Enlarge image

2022 Credit for Renewable Energy Investment and

Production for Self-Consumption by Arizona Form

International Operations Centers 351

For information or help, call one of the numbers listed: • Invest $1.25 billion in the IOC within 10 years after

Phoenix (602) 255-3381 being certified by the Arizona Commerce Authority

From area codes 520 and 928, toll-free (800) 352-4090 (ACA).

Tax forms, instructions, and other tax information • The energy produced must be used for self-

If you need tax forms, instructions, and other tax information, consumption

go to the department’s website atwww.azdor.gov. • By the fifth year the facility is in operation, at least 51

Income Tax Procedures and Rulings percent of the energy produced must be used for self-

These instructions may refer to the department’s income tax consumption in Arizona.

procedures and rulings for more information. To view or NOTE: A taxpayer that is initially authorized as an

print these, go to our website and select Reports & Legal International Operations Center after December 31, 2018 may

Research from the main menu, then click on Legal Research not claim this tax credit.

and select a Document Type and a Category from the drop This credit is available to corporate taxpayers, exempt

down menus. organizations subject to unrelated business taxable income

Publications (UBTI), and corporate partners in a partnership. The total of the

To view or print the department’s publications, go to our credits may not exceed the amount that would have been

website, select Reports & Legal Research from the main allowed for a sole owner of the business.

menu, and click on Publications in the left hand column. If the current taxable year's credit exceeds the taxpayer’s tax

