Enlarge image

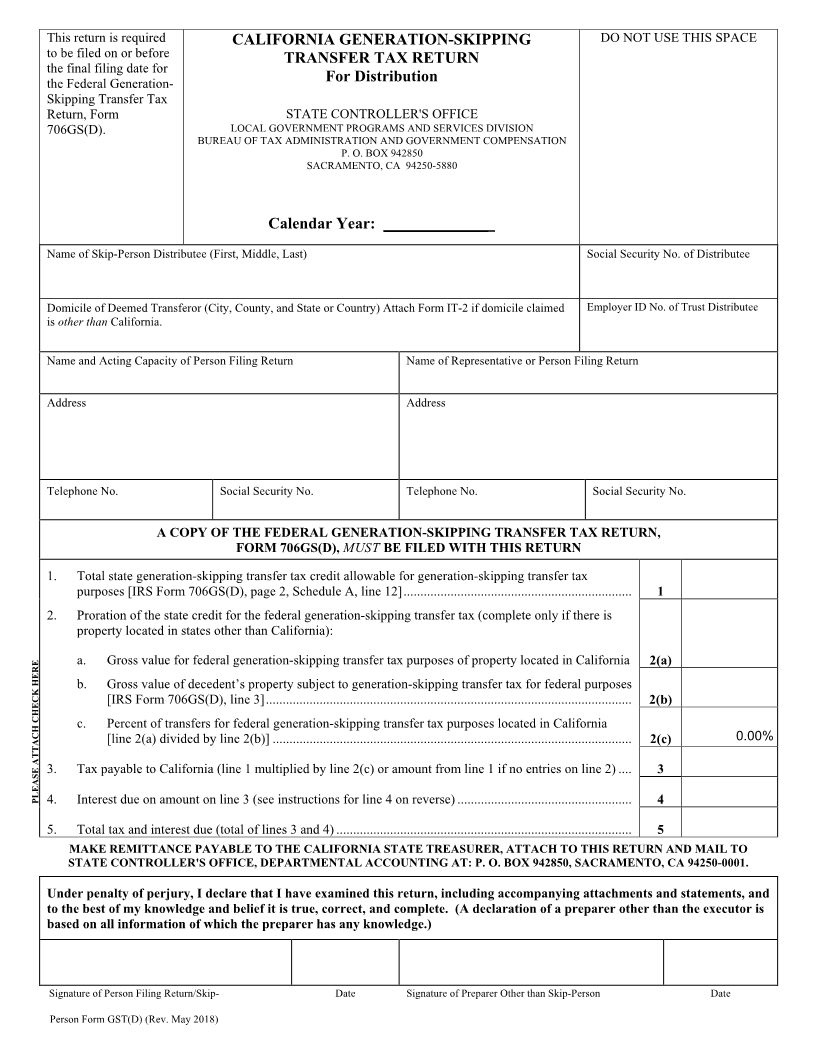

This return is required CALIFORNIA GENERATION-SKIPPING DO NOT USE THIS SPACE to be filed on or before TRANSFER TAX RETURN the final filing date for the Federal Generation- For Distribution Skipping Transfer Tax Return, Form STATE CONTROLLER'S OFFICE 706GS(D). LOCAL GOVERNMENT PROGRAMS AND SERVICES DIVISION BUREAU OF TAX ADMINISTRATION AND GOVERNMENT COMPENSATION P. O. BOX 942850 SACRAMENTO, CA 94250-5880 Calendar Year: _____________ Name of Skip-Person Distributee (First, Middle, Last) Social Security No. of Distributee Domicile of Deemed Transferor (City, County, and State or Country) Attach Form IT-2 if domicile claimed Employer ID No. of Trust Distributee is other than California. Name and Acting Capacity of Person Filing Return Name of Representative or Person Filing Return Address Address Telephone No. Social Security No. Telephone No. Social Security No. A COPY OF THE FEDERAL GENERATION-SKIPPING TRANSFER TAX RETURN, FORM 706GS(D), MUST BE FILED WITH THIS RETURN 1. Total state generation-skipping transfer tax credit allowable for generation-skipping transfer tax purposes [IRS Form 706GS(D), page 2, Schedule A, line 12].................................................................... 1 2. Proration of the state credit for the federal generation-skipping transfer tax (complete only if there is property located in states other than California): a. Gross value for federal generation-skipping transfer tax purposes of property located in California 2(a) b. Gross value of decedent’s property subject to generation-skipping transfer tax for federal purposes [IRS Form 706GS(D), line 3]............................................................................................................. 2(b) c. Percent of transfers for federal generation-skipping transfer tax purposes located in California [line 2(a) divided by line 2(b)]........................................................................................................... 2(c) 0.00% 3. Tax payable to California (line 1 multiplied by line 2(c) or amount from line 1 if no entries on line 2).... 3 PLEASE ATTACH CHECK HERE 4. Interest due on amount on line 3 (see instructions for line 4 on reverse).................................................... 4 5. Total tax and interest due (total of lines 3 and 4)........................................................................................ 5 MAKE REMITTANCE PAYABLE TO THE CALIFORNIA STATE TREASURER, ATTACH TO THIS RETURN AND MAIL TO STATE CONTROLLER'SOFFICE, DEPARTMENTAL ACCOUNTING AT :P. O. BOX 942850, SACRAMENTO, CA 94250-0001. Under penalty of perjury, I declare that I have examined this return, including accompanying attachments and statements, and to the best of my knowledge and belief it is true, correct, and complete. (A declaration of a preparer other than the executor is based on all information of which the preparer has any knowledge.) Signature of Person Filing Return/Skip- Date Signature of Preparer Other than Skip-Person Date Person Form GST(D) (Rev. May 2018)