Enlarge image

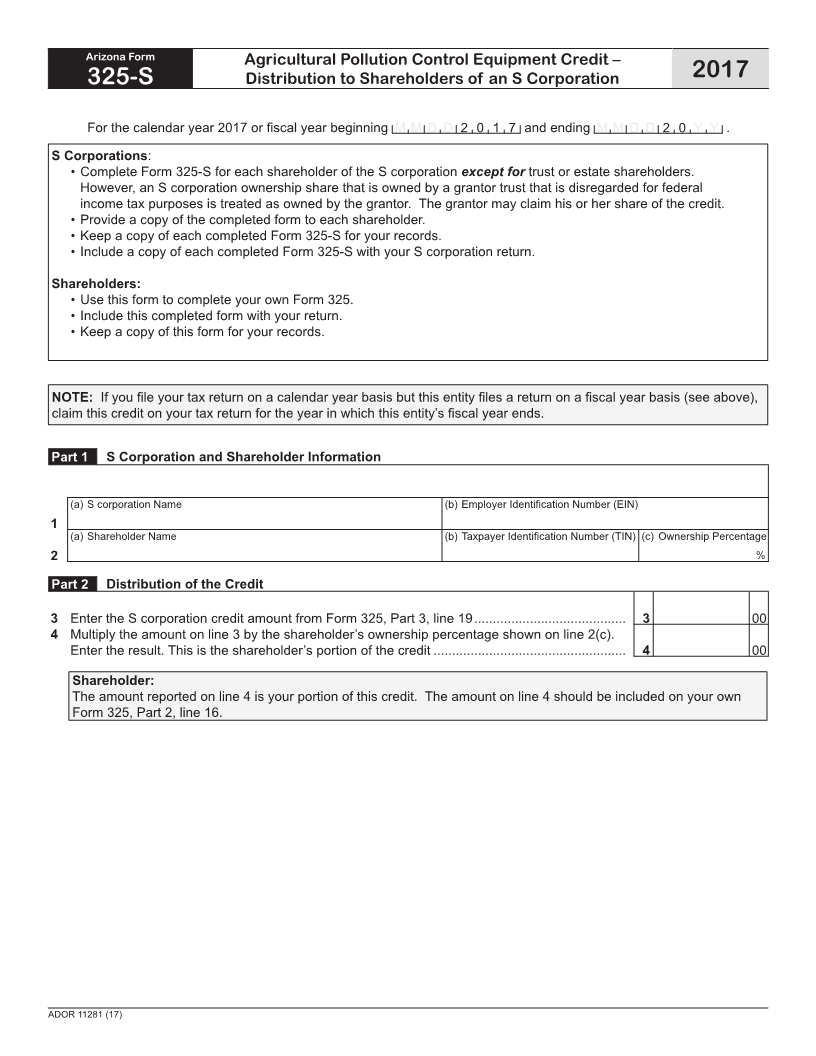

Arizona Form Agricultural Pollution Control Equipment Credit – 325-S Distribution to Shareholders of an S Corporation 2017 For the calendar year 2017 or fiscal year beginning M M D D 2 0 1 7 and ending M M D D 2 0 Y Y . S Corporations: CompleteForm325-SforeachshareholderoftheScorporation except for trust or estate shareholders. However,anScorporationownershipsharethatisownedbyagrantortrustthatisdisregardedforfederal incometaxpurposesistreatedasownedbythegrantor. Thegrantormayclaimhisorhershareofthecredit. Provideacopyofthecompletedformtoeachshareholder. KeepacopyofeachcompletedForm325-Sforyourrecords. IncludeacopyofeachcompletedForm325-SwithyourScorporationreturn. Shareholders: UsethisformtocompleteyourownForm325. Includethiscompletedformwithyourreturn. Keepacopyofthisformforyourrecords. NOTE:Ifyoufileyourtaxreturnonacalendaryearbasisbutthisentityfilesareturnonafiscalyearbasis(seeabove), claimthiscreditonyourtaxreturnfortheyearinwhichthisentity’sfiscalyearends. Part 1 S Corporation and Shareholder Information ScorporationName EmployerIdentificationNumber(EIN) 1 ShareholderName TaxpayerIdentificationNumber(TIN) OwnershipPercentage 2 % Part 2 Distribution of the Credit 3 EntertheScorporationcreditamountfromForm325,Part3,line19 ......................................... 3 00 4 Multiplytheamountonline3bytheshareholder’sownershippercentageshownonline2(c). Entertheresult. Thisistheshareholder’sportionofthecredit .................................................... 4 00 Shareholder: Theamountreportedonline4isyourportionofthiscredit. Theamountonline4shouldbeincludedonyourown Form325,Part2,line16. ADOR 11281 (17)