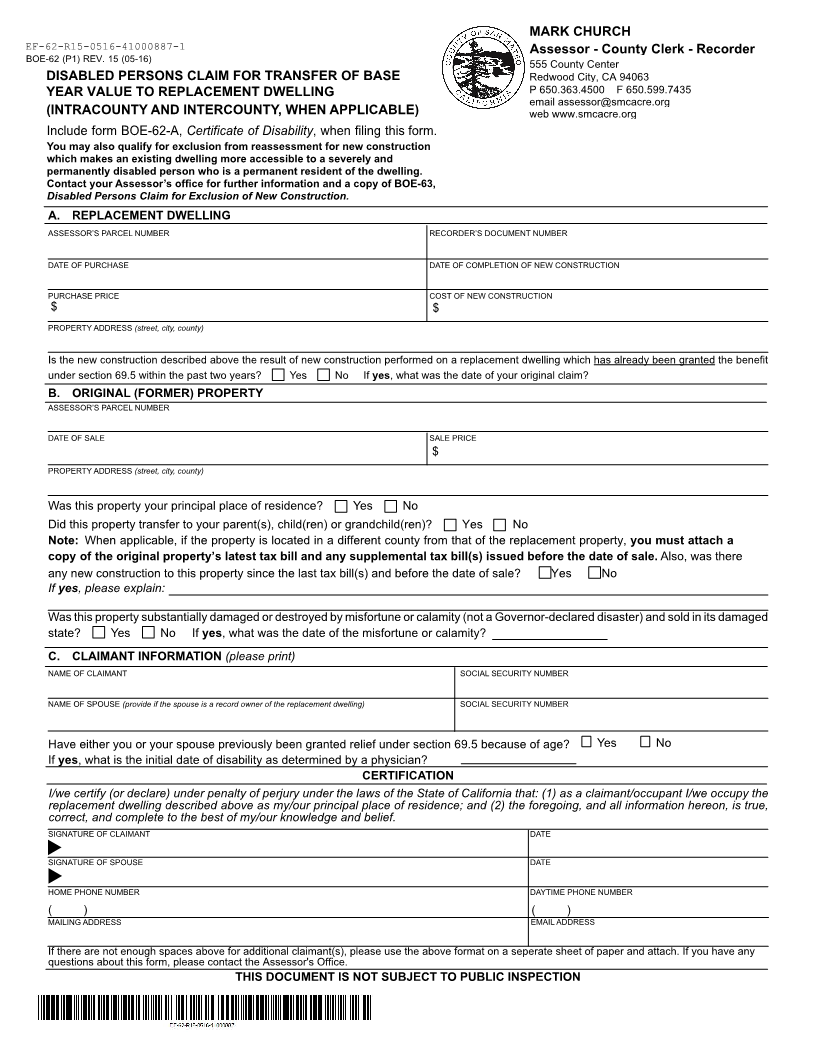

MARK CHURCH

EF-62-R15-0516-41000887-1 Assessor - County Clerk - Recorder

BOE-62 (P1) REV. 1 5(05-1 )6 555 County Center

DISABLED PERSONS CLAIM FOR TRANSFER OF BASE Redwood City, CA 94063

YEAR VALUE TO REPLACEMENT DWELLING P 650.363.4500 F 650.599.7435

email assessor@smcacre.org

(INTRACOUNTY AND INTERCOUNTY, WHEN APPLICABLE) web www.smcacre.org

Include form BOE-62-A, Certificate of Disability, when filing this form.

You may also qualify for exclusion from reassessment for new construction

which makes an existing dwelling more accessible to a severely and

permanently disabled person who is a permanent resident of the dwelling.

Contact your Assessor’s office for further information and a copy of BOE-63,

Disabled Persons Claim for Exclusion of New Construction.

A. REPLACEMENT DWELLING

ASSESSOR’S PARCEL NUMBER RECORDER’S DOCUMENT NUMBER

DATE OF PURCHASE DATE OF COMPLETION OF NEW CONSTRUCTION

PURCHASE PRICE COST OF NEW CONSTRUCTION

$ $

PROPERTY ADDRESS (street, city, county)

Is the new construction described above the result of new construction performed on a replacement dwelling which has already been granted the benefit

under section 69.5 within the past two years? Yes No If yes, what was the date of your original claim?

B. ORIGINAL (FORMER) PROPERTY

ASSESSOR’S PARCEL NUMBER

DATE OF SALE SALE PRICE

$

PROPERTY ADDRESS (street, city, county)

Was this property your principal place of residence? Yes No

Did this property transfer to your parent(s), child(ren) or grandchild(ren)? Yes No

Note: When applicable, if the property is located in a different county from that of the replacement property, you must attach a

copy of the original property’s latest tax bill and any supplemental tax bill(s) issued before the date of sale. Also, was there

any new construction to this property since the last tax bill(s) and before the date of sale? Yes No

If yes, please explain:

Was this property substantially damaged or destroyed by misfortune or calamity (not a Governor-declared disaster) and sold in its damaged

state? Yes No If yes, what was the date of the misfortune or calamity?

C. CLAIMANT INFORMATION (please print)

NAME OF CLAIMANT SOCIAL SECURITY NUMBER

NAME OF SPOUSE (provide if the spouse is a record owner of the replacement dwelling) SOCIAL SECURITY NUMBER

Have either you or your spouse previously been granted relief under section 69.5 because of age? Yes No

If yes, what is the initial date of disability as determined by a physician?

CERTIFICATION

I/we certify (or declare) under penalty of perjury under the laws of the State of California that: (1) as a claimant/occupant I/we occupy the

replacement dwelling described above as my/our principal place of residence; and (2) the foregoing, and all information hereon, is true,

correct, and complete to the best of my/our knowledge and belief.

SIGNATURE OF CLAIMANT DATE

t

SIGNATURE OF SPOUSE DATE

t

HOME PHONE NUMBER DAYTIME PHONE NUMBER

( ) ( )

MAILING ADDRESS EMAIL ADDRESS

If there are not enough spaces above for additional claimant(s), please use the above format on a seperate sheet of paper and attach. If you have any

questions about this form, please contact the Assessor's Office.

THIS DOCUMENT IS NOT SUBJECT TO PUBLIC INSPECTION