Enlarge image

Appeals Procedures Sales and Use Taxes and Special Taxes and Fees

Enlarge image | Appeals Procedures Sales and Use Taxes and Special Taxes and Fees |

Enlarge image | Who should read this publication? This publication provides general information about appeals procedures for sales and use taxes and for the numerous other business taxes and fees administered by the California Department of Tax and Fee Administration (CDTFA). We use the term “special taxes and fees” to refer to the business taxes and fees administered by CDTFA other than sales and use taxes. Page 23 lists all special taxes and fees administered by CDTFA. |

Enlarge image |

Table of Contents

Introduction ......................................................................................... 2

Appealing a Determination of Taxes or Fees Due .......................................... 4

Filing a Claim for Refund ...................................................................... 10

Filing an Action in Court ....................................................................... 13

Appealing a Finding of Successor’s Liability .............................................. 14

Other Types of Appeals ........................................................................ 15

Proposing a Settlement of a Disputed Tax or Fee Liability ............................... 17

Offer in Compromise ........................................................................... 20

If You File a Bankruptcy Petition .............................................................. 21

For More Information ........................................................................... 22

Note: The information in this publication is intended to be accurate as of its date of publication.

As with all laws and regulations, those governing appeals are subject to change, and if there is a

conflict between information in this publication and the laws or regulations, the applicable laws and

regulations are controlling. To ensure that you have the most current information, please contact the

CDTFA office responsible for your tax or fee account.

Page i

|

Enlarge image |

Introduction

If you disagree with a decision regarding your liability for taxes or fees, you can usually dispute that decision

by filing a timely appeal. The majority of appeals are resolved after discussions with staff of CDTFA’s Business

Tax and Fee Division. If your appeal is not resolved by those discussions, you may be able to appeal to CDTFA’s

Appeals Bureau and then, if necessary, to the Office of Tax Appeals, an independent state agency created to

hear such appeals.

Points to Remember

• You may challenge an assessment for a tax or fee by submitting an appeal within the time limits set forth by law.

You do not lose this right even if you initially agreed that the tax or fee is due, as long as you timely file your

appeal. If you pay a tax or fee without appealing the assessment, you may still dispute the tax or fee by filing a

claim for refund within the time limits set forth by law.

• There are several steps involved in the appeals process. In some cases, an appeal can be referred back to a

prior step. As a result, you may go through some steps in the appeals process more than once.

• You may also seek a settlement of certain liabilities and claims for which you have a pending appeal (see

page 17, “Proposing a Settlement of a Disputed Tax or Fee Liability”).

• If you file an appeal, it is very important that you carefully read all notices and letters sent by CDTFA. Your

appeal may be denied if you do not respond within the time limits stated in the notices and letters sent to you.

If a filing deadline occurs on a Saturday, Sunday, or state holiday, it is extended to the next business day. For

purposes of determining whether you have met a required deadline for documents you mail to CDTFA, the date

of the postmark will be regarded as the filing date. All time periods described in this publication are calendar

days, not business days.

• Even if you appeal an assessment, interest will continue to accrue on any assessed tax or fee that is not paid,

so, to stop the accrual of interest, you may want to pay some or all of the assessed tax or fee while your appeal

is pending (see “A Note About Interest,” on the next page). You have the authority to indicate how you would

like your payment to be applied. Your payment of an amount of assessed tax or fee disputed by your pending

appeal will not be regarded as a concession that the amount paid was due.

Page 2

|

Enlarge image |

Appeals Procedures: Sales and Use Taxes and Special Taxes • August 2019

Make Sure You Have Complete and Current Information Gifts from Taxpayers

There may be minor differences between the procedures for sales CDTFA employees are prohibited

and use tax appeals and the procedures for special tax and fee from soliciting or accepting, directly

appeals. In addition, other state agencies may be involved in or indirectly, any gift, gratuity, favor,

the appeals process for certain special taxes and fees. If you entertainment, loan, or any other thing

have procedural questions, you should call the CDTFA unit that of monetary value from a person or

administers the specific tax or fee rather than relying solely on this entity that the CDTFA employee knows

publication (see contact information on pages 24 through 25). or has reason to believe:

You may also obtain a copy of the applicable laws, regulations,

• Has or is seeking to obtain

or CDTFA publications that apply to your specific tax or fee online

contractual or other business or

at www.cdtfa.ca.gov, or by calling CDTFA’s Customer Service

financial relations with CDTFA; or

Center at 1-800-400-7115 (CRS:711).

• Conducts business or other activities

A Note About Interest that are regulated or monitored

Interest continues to accrue on the amount of the taxes or fees due by CDTFA under circumstances

while your appeal is pending. You can stop interest from accruing by from which it reasonably could

paying the assessed taxes or fees. In deciding whether to pay some be substantiated that the gift was

or all of such taxes or fees while your appeal is pending, you may intended to influence the employee

wish to consider that the interest rate CDTFA pays on refunds (often in his or her official capacity, or was

called “credit interest”) is significantly lower than the interest rate you intended as a reward for any official

must pay on amounts you owe CDTFA. For example, the interest rate action performed by the employee.

charged on unpaid taxes or fees for the period July 1, 2012, through

December 31, 2016, is six percent per year while the credit interest

rate paid on refunds for the same period is zero percent; the interest

rate charged on unpaid taxes or fees for the period July 1, 2017,

through June 30, 2018, is seven percent per year while the credit

interest rate paid on refunds for the same period is one percent per

year. Interest rates may change every six months.

If CDTFA grants a refund and the credit interest rate exceeds zero

percent, CDTFA usually pays credit interest on the amount of tax or

fee refunded to you, unless it concludes that the overpayment was

intentional or careless.

Please refer to the law and regulations for the specific instructions

and interest calculation methods that apply to your situation.

Page 3

|

Enlarge image |

Appealing a Determination

of Taxes or Fees Due

If an audit finds that you have underpaid taxes or fees or if CDTFA otherwise determines that you owe additional

amounts, CDTFA will send you a billing called, for most taxes and fees, a Notice of Determination or a Notice of

Jeopardy Determination. The notice will state the amount of tax or fee and penalty due, plus the amount of interest that

has accrued on the tax or fee due. If you do not agree with the amounts shown, you may appeal by filing a petition for

redetermination (see next section), or you may pay the amount due and file a claim for refund (see page 10, “Filing a

Claim for Refund”).

Information about the audit process is included in CDTFA publication 76, Audits, which is available online at

www.cdtfa.ca.gov or by calling CDTFA’s Customer Service Center at 1-800-400-7115 (CRS:711).

Petition for Redetermination

Filing Deadline

An appeal of a Notice of Determination is called a petition for redetermination (petition). You must wait for the Notice

of Determination to be issued before you file a petition; an appeal filed before the Notice of Determination is issued

is not a valid petition. Generally, you have 30 days from the date the Notice of Determination was mailed to you to

file a petition. If you do not file a petition before the filing deadline, your liability will be final and will be due and

payable. An appeal filed after the filing deadline is not a valid petition. However, if you miss the filing deadline, you

may still appeal the liability by paying the tax or fee determined to be due and then filing a timely claim for refund (see

page 10, “Filing a Claim for Refund”).

For information on responding to a Notice of Jeopardy Determination, see page 16, “Appealing a Jeopardy

Determination.”

Content of Your Petition

Your petition should include your tax or fee program account number and must:

• Be in writing.

• Identify the amount(s) you wish to dispute, if known (you may dispute all or part of the amount assessed by the

Notice of Determination).

• State the specific grounds or reasons you believe you do not owe the tax or fee; and

• Be signed by you or your authorized representative.

Your petition may include a request for an appeals conference, which, if necessary, would be held by CDTFA’s

Appeals Bureau.

Page 4

|

Enlarge image |

Appeals Procedures: Sales and Use Taxes and Special Taxes • August 2019

Your petition may also include a request that your case

be considered under CDTFA’s Administrative Settlement

Program. Review under the Settlement Program is confidential

and will not affect your appeal rights. See page 17,

“Proposing a Settlement of a Disputed Tax or Fee Liability,”

for additional information regarding the Settlement Program.

Although you do not need to use a specific form for your

petition and can, for example, submit your petition by letter,

CDTFA provides a form you may use, CDTFA-416, Petition

for Redetermination, a copy of which is included in this

publication and is available online at www.cdtfa.ca.gov. You

may also complete and file your petition online through your

account on CDTFA’s website, www.cdtfa.ca.gov. A petition

properly completed and submitted through your online

account is regarded as satisfying the requirements that your

petition be in writing and be signed.

Filing Your Petition

Unless you file your petition through your online account on Review by the Business Tax and Fee

CDTFA’s website, you will need to mail, email, or fax your petition Division

to CDTFA. The Business Tax and Fee Division (BTFD) will

If you are filing a petition to dispute a Notice of Determination for send you a letter confirming receipt of your

sales and use tax, email your petition to petition. BTFD may request that you provide

BTFDPetSection@cdtfa.ca.gov, or fax your petition to 1-916-324 evidence to support your position. You may

0678, or mail your petition to: amend your petition to state additional grounds

for disputing the determination while your

Petitions Section, MIC:38

appeal is pending before CDTFA.

