Enlarge image

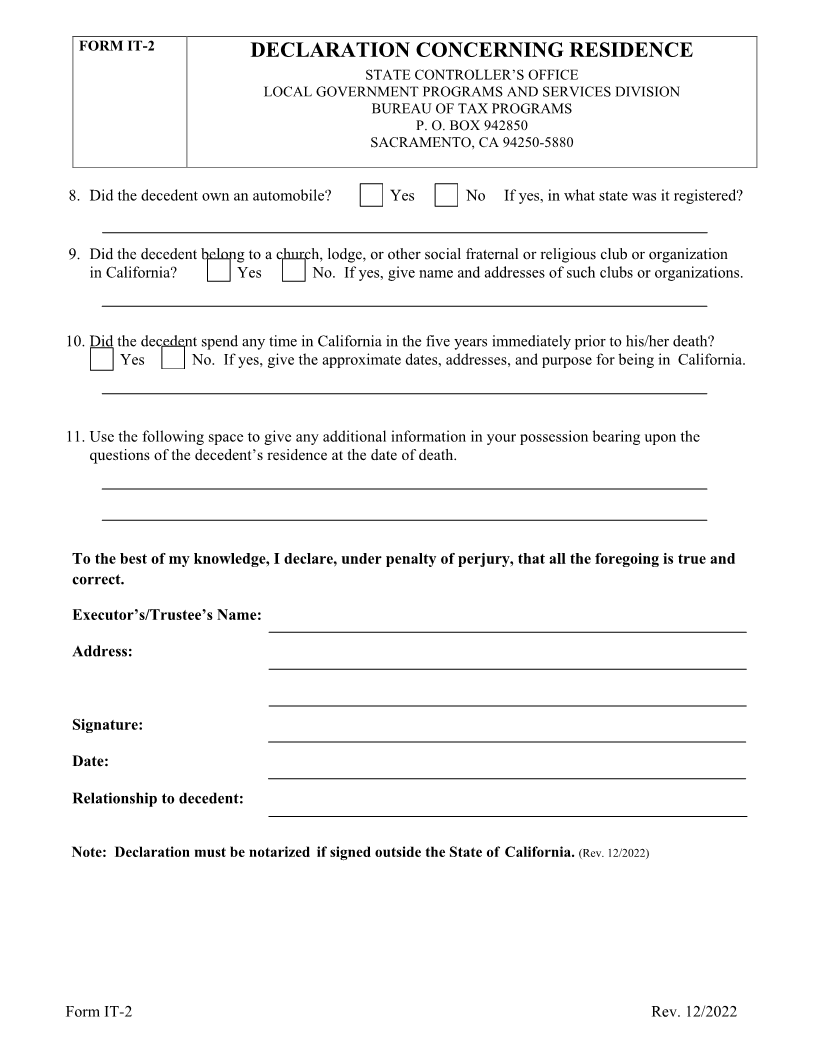

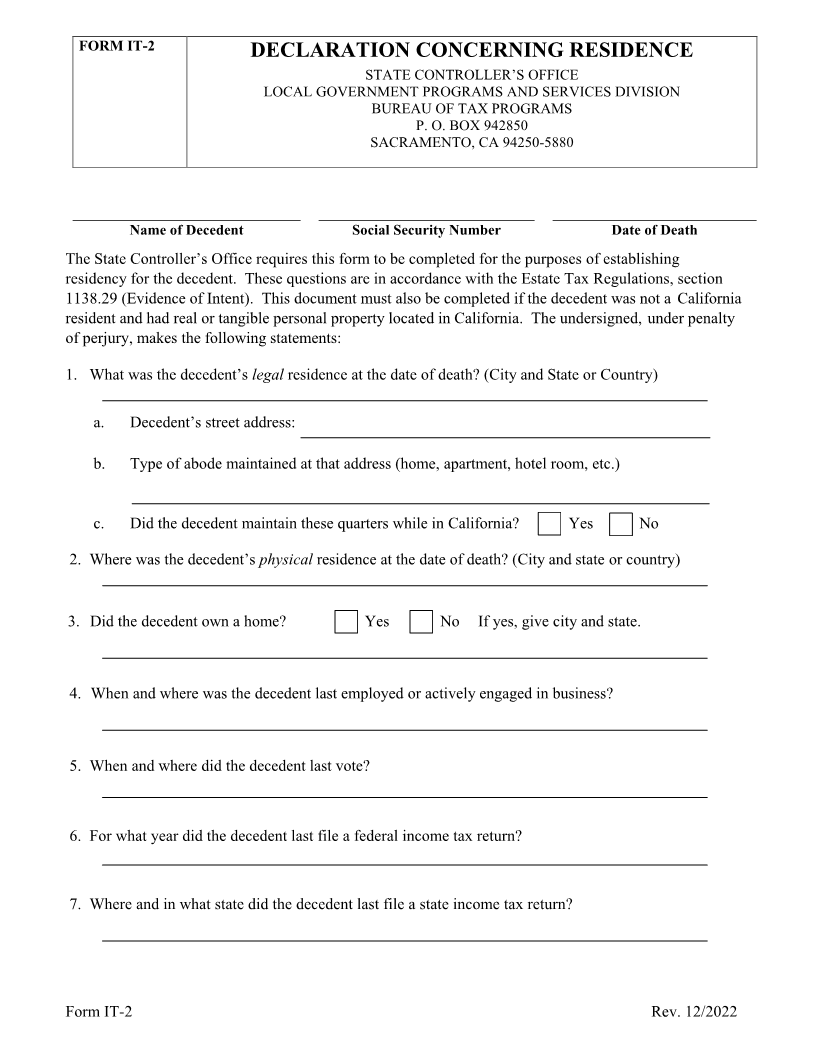

FORM IT-2

DECLARATION CONCERNING RESIDENCE

STATE CONTROLLER’S OFFICE

LOCAL GOVERNMENT PROGRAMS AND SERVICES DIVISION

BUREAU OF TAX PROGRAMS

P. O. BOX 942850

SACRAMENTO, CA 94250-5880

Name of Decedent Social Security Number Date of Death

The State Controller’s Office requires this form to be completed for the purposes of establishing

residency for the decedent. These questions are in accordance with the Estate Tax Regulations, section

1138.29 (Evidence of Intent). This document must also be completed if the decedent was not a California

resident and had real or tangible personal property located in California. The undersigned, under penalty

of perjury, makes the following statements:

1. What was the decedent’s legal residence at the date of death? (City and State or Country)

a. Decedent’s street address:

b. Type ofabode maintained at that address (home, apartment, hotel room, etc.)

c. Did the decedent maintain these quarters while in California? ( ) Yes ( ) No

2. Where was the decedent’s physical residence at the date of death? (City and state or country)

3. Did the decedent own a home? ( ) Yes ( ) No If yes, give city and state.

4. When and where was the decedent last employed or actively engaged in business?

5. When and where did the decedent last vote?

6. For what year did the decedent last file a federal income tax return?

7. Where and in what state did the decedent last file a state income tax return?

Form IT-2 Rev. 12/2022