Enlarge image

Nonprofit Organizations

Enlarge image | Nonprofit Organizations |

Enlarge image | Preface This publication is a general guide to the Sales and Use Tax Law and Regulations as they apply to sales and purchases by nonprofit organizations, including schools, religious organizations and churches, charitable organizations, and other nonprofit groups. If you cannot find the information you are looking for in this publication, please call our Customer Service Center at 1-800-400-7115 (CRS:711). Customer service representatives are available to answer your questions Monday through Friday, between 7:30 a.m. and 5:00 p.m. (Pacific time), except state holidays. This publication complements publication 73, Your California Seller’s Permit, which includes general information about obtaining a permit; using a resale certificate; collecting and reporting sales and use taxes; buying, selling, or discontinuing a business; and keeping records. Also, please refer to our website or the For More Information section of this publication for the California Department of Tax and Fee Administration (CDTFA) regulations and publications referenced throughout this publication. We welcome your ideas on improving this or any other CDTFA publication. Please send your suggestions to: Audit and Information Section, MIC:44 California Department of Tax and Fee Administration PO Box 942879 Sacramento, CA 94279-0044 Tips for using this publication Read the introduction No matter what kind of organization you operate, be sure to read the introductory section of this publication. It includes background information that will help you understand the remainder of the publication. Check the organization information While there is no general sales and use tax exclusion for nonprofit organizations, certain types of organizations are eligible for specific tax exemptions and exclusions. Please check the organization-specific sections for information that may apply to your group before you move on to the rest of the publication. Know your income and property tax exemptions As you read this publication, it will help if you know which sections of the Federal and State income tax law and property tax law apply to your organization. For example, you may need to know if your organization is exempt from income tax under Internal Revenue Code section 501(c)(3) or (c)(4), and/or California Revenue and Taxation Code section 23701. You may also need to know if your group is exempt from property taxes under Revenue and Taxation Code section 214, commonly known as the “welfare exemption.” For information on the welfare exemption, contact your county assessor or visit the Property Tax section of our website at www.cdtfa.ca.gov. Please note: This publication summarizes the law and applicable regulations in effect when the publication was written, as noted on the back cover. However, changes in the law or regulations may have occurred since that time. If there is a conflict between the text in this publication and the law, decisions will be based on the law and not on this publication. |

Enlarge image | Contents Introduction Sales and Use Tax Basics for Various Types of Nonprofit Organizations 4 Types of Organizations Charitable Organizations That Relieve Poverty and Distress 6 Cultural Organizations: Museums, Government Art Programs, Library Support Organizations, and Zoological Societies 8 Nonprofit Veterans’ Organizations 11 Religious Organizations 13 Social Clubs and Fraternal Organizations 16 Schools, Parent-Teacher Associations, Children’s Organizations, or Youth Organizations, and Children’s Clothing 18 Organizations That Provide Human Services and Goods Related to Medical or Health Information, Disabilities, HIV/AIDS, Nutrition, and Homelessness 22 Volunteer Fire Departments 23 Organizations That Construct Military and Veteran Medical Facilities 24 Specific Sales Activities Food and Meals 25 Vending Machines 30 Newspapers and Periodicals 31 Sales That Involve Fundraiser Companies 34 Promotional Items Sold to Members 34 General Obligations of Sellers and Purchasers Registration Requirements 35 Collecting and Paying Tax 36 Donations to Nonprofit and Religious Organizations Business Donations of Goods and Services 40 For More Information 42 |

Enlarge image |

Introduction

Sales and Use Tax Basics for Various Types of Nonprofit Organizations

This section provides introductory information describing California’s sales and use tax and how it generally applies to

sales and purchases by nonprofit organizations. It also provides basic information that can help you determine whether

any of your organization’s sales may qualify for special sales tax exemptions or exclusions. Be sure to read this section

before you move on to the rest of the publication.

Tax applies unless there is a specific exemption or exclusion

In California, sales tax applies to the sale of tangible personal property (referred to as “merchandise” or “goods” in this

publication) unless the sale is covered by a specific legal exemption or exclusion. Individuals, businesses, and groups that

sell taxable merchandise in California must pay sales tax on their taxable sales. Sellers may charge their customers for

sales tax reimbursement (referred to as “sales tax”).

Similarly, use tax applies to the purchase of taxable merchandise that will be used, consumed, stored, or given away in

this state unless the purchase is exempt or excluded from tax. Individuals, business, and groups must pay use tax on their

taxable purchases. The state use tax is complementary to, and mutually exclusive of, the state sales tax.

Tax generally applies regardless of whether the items you sell or purchase are new, used, donated, or homemade.

No general exemption for nonprofit and religious organizations

Although many nonprofit and religious organizations are exempt from federal and state income tax, there is no similar

broad exemption from California sales and use tax. Generally, a nonprofit’s sales and purchases are taxable. In other

words, nonprofit and religious organizations, in general, are treated just like other California sellers and buyers for sales

and use tax purposes.

However, there are special exemptions and exclusions available for certain nonprofit and religious organizations. Some

organizations may not owe tax on their sales, whereas some organizations may owe tax on certain types of sales, but not

all sales. Other organizations may be responsible for tax just like other California sellers. It all depends on what type of

organization you are and what your organization’s practices and activities are. Later sections of this publication provide

information to help you determine which exemptions and exclusions may apply to your organization.

Typical taxable sales by nonprofit organizations

As noted above, a sale of merchandise or goods is generally taxable unless it’s covered by a specific exemption or

exclusion. Before you read the sections on specific organizations or types of sales, you may need to know more about

sales in general.

A sale is an exchange of merchandise or goods for something else of value: money, barter, or trade. The barter or trade

doesn’t have to be a two-way exchange of merchandise. It also includes an exchange of merchandise for services.

For example, if you give meals to your accountant in your museum café in exchange for accounting services, that’s

considered a sale of the meals.

Nonprofits commonly conduct a variety of activities that are considered sales. These include (but are not limited to) the

following:

• Sales of food, meals, beverages, and similar items under a number of different circumstances.

• Sales of tickets that buyers will exchange for food, beverages, or other physical products.

• Sales of booklets, books, pamphlets, etc.

• Sales of tickets for fundraising events when the ticket price includes amounts for food or beverages.

• Sales of items at rummage sales, bazaars, carnival booths, community events, and other fundraisers.

• Sales of merchandise in Internet, live, and silent auctions.

• Sales of tickets for game booths where prizes are guaranteed to each ticket purchaser, even when the prizes have little

value. Examples include white elephant, fish pond, grab bag, and “pitch-’til-you-win” games.

4 NONPROFIT ORGANIZATIONS JANUARY|2023

|

Enlarge image | Typical nontaxable activities by nonprofit organizations Nonprofits also carry out certain activities that are not considered sales for sales tax purposes. These activities generally are not subject to sales or use tax. Examples include: • The gifting of merchandise for a true donation: an amount someone gives your organization without expecting to receive merchandise of equal value in return. (Example: A member who donates $100 and receives a tote bag worth $5 generally is not considered a sale.) • Sales of tickets for concerts, movies, plays, shows, and similar events when food and meals are not included in the ticket price. • Sales of tickets for game booths and raffles when prizes are not guaranteed to every ticket purchaser. • The sale of travel, home rentals, guide services, personal services, tutoring, and other things of value that are not physical products. • Sales of gift cards, gift certificates, and coupon books. • Membership drives and other fundraising activities that do not involve the exchange of merchandise or that include merchandise premiums of a much lower value than the donation or membership amount. • Sales of advertising that does not involve exchanges of merchandise or goods. Most nonprofits that make sales need seller’s permits Nonprofit organizations generally need a seller’s permit if they make sales of goods or merchandise in California. This is true even if the sales are not taxable. In limited instances, when the organization makes sales only occasionally, we can issue a temporary seller’s permit. Permit requirements are explained in more detail in the organization-specific sections of this publication. Also please see Registration Requirements. JANUARY 2023 NONPROFIT| ORGANIZATIONS 5 |

Enlarge image | Types of Organizations Charitable Organizations That Relieve Poverty and Distress The Sales and Use Tax Law includes special exemptions for qualifying charitable organizations that relieve poverty and distress. This section is designed to address those exemptions. For more information, please see Regulation 1570, Charitable Organizations. Seller’s permit required The organizations described in this section are considered retailers and must hold a seller’s permit if they make sales of goods or merchandise, even if the sales are exempt from tax. Please see Registration Requirements and Collecting and Paying Tax for more information on seller’s permits and tax reporting requirements. Sales exempt from tax if charitable organization meets certain qualifications If your organization meets all of the following qualifications, your sales are not subject to sales or use tax. The organization must: • Be formed and operated for charitable purposes. • Qualify, under Revenue and Taxation Code section 214, for the “welfare exemption” from property taxation on the retail site where you sell merchandise. Or if the organization does not own the store, the organization must qualify for the welfare exemption on its personal property located there, such as the store fixtures and equipment (please see Note for thrift store operators). • Carry out activities that relieve poverty and distress. • Sell or donate items principally to assist purchasers or recipients in distressed financial condition. • Make, prepare, assemble, or manufacture the items it sells or donates. “Preparation” includes cleaning, repairing, or reconditioning items. “Assembly” includes gathering together items at one or more locations for sale or donation. Example : Your 501(c)(3) charitable nonprofit corporation, which conducts a rehabilitation program, has qualified for the welfare exemption from property tax. You operate an emergency shelter for homeless families where you cook inexpensive hot lunches and sell them to families in need at reduced prices. Although sales of hot meals are ordinarily taxable, your sales are tax exempt because your organization and sales meet all of the conditions listed above. Some purchases may be tax exempt If your organization meets the qualifications described earlier, your qualifying organization’s purchases are not subject to sales or use tax, provided the qualifying organization will donate or sell the items you purchase. In the example above, purchases of clothing, personal supplies, and other articles donated to the families in the emergency shelter would be tax exempt. However, tax does apply to purchases of items that the qualifying organization uses rather than donates or sells, such as office supplies or equipment, tools, displays, and similar items. Welfare exemption from property tax For information on the welfare exemption, see the Property Tax section of the California State Board of Equalization (BOE) website. The welfare exemption is jointly administered by the BOE and each county assessor. The BOE will determine whether an organization is eligible for the exemption. The county assessor determines whether the organization’s use of property qualifies the property for the exemption. Eligibility review If you believe your organization’s sales or purchases are exempt from sales and use tax as described in this section, you can write us and ask us to review your eligibility. If we determine you qualify for the exemption, we will send you a letter that verifies your exempt status. We will also let you know which documents to provide to your suppliers to enable you to purchase items without tax. 6 NONPROFIT ORGANIZATIONS JANUARY|2023 |