California Department of Tax and Fee Administration

PO Box 942879 After reviewing your petition and the evidence

Sacramento, CA 94279-0038 you provide, BTFD will notify you by letter of

its conclusions. If BTFD concludes that your

If you are filing a petition to dispute a Notice of Determination for

petition should be denied in whole or in part and

a special tax or fee, email your petition to adab@cdtfa.ca.gov, or

you had not previously requested an appeals

fax your petition to 1-916-323-9497, or mail your petition to:

conference, the letter will ask whether you want

Appeals and Data Analysis Branch, MIC:33 an appeals conference; if you had previously

California Department of Tax and Fee Administration requested an appeals conference, the letter may

PO Box 942879 ask that you confirm your request. If you do not

Sacramento, CA 94279-0033 agree with BTFD’s conclusions and you wish to

Page 5

|

Enlarge image | Appeals Procedures: Sales and Use Taxes and Special Taxes • August 2019 pursue your appeal to the next level, it is very important that you respond to BTFD’s letter within 30 days to request an appeals conference or to confirm your prior request, if applicable. Otherwise, if you do not timely request an appeals conference or, if asked to do so, confirm a prior request, a Notice of Redetermination will be issued to you based on BTFD’s conclusions and your appeal will end. The Appeals Conference If you dispute BTFD’s conclusion and have requested an appeals conference (and have confirmed that request if asked to do so), your case will be referred to the Appeals Bureau for an appeals conference to be held by an Appeals Bureau attorney or auditor who has had no prior involvement with your case. BTFD will mail you a letter to notify you when it refers your case to the Appeals Bureau, and will include with that letter a Verification of Appeals Conference form, which you will be asked to complete and return within 15 days. The information requested on the form includes your current address, the name and address of your representative (if you have one), and your preferred location for the appeals conference. Unless you specify a different location, the appeals conference will generally be held in the CDTFA office that prepared your audit. You may use the form to request expedited scheduling of your appeals conference, which is discussed in the next section. More information about appeals conferences is included in CDTFA publication 142A, Appeals Conferences, which is available online at www.cdtfa.ca.gov or by calling CDTFA’s Customer Service Center at 1-800-400-711105 (CRS:711). Appeals Conference Scheduling and Notification After receiving your case, the Appeals Bureau will schedule your appeals conference. The length of time it takes for the Appeals Bureau to schedule an appeals conference varies. Upon scheduling the appeals conference, the Appeals Bureau will mail a Notice of Appeals Conference to inform you of the date, time, and location of your appeals conference. The Notice of Appeals Conference will be mailed to you at least 45 days before the date of your appeals conference. You can expedite the scheduling of your appeals conference by submitting a written request for expedited scheduling that indicates you agree to do one of the following: • Attend an appeals conference at CDTFA’s Headquarters office in Sacramento or at an office in Southern California designated by the Appeals Bureau; • Attend a video conference from certain CDTFA offices equipped with video conferencing capabilities; or • Participate in the appeals conference via telephone. If you request expedited scheduling and agree to one of these three types of conferences, the Appeals Bureau will schedule your appeals conference and mail the Notice of Appeals Conference to you within 60 days of receiving your request. The Notice of Appeals Conference may be sent to you less than 45 days before the date of your appeals conference, but will not be sent to you less than 21 days before the date of your appeals conference unless you consent to a shorter period. Page 6 |

Enlarge image |

Appeals Procedures: Sales and Use Taxes and Special Taxes • August 2019

The Appeals Bureau will include a Response to Notice of Conduct of the Appeals Conference;

Submissions

Appeals Conference form with your Notice of Appeals

Conference, and will request that you confirm your The appeals conference is intended to be an informal

attendance at the appeals conference by completing and discussion of relevant facts and applicable law

returning the form within 15 days. You may also indicate concerning your appeal. The representative(s) of BTFD

on the response form that you waive your appearance will be present, and where another state agency is a

at the appeals conference (meaning that you still dispute party to the dispute, the representative(s) of that agency

the liability but do not wish to make a presentation at the may also be present. Rules of evidence are not strictly

appeals conference). If you waive your appearance at followed. The purpose of the appeals conference is for

the appeals conference, or if you otherwise fail to appear you and BTFD to present your respective arguments

for the appeals conference, the appeals conference and supporting evidence to the Appeals Bureau.

will be held as scheduled in your absence, and the While you may submit written arguments and

representative(s) of BTFD (and other state agency, if documentary evidence during the appeals conference,

applicable) will be permitted to make a presentation at we strongly encourage you to submit your written

the appeals conference in your absence. arguments and documentary evidence before the

appeals conference. For example, you can include

Recording Your Appeals Conference

your written arguments and documentary evidence

If you would like to record the appeals conference, you

when you return your completed Response to Notice of

must check the appropriate box on the Response to Notice

Appeals Conference form. If you provide the Appeals

of Appeals Conference form and provide a copy of the

Bureau your written arguments and documentary

recording or transcript to the Appeals Bureau and to BTFD

evidence in advance of the appeals conference, the

(and other state agency, if applicable). The recording and

Appeals Bureau will be better prepared to understand

the providing of copies is at your own expense. While

and consider your position during the appeals

the Appeals Bureau generally does not record appeals

conference.

conferences, if it decides to do so, it will notify you prior to

the appeals conference and will provide you a copy of the

recording or transcript at no expense.

Page 7

|

Enlarge image | Appeals Procedures: Sales and Use Taxes and Special Taxes • August 2019 You may submit written arguments and documentary evidence after the appeals conference only with the consent or at the request of the Appeals Bureau. If you would like to submit additional arguments or documentary evidence, you may, during the appeals conference, request permission to do so. BTFD may also make such a request. If the Appeals Bureau concludes that a party’s request to make an additional submission should be accepted, the requesting party will generally be allowed 15 to 30 days to make the submission. (While a request to make an additional submission is generally granted, the purpose should be to address matters that arise during the appeals conference.) Where a post-conference submission is allowed, the other party is generally allowed 15 to 30 days to make a submission in response. Whether or not you or BTFD asks to submit additional arguments or evidence, the Appeals Bureau may request, during or after the appeals conference, that you or BTFD, or both, submit additional argument or evidence, or provide clarification of the issues in dispute. Appeals Bureau Decision After the appeals conference, the Appeals Bureau will prepare a written decision containing its analysis and conclusion for the resolution of your case. The four basic types of decisions are: (1) that your appeal be granted in full; (2) that your appeal be denied in full; (3) that your appeal be granted in part and denied in part; or (4) that BTFD perform a “reaudit” in accordance with directions set forth in the decision. If the decision orders that your appeal be granted, denied, or granted in part and denied in part, the Appeals Bureau will mail the decision to the parties along with a letter that explains the options for further appeal by each party. If the decision orders BTFD to conduct a reaudit, the Appeals Bureau will mail the decision to the parties along with a letter advising the parties that the Appeals Bureau will write the parties again after receiving BTFD’s reaudit report. When BTFD completes the reaudit, BTFD will provide its reaudit report to the Appeals Bureau, and the Appeals Bureau will then send another letter to the parties summarizing the results of the reaudit and explaining the options for further appeal by each party. Page 8 |

Enlarge image |

Appeals Procedures: Sales and Use Taxes and Special Taxes • August 2019

If you do not agree with the decision, you have two options for appeal. One option is to submit a written request

for reconsideration to the Appeals Bureau. Such a request must identify the specific issue(s) for which you seek

reconsideration, and must explain the reasons you disagree with the decision. BTFD may also submit a written request

for reconsideration, and if another state agency is a party to the dispute, it too may request reconsideration. A request

for reconsideration must be submitted to the Appeals Bureau within 30 days of the date of the letter explaining each

party’s options for appeal. If a valid request for reconsideration of a decision is submitted to the Appeals Bureau within

the 30-day period, the Appeals Bureau will reconsider the decision and issue a supplemental decision.

Your other option is to appeal the decision to the Office of Tax Appeals (OTA), an independent state agency

established to hear such appeals. You must submit your appeal to OTA within 30 days of the date of the letter from the

Appeals Bureau explaining each party’s options for appeal (the Appeals Bureau letter will explain how). BTFD cannot

appeal an Appeals Bureau decision to OTA, but if another state agency is a party to the appeal, it can appeal to OTA.

If the Appeals Bureau issues a supplemental decision, you have the same two options for appealing the supplemental

decision: within the 30-day period following the date of the Appeals Bureau letter explaining the options for appeal,

you may either submit a written request to the Appeals Bureau that it reconsider the supplemental decision or you

may submit a written appeal to OTA. Note: the Appeals Bureau has the discretion to either accept a request for

reconsideration of a supplemental decision and issue another supplemental decision, or to reject the request. If you

submit a timely request for reconsideration of a supplemental decision and your request is rejected, the Appeals Bureau

will send you a letter advising you of its denial and allowing you 30 days to submit an appeal to OTA.

If there is no timely request for reconsideration or appeal to OTA of an Appeals Bureau decision or supplemental

decision, a Notice of Redetermination will be issued to you based on the decision or supplemental decision and your

appeal will end.

Appeal to OTA

The parties to an appeal before OTA are provided the opportunity to make submissions, to respond to submissions

by the other party, and to present their respective positions to a three-member panel of administrative law judges

that will issue a written decision in the appeal. OTA’s regulations and other information relevant to appeals before

OTA can be found on OTA’s website, www.ota.ca.gov. After OTA issues its decision, the case returns to CDTFA for

issuance of the Notice of Redetermination in accordance with OTA’s decision.

Notice of Redetermination

After the Appeals Bureau (or OTA, if applicable) makes its decision on your appeal of a Notice of Determination or

other assessment, CDTFA will send you a Notice of Redetermination or other appropriate notice. If the notice reflects

that there is an amount due, you must pay that amount even if you disagree. However, once you pay the amount

due, you may proceed to the next step of the appeals process, which is to file a claim for refund. If you do not pay

the tax or fee due by the time the Notice of Redetermination becomes final 30 days after the date it was issued, you

will be charged an additional penalty of ten percent of the outstanding tax or fee due, and applicable interest will

continue to accrue.

Page 9

|

Enlarge image |

Filing a Claim for Refund

If you paid an amount you believe you did not owe and you want a refund of that amount, you must file a claim for

refund with CDTFA within the time limits set forth by law (see page 11, “Filing Period Limitations”). This requirement

applies regardless of the reason you paid that amount, whether pursuant to a Notice of Determination, with a return,

or otherwise. If you do not file a timely claim for refund, CDTFA cannot refund any amount you paid.

Form of Claim for Refund

You may be required to use a specific claim form to file a claim for refund of cigarette and tobacco products tax or

to file a claim for refund of diesel fuel tax (see Cigarette and Tobacco Products Tax and Diesel Fuel Tax, below).

Otherwise, you may file a claim for refund by submitting a letter requesting a refund or by submitting a completed

form CDTFA-101, Claim for Refund or Credit. To file a claim for refund of use tax paid to the Department of Motor

Vehicles (DMV), you may use formCDTFA-101-DMV,Claim for Refund or Creditfor Tax Paid to DMV. Copies of

both claim forms are included in this publication and are available online at www.cdtfa.ca.gov.

Your claim for refund must be in writing, must be signed by you or your authorized representative, and must state all

the grounds or reasons you believe that the amount you seek to be refunded was not actually due. Your claim must

specify the reporting period for which you made the payment and the amount of refund being claimed, if known.

Your claim must also include contact information for you or your authorized representative.

Your claim for refund may also include a request for an appeals conference, but you do not have an absolute right

to an appeals conference or to appeal to OTA for a claim for refund (see page 12, “If BTFD Concludes That Some or

All of Your Claim Should be Denied”).

You may also complete and file your claim for refund online through your account on CDTFA’s website,

www.cdtfa.ca.gov. A claim for refund properly completed and submitted through your online account is regarded

as satisfying the requirements that your claim for refund be in writing and be signed.