liability for the taxable year, the taxpayer may carry forward the

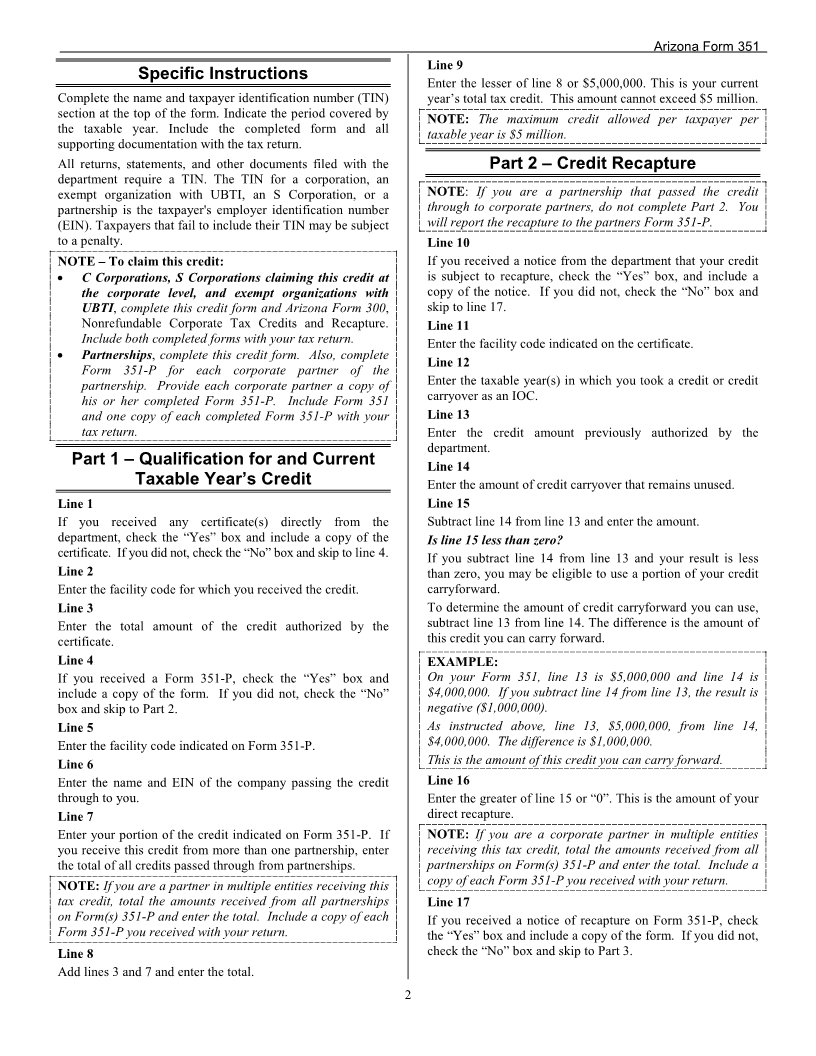

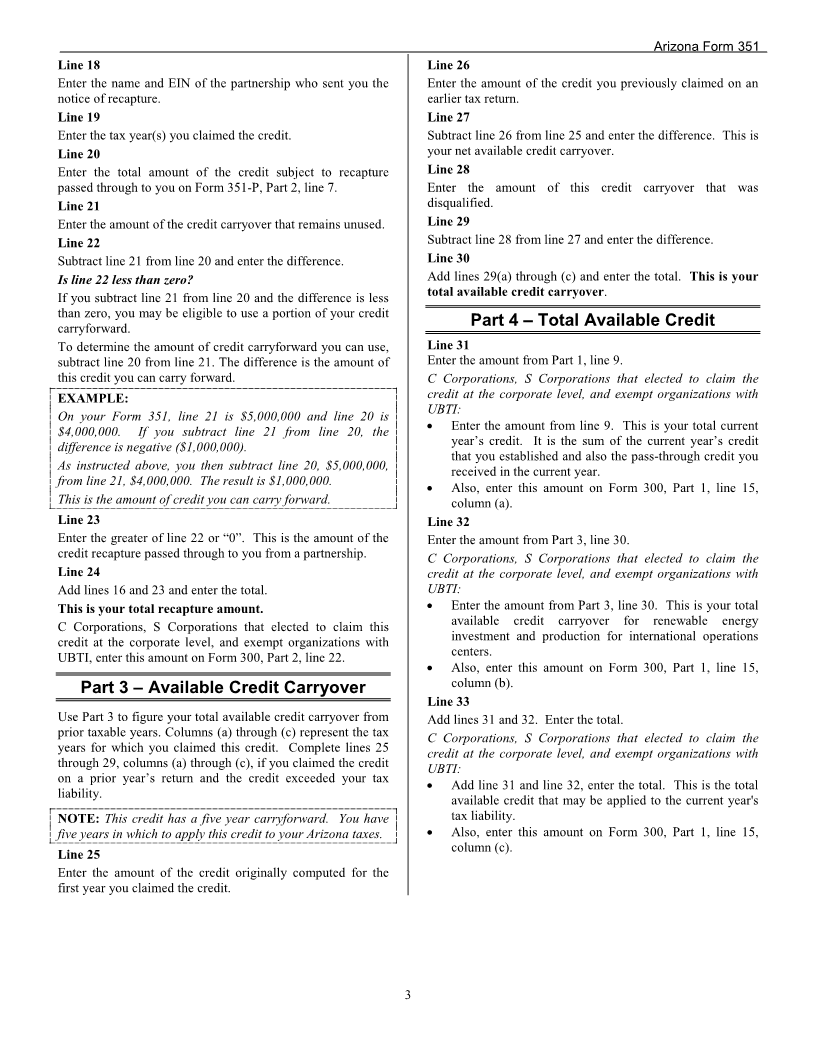

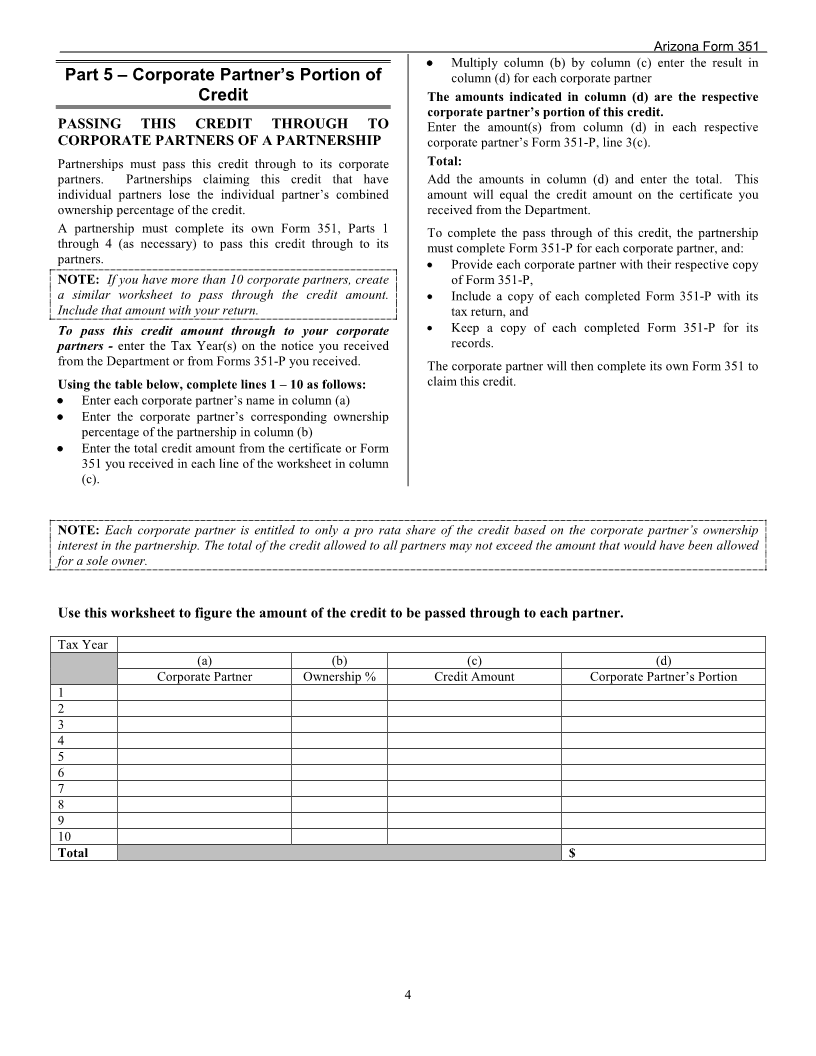

General Information unused credit to the next five consecutive taxable years. No

This credit provides nonrefundable corporate income tax credits credit, other than carryovers generated properly, may be claimed

for investment in new renewable energy facilities that produce for any taxable year beginning after December 31, 2025.

energy for self-consumption using renewable energy resources if

the power will be used primarily for an International Operations Credit Recapture

Centers. The credit authorized is $5 million per year for five If an IOC taxpayer fails to make the $1.25 billion investment in

years. The initial credit is claimed in the year the facility the center within the 10 years after certification, this credit is

becomes operational. recaptured in inverse proportion to the total capital investment

NOTE: For taxable years beginning from and after December made in the IOC by the $1.25 billion. The recapture must be

31, 2018, this credit is no longer available to individual made on the taxpayer's income tax return for the taxable year in

which it is first known that the required investment would not be

taxpayers. It is available only to corporate taxpayers. made within the required time or the taxable year in which the

certification was revoked.