Enlarge image |

Send your request to:

BTFD-CTSCPUGroup@cdtfa.ca.gov

or

Compliance Policy Unit, MIC:40

California Department of Tax and Fee Administration

PO Box 942879

Sacramento, CA 94279-0040

Please provide all of the following information and documentation with your request:

• A letter describing your organization’s practices and activities, as well as what items will generally be purchased/sold by

the organization.

• A copy of your Organizational Clearance Certificate issued by the BOE showing that the organization qualifies under

Revenue and Taxation Code section 214 for the “welfare exemption.”

Note for thrift store operators: To qualify for the welfare exemption, a thrift store must, among other things, conduct a

rehabilitation program recognized by the California Department of Rehabilitation or operate under a city or county

rehabilitation program. It must also sell goods processed in some manner by people who are being rehabilitated through

the program and are employed in the operation of the store.

JANUARY 2023 NONPROFIT| ORGANIZATIONS 7

|

Enlarge image | Cultural Organizations: Museums, Government Art Programs, Library Support Organizations, and Zoological Societies This section includes information relating to sales and purchases by certain cultural organizations. For more information, please see regulations noted in the text. Permit and tax requirements, in general Permit requirements Museums, government art programs, library support groups, and zoological societies generally must hold seller’s permits if they make sales of merchandise or goods. Please see Registration Requirements and Collecting and Paying Tax for more information on seller’s permits and tax reporting requirements. General tax requirements Unless your sales qualify as tax exempt under one of the special exemptions described in this section, your sales of merchandise are generally taxable. This is true whether you buy the merchandise, make it, or receive it as a donation from an individual or a business. When you buy merchandise you sell as a retailer in a taxable sale, you can do so without paying sales tax to the supplier by issuing a resale certificate (see Purchases for resale). If you buy merchandise you will use rather than sell, you may be required to pay use tax or an amount for the sales tax to your supplier. Museums and government art programs For more information, please see Regulation 1586, Works of Art and Museum Pieces for Public Display. Purchases and leases of artwork and museum pieces For the exemptions described below, works of art include two-dimensional and three-dimensional works of visual art. The exemption is not limited to paintings, drawings, prints, photographs, and sculptures; it also includes film and crafts. Operative January 1, 2007, costumes, dresses, clothing, and items of personal adornment (such as jewelry) are also included. Sale or purchase of works of art on public display Under certain conditions, the sale or purchase of original works of art for permanent collections on public display is exempt from sales and use tax. The exemption covers original artworks that are any of the following: 1. Purchased by the state or any California county, city, or other local government entity for free public display. 2. Purchased by a nonprofit organization operating a public museum under contract with a government entity described in condition 1. 3. Purchased by a nonprofit organization exempt from state income taxes under section 23701d of the Revenue and Taxation Code for a museum open to the public at least 35 weeks a year for at least 20 hours a week. The buyer or another qualifying nonprofit organization must operate the museum. 4. Purchased by any buyer from a retailer for donation to a qualifying organization or government entity (see conditions 1-3). The retailer must deliver the artwork directly to the donee. The donor must transfer ownership to the recipient in writing. Leases of works of art Leases of original works of art are exempt from sales or use tax when both of the following conditions are met: • Both parties to the lease are nonprofit organizations of the types listed under condition 2 or 3 in the previous section. • The term of the lease is at least 35 years. The exemption also includes public art leased by the state or any local government from another entity for display in public places. Museum defined A museum is a place specifically designated for display of artifacts or objects of art that has a significant portion of its display space open to the public without charge during its normal operating hours; or has its entire display space open to the public without charge for at least six of its normal operating hours during each month of operation; or has its entire display space open without charge to a segment of the student or adult population for educational purposes. 8 NONPROFIT ORGANIZATIONS JANUARY|2023 |

Enlarge image | Purchase of replacement museum pieces Museums and governments sometimes lose items in their permanent collections to fire, flood, earthquake, and other causes. Sales and use tax does not apply to the purchase of replacement pieces under certain conditions. The replacement pieces must be all of the following: • Purchased to replace a museum display piece that was physically destroyed by fire, flood, earthquake, or other calamity. • Purchased within three years of the calamity. • Used exclusively for display. • Valued at the same or a lesser amount as the destroyed item as of its destruction date. The replacement piece does not have to be similar to the destroyed piece. To qualify as tax-exempt, the purchase must be made by one of the following: • A nonprofit museum regularly open to the public and operated by or for a local or state government entity. • A nonprofit museum regularly open to the public and operated by a nonprofit organization exempt from state income tax under section 23701d of the Revenue and Taxation Code. • A state or local government entity for its art collection that is open to the public without charge. Please note: Display cases, lighting fixtures, shelving, and similar items used in displaying the artwork or operating the museum do not qualify for this exemption. Nonprofit organizations assisting museums: rummage sales Under certain conditions, sales tax does not apply to sales by an authorized nonprofit museum auxiliary association or equivalent organization that assists a California city or county museum. You are considered a consumer, not a retailer of the items you sell, and you cannot issue resale certificates on your purchases. As a consumer, you may be required to pay use tax or sales tax on your purchase. The sales of the items are not taxable if both of the following conditions are met: • The rummage sale is at least the sixth consecutive annual rummage sale sponsored by the organization.* • All profits are used exclusively to advance the purpose of the organization. * For the first five consecutive annual rummage sales, the museum auxiliary is considered to be a retailer of the items it sells. It must report the sales and pay sales tax on the proceeds. If your organization’s sales are tax-exempt as shown above, you are considered a consumer, not a retailer of the items you sell. Although you are not required to pay tax on your sales, you do need a seller’s permit (see Registration Requirements.) Friends of the Library organizations Nonprofit associations commonly called “Friends of the Library” and equivalent organizations are considered consumers of items they sell when they meet both of the following conditions: • The organization performs auxiliary services to a library district, municipal library, or county library in California as authorized by the library’s governing authority. • The organization uses all profits from sales exclusively to advance its purpose. As a consumer, your sales are not taxable. However, you may be required to pay sales tax or use tax on your purchases. Example: The Sierraburg Friends of the Library receives a donation of 20 new books. It sells the books in its annual book sale and uses the profits to buy more books for the library. Because the organization qualifies as a consumer for sales tax purposes, it does not owe tax on the sale of the books. Since the books were donated, there is no sales tax due on the purchase. If Sierraburg had purchased the books from a retailer and then sold them at the annual book sale, sales tax should be paid to the vendor from whom the books were purchased. Sierraburg must not issue a resale certificate to the vendor to purchase the books without tax. JANUARY 2023 NONPROFIT| ORGANIZATIONS 9 |

Enlarge image |

Zoological societies

The sale, purchase, trade, or exchange of certain animals and plants is exempt from sales and use tax when both of the

following conditions are met:

• The animal or plant is a member of a threatened or endangered species listed on one of the Convention on

International Trade in Endangered Species of Wild Fauna and Floura (CITES) Appendixes or the federal threatened or

endangered species list. Please see www.cites.org.

• The buyer and the seller are nonprofit zoological societies (private charitable, scientific, or

educational (501)(c)(3) entities or government agencies).

Donations

Generally, items withdrawn from a seller’s inventory that are not resold are subject to use tax. However, items withdrawn

from a seller’s inventory and donated to an organization operated for educational, scientific, or literary purposes, including

nonprofit museums, art galleries, libraries, and performing arts groups, are not subject to use tax.

Merchandise or goods donated by a seller (donor) who paid sales or use tax at time of purchase does not qualify for this

exemption. This is true even if the donated items are resold by the organization and the organization must charge sales

tax when they sell it.

Generally, donations of gift cards, gift certificates, checks, cash, or services are not subject to sales tax since there is not

an exchange of merchandise or goods. Donations of services and gift cards are not considered taxable regardless of the

person donating, buying, or using them.

Leases of artwork

Effective January 1, 2007, Revenue and Taxation Code 6365 expands the exemption for original works of art to include

those leased from one nonprofit organization to another nonprofit organization for 35 years or more. The exemption

includes public art leased by the state or any local government from another entity for display in public places. The

definition of a work of art now includes a costume, dress, clothing, or personal adornment. A permanent collection, as it

applies to leases of original works of art, means a collection with a lease term of 35 years or more.