Cigarette and Tobacco Products Tax

Distributors requesting a refund of cigarette tax stamps under the Cigarette and Tobacco Products Tax Law must use

forms prescribed by CDTFA on which to file a claim for refund. Contact CDTFA’s Appeals and Data Analysis Branch

for more information (see page 24).

Diesel Fuel Tax

Diesel fuel users, diesel fuel exporters, diesel fuel suppliers, and diesel fuel ultimate vendors must use the forms

prescribed by CDTFA to file a claim for refund. Contact CDTFA’s Appeals and Data Analysis Branch for more

information (see page 24).

Page 10

|

Enlarge image |

Appeals Procedures: Sales and Use Taxes and Special Taxes • August 2019

Filing a Claim for Refund

Where to File Your Claim for Refund Filing Period Limitations

Unless you file your claim for refund through your online The filing deadline for a claim for refund of sales and use

account on CDTFA’s website, you will need to mail, tax, and for a claim for refund of most special taxes and

email, or fax your claim for refund to CDTFA. fees, is the later of the following dates:

Claims for refund of sales and use tax • Three years from the due date of the return for the

period for which the claimed overpayment was made.

If you are filing a claim for refund of sales and use tax,

(For use tax paid to the DMV, this generally means

email your claim for refund to BTFD-ADRS@cdtfa.ca.gov,

three years from the date you applied for registration

fax your claim for refund to 1-916-445-2249, or mail

with the DMV.)

your claim for refund to:

• Six months from the date you made the payment for

Audit Determination and Refund Section, MIC:39

which you seek a refund.

California Department of Tax and Fee Administration

PO Box 942879 • For a payment made pursuant to a determination, six

Sacramento, CA 94279-0039 months from the date the determination became final.

Claims for refund of use tax paid to DMV • For a payment collected by CDTFA by an enforcement

procedure such as a lien or levy, three years from the

If you are filing a claim for refund of use tax

date of the payment.

paid to the DMV, email your claim for refund to

BTFD-ADRS@cdtfa.ca.gov, fax your claim for refund to Caution: This description of claim filing limitation periods

1-916-324-2491, or mail your claim for refund to: is very general, and is not applicable to all taxes and

fees administered by CDTFA. Please use it only as a

Consumer Use Tax Section, MIC:37

guideline and do not rely solely on it in filing a specific

California Department of Tax and Fee Administration

claim. Please check the appropriate laws and regulations

PO Box 942879

for the specific tax or fee for which you are filing a claim

Sacramento, CA 94279-0037

or contact the CDTFA unit responsible for your tax or fee

Claims for refund of special taxes and fees account (see page 24). If there is a conflict between any

information in this publication and the laws or regulations

If you are filing a claim for refund of a special tax or fee,

governing claim filing limitation periods, the applicable

email your claim for refund to adab@cdtfa.ca.gov, fax

laws and regulations are controlling.

your claim for refund to 1-916-323-9497, or mail your

claim for refund to: Without regard to any other consideration, CDTFA

cannot refund any tax or fee for which you do not file

Appeals and Data Analysis Branch, MIC:33

a timely claim for refund. If you do not file a claim for

California Department of Tax and Fee Administration

refund within the period specified by law, you will have

PO Box 942879

no further recourse with CDTFA to recover overpaid taxes

Sacramento, CA 94279-0033

or fees. To ensure that this does not happen, make sure

See page 23 for a list of the special taxes and fees. to submit your claim for refund within the filing period

limitations.

Page 11

|

Enlarge image | Appeals Procedures: Sales and Use Taxes and Special Taxes • August 2019 Claim for Refund Where Tax or Fee Liability Not Fully Paid If you file a timely claim for refund for a payment applied to a determination that you have not paid in full, the claim for refund will be regarded as covering all subsequent payments applied to that same determination. So, if you file a claim for refund for one or more payments applied to a determination for which the assessed tax or fee is not fully paid, you will not have to file another claim for refund for later payments. However, CDTFA may not act on the claim for refund until you have paid the full amount of tax or fee assessed by the determination. (Where applicable, CDTFA may act on a claim for refund to the extent that the full amount of tax or fee assessed for a complete reporting period has been paid.) Review of Your Claim by BTFD BTFD will send you a letter acknowledging receipt of your claim for refund. During its review of your claim, BTFD may ask you to submit additional information. BTFD will consider your claim, review any information you submit, and then decide whether your claim should be granted in its entirety, granted in part and denied in part, or denied in its entirety. If BTFD Concludes That Some or All of Your Claim Should Be Granted If BTFD concludes that your claim for refund should be granted in whole or in part, a Notice of Refund showing the amount you overpaid will be issued to you. (If BTFD concludes that an amount in excess of $50,000 should be refunded, BTFD must make that conclusion available as a public record for at least ten days prior to its effective date.) The amount the Notice of Refund shows as overpaid will not be paid directly to you if any of that amount must be credited against other amounts you owe to CDTFA or to other state agencies. The amount of the refund that will be paid directly to you will be the amount you overpaid, less any amounts credited against other amounts you owe. If BTFD Concludes That Some or All of Your Claim Should be Denied If BTFD concludes that your claim for refund should be denied in whole or in part, BTFD will send you a letter explaining the reasons for that conclusion. If you disagree with BTFD’s conclusion, you may request an appeals conference with the Appeals Bureau. Granting a request for an appeals conference for a claim for refund is discretionary. An example of a request for an appeals conference that might be denied is where the claim for refund is for payments made pursuant to a Notice of Determination for which a petition for redetermination had been denied following an appeals conference held by the Appeals Bureau. Where you request an appeals conference for a claim for refund and the request is granted, the procedures discussed above for a petition for redetermination are applicable, including that you may appeal an adverse Appeals Bureau decision to OTA. Upon conclusion of the proceedings, CDTFA will send you a Notice of Refund or a Notice of Denial of Claim for Refund, as applicable. If you do not request an appeals conference, or if your request for an appeals conference is denied, you will be sent a Notice of Denial of Claim for Refund based on BTFD’s conclusions. Page 12 |

Enlarge image |

Filing an Action in Court

If your claim for refund is denied and you wish to continue your appeal, the next step is to file a lawsuit for refund

in court. If you wish to do so, you must file the lawsuit within 90 days after the mailing of CDTFA’sNotice of Denial

of Claim for Refund. The location of the court in which your lawsuit must be filed depends on the type of tax or

fee involved. If you fail to file a lawsuit within 90 days of the date CDTFA mailed its Notice of Denial of Claim for

Refund, then you have no further recourse and your appeal ends.

If CDTFA does not act on your claim for refund within six months of the date you filed it, you have the option of

deeming the claim denied by CDTFA and proceeding with a lawsuit. If you do so, however, CDTFA’s administrative

review of your claim ceases, and the dispute will be resolved in the court action you filed.

Note: You cannot file a lawsuit for refund of a tax or fee unless you first file an administrative claim for refund with

CDTFA, as discussed above, and your lawsuit for refund is limited to the grounds identified in your claim for refund

filed with CDTFA. You may want to consult an attorney regarding the filing of a lawsuit for refund.

Page 13

|

Enlarge image |

Appealing a Finding

of Successor’s Liability

If you purchase a business or stock of goods from a person with a liability, related to that business or stock of goods,

for sales and use tax, diesel fuel tax, motor vehicle fuel tax, use fuel tax, or oil spill response and administration and

prevention fees, you may be personally liable for those taxes or fees, plus applicable penalties and interest, up to the

amount of the purchase price. This is called successor’s liability.

If BTFD determines that you are liable for successor’s liability, BTFD will mail you a Notice of Successor’s Liability.

You may dispute the determination by filing a petition for reconsideration of the liability. Your petition must be filed

in the same manner and within the same time limits as those applicable to the filing of a petition for redetermination

as described on page 4, “Appealing a Determination of Taxes or Fees Due.” The same procedures for an appeals

conference and appeal to OTA are also applicable.

Notice of Reconsideration

If your appeal results in a decision that successor’s liability applies, a Notice of Reconsideration showing the amount

of your liability will be mailed to you, which will become final 30 days after mailing. You must pay the amount due as

set forth in the notice even if you disagree. However, once you pay the amount due, you may proceed to the next step

of the appeals process, which is to file a claim for refund, as described on page 10, “Filing a Claim for Refund.”

Page 14

|

Enlarge image |

Other Types of Appeals

Administrative Protests

If you do not file a petition for redetermination within 30 days after a Notice of Determination is mailed to you, the

liability assessed in the Notice of Determination will become final. Once this happens, the only way provided by

statute for you to appeal the liability is to pay the tax or fee in full and file a claim for refund. However, CDTFA may,

in its discretion, accept a late appeal as an “administrative protest” if there is a reasonable basis to believe that there

may be an error in the Notice of Determination issued to you. For example, if you file an appeal as a petition for

redetermination more than 30 days after the Notice of Determination was mailed, your appeal will not be accepted

as a petition for redetermination, but might be accepted as an administrative protest. After receiving your appeal,

BTFD will send you a letter confirming receipt and advising you if your appeal has been rejected because it is late

or has been accepted as an administrative protest. If it is accepted as an administrative protest, your appeal will

generally be reviewed in the same manner as a timely petition for redetermination. Significant exceptions, however,

are that activities to collect the remaining tax or fee, interest, and penalty are generally not delayed, and you will not

have an absolute right to an appeals conference or appeal to OTA.

Important note: An administrative protest does not cover any amount that has been paid, whether before or after the

appeal is accepted as an administrative protest. Where your appeal has been accepted as an administrative protest

and you pay some or all of the amount you dispute, you must file a claim for refund within the time set forth by law if

you wish to obtain a refund of the amount you believe was overpaid.

Page 15

|

Enlarge image |

Appeals Procedures: Sales and Use Taxes and Special Taxes • August 2019

Proposing a Settlement of a Disputed

Tax or Fee Liability

Appealing a Jeopardy Determination

Under certain circumstances, CDTFA may serve a taxpayer with a “Notice of Jeopardy Determination” for tax due,

plus any applicable penalties and interest. A jeopardy determination is due and payable upon service of the notice

to the taxpayer, which means that CDTFA may immediately take action to collect the determined liability.

If you receive such a notice, you have ten days from the date the notice was served on you (for example, the date

of mailing) to file a petition for redetermination with a deposit of security in the amount specified in the notice. If

you file a timely petition for redetermination with the required deposit, your petition will be reviewed in the same

manner as other timely petitions for redetermination, and collection actions will be stayed (delayed) pending

CDTFA’s decision on your petition.