Claiming this Credit

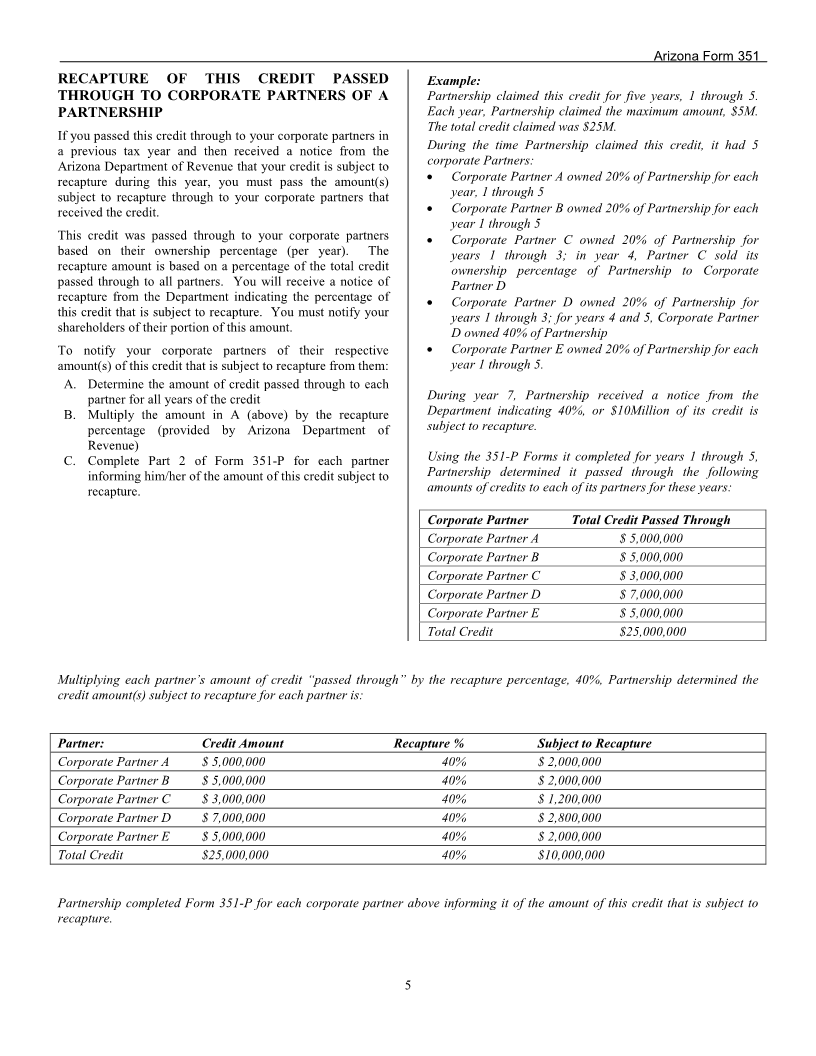

To claim this credit, a taxpayer must apply to the Arizona Example:

Department of Revenue (Department) for certification. The Ten years after its certification, an IOC taxpayer invested $900

department reviews and pre-approves the taxpayer for the credit million in its center and claimed $25 million for this credit

on a first-come, first-served basis. The maximum amount of this ($5,000,000 per year for 5 years.) The IOC taxpayer will

credit a taxpayer can receive is $5,000,000 per tax year. The determine its credit recapture by subtracting its total investment

department may not authorize tax credits under A.R.S. § ($900 million) from the required investment ($1.25 billion) and

43-1164.05 that exceed, in the aggregate, a total of $10 million dividing that amount by the required investment.

for any calendar year. IOC taxpayer invests $900 million in 10 years.

The taxpayer must submit a request for final certification to the

department within 30 days after the renewable energy facility for Required investment amount is $1.25 billion.

which authorization was given becomes operational. See the

program guidelines at www.azdor.gov under the “Tax Credits” Required Investment $1,250,000,000

Total Investment $ 900,000,000

section.

Amount not invested $ 350,000,000

The taxpayer must qualify for this credit as an International

Amount not invested $ 350,000,000

Operations Center (IOC). Required Investment $1,250,000,000

To qualify, a taxpayer must: Percentage not invested 28%

• Invest at least $100 million in one or more renewable

energy facilities in Arizona. Calculate Credit Recapture

• The minimum investment of $100 million must be Total Credit Claimed $25,000,000

completed within a 3-year period beginning on the date Percentage (above) 28%

the initial application is received by the department or Amount to Recapture $ 7,000,000

by December 31, 2018, whichever is earlier. The IOC taxpayer will report a credit recapture on its income tax

return of $7 million.