Enlarge image

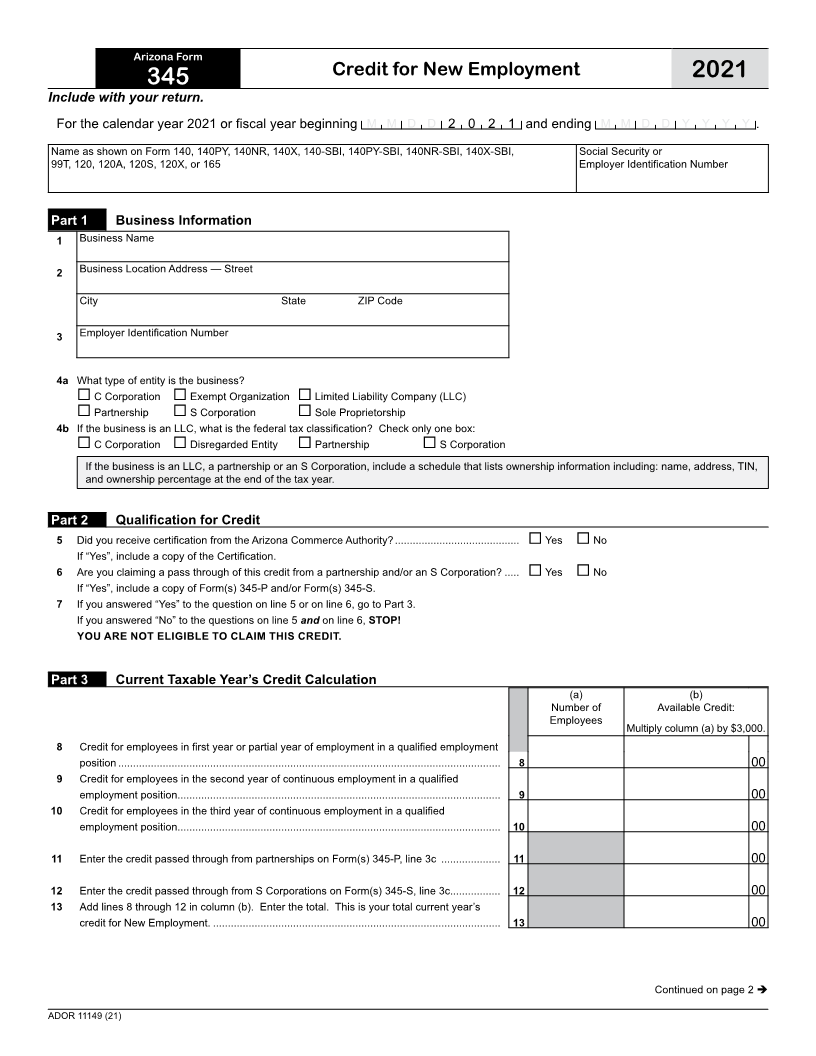

Arizona Form

Credit for New Employment 2021

345

Include with your return.

For the calendar year 2021 or fiscal year beginning M M D D 2 0 2 1 and ending M M D D Y Y Y Y .

Name as shown on Form 140, 140PY, 140NR, 140X, 140-SBI, 140PY-SBI, 140NR-SBI, 140X-SBI, Social Security or

99T, 120, 120A, 120S, 120X, or 165 Employer Identification Number

Part 1 Business Information

1 Business Name

2 Business Location Address — Street

City State ZIP Code

3 Employer Identification Number

4a What type of entity is the business?

C Corporation Exempt Organization Limited Liability Company (LLC)

Partnership S Corporation Sole Proprietorship

4b If the business is an LLC, what is the federal tax classification? Check only one box:

C Corporation Disregarded Entity Partnership S Corporation

If the business is an LLC, a partnership or an S Corporation, include a schedule that lists ownership information including: name, address, TIN,

and ownership percentage at the end of the tax year.

Part 2 Qualification for Credit

5 Did you receive certification from the Arizona Commerce Authority? .......................................... Yes No

If “Yes”, include a copy of the Certification.