If you do not file a petition for redetermination with the required deposit or pay the amount of the jeopardy

determination within ten days from the date the notice was mailed, you will be subject to a late payment penalty,

and CDTFA’s collection activities will continue. However, there is an additional appeal procedure. You may, within

30 days of the service of the Notice of Jeopardy Determination, apply for an administrative hearing for one or more

of the following purposes:

• To establish that the determination is excessive;

• To establish that the sale of property that may be seized should be delayed pending the administrative hearing

because the sale would result in irreparable injury;

• To request the release of property;

• To request a stay of collection; or

• To request review of any other issue raised by the jeopardy determination.

If you submit a timely application for an administrative hearing, your appeal generally will be reviewed in the

same manner as a timely petition for redetermination. However, filing an application for an administrative hearing

will not prevent CDTFA from pursuing collection action. It is also important to note that an application for an

administrative hearing does not cover any amount that has been paid. Even if you file a timely application for an

administrative hearing, if you pay some or all of the amount subject to the jeopardy determination and believe that

payment was not due, you must file a claim for refund within the time set forth by law if you wish to obtain a refund

of the amount you believe was overpaid.

Page 16

|

Enlarge image |

Proposing a Settlement of a Disputed

Tax or Fee Liability

While you are pursuing an appeal before CDTFA (for example, a petition for redetermination, an administrative

protest, or a claim for refund), or continuing your appeal before OTA, you may request settlement review by

CDTFA’s Settlement and Taxpayer Services Bureau (Settlement Bureau). Once OTA issues a decision, the matter is

no longer eligible for settlement consideration.

In order to settle your case, you must reach a formal agreement with the Settlement Bureau and that agreement must

be approved by the Director of CDTFA. While your request for settlement is pending, you must continue to meet all

applicable time deadlines for your pending appeal before CDTFA or OTA.

CDTFA’s settlement program does not presently apply to jet fuel taxes, motor vehicle fuel taxes, or fire prevention

fees. Additionally, the Department of Toxic Substances Control is the agency that administers the settlement program

for taxes imposed under the Hazardous Substances Tax Law, except for childhood lead poisoning prevention fees

and occupational lead poisoning prevention fees.

Requesting Settlement Review

You may request that your case be considered for settlement by completing and submitting CDTFA-393, Settlement

Review Request for Sales and Use Tax and Special Taxes and Fee Cases or, if filing a petition for redetermination on

form CDTFA-416, Petition for Redetermination, by checking the appropriate box (copies of these forms are included

in this publication and are available online at www.cdtfa.ca.gov). You may also submit a signed and dated written

request for settlement.

Page 17

|

Enlarge image | Appeals Procedures: Sales and Use Taxes and Special Taxes • August 2019 All the following information should be included in your request to ensure your case is properly acknowledged and processed: • Your name, email address, telephone number, and current address; • If applicable, the name, address, email address, and telephone number of your representative, as well as a copy of your representative’s power of attorney, form CDTFA-392, Power of Attorney (a copy of this form is available online at www.cdtfa.ca.gov); • Your taxpayer or feepayer account number (for example, your seller’s permit number); and • The type of tax or fee (for example, sales and use tax) and periods involved. Settlement requests may be emailed to settlement@cdtfa.ca.gov, faxed to 1-916-323-3387, or mailed to: Settlement and Taxpayer Services Bureau, MIC:87 California Department of Tax and Fee Administration PO Box 942879 Sacramento, CA 94279-0087 Consideration of a Request for Settlement The Settlement Bureau will review your request and advise you or your representative whether your case is suitable for settlement consideration. If the Settlement Bureau determines that there is a genuine factual or legal dispute, your case will generally be accepted for settlement consideration. A case may, however, be rejected for a variety of reasons. For example, if the Settlement Bureau perceives little litigation risk to CDTFA’s position or if sufficient facts to allow proper settlement evaluation have not been developed, your case will not likely be accepted for settlement consideration. The Settlement Bureau will contact you with a proposed settlement amount after it reviews your case. It is not necessary to include a proposed amount in your settlement review request. If you and the Settlement Bureau cannot reach an agreement, the settlement process ends and your appeal will continue through the normal appeals process. Approval of a Proposed Settlement Agreement If you and the Settlement Bureau reach an agreement on a settlement amount, you will be sent a confirmation letter and a settlement agreement (a legal document containing the settlement terms and conditions). After you sign, date, and return the settlement agreement, the Settlement Bureau will prepare a settlement recommendation to be forwarded to CDTFA’s Chief Counsel for approval. Larger cases are then forwarded to the Attorney General, who has 30 days to review and comment on the proposed settlement agreement. The proposed settlement agreement and the Attorney General’s comments, if necessary, are then submitted to the Director of CDTFA for approval. If the Director does not approve or deny the proposed settlement agreement within 45 days of its submission to him or her, the recommendation to settle the case is deemed approved. If the proposed settlement agreement is approved, you generally must pay any required settlement payment within 30 days of notification that the settlement has been approved. Page 18 |

Enlarge image |

Appeals Procedures: Sales and Use Taxes and Special Taxes • August 2019

Public Record

If the CDTFA Director approves the proposed settlement agreement and the reduction of tax in the settlement exceeds

$500, certain information about the settlement will become a matter of public record, which will be available for

review for one year at the office of CDTFA’s Director.

The public record will include the following:

• The names of the taxpayers who are parties to the settlement;

• The total amount in dispute;

• The amount agreed to in the settlement;

• A summary of the reasons why the settlement is in the best interest of the state; and

• When applicable, the Attorney General’s conclusion regarding the reasonableness of the settlement.

Note: Information that relates to any trade secret, patent, process, style of work, apparatus, business secret, or

organizational structure will not be included in the public record if its disclosure would adversely affect you. With the

exception of the required public record, settlement agreements are considered confidential information.

All settlement agreements entered into under this program are final, and cannot be appealed unless one of the

parties can show fraud or misrepresentation of a material fact.

For more information, contact the Settlement Bureau (see page 24).

Page 19

|

Enlarge image |

Offer in Compromise

An Offer in Compromise (OIC) is a proposal to pay CDTFA an amount that is less than the full tax or fee liability

due. The OIC program is for taxpayers and feepayers that do not have, and will not have in the foreseeable future,

the income, assets, or means to pay their tax or fee liability in full. You must satisfy all of the following criteria to

qualify for the program:

• Have a final tax or fee liability on a closed account, or have a “qualified” final CDTFA-assessed tax or fee

liability on an active account where you have not received reimbursement for taxes or fees owed and have not

previously received a compromise;

• Are not currently disputing your tax or fee liability;

• Are not currently in a bankruptcy proceeding; and

• Are unable to pay the full amount due in a reasonable period of time, typically from five to seven years.

If you wish to propose an OIC, you must complete an OIC application (CDTFA-490 for individuals or CDTFA-490-C

for all others).

The completed application, along with the required supporting documentation as described in the application,

must be submitted to the collector assigned to your account or directly to the OIC Section. You may obtain an OIC

application or publication 56, Offer in Compromise, online at www.cdtfa.ca.gov or by calling CDTFA’s Customer

Service Center at 1-800-400-7115 (CRS:711). If you have questions regarding the OIC process, please contact the

OIC Section at 1-916-322-7931.

Page 20

|

Enlarge image |

If You File a Bankruptcy Petition

Upon the filing of a bankruptcy petition, an automatic stay becomes effective that prevents CDTFA from taking

collection action. However, while the automatic stay is in effect, CDTFA may continue to:

• Perform an audit or reaudit;

• Make an assessment;

• Issue a notice of determination;

• Continue investigating a tax liability;

• Make adjustments to a tax liability;

• Accept a petition for redetermination or claim for refund;

• Hold an appeals conference; and

• File a proof of claim in the bankruptcy case based on the best information available.

Page 21

|

Enlarge image |

Appeals Procedures: Sales and Use Taxes and Special Taxes • August 2019

For More Information

Appeals Regulations interest or penalty otherwise due on a transaction or activity

You may obtain a copy of CDTFA’s Appeals regulations, if CDTFA concludes that you did not pay the tax or fee

which consist of Regulations 35001 through 35067 (title 18, because you reasonably relied on written advice from

California Code of Regulations, sections 35001-35067), CDTFA regarding the transaction or activity.

online at www.cdtfa.ca.gov or by calling CDTFA’s Customer

For this relief to apply, the advice from CDTFA must have

Service Center at 1-800-400-7115 (CRS:711). You may

been written specifically for your circumstances in response

obtain a copy of OTA’s Rules for Tax Appeals online at

to a written request for advice that identified you as the

www.ota.ca.gov.

taxpayer or feepayer and fully described the facts and

Publications circumstances of the transaction or activity. You cannot

obtain tax relief by relying on a written opinion CDTFA gave

To inform taxpayers about the law, CDTFA offers many

to another person, even if your transactions are similar.

free publications, some of which explain how the law and

regulations apply to specific types of businesses. CDTFA also Note: While CDTFA will also provide you verbal advice

publishes copies of the laws and regulations for each of the by telephone or in person, the law does not permit CDTFA

taxes and fees it administers. to grant you relief from tax or fee otherwise due, and

applicable interest and penalty, based on your reliance on

A list of CDTFA publications is found in publication 51,

verbal advice. By getting advice in writing, not only is there

California Department of Tax and Fee Administration

no dispute as to exactly what you asked and how CDTFA

Resource Guide to Free Tax Products and Services.

responded, but you may also then qualify for relief from the

CDTFA forms and publications as well as answers tax or fee otherwise due if you can establish that you did

to your general tax questions are available online at not pay the tax or fee because you reasonably relied on

www.cdtfa.ca.gov, or you can call CDTFA’s Customer qualifying written advice.

Service Center at 1-800-400-7115 (CRS:711).

