Enlarge image

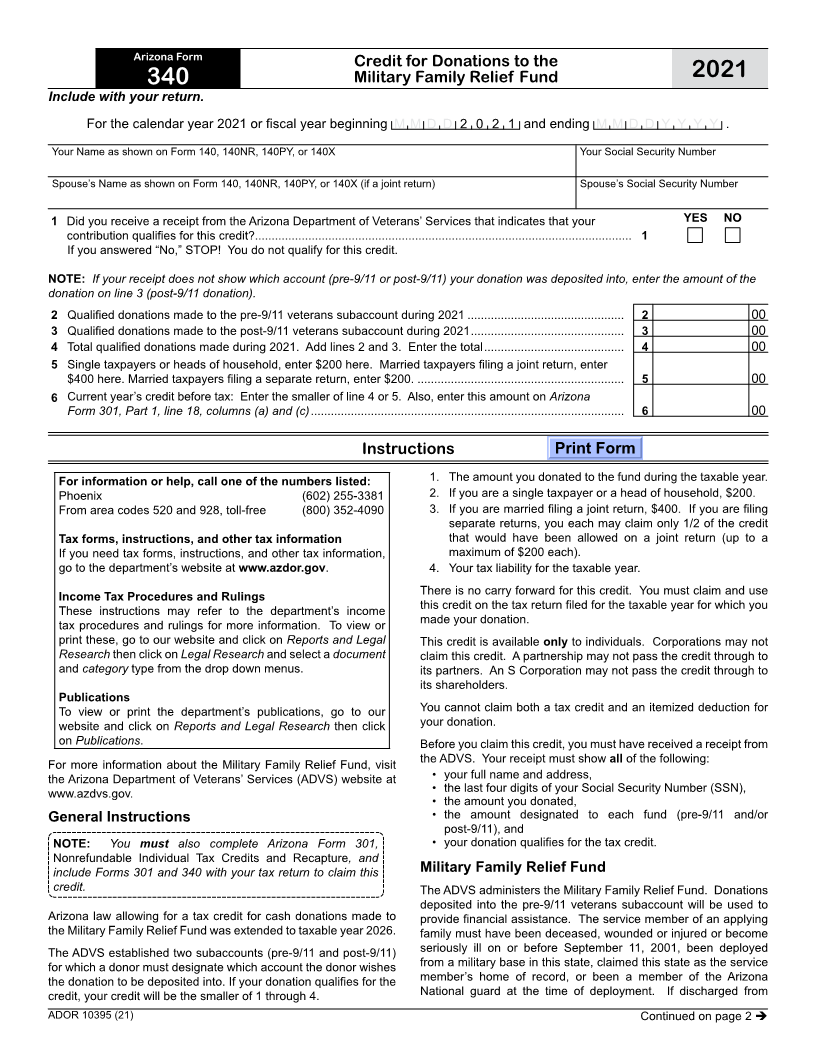

Arizona Form

Credit for Donations to the

340 Military Family Relief Fund 2021

Include with your return.

For the calendar year 2021 or fiscal year beginning M M D D 2 0 2 1 and ending M M D D Y Y Y Y .

Your Name as shown on Form 140, 140NR, 140PY, or 140X Your Social Security Number

Spouse’s Name as shown on Form 140, 140NR, 140PY, or 140X (if a joint return) Spouse’s Social Security Number

1Did you receive a receipt from the Arizona Department of Veterans’ Services that indicates that your YES NO

contribution qualifies for this credit?................................................................................................................. 1

If you answered “No,” STOP! You do not qualify for this credit.

NOTE: If your receipt does not show which account (pre-9/11 or post-9/11) your donation was deposited into, enter the amount of the

donation on line 3 (post-9/11 donation).

2 Qualified donations made to the pre-9/11 veterans subaccount during 2021 ............................................... 2 00

3 Qualified donations made to the post-9/11 veterans subaccount during 2021 .............................................. 3 00

4 Total qualified donations made during 2021. Add lines 2 and 3. Enter the total .......................................... 4 00

5 Single taxpayers or heads of household, enter $200 here. Married taxpayers filing a joint return, enter

$400 here. Married taxpayers filing a separate return, enter $200. .............................................................. 5 00

6 Current year’s credit before tax: Enter the smaller of line 4 or 5. Also, enter this amount on Arizona

Form 301, Part 1, line 18, columns (a) and (c) .............................................................................................. 6 00

Instructions Print Form

For information or help, call one of the numbers listed: 1. The amount you donated to the fund during the taxable year.

Phoenix (602) 255-3381 2. If you are a single taxpayer or a head of household, $200.

From area codes 520 and 928, toll-free (800) 352-4090 3. If you are married filing a joint return, $400. If you are filing

separate returns, you each may claim only 1/2 of the credit

Tax forms, instructions, and other tax information that would have been allowed on a joint return (up to a

If you need tax forms, instructions, and other tax information, maximum of $200 each).

go to the department’s website at www.azdor.gov. 4. Your tax liability for the taxable year.

There is no carry forward for this credit. You must claim and use

Income Tax Procedures and Rulings

These instructions may refer to the department’s income this credit on the tax return filed for the taxable year for which you

tax procedures and rulings for more information. To view or made your donation.

print these, go to our website and click on Reports and Legal This credit is available only to individuals. Corporations may not

Research then click on Legal Research and select a document claim this credit. A partnership may not pass the credit through to

and category type from the drop down menus. its partners. An S Corporation may not pass the credit through to

its shareholders.

Publications

To view or print the department’s publications, go to our You cannot claim both a tax credit and an itemized deduction for

website and click on Reports and Legal Research then click your donation.

on Publications. Before you claim this credit, you must have received a receipt from

For more information about the Military Family Relief Fund, visit the ADVS. Your receipt must show all of the following:

the Arizona Department of Veterans’ Services (ADVS) website at • your full name and address,

www.azdvs.gov. • the last four digits of your Social Security Number (SSN),

• the amount you donated,

General Instructions • the amount designated to each fund (pre-9/11 and/or

post-9/11), and

NOTE: You must also complete Arizona Form 301, • your donation qualifies for the tax credit.

Nonrefundable Individual Tax Credits and Recapture, and

include Forms 301 and 340 with your tax return to claim this Military Family Relief Fund

credit. The ADVS administers the Military Family Relief Fund. Donations

deposited into the pre-9/11 veterans subaccount will be used to

Arizona law allowing for a tax credit for cash donations made to provide financial assistance. The service member of an applying

the Military Family Relief Fund was extended to taxable year 2026. family must have been deceased, wounded or injured or become

The ADVS established two subaccounts (pre-9/11 and post-9/11) seriously ill on or before September 11, 2001, been deployed

for which a donor must designate which account the donor wishes from a military base in this state, claimed this state as the service

the donation to be deposited into. If your donation qualifies for the member’s home of record, or been a member of the Arizona

credit, your credit will be the smaller of 1 through 4. National guard at the time of deployment. If discharged from

ADOR 10395 (21) Continued on page 2