Enlarge image

Arizona Form

Credit for Contributions to

348 Certified School Tuition Organizations - Individuals 2021

For contributions that exceed the maximum allowable credit on Arizona Form 323. Include with your return.

For the calendar year 2021 or fiscal year beginning M M D D 2 0 2 1 and ending M M D D Y Y Y Y .

Your Name as shown on Form 140, 140NR, 140PY, or 140X Your Social Security Number

Spouse’s Name as shown on Form 140, 140NR, 140PY, or 140X (if joint return) Spouse’s Social Security Number

Before you can claim this credit, you must claim the maximum allowable credit on Arizona Form 323, Credit for Contributions to Private School

Tuition Organizations. If you made cash contributions totaling more than the maximum allowable credit on Form 323, you may claim a credit on Form

348 for some or all of those cash contributions that exceed the maximum allowable credit on Form 323.

If you have a carryover amount(s) from a credit claimed on Form 348 from prior tax year(s), you do not have to claim the maximum allowable credit

on Form 323 to only claim a carryover amount available on Form 348. See instructions under “Notice to All Taxpayers”.

Part 1 Eligibility YES NO

1a Are you claiming a current year’s credit on your 2021 Form 323 for cash contributions to private school

tuition organizations? .......................................................................................................................................................................1a

• If you answered, “No”, skip line 1b and go to line 1c.

• If you answered, “Yes”, complete line 1b.

1b Did you make cash contributions in excess of the allowable credit claimed on Form 323? See Form 323, Part 4, line 25 ...... 1b

• If you answered, “No”, go to line 1c.

• If you answered, “Yes”, complete this form to claim an allowable credit for the amount of cash contributions

that exceed the amount of the allowable credit claimed on Form 323.

1c Are you claiming only a carryover from Form 348 from prior tax year? ....................................................................... 1c

• If you answered, “No”, to lines 1a, 1b, and 1c, STOP, do not complete this form.

• If you answered, “Yes”, to line 1c, skip Part 2 and complete Part 3 and Part 4.

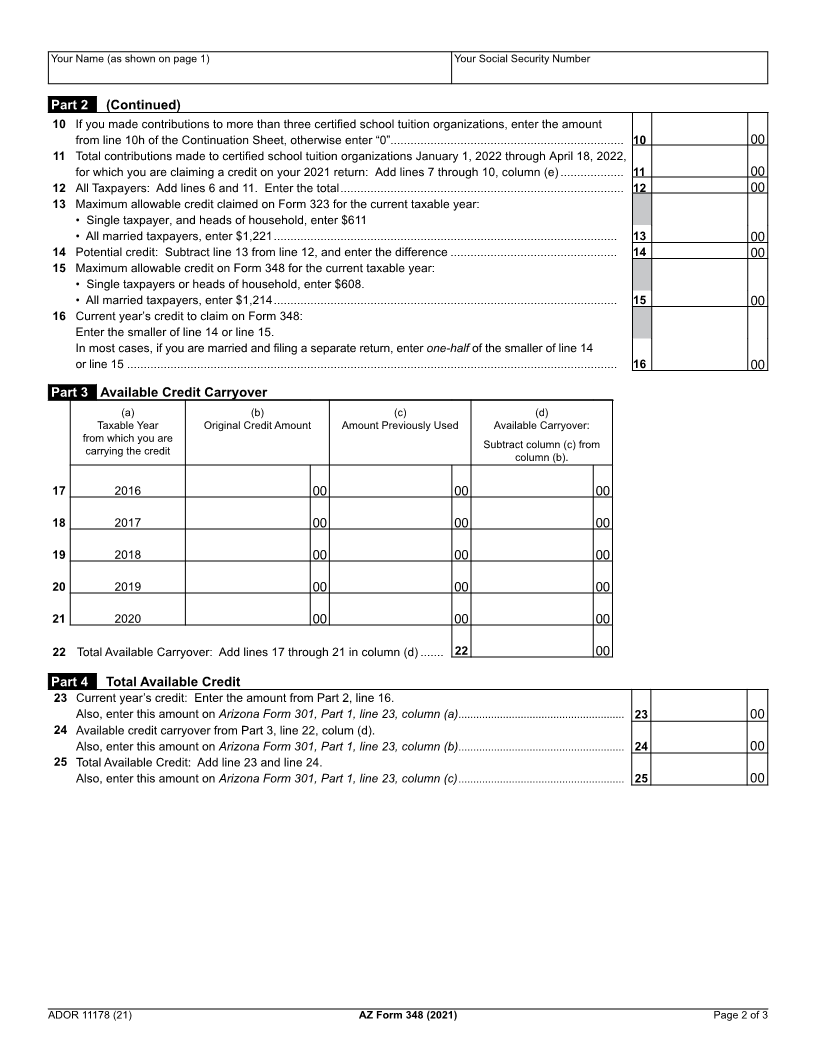

Part 2 Current Year’s Credit

A. Cash contributions made January 1, 2021 through December 31, 2021. You must list all contributions claimed on Form 323.