Representatives are available Monday-Friday, 8:00 a.m. to For written advice regarding sales and use taxes,

5:00 p.m. (Pacific time), except state holidays. Automated send your letter to:

services are available 24 hours a day. Tax Policy Bureau, MIC:92

California Department of Tax and Fee Administration

Internet PO Box 942879

Address: www.cdtfa.ca.gov Sacramento, CA 94279-0092

Tax Advice For written advice regarding special taxes and

If you have questions about how a tax or fee applies to fees, send your letter to:

specific circumstances, please call or write the appropriate Program and Administration Branch, MIC:31

CDTFA Division or Bureau for specific information. California Department of Tax and Fee Administration

PO Box 942879

For your protection, it is best to get any tax advice from

Sacramento, CA 94279-0031

CDTFA in writing. You may be relieved of tax and any

Page 22

|

Enlarge image |

Appeals Procedures: Sales and Use Taxes and Special Taxes • August 2019

List of Special Taxes and Fees • Integrated Waste Management Fee

• Aircraft Jet Fuel • Lead-Acid Battery Fees

• California Tire Fee o California battery fee, manufacturer battery fee

• Cannabis Tax • Marine Invasive Species Fee

o Cannabis excise tax, cultivation tax

• Motor Vehicle Fuel Tax

• Childhood Lead Poisoning Prevention Fee • Natural Gas Surcharge

• Cigarette and Tobacco Products Licensing • Occupational Lead Poisoning Prevention Fee

• Cigarette and Tobacco Products Taxes • Oil Spill Prevention, and Administration Fee

• Diesel Fuel Tax* • Oil Spill Response Fee

• Electronic Waste Recycling Fee • Regional Railroad Accident Preparedness and

• Emergency Telephone Users Surcharge Immediate Response Fee

• Energy Resources Surcharge • Underground Storage Tank Maintenance Fee

• Hazardous Substances Tax • Use Fuel Tax*

o Disposal fees, environmental fees, facility fees, • Water Rights Fee

generator fees * You may be paying these taxes under the International

Fuel Tax Agreement (IFTA).

Page 23

|

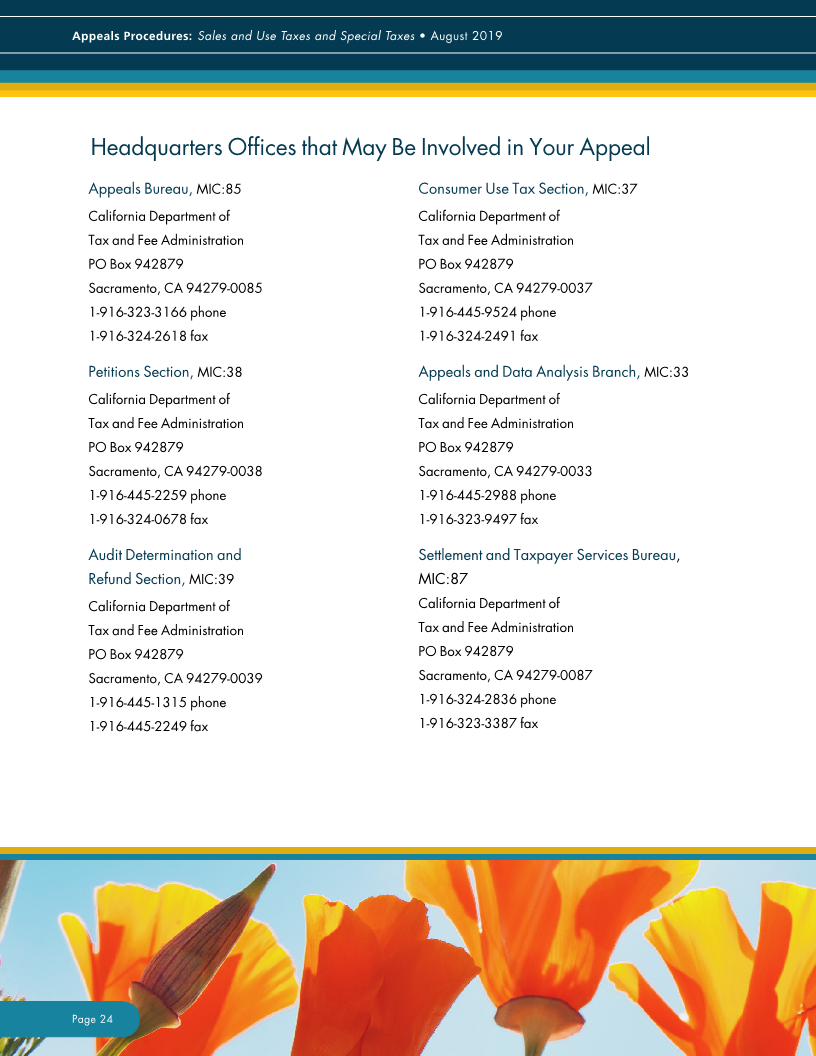

Enlarge image | Appeals Procedures: Sales and Use Taxes and Special Taxes • August 2019 Headquarters Offices that May Be Involved in Your Appeal Appeals Bureau, MIC:85 Consumer Use Tax Section, MIC:37 California Department of California Department of Tax and Fee Administration Tax and Fee Administration PO Box 942879 PO Box 942879 Sacramento, CA 94279-0085 Sacramento, CA 94279-0037 1-916-323-3166 phone 1-916-445-9524 phone 1-916-324-2618 fax 1-916-324-2491 fax Petitions Section, MIC:38 Appeals and Data Analysis Branch, MIC:33 California Department of California Department of Tax and Fee Administration Tax and Fee Administration PO Box 942879 PO Box 942879 Sacramento, CA 94279-0038 Sacramento, CA 94279-0033 1-916-445-2259 phone 1-916-445-2988 phone 1-916-324-0678 fax 1-916-323-9497 fax Audit Determination and Settlement and Taxpayer Services Bureau, Refund Section, MIC:39 MIC:87 California Department of California Department of Tax and Fee Administration Tax and Fee Administration PO Box 942879 PO Box 942879 Sacramento, CA 94279-0039 Sacramento, CA 94279-0087 1-916-445-1315 phone 1-916-324-2836 phone 1-916-445-2249 fax 1-916-323-3387 fax Page 24 |

Enlarge image |

Appeals Procedures: Sales and Use Taxes and Special Taxes • August 2019

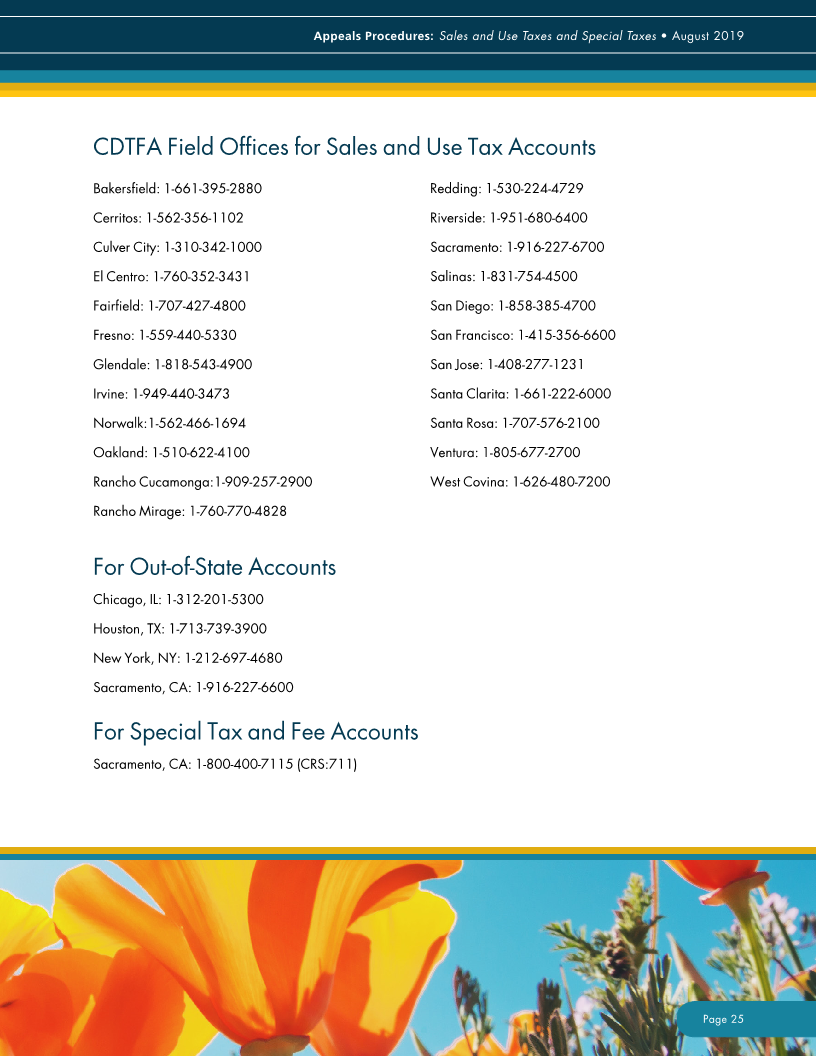

CDTFA Field Offices for Sales and Use Tax Accounts

Bakersfield: 1-661-395-2880 Redding: 1-530-224-4729

Cerritos: 1-562-356-1102 Riverside: 1-951-680-6400

Culver City: 1-310-342-1000 Sacramento: 1-916-227-6700

El Centro: 1-760-352-3431 Salinas: 1-831-754-4500

Fairfield: 1-707-427-4800 San Diego: 1-858-385-4700

Fresno: 1-559-440-5330 San Francisco: 1-415-356-6600

Glendale: 1-818-543-4900 San Jose: 1-408-277-1231

Irvine: 1-949-440-3473 Santa Clarita: 1-661-222-6000

Norwalk:1-562-466-1694 Santa Rosa: 1-707-576-2100

Oakland: 1-510-622-4100 Ventura: 1-805-677-2700

Rancho Cucamonga:1-909-257-2900 West Covina: 1-626-480-7200

Rancho Mirage: 1-760-770-4828

For Out-of-State Accounts

Chicago, IL: 1-312-201-5300

Houston, TX: 1-713-739-3900

New York, NY: 1-212-697-4680

Sacramento, CA: 1-916-227-6600

For Special Tax and Fee Accounts

Sacramento, CA: 1-800-400-7115 (CRS:711)

