Enlarge image

2021 Credit for Contributions to

Certified School Tuition Organizations - Individuals Arizona Form

(For contributions that exceed the maximum allowable credit on Arizona Form 323) 348

For information or help, call one of the numbers listed: General Instructions

Phoenix (602) 255-3381

Arizona law provides an individual income tax credit for the

From area codes 520 and 928, toll-free (800) 352-4090

voluntary cash contributions made to a certified School Tuition

Tax forms, instructions, and other tax information Organization (STO) in order to improve education by raising

If you need tax forms, instructions, and other tax information, tuition scholarships for children in Arizona.

go to the department’s website at www.azdor.gov. This credit is available only to individuals. Corporations may

Income Tax Procedures and Rulings not claim this credit. A partnership may not pass the credit

These instructions may refer to the department’s income tax through to its partners. An S Corporation may not pass the

procedures and rulings for more information. To view or print credit through to its shareholders.

these, go to our website select Reports, Statistics and Legal The amount of current year’s contributions that may be claimed

Research from the main menu, then click on Legal Research on Form 348 is computed after the maximum credit is claimed

and select a Document Type and Category from the drop down on Form 323 and is based on the excess amount of contributions

menus. shown on Form 323, Part 4, line 25.

Publications For 2021, the maximum amount of credit on Form 348 that a

To view or print the department’s publications, go to our taxpayer can establish for the current taxable year is $608 for

website select Reports, Statistics and Legal Research from the single taxpayers or heads of household. For married taxpayers

main menu then click on Publications in the left hand column. that file a joint return, the maximum amount of credit that a

taxpayer can establish for the current taxable year is $1,214. In

NOTE: You must also complete Arizona Form 301, most cases, for married taxpayers who file separate returns,

Nonrefundable Individual Tax Credits and Recapture, and

each spouse may claim only one-half (½) of the credit that

include Forms 301 and 348 with your tax return to claim this

would have been allowed on a joint return.

credit.

NOTE: The maximum amount of credit established for the

Notice to All Taxpayers current taxable year does not include any unused valid

carryover amount(s) from prior taxable years. Because this is

NOTE: To claim a current year’s credit on Form 348, you must a nonrefundable credit, the total amount of available credit

first claim the maximum current year’s credit allowed on [current year plus any valid carryover amount(s)] that a

Arizona Form 323, Credit for Contributions to Private School taxpayer may use for the taxable year cannot be greater than

Tuition Organizations. The amount of credit you must claim on the tax liability shown.

Form 323 depends on your filing status. See Form 323 for these

amounts. A cash contribution for which a credit is claimed that is made

If you have a carryover amount from a credit claimed on on or before the fifteenth day of the fourth month following the

Form 348 from prior tax years, you do not have to claim the close of the taxable year may be applied to either the current or

maximum allowable credit on Form 323 to only use a preceding taxable year and is considered to have been made on

carryover amount on Form 348. If you are claiming only a the last day of that taxable year.

carryover amount on Form 348, and are not claiming any FOR CALENDAR YEAR FILERS: Credit eligible cash

current year’s credit on Form 323, submit only Forms 301 contributions made to a certified STO from January 1, 2022, to

and 348. April 18, 2022, may be claimed as a tax credit on either the

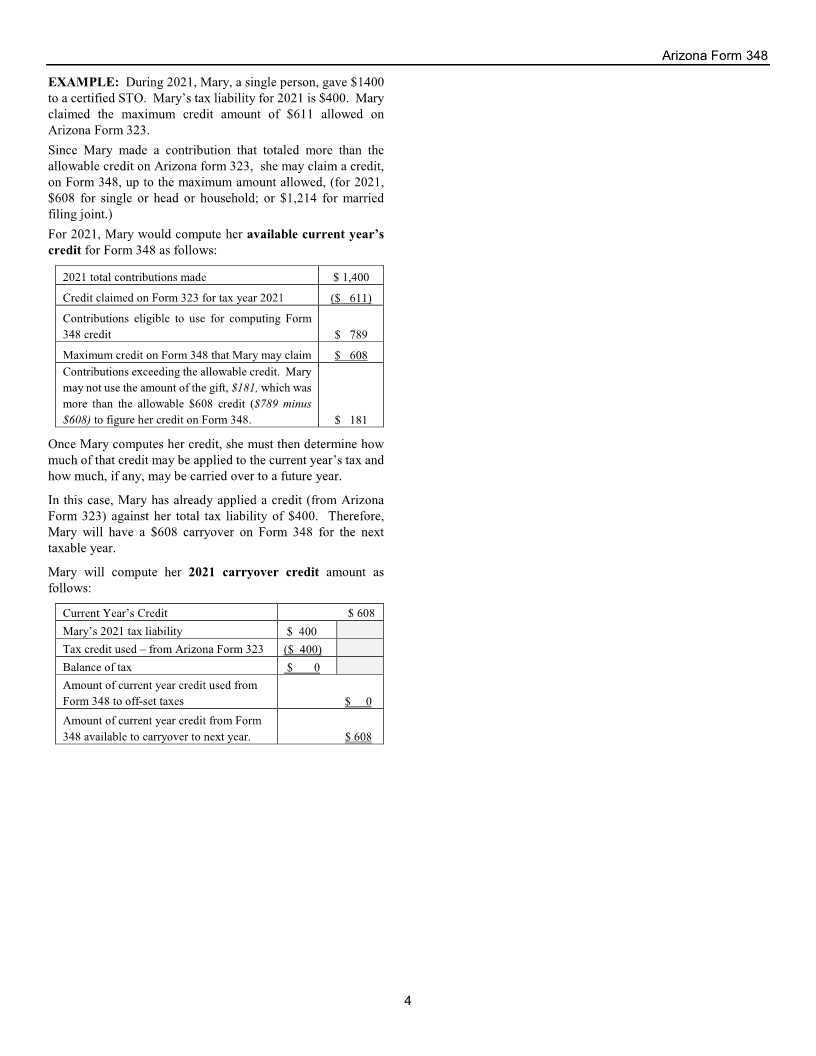

For an example of how to calculate the current year credit and 2021 or 2022 Arizona income tax return.

carryover credit, if any, see the last page of these instructions. If you claim this credit in 2021 for a contribution made from

January 1, 2022, to April 18, 2022, you must make an

Arizona Form 348 Credit Carryover Amount from adjustment on your 2022 Arizona Form 140 Schedule A, Form

Prior Tax Years 140PY Schedule A(PY) or A(PYN), or Form 140NR Schedule

If you claimed an allowable credit on Form 348 on your 2016 A(NR).

through 2020 tax returns and your tax liability was less than If the allowable credit is more than your tax or if you have no

your allowable credit, you may have a carryover amount tax, you may carry the unused credit forward for up to the next

available. five consecutive taxable years’ income tax liability.

You may use the available credit carryover amount to reduce

your 2021 tax liability even if you do not claim a credit on Form

323 for 2021.