10 NONPROFIT ORGANIZATIONS JANUARY|2023

|

Enlarge image | Nonprofit Veterans’ Organizations This section describes specific exemptions that apply to nonprofit veterans’ organizations. If your organization sells food or meals, be sure to also read Food and Meals. Permit and tax requirements (in general) Permit requirements Nonprofit veterans’ organizations that make sales of merchandise or goods generally must hold a seller’s permit. Please see Registration Requirements and Collecting and Paying Tax for more information on seller’s permits and tax reporting requirements. General tax requirements Except for transactions where you are considered the consumer of purchases (for example: purchases that will be resold) but qualify as exempt sales as described in this section, your organization’s sales of merchandise are generally taxable. This is true whether you buy the merchandise, make it, or receive it as a donation from an individual or a business. When you buy merchandise to resell as a retailer in a taxable sale, you can do so without paying tax to your vendor by issuing a resale certificate (see Using a resale certificate). If you buy merchandise you will consume rather than sell, you may be required to pay sales tax to your supplier. Sales of flags and symbolic pins Nonprofit veterans’ organizations are considered the consumers of American flags they sell when the profits from the sales are used exclusively to advance the organization’s purpose. As explained in Introduction: Sales and Use Tax Basics for Various Types of Nonprofit Organizations and Collecting and Paying Tax, your sales are not taxable when your organization is a consumer. However, tax does apply to your purchase of the flags or materials used to make them. For more information, please see Regulation 1597, Property Transferred or Sold by Certain Nonprofit Organizations. Sales or use tax does not apply to a veterans’ organization’s sale or purchase of “Buddy Poppies,” and similar symbolic, temporary lapel pins when both of the following conditions are met: • The pins are sold or purchased by the Veterans of Foreign Wars or other specified organizations described in Revenue and Taxation Code section 6360.1. • The pins memorialize U.S. military veterans killed in foreign wars. Meals served by nonprofit veterans’ organizations Meal exemption Tax does not apply to your nonprofit veterans’ organization’s sales of meals and food products when all of the following conditions are met: • You sell the food or meals at a social or other gathering you conduct. • You furnish the meals or food to raise funds for your organization’s functions and activities. • You use the proceeds to carry out those functions and activities. Please note: Sales of carbonated and alcoholic beverages are exempt from sales tax as described above only when included in the price of a meal. Even though your sales of carbonated and alcoholic beverages may be exempt from sales tax, if you issue a resale certificate when purchasing these items, you will owe use tax on the purchase price if the carbonated or alcoholic beverage is included in the price of a meal. You must report the purchase price of the item under Purchases Subject to Use Tax on your sales and use tax return. Sales of carbonated and alcoholic beverages for a separate price are taxable. For additional information on the sale of food and meals, see Food and Meals. Loans of motor vehicles Loans by a retailer of motor vehicles to a veterans’ hospital or other nonprofit facility for use in teaching disabled veterans how to operate specially equipped vehicles are exempt from use tax. JANUARY 2023 NONPROFIT| ORGANIZATIONS 11 |

Enlarge image |

Veterans who qualify as an itinerant vendor (This law has ended December 31, 2021.)

The itinerant veteran vendor program was authorized by legislation from April 1, 2010, through December 31, 2021.

During this period, veterans who sold goods from temporary locations may have been considered “qualified itinerant

vendors.” Qualified itinerant vendors are the consumer and not the retailer of tangible personal property owned and sold

by the qualified itinerant vendor under specified conditions. When you are considered the consumer of tangible personal

property that you sell, it means that sales to you are retail sales for which either the sales or use tax applies. Resale

certificates may not be issued by you, the consumer, when making purchases. Since businesses generally owe tax on

sales made to consumers, a qualified itinerant vendor should expect to pay tax when purchasing merchandise from their

suppliers. As a consumer, a qualified itinerant vendor is generally not required to hold a seller’s permit.

A person is a “qualified itinerant vendor” when all of the following apply:

• The person was a member of the Armed Forces of the United States who received an honorable discharge or a

release from active duty under honorable conditions.

• The person is unable to obtain a livelihood by manual labor due to a service-related disability.

• For the purposes of selling tangible personal property, the person is a sole proprietor with no employees.

• The person has no permanent place of business in this state.

Please note: Itinerant veteran vendors who are engaged in catering or vending machine businesses, sell alcoholic

beverages, or who sell single items for more than $100, are not considered “qualified itinerant vendors” and are generally

required to obtain a seller’s permit and report and pay tax on their sales.

As a qualified itinerant vendor, you are responsible for maintaining documentation to establish that you meet all the

criteria noted above.

For this exemption, a “permanent place of business” means any building or other permanently affixed structure, including

a residence, used for the purpose of making sales or taking orders and arranging property for shipment.

A “permanent place of business” does not include any building or permanently affixed structure, including a residence,

used for the storage of tangible personal property or the cleaning of equipment or other property used in connection

with the manufacture or sale of tangible personal property.

Persons who are generally considered to not have a “permanent place of business” may include: vendors who only sell from

mobile food carts, beverage stands, or lunch wagons, and vendors who only sell at swap meets or other special events.

Starting January 1, 2022, itinerant veteran vendors that qualified for the above exemption are required to obtain a seller’s

permit, file sales and use tax returns, and pay tax on their sales to consumers in California.

If you have any further questions regarding this topic, please visit our website at www.cdtfa.ca.gov or call our Customer

Service Center at 1-800-400-7115 (CRS:711). Customer service representatives are available to answer your questions

Monday through Friday between 7:30 a.m. and 5:00 p.m. (Pacific time), except state holidays.

Military welfare society thrift stores

Tax does not apply to the sale of, and the storage, use, or other consumption in this state of, tangible personal property

sold by a thrift store located on a military installation and operated by a designated entity that, in partnership with the

United States Department of Defense, provides financial, educational, and other assistance to members of the Armed

Forces of the United States, eligible family members, and survivors that are in need. A “designated entity” means a military

welfare society described in Section 1033 of Chapter 53 of Part II of Subtitle A of Title 10 of the United States Code.

12 NONPROFIT ORGANIZATIONS JANUARY|2023

|

Enlarge image | Religious Organizations As discussed in Sales and Use Tax Basics for Various Types of Nonprofit Organizations, there is no blanket sales or use tax exemption available for nonprofit religious organizations or churches, even when the organizations are exempt from income tax. This section discusses the special exemptions that do exist. You may also want to read Charitable Organizations That Relieve Poverty and Distress. Permit and tax requirements (in general) Permit requirements Unless all of your sales are exempt from tax, religious organizations and churches that make sales of goods or merchandise must hold a seller’s permit as described below and file sales and use tax returns. Please see Registration Requirements and Collecting and Paying Tax for more information on seller’s permits and tax reporting requirements. General tax requirements Unless your sales qualify as tax-exempt under the meal exemption described in this section, your sales of merchandise are generally taxable. This is true whether you buy the merchandise, make it, or receive it as a donation from an individual or a business. Sales of items other than food Religious organizations’ sales and purchases of goods and merchandise other than food are generally taxable. If your religious organization holds or participates in fundraising events where you sell goods and merchandise, such as auctions, festivals, bazaars, firework stands, swap meets, or craft shows, your sales of nonfood items are generally taxable. Tax also applies when you sell from a church bookstore, from tables in your church at events, by Internet, or by mail order. Donations to religious organizations Donations vs. sales You may receive donations at the same time you are selling merchandise. “True donations” are not taxable. A true donation is an amount someone gives you without expecting merchandise in return. Example: If one of your members donates $100 and receives a tote bag worth $5, this is generally not a sale. However, your purchase of the tote bags is subject to sales or use tax when you purchase it. If the tote bag were donated to your organization by another member, then no sales or use tax is due when the member donates the $100. If your members make donations and expect merchandise in return, then this is a sale. Example: Your religious nonprofit organization receives 100 knitted afghans donated by the local knitting guild. Afghans of this quality usually are sold for $75. Your organization decides to sell the afghans and use the proceeds to fund one of its community projects. You sell some of the afghans for $100 and toward the end of the sale you reduce the price to $50. In this example, the sales of the afghans are taxable regardless of the price you charge for them. You are making a sale of merchandise or goods, since the person purchasing the afghans is expecting merchandise or goods in exchange for the set price. If you purchase afghans to resell instead of receiving them as a donation, you may present your vendor with a resale certificate and purchase the afghans without tax. JANUARY 2023 NONPROFIT| ORGANIZATIONS 13 |

Enlarge image |

Donations of merchandise and goods

Generally, items withdrawn from a seller’s inventory that are not resold are subject to use tax. However, items withdrawn

from a seller’s inventory and donated to qualified religious organizations located in California are not subject to use tax.

Qualified organizations 1are described in section 170(b)(1)(A) of the Internal Revenue Code.

Merchandise or goods donated by a seller (donor) who paid sales or use tax at the time of purchase does not qualify

for this exemption. This is true even if the donated items are resold by the religious organization and the religious

organization charges sales tax when they sell them.

Donations of gift cards, gift certificates, services, or cash donations are not subject to sales tax since there is not an

exchange of merchandise or goods for a consideration. Gift cards, gift certificates, services, or cash donations are not

considered taxable regardless of the person donating, buying, or using them.

Example: Mr. Bob Smith sells fishing gear at his bait shop and provides guided fishing excursions. Mr. Smith donates

a fishing pole, a fishing excursion, and a gift certificate to his church. Mr. Smith does not owe use tax on any of these

items, since the fishing pole came from his resale inventory and tax does not apply to services or gift certificates. 2

Example : Ms. Jane Jones works for a company that sells wholesale veterinary supplies. Her temple asks for donations

of new or gently used children’s toys to put up for auction at a fundraising event. The company does not sell

children’s toys. Ms. Jones purchases and donates fifty children’s toys on behalf of her company.

