Enlarge image

2022 Credit for Contributions to

Certified School Tuition Organizations - Individuals Arizona Form

(For contributions that exceed the maximum allowable credit on Arizona Form 323) 348

For information or help, call one of the numbers listed: General Instructions

Phoenix (602) 255-3381

Arizona law provides an individual income tax credit for the

From area codes 520 and 928, toll-free (800) 352-4090

voluntary cash contributions made to a certified School Tuition

Tax forms, instructions, and other tax information Organization (STO) in order to improve education by raising

If you need tax forms, instructions, and other tax information, tuition scholarships for children in Arizona.

go to the department’s website at www.azdor.gov. This credit is available only to individuals. Corporations may

Income Tax Procedures and Rulings not claim this credit. A partnership may not pass the credit

These instructions may refer to the department’s income tax through to its partners. An S Corporation may not pass the

procedures and rulings for more information. To view or print credit through to its shareholders.

these, go to our website select Reports, Statistics and Legal The amount of current year’s contributions that may be claimed

Research from the main menu, then click on Legal Research on Form 348 is computed after the maximum credit is claimed

and select a Document Type and Category from the drop down on Form 323 and is based on the excess amount of contributions

menus. shown on Form 323, Part 4, line 25.

Publications For 2022, the maximum amount of credit on Form 348 that a

To view or print the department’s publications, go to our taxpayer can establish for the current taxable year is $620 for

website select Reports, Statistics and Legal Research from the single taxpayers or heads of household. For married taxpayers

main menu then click on Publications in the left-hand side that file a joint return, the maximum amount of credit that a

column. taxpayer can establish for the current taxable year is $1,238. In

most cases, for married taxpayers who file separate returns,

NOTE: You must also complete Arizona Form 301,

each spouse may claim only one-half (½) of the credit that

Nonrefundable Individual Tax Credits and Recapture, and

would have been allowed on a joint return.

include Forms 301 and 348 with your tax return to claim this

credit. NOTE: The maximum amount of credit established for the

current taxable year does not include any unused valid

Notice to All Taxpayers carryover amount(s) from prior taxable years. Because this is

a nonrefundable credit, the total amount of available credit

NOTE: To claim a current year’s credit on Form 348, you must [current year plus any valid carryover amount(s)] that a

first claim the maximum current year’s credit allowed on taxpayer may use for the taxable year cannot be greater than

Arizona Form 323, Credit for Contributions to Private School the tax liability shown.

Tuition Organizations. The amount of credit you must claim on

Form 323 depends on your filing status. See Form 323 for these A cash contribution for which a credit is claimed that is made

amounts. on or before the fifteenth day of the fourth month following the

If you have a carryover amount from a credit claimed on close of the taxable year may be applied to either the current or

Form 348 from prior tax years, you do not have to claim the preceding taxable year and is considered to have been made on

maximum allowable credit on Form 323 to only use a the last day of that taxable year.

carryover amount on Form 348. If you are claiming only a FOR CALENDAR YEAR FILERS: Credit eligible cash

carryover amount on Form 348, and are not claiming any contributions made to a certified STO from January 1, 2023 to

current year’s credit on Form 323, submit only Forms 301 April 18, 2023 may be claimed as a tax credit on either the 2022

and 348. or 2023 Arizona income tax return.

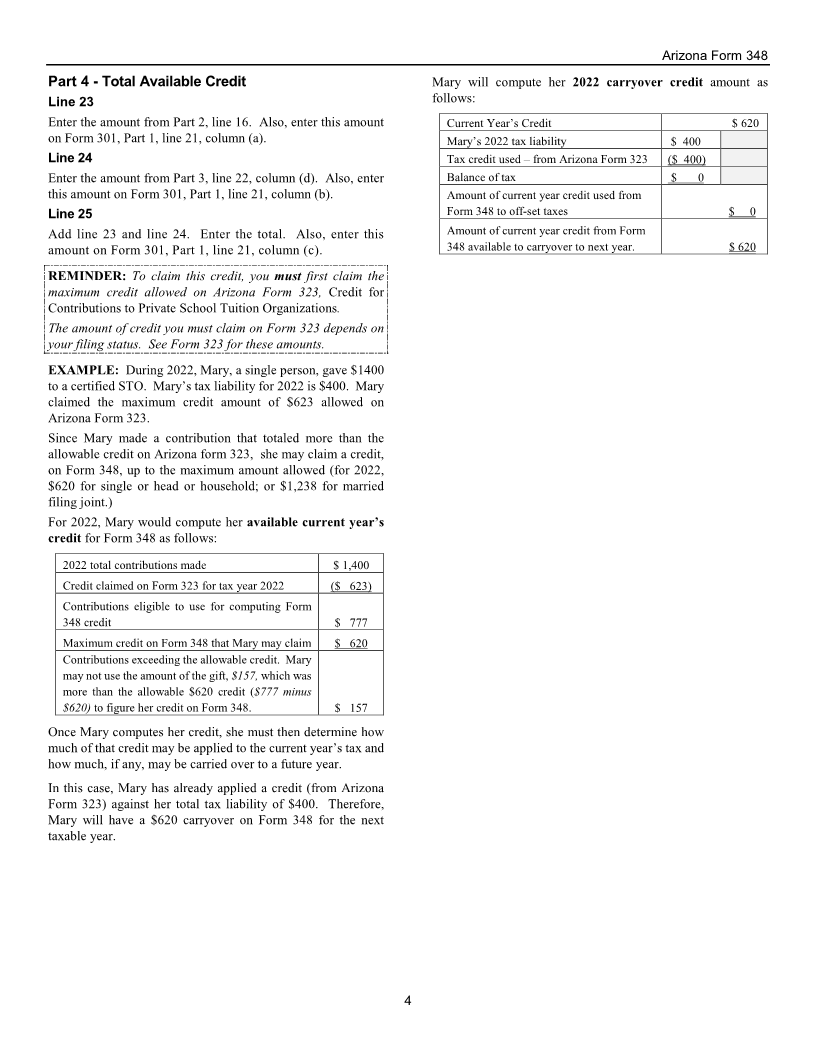

For an example of how to calculate the current year credit and If you claim this credit in 2022 for a contribution made from

carryover credit, if any, see the last page of these instructions. January 1, 2023 to April 18, 2023 you must make an adjustment

on your 2023 Arizona Form 140 Schedule A, Form 140PY

Arizona Form 348 Credit Carryover Amount from Schedule A(PY) or A(PYN), or Form 140NR Schedule A(NR).

Prior Tax Years

If the allowable credit is more than your tax or if you have no

If you claimed an allowable credit on Form 348 on your 2017 tax, you may carry the unused credit forward for up to the next

through 2021 tax returns and your tax liability was less than five consecutive taxable years’ income tax liability.

your allowable credit, you may have a carryover amount

available.

You may use the available credit carryover amount to reduce

your 2022 tax liability even if you do not claim a credit on Form

323 for 2022.