Page 25

|

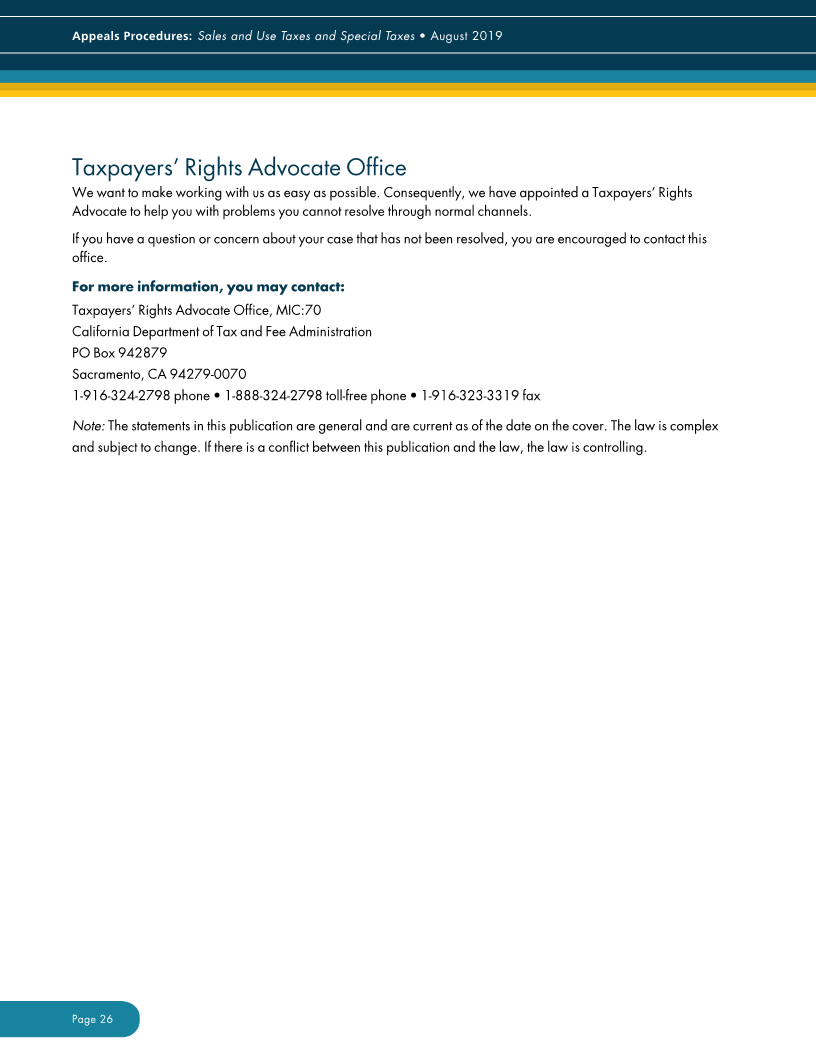

Enlarge image | Appeals Procedures: Sales and Use Taxes and Special Taxes • August 2019 Taxpayers’ Rights Advocate Office We want to make working with us as easy as possible. Consequently, we have appointed a Taxpayers’ Rights Advocate to help you with problems you cannot resolve through normal channels. If you have a question or concern about your case that has not been resolved, you are encouraged to contact this office. For more information, you may contact: Taxpayers’ Rights Advocate Office, MIC:70 California Department of Tax and Fee Administration PO Box 942879 Sacramento, CA 94279-0070 1-916-324-2798 phone • 1-888-324-2798 toll-free phone • 1-916-323-3319 fax Note: The statements in this publication are general and are current as of the date on the cover. The law is complex and subject to change. If there is a conflict between this publication and the law, the law is controlling. Page 26 |

Enlarge image |

Appeals Procedures: Sales and Use Taxes and Special Taxes • August 2019

CDTFA-416 REV. 10 (1-18) STATE OF CALIFORNIA

PETITION FOR REDETERMINATION CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION

BUSINESS NAME ACCOUNT NUMBER

TAXPAYER/FEEPAYER NAME TYPE OF TAX OR FEE

PETITION FOR REDETERMINATION

Administrative Appeal

Generally, if you have received a notice of amount due from the California Department of Tax and Fee Administration (CDTFA), you may

file an administrative appeal of that notice using this Petition for Redetermination. There are two important deadlines:

1. Ifyou received a Notice of Determination, aNotice of Deficiency Assessment, or aNotice of Successor Liability, you have

30 days from the date on the notice to appeal.

2. Ifyou received a Jeopardy Notice of Determination, you only have 10 days from the date listed on that document to appeal

andpay the amount dueor deposit security considered acceptable by the CDTFA.

Look carefully at the notice you received for the specific conditions and requirements for filing this petition. Anyone submitting a petition

should be prepared, upon request, to provide documents that support the specific grounds upon which the petition is founded.

I am filing a petition of the notice dated for the period

in the amount of $ .

Please indicate below the specific grounds upon which the petition is founded (required):

In addition, I have new documentation ready to present for review and consideration.

You have the right to, and may request, an appeals conference. During the review of your petition, CDTFA staff may ask you about your

request for an appeals conference, and confirm whether you still want an appeals conference. You must respond timelyto that request. If

your case is accepted into the administrative appeals process, you may request that your case be considered under the CDTFA’s

administrative Settlement Program. Review under the Settlement Program is confidential and will not affect your appeal rights.

Please indicate your requests below:

I request an appeals conference with an Appeals Bureau attorney or auditor at the CDTFA’s nearest office or in the

CDTFA’s Headquarters office in Sacramento.

I request my appeal be considered under the Settlement Program.

SIGNATURE DATE SIGNED DAYTIME TELEPHONE NUMBER

PRINTED NAME TITLE/CAPACITY EMAIL ADDRESS

If there is a conflict between this form or the notice you received and the law, the law is controlling. The filing of a Petition for Redetermination

does not protect your right to a refund of tax/fee, interest, or penalty amounts paid in excess of amounts legally due. You must timely file a claim

for refund if you believe you have overpaid tax/fee, interest, or penalty amounts. Filing a petition will not prevent interest from accruing on any

unpaid tax/fee due.

Page 27

CLEAR PRINT

|

Enlarge image |

Appeals Procedures: Sales and Use Taxes and Special Taxes • August 2019

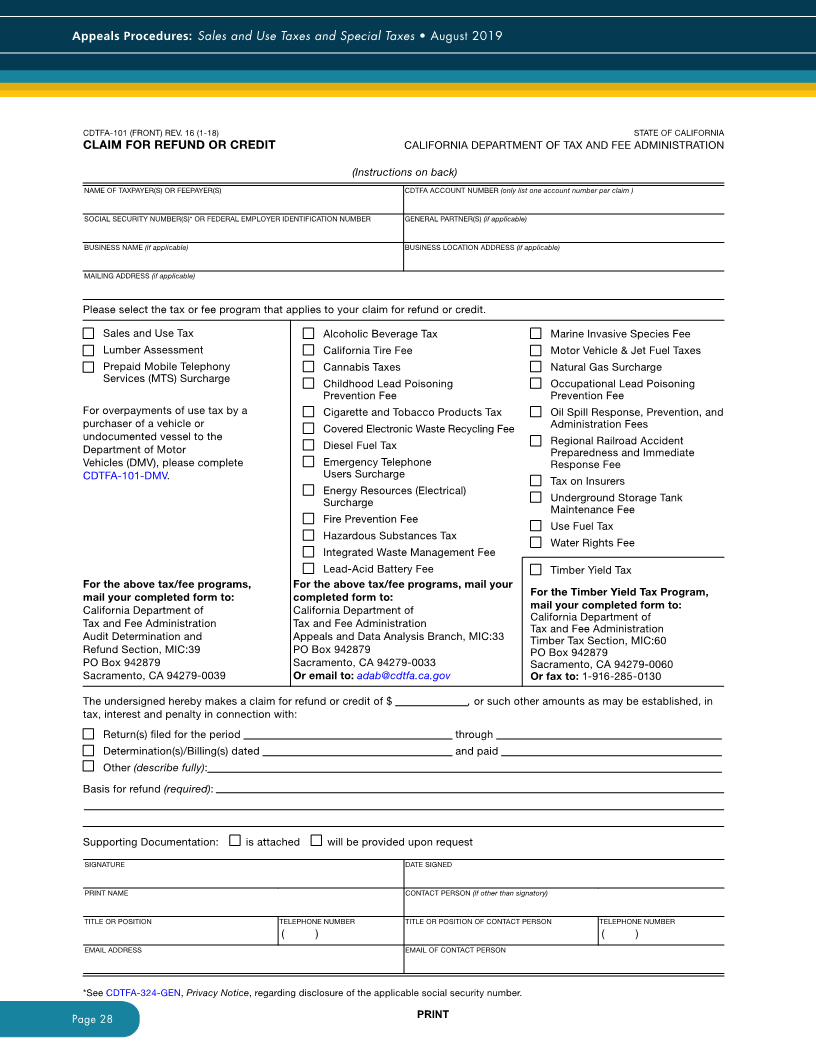

CDTFA-101 (FRONT) REV. 16 (1-18) STATE OF CALIFORNIA

CLAIM FOR REFUND OR CREDIT CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION

(Instructions on back)

NAME OF TAXPAYER(S) OR FEEPAYER(S) CDTFA ACCOUNT NUMBER (only list one account number per claim )

SOCIAL SECURITY NUMBER(S)* OR FEDERAL EMPLOYER IDENTIFICATION NUMBER GENERAL PARTNER(S) (if applicable)

BUSINESS NAME (if applicable) BUSINESS LOCATION ADDRESS (if applicable)

MAILING ADDRESS (if applicable)

Please select the tax or fee program that applies to your claim for refund or credit.

Sales and Use Tax Alcoholic Beverage Tax Marine Invasive Species Fee

Lumber Assessment California Tire Fee Motor Vehicle & Jet Fuel Taxes

Prepaid Mobile Telephony Cannabis Taxes Natural Gas Surcharge

Services (MTS) Surcharge Childhood Lead Poisoning Occupational Lead Poisoning

Prevention Fee Prevention Fee

For overpayments of use tax by a Cigarette and Tobacco Products Tax Oil Spill Response, Prevention, and

purchaser of a vehicle or Covered Electronic Waste Recycling Fee Administration Fees

undocumented vessel to the Diesel Fuel Tax Regional Railroad Accident

Department of Motor Preparedness and Immediate

Vehicles (DMV), please complete Emergency Telephone Response Fee

CDTFA-101-DMV. Users Surcharge Tax on Insurers

Energy Resources (Electrical) Underground Storage Tank

Surcharge

Maintenance Fee

Fire Prevention Fee Use Fuel Tax

Hazardous Substances Tax Water Rights Fee

Integrated Waste Management Fee

Lead-Acid Battery Fee Timber Yield Tax

For the above tax/fee programs, For the above tax/fee programs, mail your

mail your completed form to: completed form to: For the Timber Yield Tax Program,

California Department of California Department of mail your completed form to:

Tax and Fee Administration Tax and Fee Administration California Department of

Tax and Fee Administration

Audit Determination and Appeals and Data Analysis Branch, MIC:33 Timber Tax Section, MIC:60

Refund Section, MIC:39 PO Box 942879 PO Box 942879

PO Box 942879 Sacramento, CA 94279-0033 Sacramento, CA 94279-0060

Sacramento, CA 94279-0039 Or email to: adab@cdtfa.ca.gov Or fax to: 1-916-285-0130

The undersigned hereby makes a claim for refund or credit of $ , or such other amounts as may be established, in

tax, interest and penalty in connection with:

Return(s) filed for the period through

Determination(s)/Billing(s) dated and paid

Other (describe fully):

Basis for refund (required):

Supporting Documentation: is attached will be provided upon request

SIGNATURE DATE SIGNED

PRINT NAME CONTACT PERSON (if other than signatory)

TITLE OR POSITION TELEPHONE NUMBER TITLE OR POSITION OF CONTACT PERSON TELEPHONE NUMBER

( ) ( )

EMAIL ADDRESS EMAIL OF CONTACT PERSON

*See CDTFA-324-GEN, Privacy Notice, regarding disclosure of the applicable social security number.

