Enlarge image

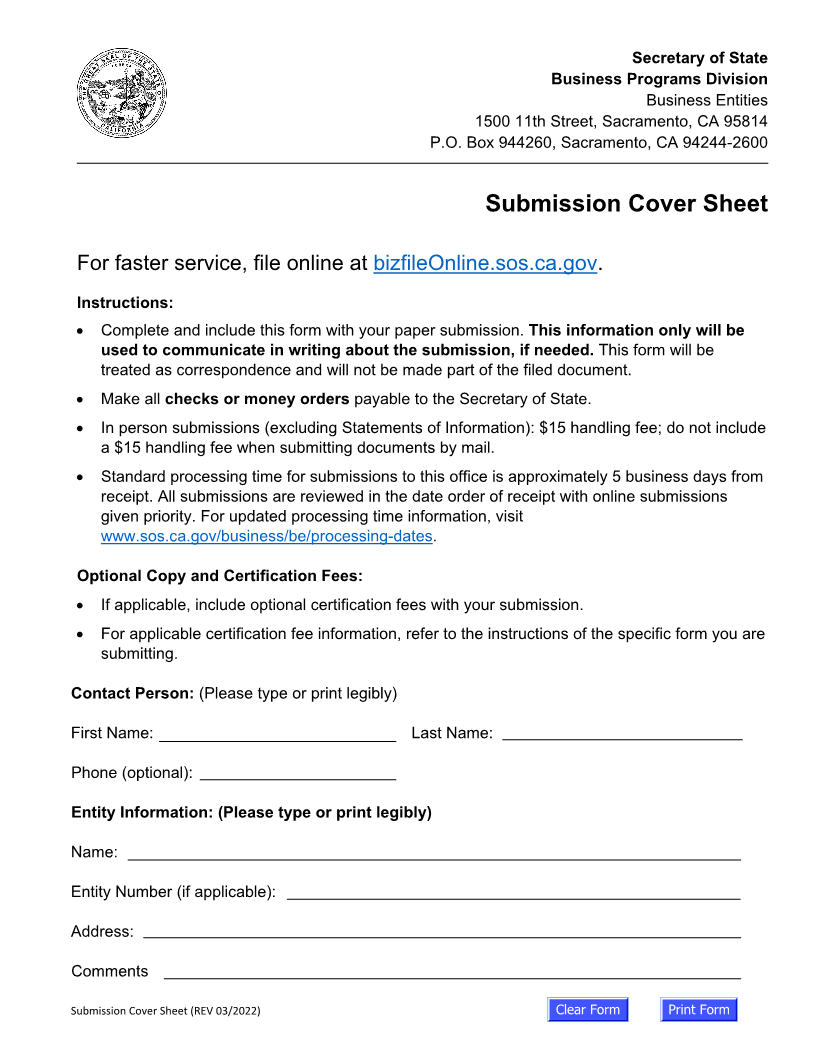

Secretary of State

Business Programs Division

Business Entities

1500 11th Street, Sacramento, CA 95814

P.O. Box 944260, Sacramento, CA 94244-2600

Submission Cover Sheet

For faster service, file online at bizfileOnline.sos.ca.gov .

Instructions:

• Complete and include this form with your paper submission. This information only will be

used to communicate in writing about the submission, if needed. This form will be

treated as correspondence and will not be made part of the filed document.

• Make all checks or money orders payable to the Secretary of State.

• In person submissions (excluding Statements of Information): $15 handling fee; do not include

a $15 handling fee when submitting documents by mail.

• Standard processing time for submissions to this office is approximately 5 business days from

receipt. All submissions are reviewed in the date order of receipt with online submissions

given priority. For updated processing time information, visit

www.sos.ca.gov/business/be/processing-dates.

Optional Copy and Certification Fees:

• If applicable, include optional certification fees with your submission.

• For applicable certification fee information, refer to the instructions of the specific form you are

submitting.

Contact Person: (Please type or print legibly)

First Name: Last Name:

Phone (optional):

Entity Information: (Please type or print legibly)

Name:

Entity Number (if applicable):

Address:

Comments

Submission Cover Sheet (REV 03/2022) Clear Form Print Form