6 Are you claiming a pass through of this credit from a partnership and/or an S Corporation? ..... Yes No

If “Yes”, include a copy of Form(s) 345-P and/or Form(s) 345-S.

7 If you answered “Yes” to the question on line 5 or on line 6, go to Part 3.

If you answered “No” to the questions on line 5 and on line 6, STOP!

YOU ARE NOT ELIGIBLE TO CLAIM THIS CREDIT.

Part 3 Current Taxable Year’s Credit Calculation

(a) (b)

Number of Available Credit:

Employees

Multiply column (a) by $3,000.

8 Credit for employees in first year or partial year of employment in a qualified employment

position ................................................................................................................................. 8 00

9 Credit for employees in the second year of continuous employment in a qualified

employment position............................................................................................................. 9 00

10 Credit for employees in the third year of continuous employment in a qualified

employment position............................................................................................................. 10 00

11 Enter the credit passed through from partnerships on Form(s) 345-P, line 3c .................... 11 00

12 Enter the credit passed through from S Corporations on Form(s) 345-S, line 3c................. 12 00

13 Add lines 8 through 12 in column (b). Enter the total. This is your total current year’s

credit for New Employment. ................................................................................................. 13 00

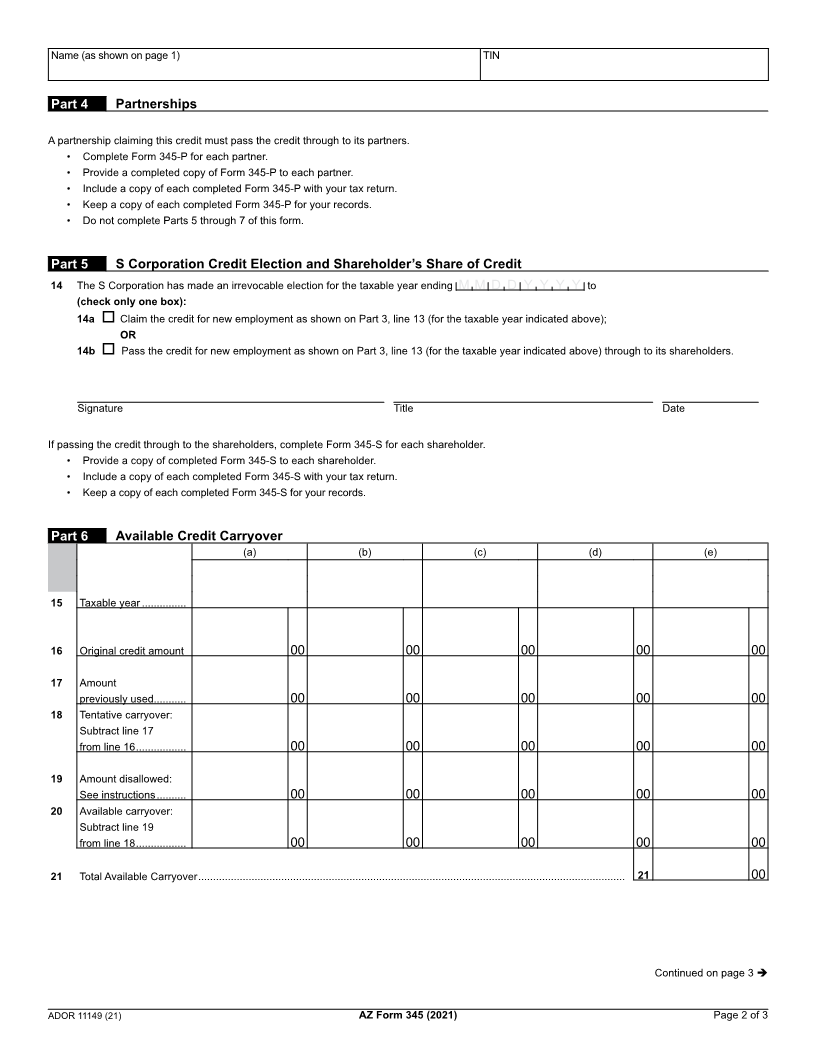

Continued on page 2

ADOR 11149 (21)