Enlarge image

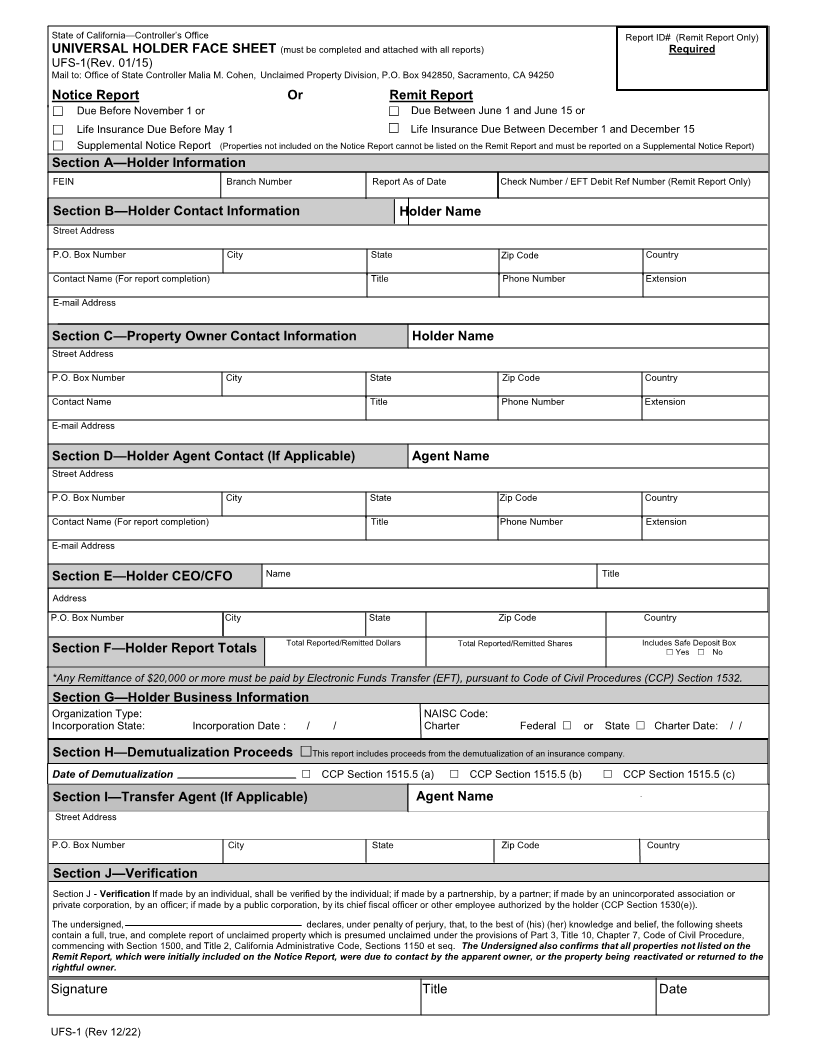

State of California—Controller’sOffice Report ID# (Remit Report Only)

UNIVERSAL HOLDER FACE SHEET (must be completed and attached with all reports) Required

UFS-1(Rev. 01/15)

Mail to: Office of State Controller Malia M. Cohen, Unclaimed Property Division, P.O. Box 942850, Sacramento, CA 94250

Notice Report Or Remit Report

Due Before November 1 or Due Between June 1 and June 15 or

Life Insurance Due Before May 1 Life Insurance Due Between December 1 and December 15

Supplemental Notice Report Notice Report cannotnot (Properties included the on Report andRemit be listed the on aon must be reported Supplemental Report)Notice

Section A—Holder Information

FEIN Branch Number Report As of Date Check Number / EFT Debit Ref Number (Remit Report Only)

Section B—Holder Contact Information Holder Name

Street Address

P.O. Box Number City State Zip Code Country

Contact Name (For report completion) Title Phone Number Extension

E-mail Address

Section C—Property Owner Contact Information Holder Name

Street Address

P.O. Box Number City State Zip Code Country

Contact Name Title Phone Number Extension

E-mail Address

Section D—Holder Agent Contact (If Applicable) Agent Name

Street Address

P.O. Box Number City State Zip Code Country

Contact Name (For report completion) Title Phone Number Extension

E-mail Address

Section E—Holder CEO/CFO Name Title

Address

P.O. Box Number City State Zip Code Country

Section F—Holder Report Totals Yes

Total Reported/Remitted Dollars Total Reported/Remitted Shares Includes SafeDepositNoBox

*Any Remittance of $20,000 or more must be paid by Electronic Funds Transfer (EFT), pursuant to Code of Civil Procedures (CCP )Section 1532.

Section G—Holder Business Information

Organization Type: NAISC Code:

Incorporation State: Incorporation Date : / / Charter Federal or State Charter Date: / /

Section H—Demutualization Proceeds This report includes proceeds from the demutualization of an insurance company.

Date of Demutualization CCP Section 1515.5 (a) CCP Section 1515.5 (b) CCP Section 1515.5 (c)

Section I Transfer— Agent (If Applicable) Agent Name

Street Address

P.O. Box Number City State Zip Code Country

Section J—Verification

Section J - Verification If made by an individual, shall be verified by the individual; if made by a partnership, by a partner; if made by an unincorporated association or

private corporation, by an officer; if made by a public corporation, by its chief fiscal officer or other employee authorized by the holder (CCP Section 1530(e)).

The undersigned, declares, under penalty of perjury, that, to the best of (his) (her) knowledge and belief, the following sheets

contain a full, true, and complete report of unclaimed property which is presumed unclaimed under the provisions of Part 3, Title 10, Chapter 7, Code of Civil Procedure,

commencing with Section 1500, and Title 2, California Administrative Code, Sections 1150 et seq. The Undersigned also confirms that all properties not listed on the

Remit Report, which were initially included on the Notice Report, were due to contact by the apparent owner, or the property being reactivated or returned to the

rightful owner.

Signature Title Date

UFS-1 (Rev12 22 / )