Ms. Jones should pay sales tax when she purchases the children’s toys from the toy store. The temple should charge

sales tax on the auction price of the toys for their fundraiser.

Meals furnished or served by religious organizations

Religious organizations are generally considered retailers of meals. Tax applies to your sales of food as described in

Food and Meals.

However, there is a specific exemption for meals served for fundraising purposes, described below. For purposes of the

exemption, “religious organization” means an organization whose property is exempt from property taxation under

article XIII, section 3, subdivision (f) of the state Constitution.

Tax-exempt sales of meals

Tax does not apply to sales of meals and food by your religious organization when all of these conditions are met:

• You sell the food at a social or other gathering you conduct.

• You furnish the meals to raise funds for your organization’s functions and activities.

• You use the proceeds to carry out those functions and activities.

The tax exemption applies regardless of who serves the meals. Your organization can serve the meal or have someone

else serve them.

The person furnishing the meals, such as a restaurant or caterer, is selling the meals for resale to the religious

organizations and the religious organizations may issue resale certificates to the person furnishing the meals and

purchase the meals without tax.

Please note: It is important to note that sales of alcoholic or carbonated beverages sold for a separate price are subject to

sales tax. If such beverages are included in the price of the meal (single price) and the sale meets the requirement of the

exemption, the beverage is regarded as part of the exempt sale of the meal.

1 Includes religious organizations; charitable organizations such as Red Cross, Salvation Army, nonprofit schools and

hospitals, medical assistance and research groups; organizations operated for educational, scientific, or literary purposes

including nonprofit museums, art galleries, and performing arts groups; organizations operated for the protection

of children or animals; fraternal lodges if the property is used for charitable purposes; and U.S., this state or political

subdivisions thereof.

2 Once the gift certificate is redeemed, it will be considered the same as cash; thus, the retail selling price of the goods

must be included in the taxable gross receipts of the bait shop.

14 NONPROFIT ORGANIZATIONS JANUARY|2023

|

Enlarge image |

Taxable sales of meals

When your organization serves meals that do not qualify for the exemption described above, sales tax applies as

described in Food and Meals. Examples of sales of meals that do not qualify for the exemption include:

• Serving meals at an event you do not make a profit on the proceeds (meals are free or sold at or below your cost).

These sales do not qualify for the exemption because they are not for fundraising.

• Selling meals at church retreats or church camps, or at year-round cafes that are open to the public. These sales do

not qualify for the exemption because they do not occur at a social or other gathering, nor are the meals served for

the specific purpose of raising revenue.

In addition, the sale of “edible nonfood items” at an event where tax-exempt meals are served may be taxable. For

example, tax would apply to your sales of alcoholic or carbonated beverages for a separate price.

Purchases of meals

Religious organizations are the retailers of meals even when the sale of the meal is tax-exempt. Your organization may

purchase meals without paying sales tax from a restaurant, hotel, caterer, or other supplier by issuing that business a resale

certificate at the time of purchase (see Using a resale certificate). You may use resale certificates to buy meals that you resell.

JANUARY 2023 NONPROFIT| ORGANIZATIONS 15

|

Enlarge image |

Social Clubs and Fraternal Organizations

“Social clubs” and “fraternal organizations” include any corporation, partnership, association, or group acting as a unit, such

as service clubs, lodges, and community, country, or athletic clubs. This section focuses on the limited sales tax exemption

available to these organizations. You may also need to read Food and Meals, for information on food and meal sales that are

not covered by that limited tax exemption. More information on sales of food and meals is found in publication 22, Dining and

Beverage Industry.

Permit and tax requirements (in general)

Permit requirements

Social clubs and fraternal organizations that make sales must hold a seller’s permit and file sales and use tax returns.

Please see Registration Requirements and Collecting and Paying Tax for more information on seller’s permits and tax

reporting requirements.

General tax requirements

Except for sales that qualify as tax-exempt under the meal exemption described in this section, your sales of goods and

merchandise are generally taxable. This is true whether you buy the merchandise, make it, or receive it as a donation

from an individual or a business. Organizations that sell nonfood items at fundraising events, such as auctions, festivals,

firework stands, bazaars, swap meets, or craft shows are considered retailers and their sales are subject to sales tax.

Sales of food and beverages

Meals, food, and beverages furnished by social clubs or fraternal organizations

Tax applies to your group’s sales of meals, food, and drinks in the same way it does to sales by other businesses unless

both of the following conditions apply:

• You sell meals, food, and beverages exclusively to your members. Items paid for by members but consumed by guests

are considered sold to members.

• You make these sales less than once a week.

Example : Your fraternal organization sells meals and drinks only to your members at a monthly dinner. You make

no other food or beverage sales. Tax would not apply to the proceeds from your monthly dinner sales. However, if

nonmembers attend even one of your dinners and pay for their own food or drinks, all of your food and drink income

from all dinners is taxable. The member must pay for the guest(s) meal for the exemption to apply.

Exception: Meals served to your members by a restaurant are generally taxable. See Food served by a restaurant, below.

Food served by a caterer

A caterer is a person in the business of serving meals, food, or drinks on premises owned or supplied by a customer,

including premises leased by the customer from a person other than the caterer.

Sales of meals to social clubs and fraternal organizations are sales for resale if the social club or fraternal organization is

the retailer of the meal. You may issue the caterer a resale certificate and report the sales of meals on your sales and use

tax return. Meals served by a caterer, where the social club or fraternal organization is the retailer, are subject to tax unless

the criteria noted in the previous section are met.

Food served by a restaurant

Tax applies to a restaurant’s sales of meals to social or fraternal organizations in the same way it does to sales to any other

customers. This is true regardless of the frequency of the meals or whether the meals are served to the organization’s

members. However, if the meals are served at a location other than the restaurant, the restaurant is acting as a caterer and

tax applies as explained in the previous section.

Donations of merchandise and goods

Generally, items withdrawn from a seller’s inventory that are not resold are subject to use tax. However, items

withdrawn from a seller’s inventory and donated to fraternal organizations are not subject to use tax if the donated

items are to be used for charitable purposes and not for the benefit of the members. This exemption does not apply to

social organizations unless they are an organization described in section 170(b)(1)(A) of the Internal Revenue Code.

16 NONPROFIT ORGANIZATIONS JANUARY|2023

|

Enlarge image |

Merchandise or goods donated by a donor who paid sales tax or use tax at the time of purchase does not qualify for this

exemption. This is true even if the donated items are resold by the fraternal organization and the fraternal organization

must charge sales tax when they sell it.

Donations of gift cards, gift certificates, checks, cash, or services are not subject to sales tax since there is not an exchange

of merchandise or goods. Donations of services and gift cards are not considered taxable regardless of the person

donating, buying, or using them.

JANUARY 2023 NONPROFIT| ORGANIZATIONS 17

|

Enlarge image |

Schools, Parent-Teacher Associations, Children’s Organizations,

Youth Organizations, and Children’s Clothing

This section provides information on sales and use tax issues for schools, parent cooperative nursery schools, parent-

teacher associations, children’s organizations, and youth organizations.

Permit and tax requirements (in general)

Permit requirements

The organizations described in this section may be consumers of items they sell rather than retailers. If the organization

meets certain requirements, as a consumer, your organization is not required to hold California seller’s permits or

pay tax on their sales. However, some of the organizations are consumers for certain types of sales and retailers for

others. Retailers must hold a seller’s permit and file sales and use tax returns. Please see Registration Requirements and

Collecting and Paying Tax for more information on seller’s permits and tax reporting requirements.

Before you apply for a permit, please read the rest of this section to determine whether any part of your organization is

considered a retailer or a consumer regarding the sales it makes.

General tax requirements

When you are the consumer of items you sell, you should pay tax to your supplier when you buy those items. You cannot

legally buy the items for resale using a resale certificate. When you are a retailer, tax applies to your sales whether the

items you sell are things that you buy, make, or receive as a donation from an individual or a business. You may buy items

without paying tax by issuing a resale certificate if you will resell the goods or merchandise in your normal sales activities

(see Using a resale certificate).

Schools

Meal and food sales

Tax does not generally apply to sales of meals, as defined in subdivision (k)(1)(B) of Regulation 1603, to school students, for

an established single price, when the sales are made at a time set aside for meals, and by public or private schools, school

districts, student organizations, parent-teacher associations, a blind person operating a restaurant, vending machine,

or a vending stand in an educational institution (as specified in Regulation 1603). The term “meal”, as it applies to sales

to school students, includes both food and nonfood products (such as carbonated drinks), which are sold together for

an established single price. A meal does not include nonfood products which are sold to students for a separate price.

Products sold at a time designated as nutrition breaks, recesses, or similar breaks are not considered meals. In addition,

tax does not apply to individual sales of food products that are sold to school students.

The following food sales at schools are taxable:

• Sales of edible nonfood products—such as carbonated beverages—unless the products are sold as part of a meal.

• Sales of food to students and nonstudents in a place where admission is charged—such as an athletic event—even

when the event is held at a school.

• Sales of meals and food products to nonstudents.

Sales made by caterers are subject to tax unless:

• The premises used by the caterer to serve the lunches to the students are used by the school for other purposes such

as sporting events and other activities during the remainder of the day;

• The fixtures and equipment used by the caterer are owned and maintained by the school; and

• The students purchasing the meals cannot distinguish the caterer from the employees of the school.

Yearbooks and catalogs distributed to students

A public or private school, school district, student organization, or county office of education is considered the

consumer of yearbooks and catalogs it sells. The yearbooks or catalogs must be prepared for or by the school, district, or

organization and distributed to students. There is no restriction on how the profits may be used.

