Enlarge image

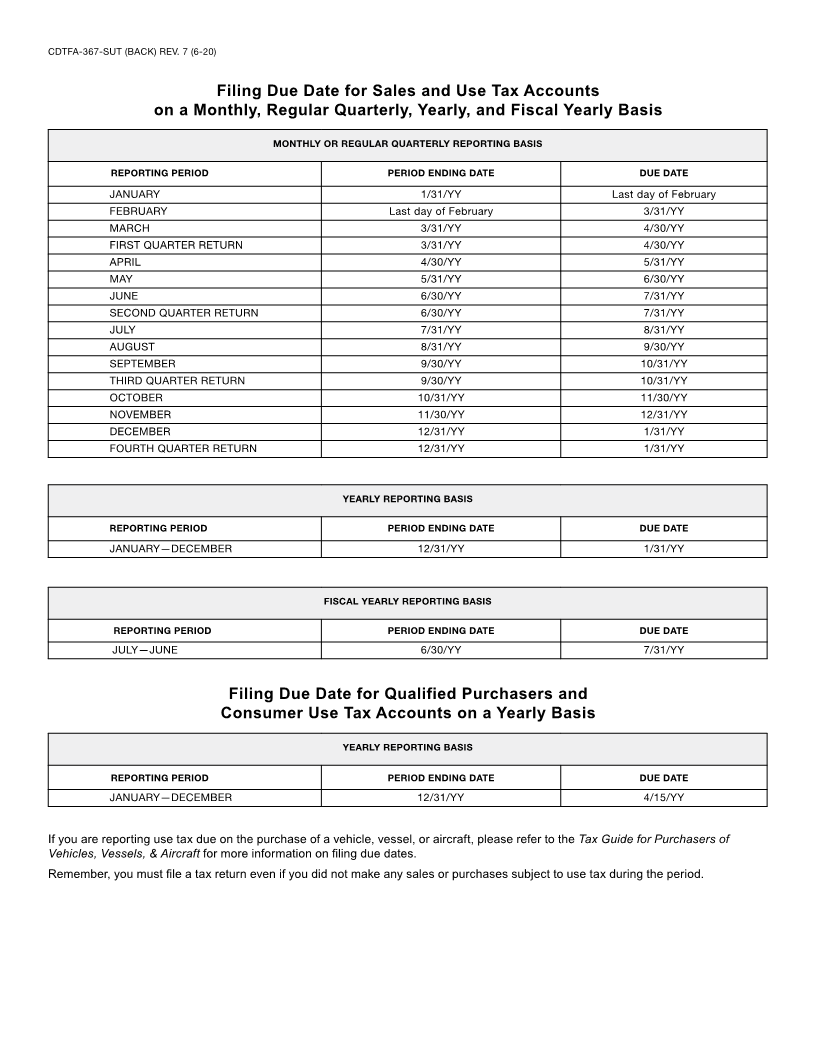

CDTFA-367-SUT (FRONT) REV. 7 (6-20) STATE OF CALIFORNIA CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION FILING INSTRUCTIONS FOR SALES AND USE TAX ACCOUNTS ON A QUARTERLY AND PREPAYMENT FILING BASIS (The following due dates do not apply to taxpayers filing on a special reporting basis.) Prepayments of tax are due as follows: FIRST, THIRD, AND FOURTH CALENDAR QUARTERS The first prepayment is due on or before the 24th day of the month following the first month of the quarter. The second prepayment is due on or before the 24th day of the month following the second month of the quarter. All prepayments in the first, third, and fourth quarters must be an amount: 1. not less than 90 percent of the tax liability for the month, or 2. equal to one‑third (1/3) of the measure of tax liability reported for the corresponding quarterly period of the preceding year multiplied by the tax rate in effect when prepayment is made, provided you or your predecessor were in business during all of the quarter. SECOND CALENDAR QUARTER The first prepayment is due on or before May 24th. This prepayment is for the month of April and must be an amount: 1. not less than 90 percent of the tax liability for the month of April, or 2. equal to one‑third (1/3) of the measure of tax liability reported for the corresponding quarterly period of the preceding year multiplied by the tax rate in effect when prepayment is made, provided you or your predecessor were in business during all of the quarter. The second prepayment is due on or before June 24th. This prepayment is for the period of May 1 through June 15 and must be an amount: 1. equal to 135 percent of the tax liability for May, or 2. equal to 90 percent of the tax liability for May plus 90 percent of the tax liability for the first 15 days of June, or 3. not less than one‑half (1/2) of the measure of tax liability reported for the corresponding quarterly period of the preceding year multiplied by the tax rate in effect when prepayment is made, provided you or your predecessor were in business during all of the quarter. Filing Due Date for Sales and Use Tax Prepayments and Returns QUARTERLY OR QUARTERLY PREPAYMENT REPORTING BASIS REPORTING PERIOD PERIOD ENDING DATE DUE DATE 1ST QUARTER (JANUARY—MARCH) FIRST PREPAYMENT 3/31/YY 2/24/YY SECOND PREPAYMENT 3/31/YY 3/24/YY QUARTERLY RETURN 3/31/YY 4/30/YY 2ND QUARTER (APRIL—JUNE) FIRST PREPAYMENT 6/30/YY 5/24/YY SECOND PREPAYMENT 6/30/YY 6/24/YY QUARTERLY RETURN 6/30/YY 7/31/YY 3RD QUARTER (JULY—SEPTEMBER) FIRST PREPAYMENT 9/30/YY 8/24/YY SECOND PREPAYMENT 9/30/YY 9/24/YY QUARTERLY RETURN 9/30/YY 10/31/YY 4TH QUARTER (OCTOBER—DECEMBER) FIRST PREPAYMENT 12/31/YY 11/24/YY SECOND PREPAYMENT 12/31/YY 12/24/YY QUARTERLY RETURN 12/31/YY 1/31/YY (over)