Page 28 CLEAR PRINT

|

Enlarge image |

Appeals Procedures: Sales and Use Taxes and Special Taxes • August 2019

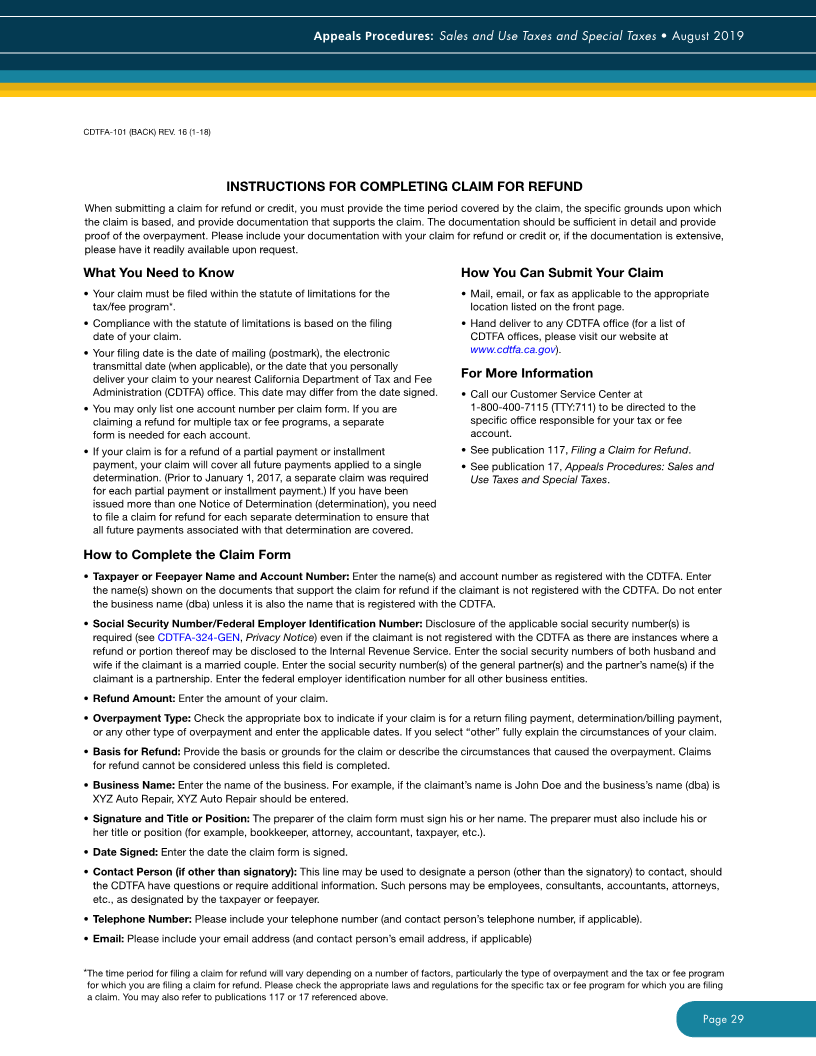

CDTFA-101 (BACK) REV. 16 (1-18)

INSTRUCTIONS FOR COMPLETING CLAIM FOR REFUND

When submitting a claim for refund or credit, you must provide the time period covered by the claim, the specific grounds upon which

the claim is based, and provide documentation that supports the claim. The documentation should be sufficient in detail and provide

proof of the overpayment. Please include your documentation with your claim for refund or credit or, if the documentation is extensive,

please have it readily available upon request.

What You Need to Know How You Can Submit Your Claim

• Your claim must be filed within the statute of limitations for the • Mail, email, or fax as applicable to the appropriate

tax/fee program*. location listed on the front page.

• Compliance with the statute of limitations is based on the filing • Hand deliver to any CDTFA office (for a list of

date of your claim. CDTFA offices, please visit our website at

• Your filing date is the date of mailing (postmark), the electronic www.cdtfa.ca.gov).

transmittal date (when applicable), or the date that you personally

deliver your claim to your nearest California Department of Tax and Fee For More Information

Administration (CDTFA) office. This date may differ from the date signed. • Call our Customer Service Center at

• You may only list one account number per claim form. If you are 1-800-400-7115 (TTY:711) to be directed to the

claiming a refund for multiple tax or fee programs, a separate specific office responsible for your tax or fee

form is needed for each account. account.

• If your claim is for a refund of a partial payment or installment • See publication 117, Filing a Claim for Refund.

payment, your claim will cover all future payments applied to a single • See publication 17, Appeals Procedures: Sales and

determination. (Prior to January 1, 2017, a separate claim was required Use Taxes and Special Taxes.

for each partial payment or installment payment.) If you have been

issued more than one Notice of Determination (determination), you need

to file a claim for refund for each separate determination to ensure that

all future payments associated with that determination are covered.

How to Complete the Claim Form

• Taxpayer or Feepayer Name and Account Number: Enter the name(s) and account number as registered with the CDTFA. Enter

the name(s) shown on the documents that support the claim for refund if the claimant is not registered with the CDTFA. Do not enter

the business name (dba) unless it is also the name that is registered with the CDTFA.

• Social Security Number/Federal Employer Identification Number: Disclosure of the applicable social security number(s) is

required (see CDTFA-324-GEN, Privacy Notice) even if the claimant is not registered with the CDTFA as there are instances where a

refund or portion thereof may be disclosed to the Internal Revenue Service. Enter the social security numbers of both husband and

wife if the claimant is a married couple. Enter the social security number(s) of the general partner(s) and the partner’s name(s) if the

claimant is a partnership. Enter the federal employer identification number for all other business entities.

• Refund Amount: Enter the amount of your claim.

• Overpayment Type: Check the appropriate box to indicate if your claim is for a return filing payment, determination/billing payment,

or any other type of overpayment and enter the applicable dates. If you select “other” fully explain the circumstances of your claim.

• Basis for Refund: Provide the basis or grounds for the claim or describe the circumstances that caused the overpayment. Claims

for refund cannot be considered unless this field is completed.

• Business Name: Enter the name of the business. For example, if the claimant’s name is John Doe and the business’s name (dba) is

XYZ Auto Repair, XYZ Auto Repair should be entered.

• Signature and Title or Position: The preparer of the claim form must sign his or her name. The preparer must also include his or

her title or position (for example, bookkeeper, attorney, accountant, taxpayer, etc.).

• Date Signed: Enter the date the claim form is signed.

• Contact Person (if other than signatory): This line may be used to designate a person (other than the signatory) to contact, should

the CDTFA have questions or require additional information. Such persons may be employees, consultants, accountants, attorneys,

etc., as designated by the taxpayer or feepayer.

• Telephone Number: Please include your telephone number (and contact person’s telephone number, if applicable).

• Email: Please include your email address (and contact person’s email address, if applicable)

* The time period for filing a claim for refund will vary depending on a number of factors, particularly the type of overpayment and the tax or fee program

for which you are filing a claim for refund. Please check the appropriate laws and regulations for the specific tax or fee program for which you are filing

a claim. You may also refer to publications 117 or 17 referenced above.

Page 29

|

Enlarge image |

Appeals Procedures: Sales and Use Taxes and Special Taxes • August 2019

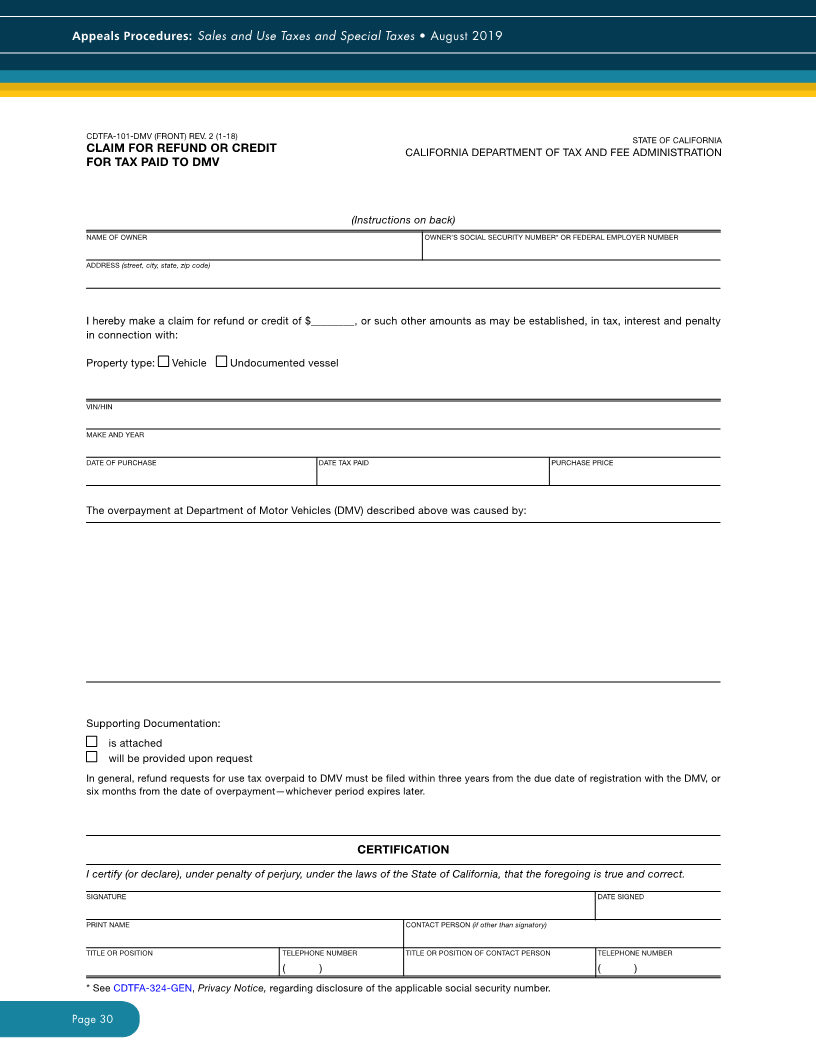

CDTFA-101-DMV (FRONT) REV. 2 (1-18) STATE OF CALIFORNIA

CLAIM FOR REFUND OR CREDIT CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION

FOR TAX PAID TO DMV

(Instructions on back)

NAME OF OWNER OWNER’S SOCIAL SECURITY NUMBER* OR FEDERAL EMPLOYER NUMBER

ADDRESS (street, city, state, zip code)

I hereby make a claim for refund or credit of $________, or such other amounts as may be established, in tax, interest and penalty

in connection with:

Property type: Vehicle Undocumented vessel

VIN/HIN

MAKE AND YEAR

DATE OF PURCHASE DATE TAX PAID PURCHASE PRICE

The overpayment at Department of Motor Vehicles (DMV) described above was caused by:

Supporting Documentation:

is attached

will be provided upon request

In general, refund requests for use tax overpaid to DMV must be filed within three years from the due date of registration with the DMV, or

six months from the date of overpayment—whichever period expires later.