18 NONPROFIT ORGANIZATIONS JANUARY|2023

|

Enlarge image | Donations of merchandise and goods Generally, items withdrawn from a seller’s inventory that are not resold are subject to use tax. However, items withdrawn from a seller’s inventory and donated to a nonprofit school are not subject to use tax. Merchandise or goods donated by a donor who paid sales tax or use tax at time of purchase does not qualify for this exemption. This is true even if the donated items are resold by the organization, and the organization must charge sales tax when they sell it. Donations of gift cards, gift certificates, checks, cash, or services are not subject to sales tax since there is not an exchange of merchandise or goods. Donations of services and gift cards are not considered taxable regardless of the person donating, buying, or using them. Loans to schools Certain loans by retailers are exempt from use tax, including: • Loans of items to a school district for a district educational program. • Loans of motor vehicles to be used exclusively in driver training programs by accredited private or parochial secondary schools. The driver training program must be approved by the State Department of Education as a regularly conducted course of study. • Loans of motor vehicles to the California State University or the University of California for exclusive use in an approved driver education program conducted by the university. Donations of children’s new clothing Effective January 1, 2008, through December 31, 2013, if your charitable nonprofit organization distributes new clothing to individuals under 18 years of age, at no charge, to assist those in financial need, you are not required to pay sales tax or use tax on the purchase or use of the clothing. To qualify for this exemption, your organization must be organized for charitable purposes and exempt from state income tax under Revenue and Taxation Code section 23701d or 23701f. Nonprofit organizations are no longer required to be engaged in relieving poverty or distress to qualify for this exemption. Prior to January 1, 2008, if your charitable nonprofit organization distributed new clothing to elementary school children at no charge, to assist those in financial need, you were not required to pay sales tax or use tax on the purchase or use of the clothing. To qualify for the exemption, your organization must be organized for charitable purposes, engaged in relieving poverty or distress, and exempt from state income tax under Revenue and Taxation Code section 23701d. Parent cooperative nursery schools Nonprofit parent cooperative nursery school associations are considered consumers of property they sell, provided the resulting profits are used exclusively to advance the organization’s purpose. Nonprofit parent-teacher associations Nonprofit Parent-Teacher Associations (PTAs) chartered by the California Congress of PTAs, incorporated and equivalent organizations authorized by school authorities to perform the same type of service for public or private schools are considered to be consumers of products they sell. The profits from the sale must be used exclusively to further the organization’s purpose. Important: Connection with a school does not automatically make a group equivalent to a chartered PTA. To be considered equivalent, your group must meet all of the following conditions: • It is a nonprofit organization that includes parents. • The group’s objectives include enhancing the welfare of all of the students in the school and developing better communication between parents and school authorities. (Groups such as athletic booster clubs, whose efforts are directed toward a select group of students rather than all students, are not considered PTA-equivalent organizations.) • The group is authorized to operate in the school by the school’s governing authority. • The profits from the group’s sales are used exclusively to advance the group’s purpose. If your group meets these qualifications or is a chartered PTA, you are the consumer of products you sell provided your group uses the profits from the sales only to advance your organization’s purpose. Your organization is generally not required to hold a California seller’s permit or file sales and use tax returns. JANUARY 2023 NONPROFIT| ORGANIZATIONS 19 |

Enlarge image | Although your organization’s sales may not be taxable, your purchases generally are taxable and you cannot issue resale certificates to buy merchandise tax-free. Since businesses that sell to your organization generally must pay tax on their sales to your organization, you can expect to pay an amount for tax when you buy merchandise unless the sale qualifies for a specific exemption or exclusion. If you work with a fundraiser company or similar supplier, different regulations may apply—please see Sales That Involve Fundraiser Companies. Nonprofit youth organizations Retailers Youth groups that sell merchandise such as t-shirts, wrapping paper, mugs, and other items, are generally retailers of those products. Sales of these items are taxable and your group must obtain a seller’s permit and file sales and use tax returns. Please see Registration Requirements and Collecting and Paying Tax. Your group may need a permanent seller’s permit. Consumers Qualifying requirements Specific types of nonprofit youth organizations may qualify as consumers in certain situations. To qualify as a consumer, your group must be one of the following: • A nonprofit organization that qualifies for tax-exempt status under Internal Revenue Code section 501(c). Your primary purpose must be to provide a supervised program of competitive sports for youth or to promote good youth citizenship. The group must not discriminate on the basis of race, sex, nationality, or religion. • A youth group or club sponsored by or affiliated with a “qualified educational institution.” This includes, but is not limited to, student activity groups such as debating teams, swimming teams, bands, and choirs. Most public and private schools are qualified educational institutions. Qualified educational institutions do not include schools that discriminate on the basis of race, sex, nationality, or religion. Youth organizations affiliated with them do not qualify for the tax exemption. If your youth group does not meet the requirements listed above, it is generally considered the retailer of products it sells and may need a seller’s permit. Please see Registration Requirements. Qualifying sales If your group qualifies as described above, you are a consumer when you do all of the following: • Sell food products, nonalcoholic beverages, or items made by members of your organization. • Make sales on an irregular or intermittent basis. Sales made in storefront or mobile retail outlets that normally require local business licenses do not qualify as intermittent or irregular sales. • Use the profits from your sale only to advance your organization’s purpose. As a consumer, you do not owe tax on your sales, however, your purchases are generally taxable and you cannot issue resale certificates to your suppliers (see Taxable purchases). Since your suppliers will generally owe tax when they sell you merchandise, you can expect them to collect tax on your purchases. If you work with a fundraiser company or similar supplier, different regulations may apply—please see Sales That Involve Fundraiser Companies for details. For more information, please see Regulation 1597, Property Transferred or Sold by Certain Nonprofit Organizations. 20 NONPROFIT ORGANIZATIONS JANUARY|2023 |

Enlarge image | Organizations That Provide Human Services and Goods Related to Medical or Health Information, Disabilities, HIV/AIDS, Nutrition, and Homelessness This section focuses on the limited tax exemptions available to certain organizations that provide community health and human services. If your organization’s sales are not covered by those specific exemptions, be sure to read the other sections of this publication that may apply to you. Permit and tax requirements (in general) Permit requirements Please see Registration Requirements and Collecting and Paying Tax for more information on seller’s permits and tax reporting requirements. General tax requirements Unless they qualify as tax-exempt under the exemptions described in this section, your sales of merchandise are generally taxable. This is true whether you buy the merchandise, make it, or receive it as a donation from an individual or a business. Organizations that sell nonfood items at fundraising events, such as auctions, festivals, firework stands, bazaars, swap meets, or craft shows, are considered retailers and sales tax is due on their sales. Please see Collecting and Paying Tax for more information on tax reporting requirements. Medical health information literature or health and safety materials Qualifying organizations If your charitable organization’s local office distributes medical health information literature, you are not required to pay use tax on the purchase, storage, or other use of that literature, provided you meet all of these conditions: • You purchase the literature from your organization’s national or branch office. • Your organization is formed and operated for charitable purposes. • Your organization qualifies for the welfare exemption from property taxation under Revenue and Taxation Code section 214. This exemption also applies to your purchase, storage, or distribution of health and safety educational materials you routinely sell in connection with health and safety and first aid classes. To qualify for the exemption on materials you sell, your national organization must routinely distribute health and safety information and meet all the conditions listed above. However, your other sales of medical health information or health and safety materials are generally taxable. Example : You operate the local office of a national nonprofit charitable organization that distributes health and safety materials to the public. As part of your activities, you conduct cardiopulmonary resuscitation (CPR) classes. You purchase textbooks from your national or branch office and provide them to CPR students. Your textbook purchases would not be taxable. However, if you also sell health booklets you purchase from other sources, your sales of those booklets would be taxable. Medical identification tags People wear medical identification tags to alert others that they have a medical disability or allergic reaction to certain treatments. A nonprofit organization’s sale, storage, or other use of those tags is exempt from sales and use tax provided the organization is exempt from state income taxes under Revenue and Taxation Code section 23701. Thrift stores benefiting individuals with HIV or AIDS Legislation has extended the sunset date until January 1, 2029, for the sales tax exemption for thrift stores, the proceeds of which benefit individuals with HIV or AIDS. Therefore, through December 31, 2028, tax does not apply to certain thrift stores’ sales of used clothing, household items, or other retail merchandise. A nonprofit organization must operate the thrift store to raise funds that will be used to provide medical, hospice, or social services for individuals chronically ill with HIV or AIDS. JANUARY 2023 NONPROFIT| ORGANIZATIONS 21 |

Enlarge image |

The organization operating the thrift store must:

• Spend at least 75 percent of the store’s net income on providing the medical, hospice, or social services for

individuals with HIV or AIDS, and

• Be exempt from state income tax under section 23701d of the Revenue and Taxation Code.

If you believe that your organization’s sales qualify for this tax exemption, you may ask us to review your eligibility. If you

qualify, we’ll provide your organization with a verification letter. Please send your request to:

Compliance Policy Unit, MIC:40

California Department of Tax and Fee Administration

PO Box 942879

Sacramento, CA 94279-0040

Please provide the following information with your request:

• A letter signed by an officer of your organization describing the organization’s activities and certifying that it meets

the requirements for the exemption described above.

• A letter from the California Franchise Tax Board verifying your organization’s exempt status under Revenue and

Taxation Code section 23701d.

• A list of the types of merchandise your organization will sell.

Organizations providing services to people with developmental disabilities or children with

severe emotional disturbances

Under certain circumstances, organizations whose primary purpose is to provide services to individuals with

developmental disabilities or children with severe emotional disturbances are considered consumers of items they sell.

