Enlarge image

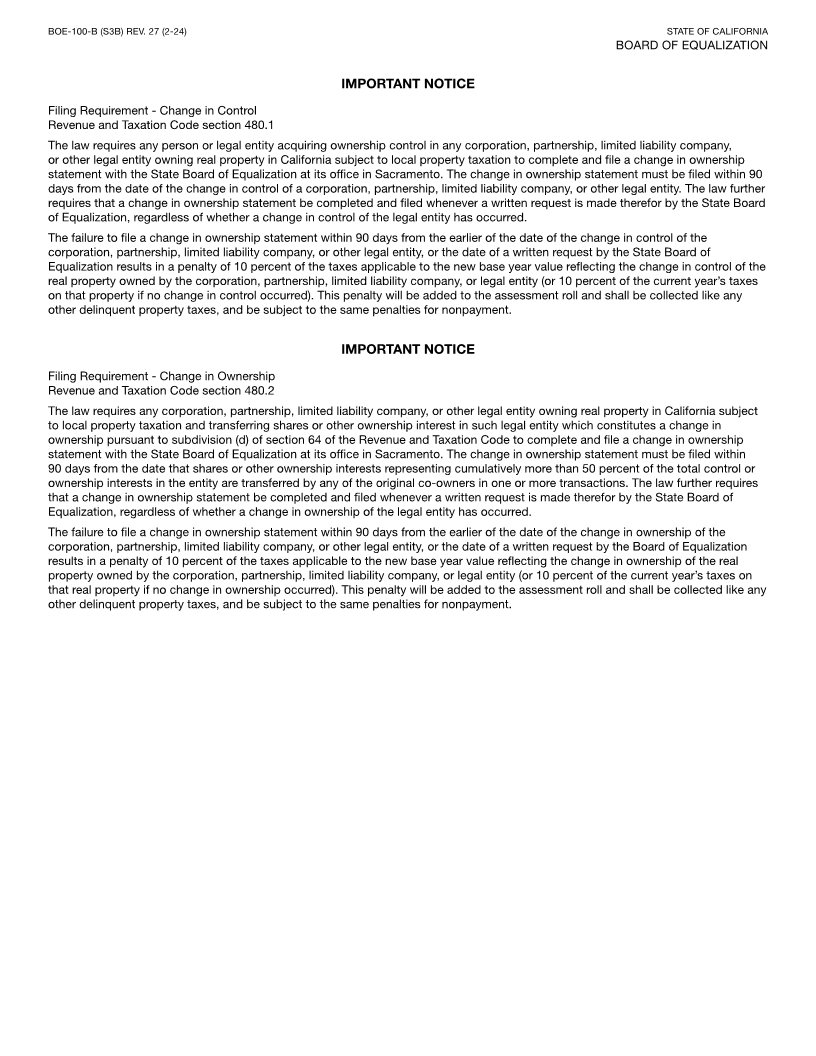

BOE-100-B (S1F) REV. 27 (2-24) Submit completed form to: STATE OF CALIFORNIA

STATE BOARD OF EQUALIZATION BOARD OF EQUALIZATION

COUNTY-ASSESSED PROPERTIES DIVISION (MIC:64)

PO BOX 942879, SACRAMENTO, CA 94279-0064

STATEMENT OF CHANGE IN CONTROL AND OWNERSHIP OF LEGAL ENTITIES

STATE USE ONLY NAME AND ADDRESS OF LEGAL ENTITY:

CIC/CIO Date:

Result Code

FLE:

Sch. A

Sch. B

Date Entered:

Legal Entity Identification Number:

Note: For corporations and limited liability companies, list the ID Number assigned by California Secretary of State.

For partnerships, list the Employer Identification Number (EIN).

FILING REQUIREMENTS under Revenue and Taxation Code (R&TC) (see Important Notice [BOE-100-B, S3B]):

This statement must be completed and filed with the Board of Equalization (BOE) within 90 days of a change in control (CIC) or

change in ownership (CIO) of a legal entity, if, as of that date, that legal entity (or entities under its ownership control) also owned (or

under certain circumstances leased) an interest in California real property. Additionally, this statement must also be filed within 90 days

of the BOE’s written request, regardless of whether a CIC or CIO occurred.

Please refer to page 1 of the Instructions (BOE-100-B-INST) for definition of terms.

*ALL questions below must be completed.

