Enlarge image

Arizona Form

Renewable Energy Production Tax Credit 2022

343

Include with your return.

For the calendar year 2022 or fiscal year beginning M M D D 2 0 2 2 and ending M M D D Y Y Y Y .

Name as shown on Form 140, 140PY, 140NR, 140X, 140-SBI, 140PY-SBI, 140NR-SBI, 140X-SBI, Social Security or

99T, 120, 120A, 120S, 120X, or 165 Employer Identification Number

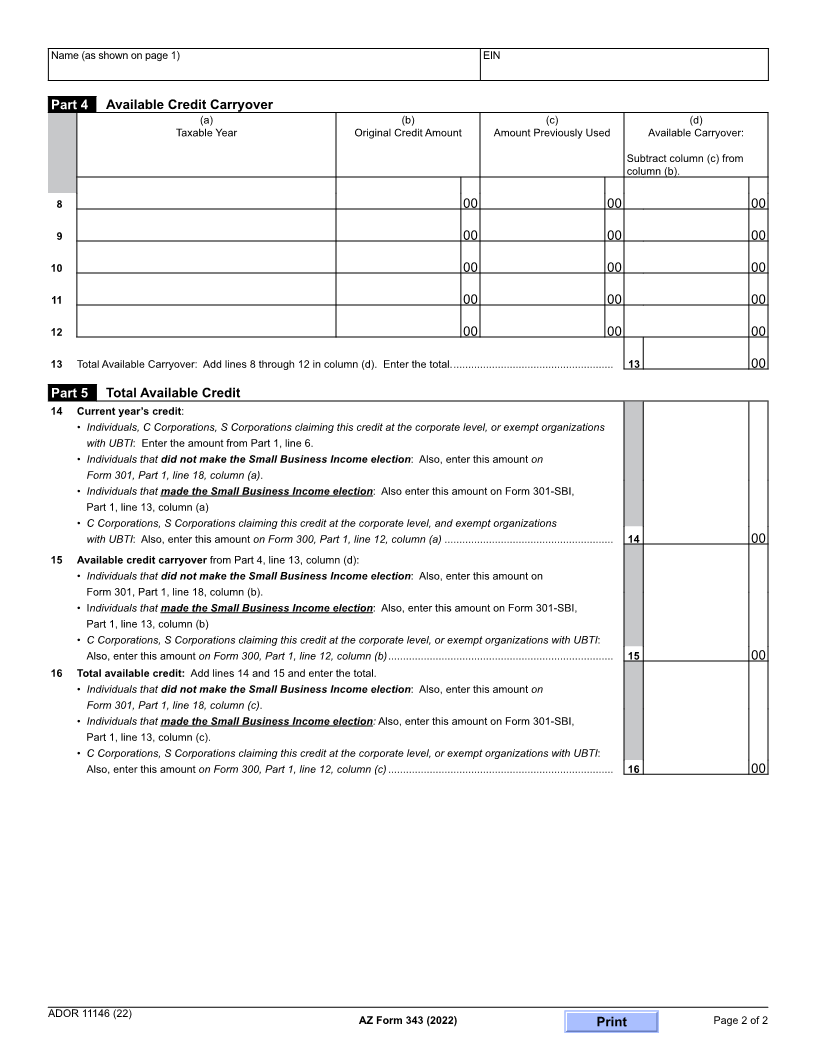

Part 1 Qualification for and Current Taxable Year’s Credit

1 Did you receive a Certificate from the Arizona Department of Revenue? ...................................... Yes No

If “Yes”, include a copy of the Certificate. If “No”, skip line 2.

2 Enter the credit amount on the Certificate from the Arizona Department of Revenue for

this taxable year .............................................................................................................................................................. 2 00

3 Did an entity from which you are claiming a pass through renewable energy production tax

credit receive a Certificate from the Arizona Department of Revenue?.......................................... Yes No

If “Yes”, include a copy of the certificate and Form(s) 343-P and/or Form(s) 343-S.

If “No”, skip lines 4 and 5.

If you checked “No” for both line 1 and line 3, do not file this form unless you have carryovers from prior years.

4 Enter the amount of this credit passed through from partnerships on Form 343-P, line 3c ............................................ 4 00

5 Enter the amount of this credit passed through from S Corporations on Form 343-S, line 3c ........................................ 5 00

6 Add lines 2, 4, and 5. Enter the total. This is your current taxable year’s Renewable Energy

Production Tax Credit ................................................................................................................................................... 6 00

Part 2 Partnerships

A partnership claiming this credit must pass it through to its partners.

• Complete Form 343-P for each partner.

• Provide a completed copy of Form 343-P to each partner.

• Include a copy of each completed Form 343-P with your tax return.

• Keep a copy of each completed Form 343-P for your records.

• Do not complete Parts 3 through 5 of this form.

Part 3 S Corporation Credit Election and Shareholder’s Share of Credit

7 The S Corporation has made an irrevocable election for the taxable year ending M M D D Y Y Y Y to

(check only one box):

7a Claim the renewable energy production tax credit as shown on Part 1, line 6 (for the taxable year indicated above);

OR

7b Pass the renewable energy production tax credit as shown on Part 1, line 6 (for the taxable year indicated above)

through to its shareholders.

Signature Title Date

If passing the credit through to the shareholders, complete Form 343-S for each shareholder.

• Provide a copy of the completed Form 343-S to each shareholder.

• Include a copy of each completed Form 343-S with your tax return.

• Keep a copy of each completed Form 343-S for your records.

Continued on page 2

ADOR 11146 (22)