Enlarge image

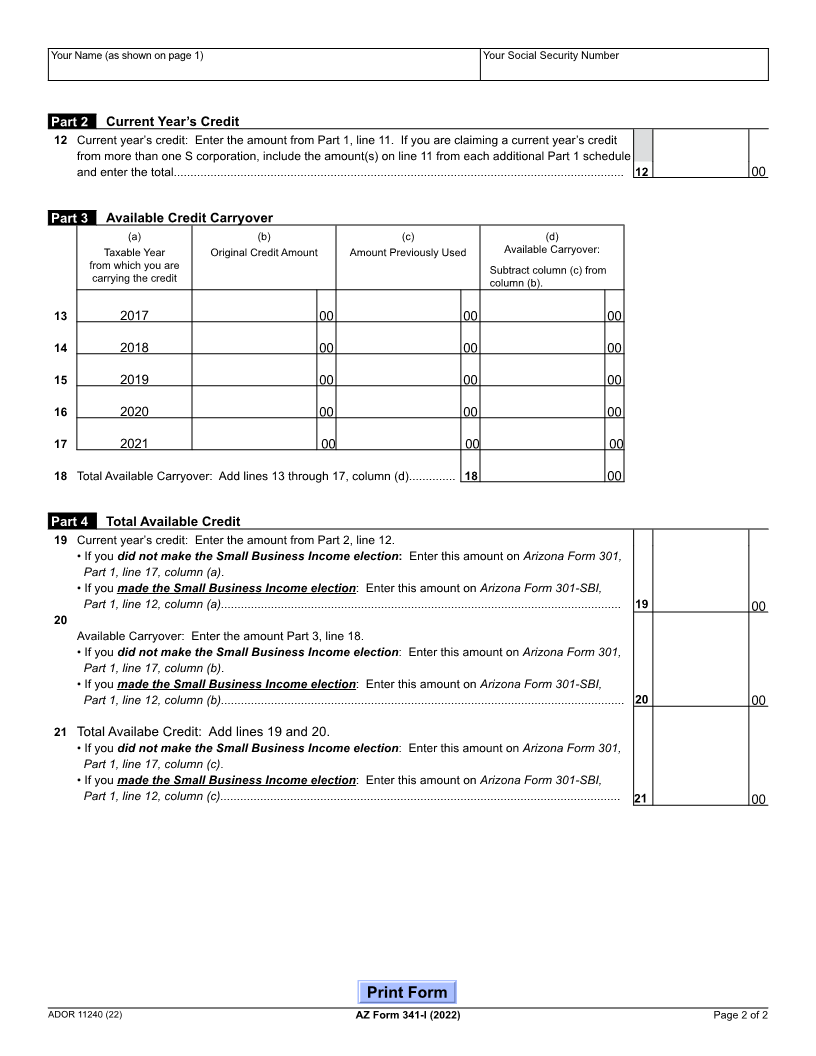

Arizona Form Credit for Business Contributions by an S Corporation

to School Tuition Organizations for Displaced Students 2022

341-I

or Students with Disabilities - Individual

Include with your return.

For the calendar year 2022 or fiscal year beginning M M D D 2 0 2 2 and ending M M D D Y Y Y Y .

Your Name as shown on Form 140, 140PY, 140NR, 140X, 140-SBI, 140NR-SBI, 140PY-SBI or 140X-SBI Your Social Security Number

Spouse’s Name as shown on Form 140, 140PY, 140NR, 140X, 140-SBI, 140NR-SBI, 140PY-SBI or 140X-SBI (if a joint return) Spouse’s Social Security Number

Part 1 School Tuition Organization Information

Check if you are claiming a pro rata credit from more than one S corporation. Complete and include a separate Part 1 for each

additional S corporation.

I am claiming a credit for my pro rata share of contributions made by the S corporation named below to the following

school tuition organizations:

S corporation name: EIN:

If you need more space to list all school tuition organizations for which contributions were made by the S corporation identified

above, complete an additional schedule and include it with the credit form.

(a) (b)

School Tuition Organization Name Credit Approval Number

1

2

3

4

5

6

7

8

9

10

11 Amount of individual shareholder’s pro rata share of qualified contributions made to school tuition

organizations from the S corporation listed above ............................................................................... 11 00

Continued on page 2

ADOR 11240 (22)