YES NO 1a. On or after January 1, and through the certification date below, has the legal entity filing this form (or any

legal entity[ies] under its ownership control) acquired ownership control (more than 50 percent of the ownership

interests) in any other legal entity, through one or more transactions; AND

YES NO 1b. Did the acquired legal entity(ies) (or any legal entity[ies] under its ownership control) hold any interests in real

property in California on the date of acquisition?

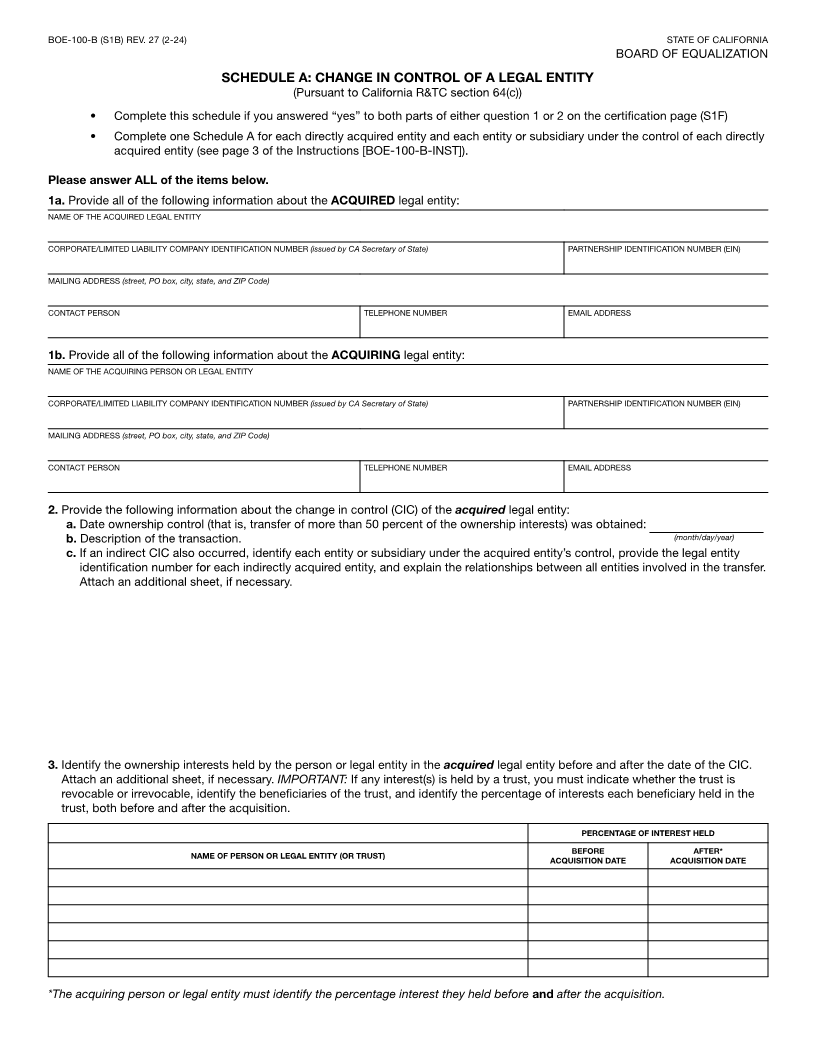

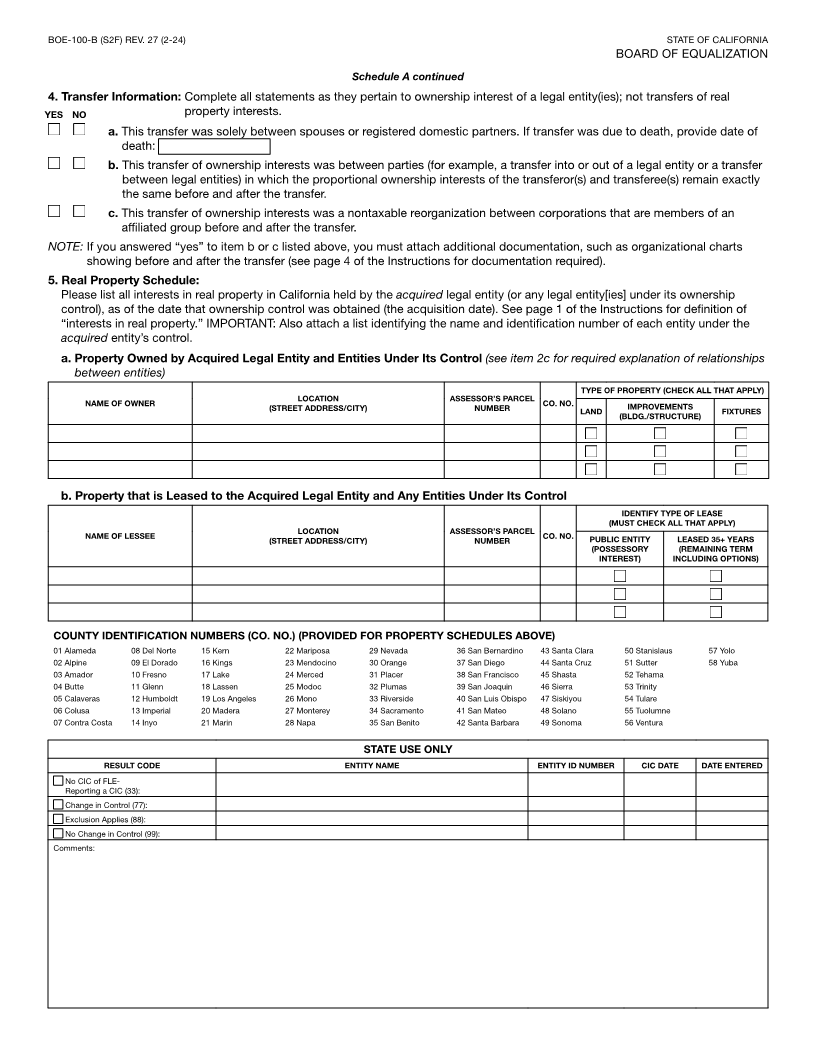

*If you answered “yes” to both parts of question 1 above, R&TC section 64(c) applies. Complete Schedule A.

YES NO 2a. On or after January 1, and through the certification date below, has any person or legal entity (or any

legal entity[ies] under its ownership control) acquired ownership control (more than 50 percent of the ownership

interests) in the legal entity filing this form (or any legal entity[ies] under its ownership control), through one or

more transactions; AND

YES NO 2b. Did the legal entity filing this form (or any legal entity[ies] under its ownership control) hold any interests in real

property in California on the date of acquisition?

*If you answered “yes” to both parts of question 2 above, R&TC section 64(c) applies. Complete Schedule A.

YES NO 3a. Since March 1, 1975, has any California real property that was transferred to the filing legal entity been excluded

from reassessment under R&TC section 62(a)(2); AND

YES NO 3b. Has cumulatively more than 50 percent of any original co-owners’ interests in the legal entity filing this form

transferred since the date the real property was originally excluded from reassessment?