The organization must:

• Be tax-exempt under Internal Revenue Code section 501(c)(3).

• Not discriminate on the basis of race, sex, nationality, or religion.

In addition, all of the following conditions must be met:

• The items sold are handcrafted or artistic and designed, created, or made by individuals with developmental

disabilities or children with severe emotional disturbances. Those individuals must be members of your organization

or receive services from it.

• Each item sells for $20 or less.

• Your organization makes sales on an irregular or intermittent basis.

• You use the profits from your sales exclusively to advance your organization’s purpose.

Tax applies to your organization’s purchases of materials and supplies for use in making the items you sell. You cannot

buy materials and supplies for resale using a resale certificate (see Using a resale certificate).

Example: Your charitable, Internal Revenue Code section 501(c)(3) tax-exempt organization provides educational

services and skills training for adults with developmental disabilities. Each year, participants in your programs make

holiday decorations you sell at an annual open house for $20 each. The profits are used to buy educational materials

for your classes. Your organization’s sales are not taxable.

Organizations and institutions that serve meals or food

Deliveries to the elderly and people with disabilities

Tax does not apply to the sale or use of meals by a nonprofit volunteer home-delivery organization that delivers meals to

homebound elderly people or people with disabilities.

Meals or food served to low-income elderly people

Sales tax does not apply to meals served to low-income elderly people by a nonprofit organization when both of the

following conditions are met:

• The meals or food are served at or below the organization’s cost.

• The meals are provided under a state-financed or federally-financed program.

22 NONPROFIT ORGANIZATIONS JANUARY|2023

|

Enlarge image | Meals served to patients or residents of institutions Sales of meals and food products to residents or patients of certain institutions are exempt from sales tax. These facilities include: • Qualified health care facilities. • Qualified community care facilities. • Qualified residential care facilities for the elderly. • Qualified alcoholism recovery, drug recovery, or drug treatment facilities. • Any house or institution financed by state or federal programs that (1) serves as a principal residence exclusively for people age 62 or older, and (2) supplies room and board for a flat monthly rate. In addition, sales tax does not apply to those institutions’ purchases of food products, meals, and nonreusable items that become parts of meals or food products such as straws, paper napkins, and carbonated beverages. The meals or food products must be furnished or served to patients or residents. For more information on qualifying institutions, please see Regulation 1503, Hospitals and Other Medical Service Facilities, Institutions and Homes for the Care of Persons. Homeless shelters and related organizations Homeless shelter operators Nonprofit organizations operating homeless shelters may qualify for an exemption from sales and use tax. See Charitable Organizations That Relieve Poverty and Distress. Auctions to benefit homeless shelters Auction sales made to benefit a homeless shelter are exempt from tax when the auction is conducted by or affiliated with a nonprofit organization and all three conditions below are met: • The funds raised in the auction are spent to benefit the homeless shelter and homeless people. • The organization is exempt from state income tax under Revenue and Taxation Code section 23701d. • The organization conducts only one such auction during any 12-month period. Volunteer Fire Departments General tax requirements From January 1, 2016, through December 31, 2020, qualified all-volunteer fire departments are no longer required to report sales tax, have a seller’s permit, or file sales tax returns for the sale of tangible personal property, including clothing and hot prepared food products, when the profits are used to further the department’s purposes. Instead, your all-volunteer fire department may be considered the consumer of items sold. As a consumer, you cannot issue a resale certificate for the purchase of items you will be reselling in your fundraising. You will need to pay sales or use tax on the purchase of these items. To qualify, an “all-volunteer fire department” must meet all of the following requirements: • Not pay members a regular salary, but may pay members hourly or per incident; • Have as its purpose the protection of lives, property, and environment within a designated geographical area from fire, disasters, and emergency incidents; • Be regularly organized for volunteer fire department purposes; • Qualify as a tax exempt nonprofit organization, and • Not have gross receipts of more than $100,000 in each of the two prior calendar years. How do I obtain more information? For more information, please call our Customer Service Center at 1-800-400-7115 (CRS:711), Monday through Friday from 7:30 a.m. to 5:00 p.m. (Pacific time), except state holidays. JANUARY 2023 NONPROFIT| ORGANIZATIONS 23 |

Enlarge image |

Organizations that construct military and veteran medical facilities

Beginning January 1, 2019, through December 31, 2024, Revenue and Taxation Code section 6369.7 provides for a sales

and use tax exemption on the sale and use of building materials and supplies purchased by a qualified person for use by

that qualified person in the construction of a qualified facility.

A qualified person is either or both of the following:

• A “qualified nonprofit organization,” which means an organization exempt from taxation under section

501(c)(3) of the Internal Revenue Code that constructs a “qualified facility” as a gift to the United States Department of

Defense (USDOD), pursuant to section 2601 of Title 10 of the United States Code or the United States Department of

Veterans Affairs (USDVA), pursuant to section 8301 of Title 38 of the United States Code; or

• A contractor, sub-contractor, or builder working under contract with a “qualified nonprofit organization” to construct

a “qualified facility.”

A “qualified facility” is either:

• A medical facility, or a temporary residential facility for families of patients receiving care, including either or both

inpatient and outpatient care, at a medical facility, located on a United States military base in California; or

• A USDVA medical center, or a temporary residential facility for families of patients receiving care at or as part of a

USDVA medical center, located in California.

Building materials and supplies that may be purchased under this exemption include any machinery, equipment,

materials, accessories, appliances, contrivances, furniture, fixtures, and all technical equipment or other tangible personal

property of any other nature or description that meet all of the following:

• Are necessary to construct and equip a qualified facility.

• Become part of the completed qualified facility.

• Are transferred to the USDOD or USDVA as a gift, as specified.

The exemption does not apply to purchases of tools or other construction equipment that are not specified above and

meet the three listed criteria.

This exemption from tax only applies to sales and purchases made after the date the USDOD or USDVA accepts the

qualified nonprofit organization’s offer to construct the qualified facility and on or before the date the USDOD or USDVA

accepts the qualified facility.

If you are a qualified nonprofit organization constructing a qualified facility, you may issue CDTFA-230-C-2, Exemption

Certificate for Property Used in the Construction of a Qualified Facility, to your vendors for your qualifying purchases of

building materials and supplies.

A purchaser who issues an exemption certificate for its purchases made pursuant to Revenue and Taxation Code section

6369.7, and who subsequently uses the items purchased in a manner not qualifying for the exemption, will be liable for

the payment of tax (calculated on the sales price of the property), plus any applicable interest.

24 NONPROFIT ORGANIZATIONS JANUARY|2023

|

Enlarge image |

Specific Sales Activities

Food and Meals

This section is a general guide for applying tax to sales of food and meals. It is not intended for organizations that are

considered consumers of items they sell and is not a detailed explanation of all circumstances affecting food sales. Be

sure to also read the portions of the prior sections that may apply to your specific kind of organization. If after reading

this publication, you have questions regarding how to apply tax to the sale of food at your particular event, please call

our Customer Service Center 1-800-400-7115 (CRS:711). Customer service representatives are available Monday through

Friday from 7:30 a.m. to 5:00 p.m. (Pacific time), except state holidays.

Food sales (in general)

The sale of food can be tax-exempt or taxable, depending on:

• The type of food,

• The circumstances under which the food is sold, and

• Who makes the sale.

However, the source of the food does not affect how tax applies—the same rules apply whether the food is purchased,

donated to you, or homemade.

Special exemptions for the sale or use of meals and food products

Some nonprofit organizations qualify for special exemptions from sales or use tax on meals and food products. For more

information, see the sections referenced in the list below.

Sales or use tax exemptions may be available for meals and/or food that are:

• Served to low-income elderly people. See Organizations and institutions that serve meals or food.

• Delivered to elderly people and people with disabilities. See Organizations and institutions that serve meals or food.

• Sold at schools. See Schools.

• Furnished or served by religious organizations. See Meals furnished or served by religious organizations.

• Furnished by social clubs and fraternal organizations. See Sales of food and beverages.

• Sold by nonprofit veterans’ organizations. See Meals served by nonprofit veterans’ organizations.

• Served to patients or residents of “institutions.” See Organizations and institutions that serve meals or food.

• Sold by nonprofit youth organizations. See Nonprofit youth organizations.

If your organization’s food-related activity isn’t listed above, your sale of food or meals may be taxable. The next section

“Sales of food at fundraising events” discusses how tax generally applies to various event sales. If you have an ongoing

food sales operation, such as a café or restaurant, please refer to publication 22, Dining and Beverage Industry.

Sales of food at fundraising events

The circumstances under which you sell food at fundraising events affect whether your sales are taxable. The chart and

the following sections describe certain general rules for those food sales. They will help you understand how to apply tax

to common fundraising situations such as bake sales, fundraising dinners, and other events. Be sure to read the sections

that apply to your nonprofit organization rather than rely on this table alone.