• If you are married and filing separate returns, be sure to include all cash contributions made by you and your spouse.

• Do not include those contributions for which you or your spouse claimed a credit on the 2020 tax return.

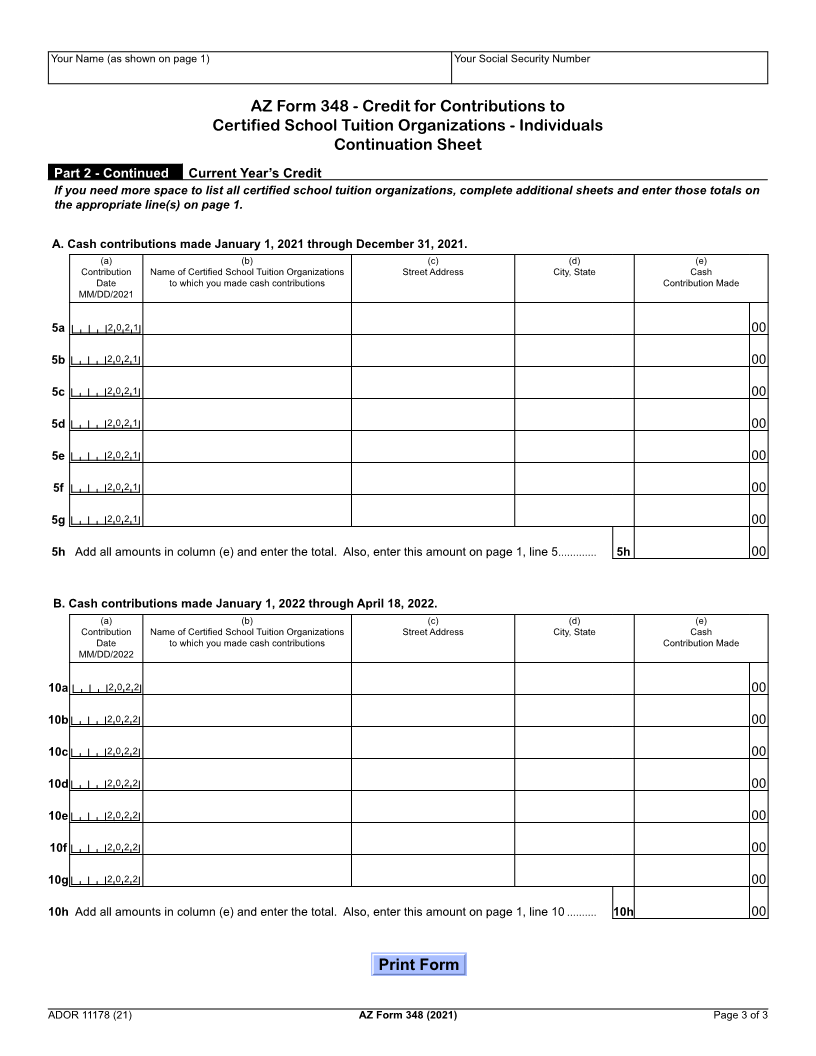

• If you made cash contributions to more than three certified school tuition organizations, complete the Continuation Sheet on

page 3 and include it with the credit form.

(a) (b) (c) (d) (e)

Contribution Name of Certified School Tuition Organizations Street Address City, State Cash

Date to which you made cash contributions Contribution Made

MM/DD/2021

2 2 0 2 1 00

3 2 0 2 1 00

4 2 0 2 1 00

5 If you made contributions to more than three certified school tuition organizations, enter the amount from

line 5h of the Continuation Sheet, otherwise enter “0” ................................................................................... 5 00

6 Total contributions made to certified school tuition organizations during 2021: Add lines 2 through 5,

column (e)....................................................................................................................................................... 6 00

B. Cash contributions made January 1, 2022 through April 18, 2022, for which you or your spouse are claiming a credit on the 2021 tax

return. You must list all contributions claimed on Form 323.

• If you are married and filing separate returns, be sure to include all cash contributions made by you and your spouse.

• If you made cash contributions to more than three certified school tuition organizations, complete the Continuation Sheet on

page 3 and include it with the credit form.

(a) (b) (c) (d) (e)

Contribution Name of Certified School Tuition Organizations Street Address City, State Cash

Date to which you made cash contributions Contribution Made

MM/DD/2022

7 2 0 2 2 00

8 2 0 2 2 00

9 2 0 2 2 00

ADOR 11178 (21) Continued on page 2