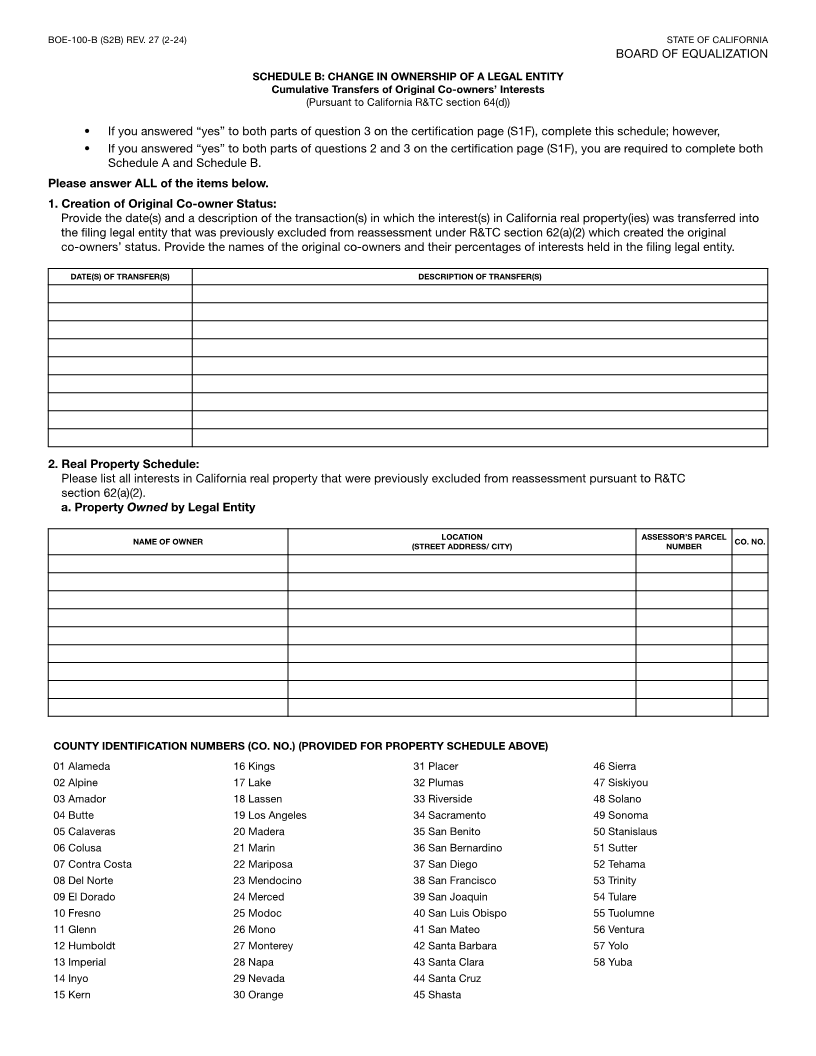

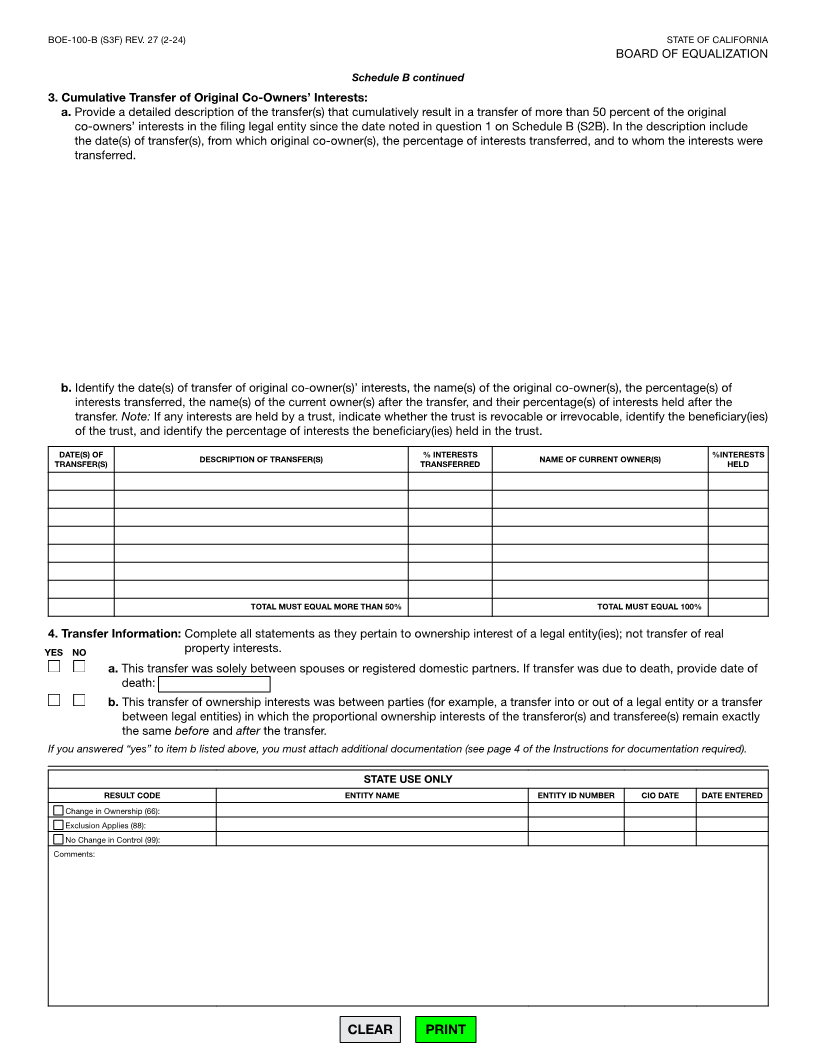

*If you answered “yes” to both parts of question 3 above, R&TC section 64(d) applies. Complete Schedule B.

CERTIFICATION

I certify (or declare) under penalty of perjury under the laws of the State of California that the foregoing and all information hereon,

including any accompanying statements or documents, is true, correct, and complete to the best of my knowledge and belief.

SIGNATURE (required) TITLE OF PERSON CERTIFYING INFORMATION EMAIL ADDRESS (required)

PRINT/TYPE NAME OF PERSON CERTIFYING (required) TELEPHONE NUMBER (required) DATE (required)

This statement shall be signed either by an officer, partner, or an employee or agent who has been designated in writing by the board

of directors, partnership, limited liability company, or other entity to sign such statements on its behalf.

THIS STATEMENT IS SUBJECT TO AUDIT AND IS NOT A PUBLIC DOCUMENT