Enlarge image

MARK CHURCH

EF-60-NR-R03-0208-41000836-1 Assessor - County Clerk - Recorder

BOE-60-NR (FRONT) REV. 3 (2-08) 555 County Center

Redwood City, CA 94063

NOTICE OF RESCISSION OF CLAIM P 650.363.4500 F 650.599.7435

TO TRANSFER BASE YEAR VALUE TO email assessor@smcacre.org

REPLACEMENT DWELLING web www.smcacre.org

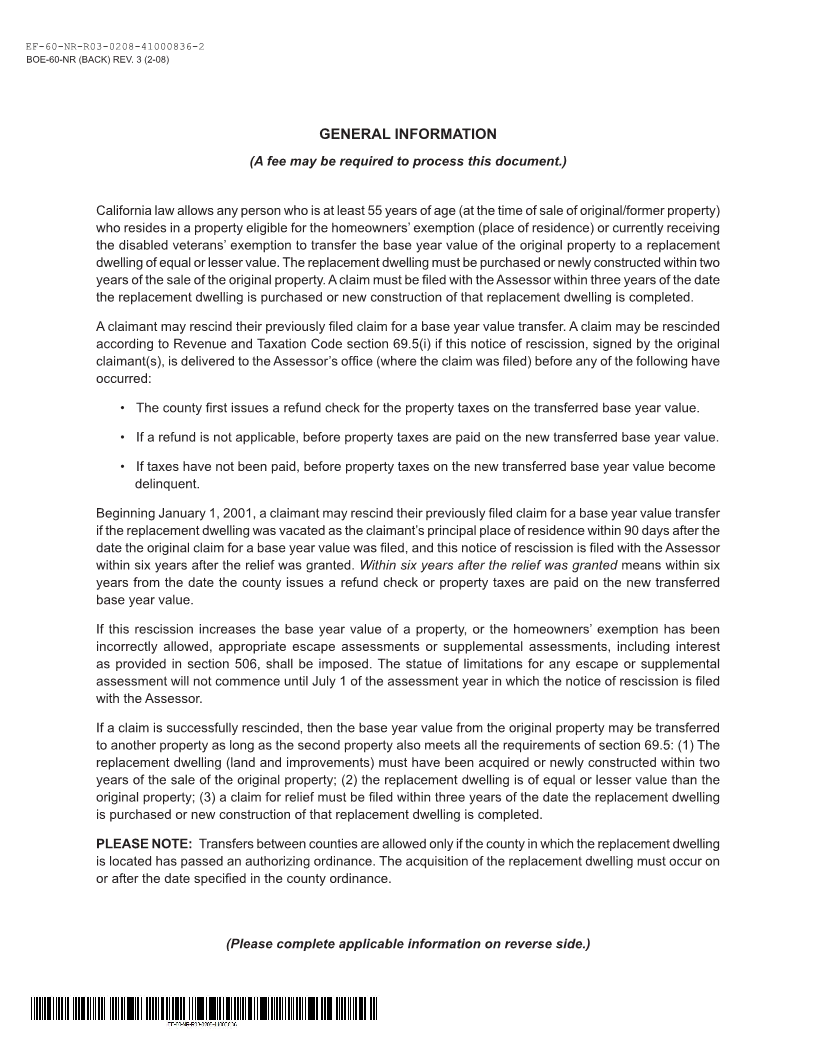

REPLACEMENT DWELLING

ASSESSOR’S PARCEL NUMBER RECORDER’S DOCUMENT NUMBER

DATE OF PURCHASE PURCHASE PRICE DATE OF COMPLETION OF NEW CONSTRUCTION COST OF NEW CONSTRUCTION

$ $

PROPERTY ADDRESS (street, city, county, state, zip code)

DATE ORIGINAL CLAIM WAS FILED

CLAIMANT INFORMATION (please print)

NAME OF CLAIMANT SOCIAL SECURITY NUMBER

NAME OF SPOUSE (provide if the spouse is a record owner of either the original property or the replacement dwelling) SOCIAL SECURITY NUMBER

Please check the box under which you are fi ling this Notice of Rescission:

(1) This Notice of Rescission must be fi led with the Assessor:

• Before the date the county fi rst issues a refund check for the property taxes on the transferred base year value.

• If a refund is not applicable, before any property taxes are paid on the new transferred base year value.

• If taxes have not been paid, before any property taxes on the new transferred base year value become delinquent.

OR

(2) This Notice of Rescission must be fi led with the Assessor:

• Within 6 years after relief was granted, and

• The replacement property was vacated as the principal place of residence within 90 days after the original claim

was fi led.

CERTIFICATION

I/We certify (or declare) under penalty of perjury under the laws of the State of Californiathat the foregoing, and all

information hereon, is true, correct, and complete to thebest of my/our knowledge and belief.

CLAIMANT’S SIGNATURE DATE

W

SPOUSE’S SIGNATURE DATE

W

HOME PHONE NUMBER DAYTIME PHONE NUMBER

( ) ( )

MAILING ADDRESS (including zip code) E-MAIL ADDRESS

All information provided on this form is subject to verifi cation.

IF YOUR APPLICATION IS INCOMPLETE, YOUR NOTICE OF RESCISSION MAY NOT BE PROCESSED.

THIS NOTICE IS NOT SUBJECT TO PUBLIC INSPECTION