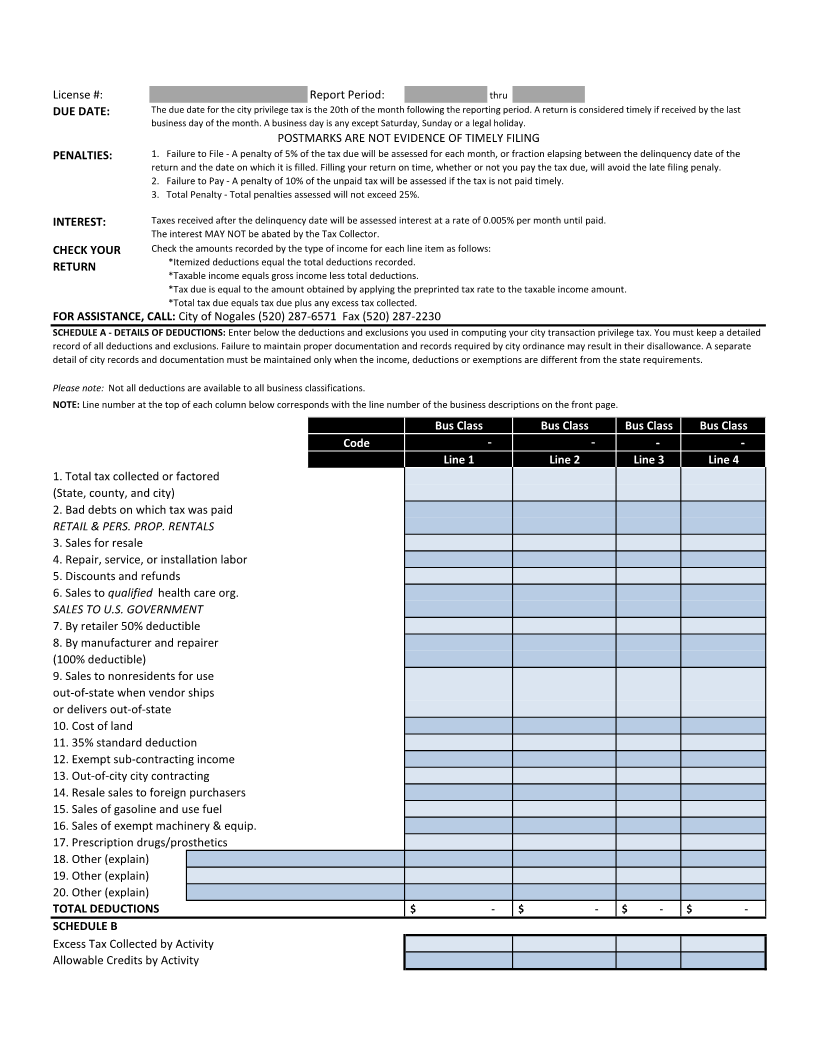

Enlarge image

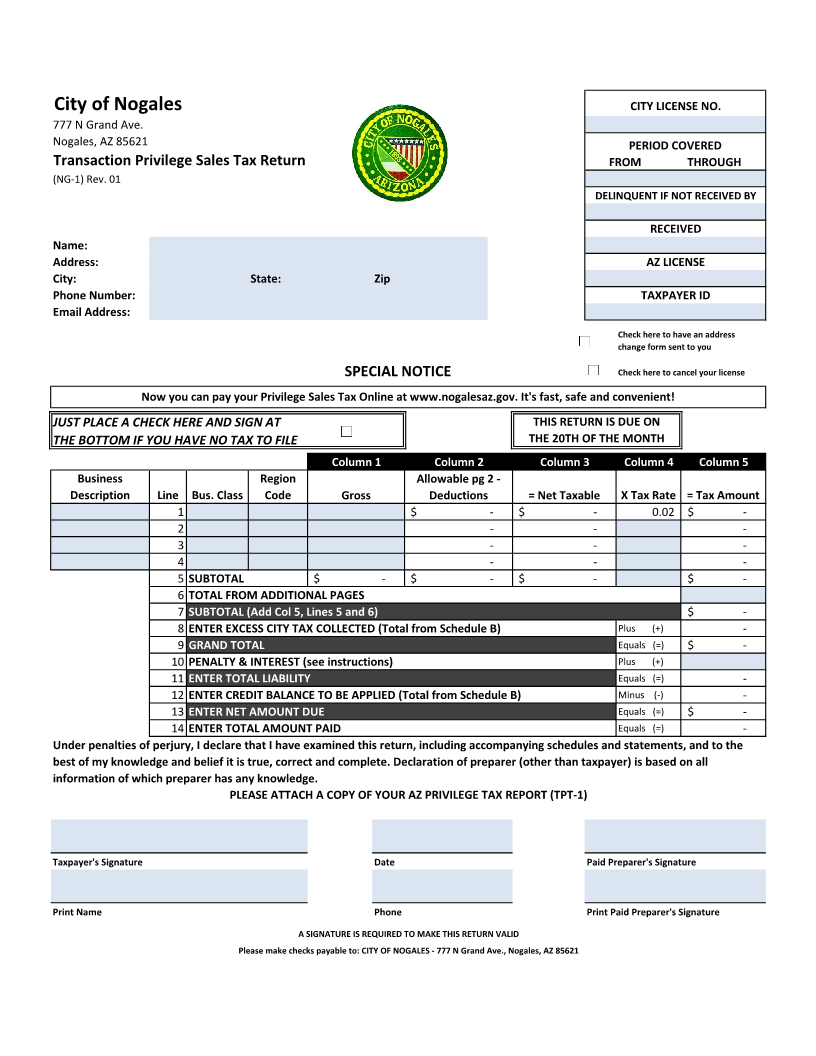

City of Nogales CITY LICENSE NO.

777 N Grand Ave.

Nogales, AZ 85621 PERIOD COVERED

Transaction Privilege Sales Tax Return FROM THROUGH

(NG-1) Rev. 01

DELINQUENT IF NOT RECEIVED BY

RECEIVED

Name:

Address: AZ LICENSE

City: State: Zip

Phone Number: TAXPAYER ID

Email Address:

Check here to have an address

change form sent to you

SPECIAL NOTICE Check here to cancel your license

Now you can pay your Privilege Sales Tax Online at www.nogalesaz.gov. It's fast, safe and convenient!

JUST PLACE A CHECK HERE AND SIGN AT THIS RETURN IS DUE ON

THE BOTTOM IF YOU HAVE NO TAX TO FILE THE 20TH OF THE MONTH

Column 1 Column 2 Column 3 Column 4 Column 5

Business Region Allowable pg 2 -

Description Line Bus. Class Code Gross Deductions = Net Taxable X Tax Rate = Tax Amount

1 $ - $ - 0.02 $ -

2 - - -

3 - - -

4 - - -

5 SUBTOTAL $ - $ - $ - $ -

6 TOTAL FROM ADDITIONAL PAGES

7 SUBTOTAL (Add Col 5, Lines 5 and 6) $ -

8 ENTER EXCESS CITY TAX COLLECTED (Total from Schedule B) Plus (+) -

9 GRAND TOTAL Equals (=) $ -

10 PENALTY & INTEREST (see instructions) Plus (+)

11 ENTER TOTAL LIABILITY Equals (=) -

12 ENTER CREDIT BALANCE TO BE APPLIED (Total from Schedule B) Minus (-) -

13 ENTER NET AMOUNT DUE Equals (=) $ -

14 ENTER TOTAL AMOUNT PAID Equals (=) -

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the

best of my knowledge and belief it is true, correct and complete. Declaration of preparer (other than taxpayer) is based on all

information of which preparer has any knowledge.

PLEASE ATTACH A COPY OF YOUR AZ PRIVILEGE TAX REPORT (TPT-1)

Taxpayer's Signature Date Paid Preparer's Signature

Print Name Phone Print Paid Preparer's Signature

A SIGNATURE IS REQUIRED TO MAKE THIS RETURN VALID

Please make checks payable to: CITY OF NOGALES - 777 N Grand Ave., Nogales, AZ 85621