Enlarge image

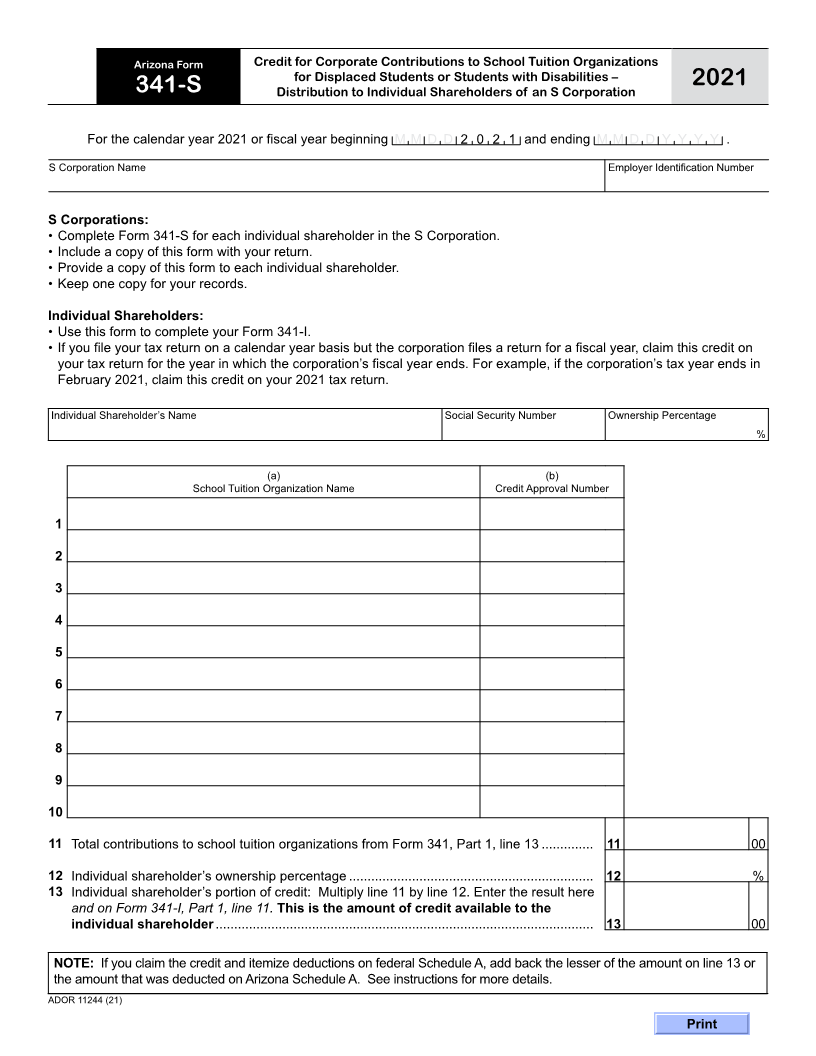

Arizona Form Credit for Corporate Contributions to School Tuition Organizations

for Displaced Students or Students with Disabilities – 2021

341-S Distribution to Individual Shareholders of an S Corporation

For the calendar year 2021 or fiscal year beginning M M D D 2 0 2 1 and ending M M D D Y Y Y Y .

S Corporation Name Employer Identification Number

S Corporations:

• Complete Form 341-S for each individual shareholder in the S Corporation.

• Include a copy of this form with your return.

• Provide a copy of this form to each individual shareholder.

• Keep one copy for your records.

Individual Shareholders:

• Use this form to complete your Form 341-I.

• If you file your tax return on a calendar year basis but the corporation files a return for a fiscal year, claim this credit on

your tax return for the year in which the corporation’s fiscal year ends. For example, if the corporation’s tax year ends in

February 2021, claim this credit on your 2021 tax return.

Individual Shareholder’s Name Social Security Number Ownership Percentage

%

(a) (b)

School Tuition Organization Name Credit Approval Number

1

2

3

4

5

6

7

8

9

10

11 Total contributions to school tuition organizations from Form 341, Part 1, line 13 .............. 11 00

12 Individual shareholder’s ownership percentage .................................................................. 12 %

13 Individual shareholder’s portion of credit: Multiply line 11 by line 12. Enter the result here

and on Form 341‑I, Part 1, line 11. This is the amount of credit available to the

individual shareholder ...................................................................................................... 13 00

NOTE: If you claim the credit and itemize deductions on federal Schedule A, add back the lesser of the amount on line 13 or

the amount that was deducted on Arizona Schedule A. See instructions for more details.

ADOR 11244 (21)

Print