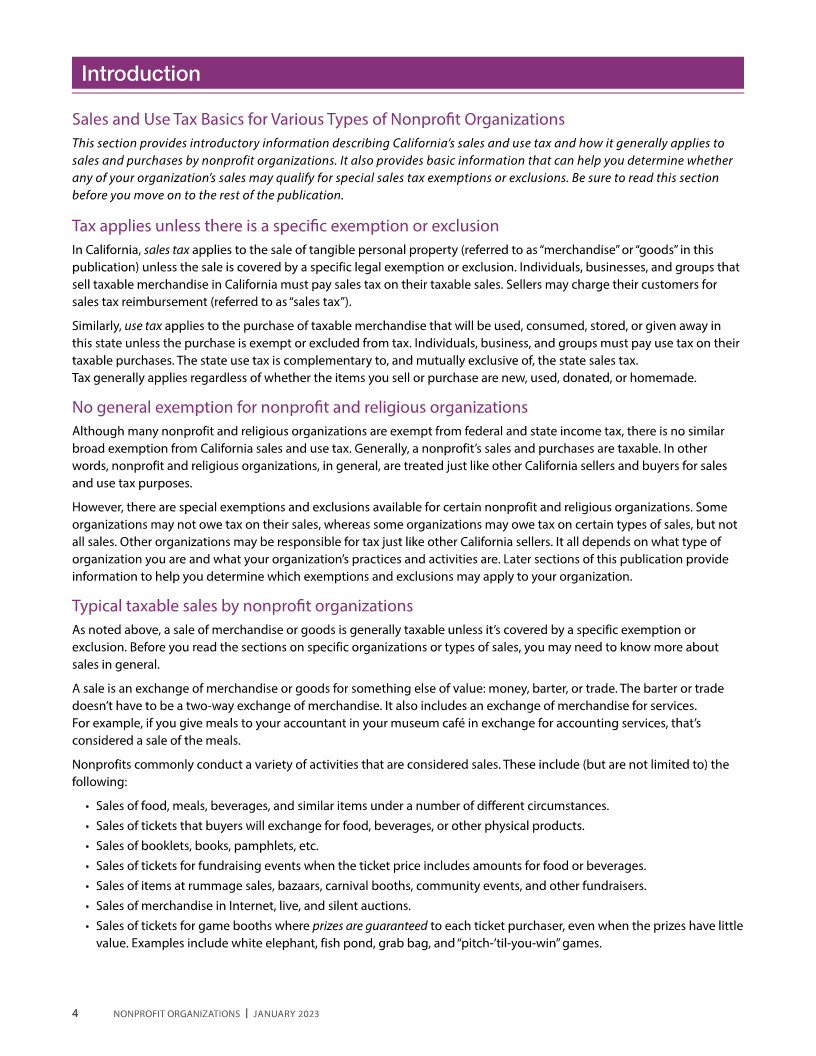

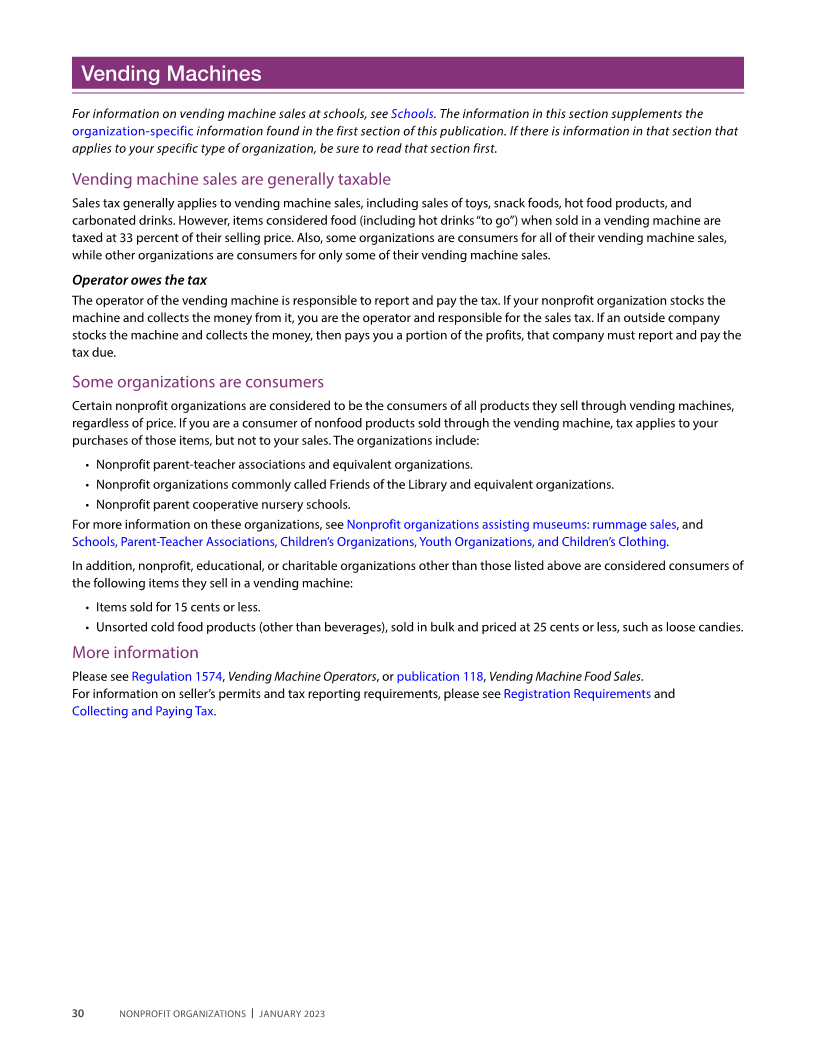

General rules for applying sales tax to food sold at events

Please note: This table does not apply to nonprofit organizations covered by the exemptions listed previously in this

section, to restaurant sales, or to vending machine sales (see Vending Machines).

