Enlarge image

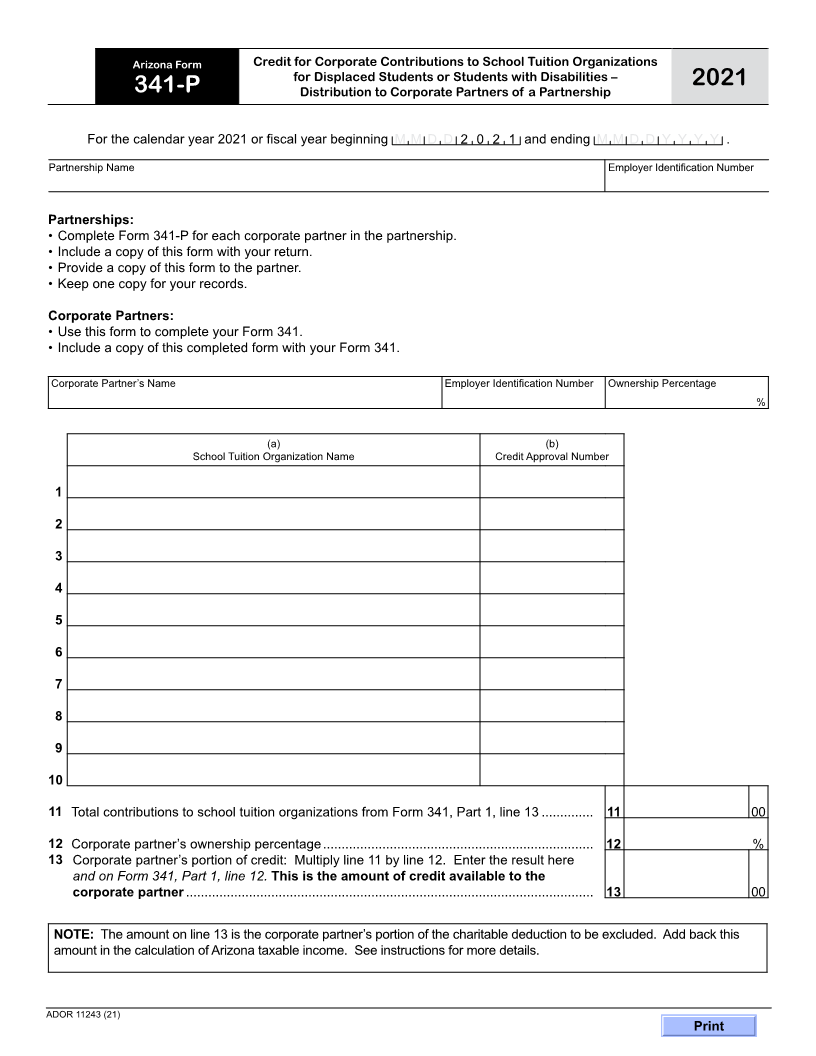

Arizona Form Credit for Corporate Contributions to School Tuition Organizations

for Displaced Students or Students with Disabilities – 2021

341-P Distribution to Corporate Partners of a Partnership

For the calendar year 2021 or fiscal year beginning M M D D 2 0 2 1 and ending M M D D Y Y Y Y .

Partnership Name Employer Identification Number

Partnerships:

• Complete Form 341-P for each corporate partner in the partnership.

• Include a copy of this form with your return.

• Provide a copy of this form to the partner.

• Keep one copy for your records.

Corporate Partners:

• Use this form to complete your Form 341.

• Include a copy of this completed form with your Form 341.

Corporate Partner’s Name Employer Identification Number Ownership Percentage

%

(a) (b)

School Tuition Organization Name Credit Approval Number

1

2

3

4

5

6

7

8

9

10

11 Total contributions to school tuition organizations from Form 341, Part 1, line 13 .............. 11 00

12 Corporate partner’s ownership percentage ......................................................................... 12 %

13 Corporate partner’s portion of credit: Multiply line 11 by line 12. Enter the result here

and on Form 341, Part 1, line 12. This is the amount of credit available to the

corporate partner .............................................................................................................. 13 00

NOTE: The amount on line 13 is the corporate partner’s portion of the charitable deduction to be excluded. Add back this

amount in the calculation of Arizona taxable income. See instructions for more details.

ADOR 11243 (21)

Print