CERTIFICATION

I certify (or declare), under penalty of perjury, under the laws of the State of California, that the foregoing is true and correct.

SIGNATURE DATE SIGNED

PRINT NAME CONTACT PERSON (if other than signatory)

TITLE OR POSITION TELEPHONE NUMBER TITLE OR POSITION OF CONTACT PERSON TELEPHONE NUMBER

( ) ( )

* See CDTFA-324-GEN, Privacy Notice, regarding disclosure of the applicable social security number.

Page 30

|

Enlarge image |

Appeals Procedures: Sales and Use Taxes and Special Taxes • August 2019

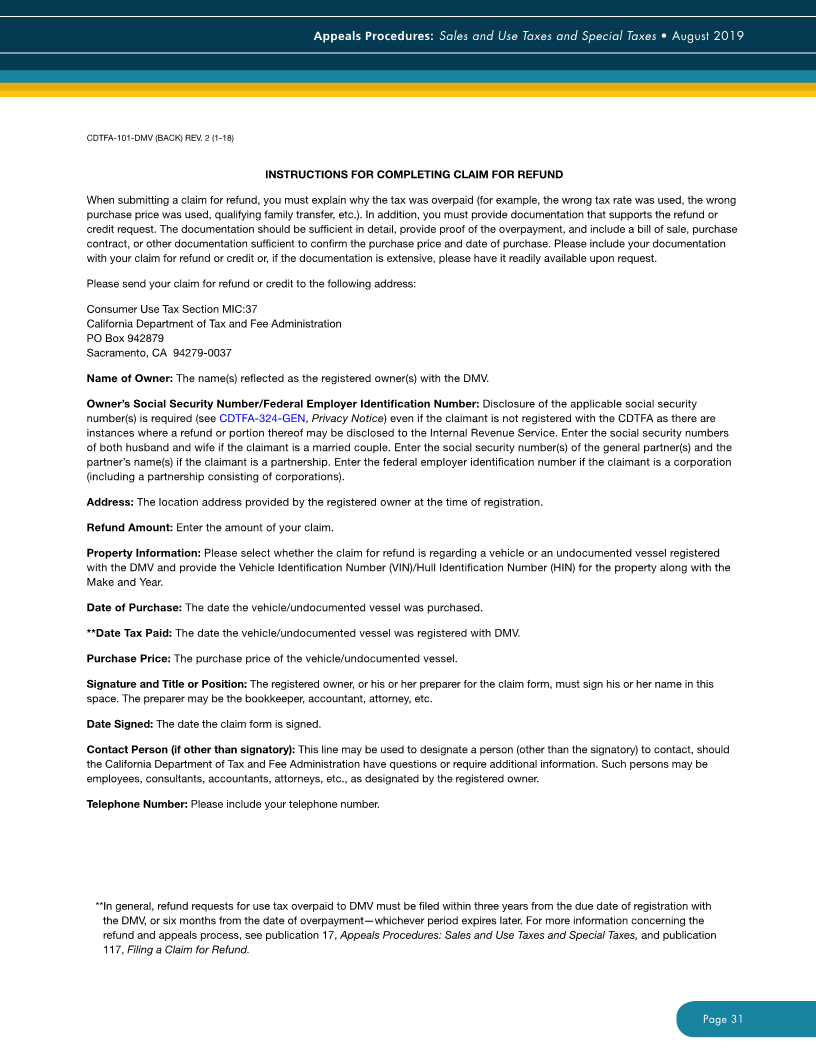

CDTFA-101-DMV (BACK) REV. 2 (1-18)

INSTRUCTIONS FOR COMPLETING CLAIM FOR REFUND

When submitting a claim for refund, you must explain why the tax was overpaid (for example, the wrong tax rate was used, the wrong

purchase price was used, qualifying family transfer, etc.). In addition, you must provide documentation that supports the refund or

credit request. The documentation should be sufficient in detail, provide proof of the overpayment, and include a bill of sale, purchase

contract, or other documentation sufficient to confirm the purchase price and date of purchase. Please include your documentation

with your claim for refund or credit or, if the documentation is extensive, please have it readily available upon request.

Please send your claim for refund or credit to the following address:

Consumer Use Tax Section MIC:37

California Department of Tax and Fee Administration

PO Box 942879

Sacramento, CA 94279-0037

Name of Owner: The name(s) reflected as the registered owner(s) with the DMV.

Owner’s Social Security Number/Federal Employer Identification Number: Disclosure of the applicable social security

number(s) is required (see CDTFA-324-GEN, Privacy Notice) even if the claimant is not registered with the CDTFA as there are

instances where a refund or portion thereof may be disclosed to the Internal Revenue Service. Enter the social security numbers

of both husband and wife if the claimant is a married couple. Enter the social security number(s) of the general partner(s) and the

partner’s name(s) if the claimant is a partnership. Enter the federal employer identification number if the claimant is a corporation

(including a partnership consisting of corporations).

Address: The location address provided by the registered owner at the time of registration.

Refund Amount: Enter the amount of your claim.

Property Information: Please select whether the claim for refund is regarding a vehicle or an undocumented vessel registered

with the DMV and provide the Vehicle Identification Number (VIN)/Hull Identification Number (HIN) for the property along with the

Make and Year.

Date of Purchase: The date the vehicle/undocumented vessel was purchased.

**Date Tax Paid: The date the vehicle/undocumented vessel was registered with DMV.

Purchase Price: The purchase price of the vehicle/undocumented vessel.

Signature and Title or Position: The registered owner, or his or her preparer for the claim form, must sign his or her name in this

space. The preparer may be the bookkeeper, accountant, attorney, etc.

Date Signed: The date the claim form is signed.

Contact Person (if other than signatory): This line may be used to designate a person (other than the signatory) to contact, should

the California Department of Tax and Fee Administration have questions or require additional information. Such persons may be

employees, consultants, accountants, attorneys, etc., as designated by the registered owner.

Telephone Number: Please include your telephone number.

**In general, refund requests for use tax overpaid to DMV must be filed within three years from the due date of registration with

the DMV, or six months from the date of overpayment—whichever period expires later. For more information concerning the

refund and appeals process, see publication 17, Appeals Procedures: Sales and Use Taxes and Special Taxes, and publication

117, Filing a Claim for Refund.

Page 31

|

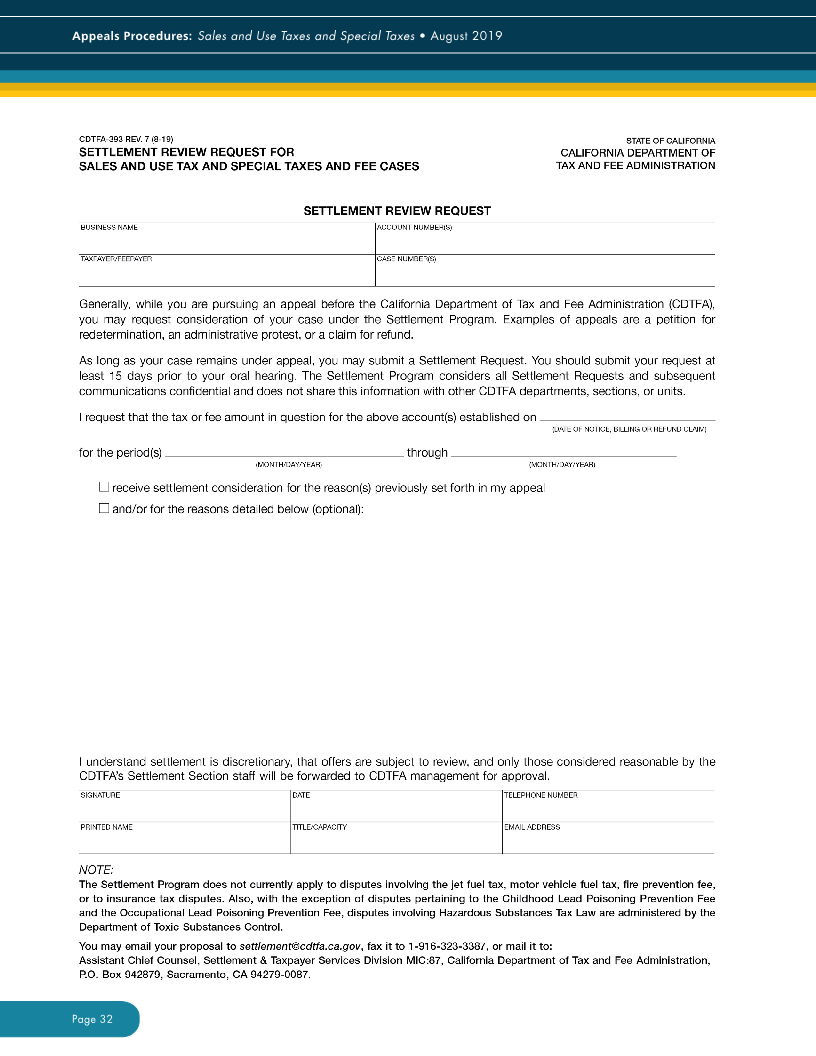

Enlarge image | Appeals Procedures: Sales and Use Taxes and Special Taxes • August 2019 Page 32 |

Enlarge image | PUBLICATION 17 AUGUST•2019 |