JANUARY 2023 NONPROFIT| ORGANIZATIONS 25

|

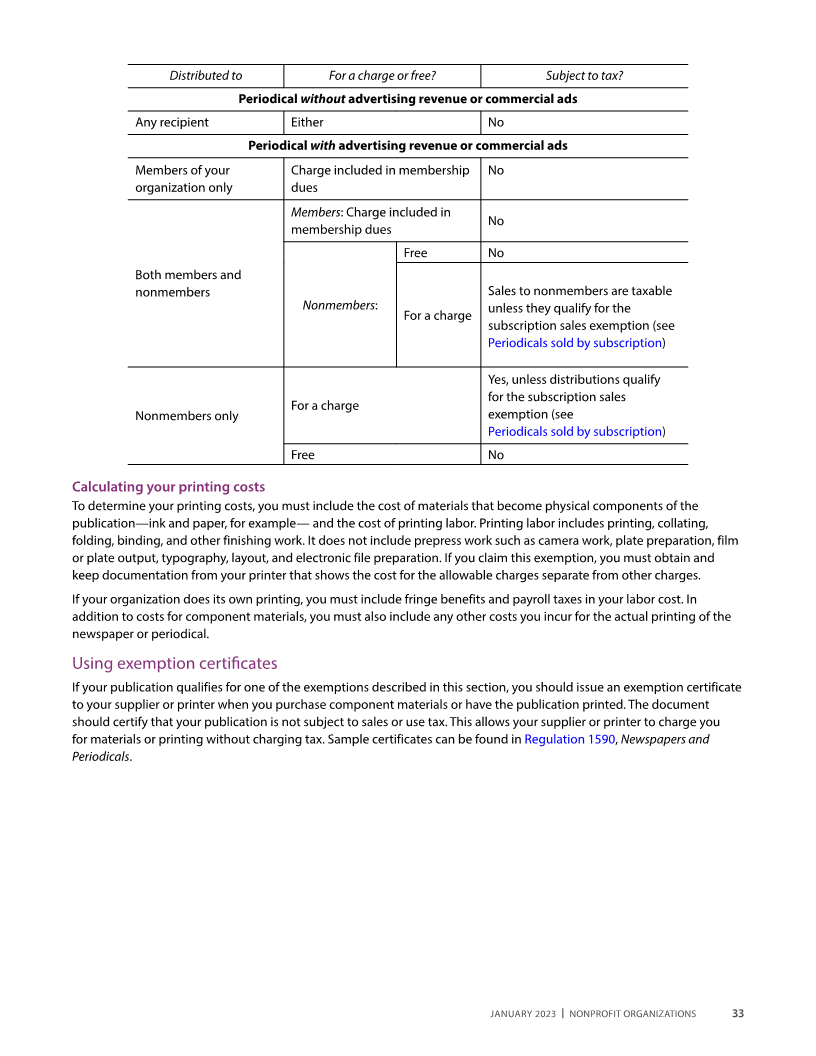

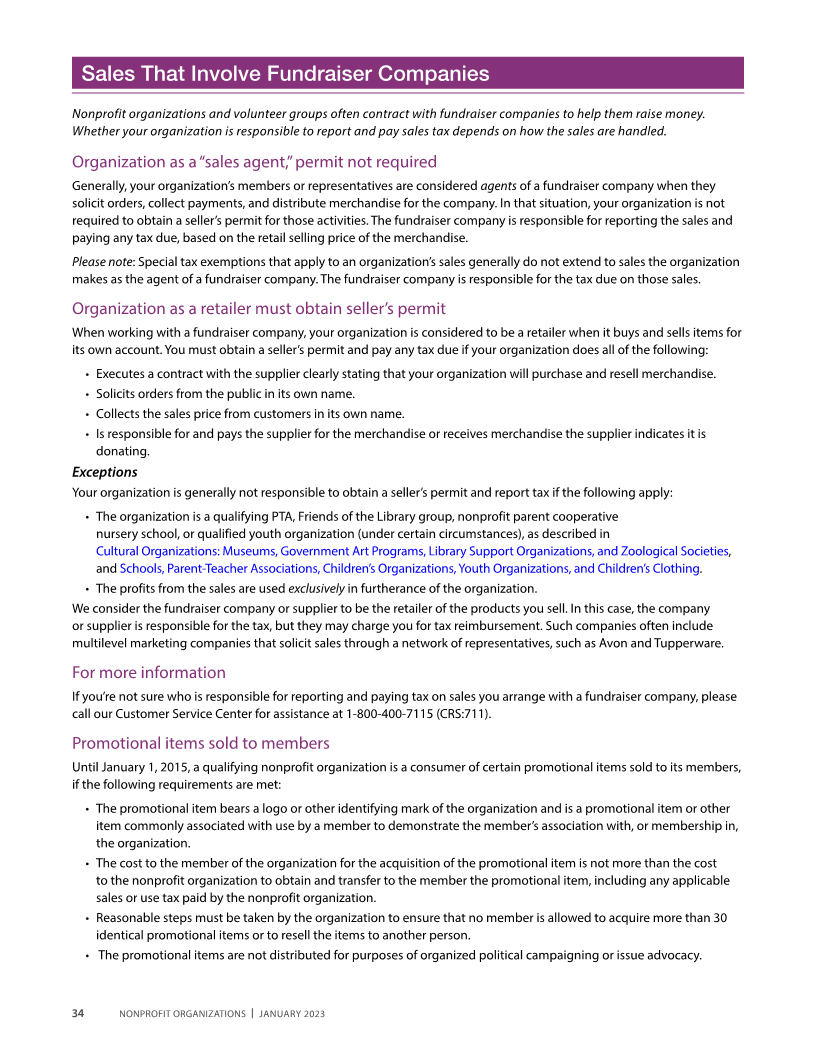

Enlarge image |

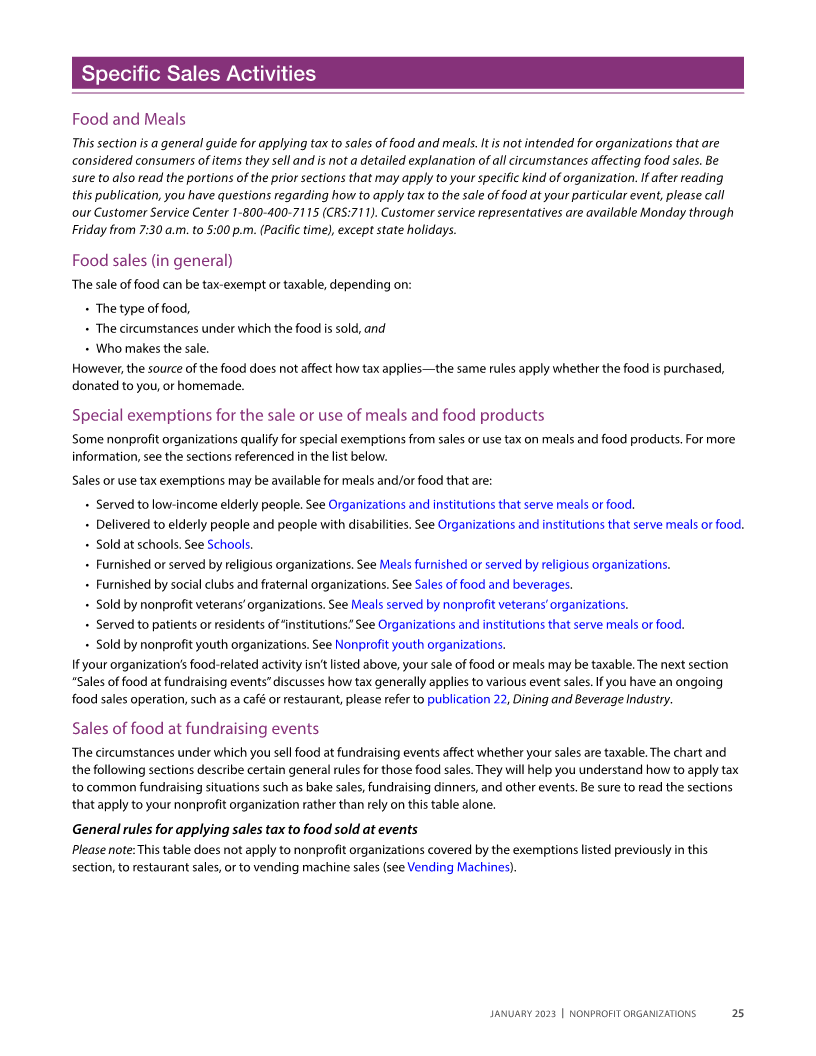

Sales of food “to go”

Type of food Is sale usually taxable? See

Cold food (candy,

No. Exception: Tax applies to the sale of cold food when

snack food, Combination packages

it is part of a hot food combination package.

produce, etc.)

No. Exception : Tax applies to the sale of alcoholic,

Cold beverages carbonated beverages and cold beverages sold in hot Combination packages

food combination packages.

Yes. Exception: Tax does not apply to sales of individual

Hot prepared food Hot prepared foods

hot drinks or bakery goods sold for a separate price.

Combination Yes. Application of tax depends on contents of

Combination packages

packages package.

Sales of food for consumption on-site

Type of sale,

Is sale usually taxable? See

location

Food sold where Yes. Exception: Food sold in a form or size that buyers

admission is would not ordinarily eat on-site. For example, the sale Sales of food for consumption on-site

charged of a whole pie.

Food sold where Yes. Exception: Food sold in a form or size that buyers

dining facilities are would not ordinarily eat on-site. For example, the sale Where dining facilities are provided

provided of a whole pie.

Meals served at

fundraising events Yes. Meals served at fundraising events

Sales of food “to go”

The information in this section does not apply to your organization’s sales of food in places where admission is charged or

where “dining facilities” are provided for your customers. (Dining facilities include tables, chairs, benches, counters, plates

and glasses, etc.) For information on those types of sales, see Sales of food for consumption on-site.

Cold food products

Sales of “cold food products” such as produce, candy, cold sandwiches, baked goods, ice cream, and snack foods are

generally not taxable (for exceptions, see Combination packages). However, certain vending machine sales of candy and

other food products are partially taxable (see Vending Machines for more information on vending machine sales).

Cold beverages

Sales of alcoholic beverages are taxable. Sales of carbonated beverages—including carbonated bottled water—are also

taxable. “To go” sales of noncarbonated and noneffervescent bottled water and juice are not taxable

(see Combination packages). Special rules for hot beverages are discussed under Hot prepared foods, below.

Hot prepared foods

Sales of “hot prepared food products” are taxable. This includes food products, items, components, or beverages heated

for sale and sold at any temperature higher than the air temperature of their sales location. Examples include hot pizza,

hot nuts, hot barbecued chicken, hot sandwiches, and hot soup. Sales of food prepared to be served hot are taxable even

if the food has cooled by the time it is served.

Hot bakery goods, hot coffee, and other hot beverages are considered hot prepared food products. However, the sale

of individual hot bakery items or drinks “to go” for a separate price is tax-exempt unless the items are sold through a

vending machine for more than 15 cents or as part of a combination package.

26 NONPROFIT ORGANIZATIONS JANUARY|2023

|

Enlarge image |

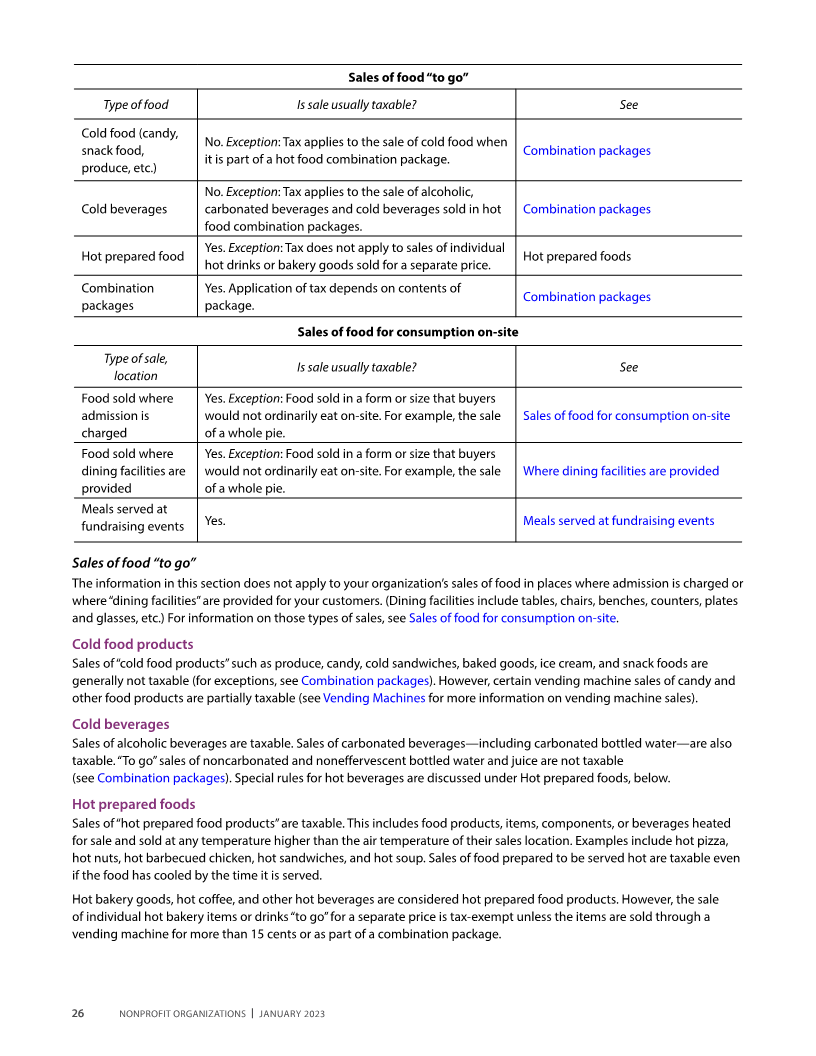

Combination packages