Enlarge image

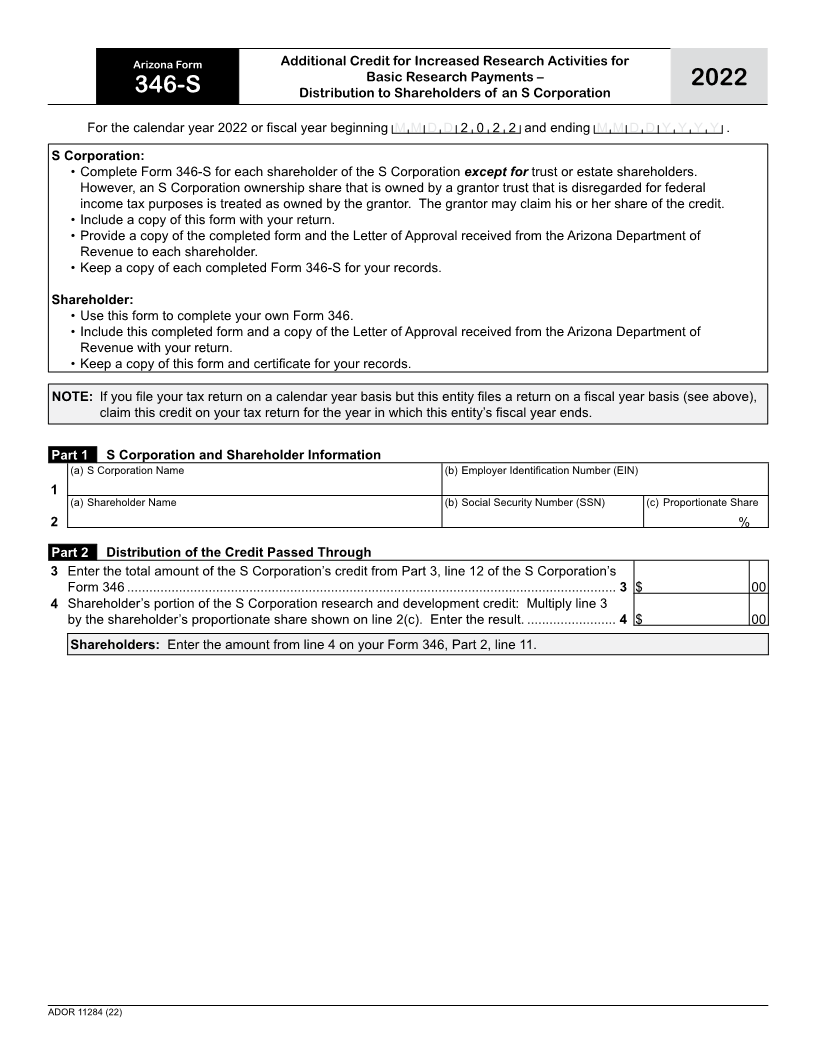

Arizona Form Additional Credit for Increased Research Activities for

Basic Research Payments – 2022

346-S Distribution to Shareholders of an S Corporation

For the calendar year 2022 or fiscal year beginning M M D D 2 0 2 2 and ending M M D D Y Y Y Y .

S Corporation:

• Complete Form 346-S for each shareholder of the S Corporation except for trust or estate shareholders.

However, an S Corporation ownership share that is owned by a grantor trust that is disregarded for federal

income tax purposes is treated as owned by the grantor. The grantor may claim his or her share of the credit.

• Include a copy of this form with your return.

• Provide a copy of the completed form and the Letter of Approval received from the Arizona Department of

Revenue to each shareholder.

• Keep a copy of each completed Form 346-S for your records.

Shareholder:

• Use this form to complete your own Form 346.

• Include this completed form and a copy of the Letter of Approval received from the Arizona Department of

Revenue with your return.

• Keep a copy of this form and certificate for your records.

NOTE: If you file your tax return on a calendar year basis but this entity files a return on a fiscal year basis (see above),

claim this credit on your tax return for the year in which this entity’s fiscal year ends.

Part 1 S Corporation and Shareholder Information

(a) S Corporation Name (b) Employer Identification Number (EIN)

1

(a) Shareholder Name (b) Social Security Number (SSN) (c) Proportionate Share

2 %

Part 2 Distribution of the Credit Passed Through

3 Enter the total amount of the S Corporation’s credit from Part 3, line 12 of the S Corporation’s

Form 346 .................................................................................................................................... 3 $ 00

4 Shareholder’s portion of the S Corporation research and development credit: Multiply line 3

by the shareholder’s proportionate share shown on line 2(c). Enter the result. ........................ 4 $ 00

Shareholders: Enter the amount from line 4 on your Form 346, Part 2, line 11.

ADOR 11284 (22)