Enlarge image

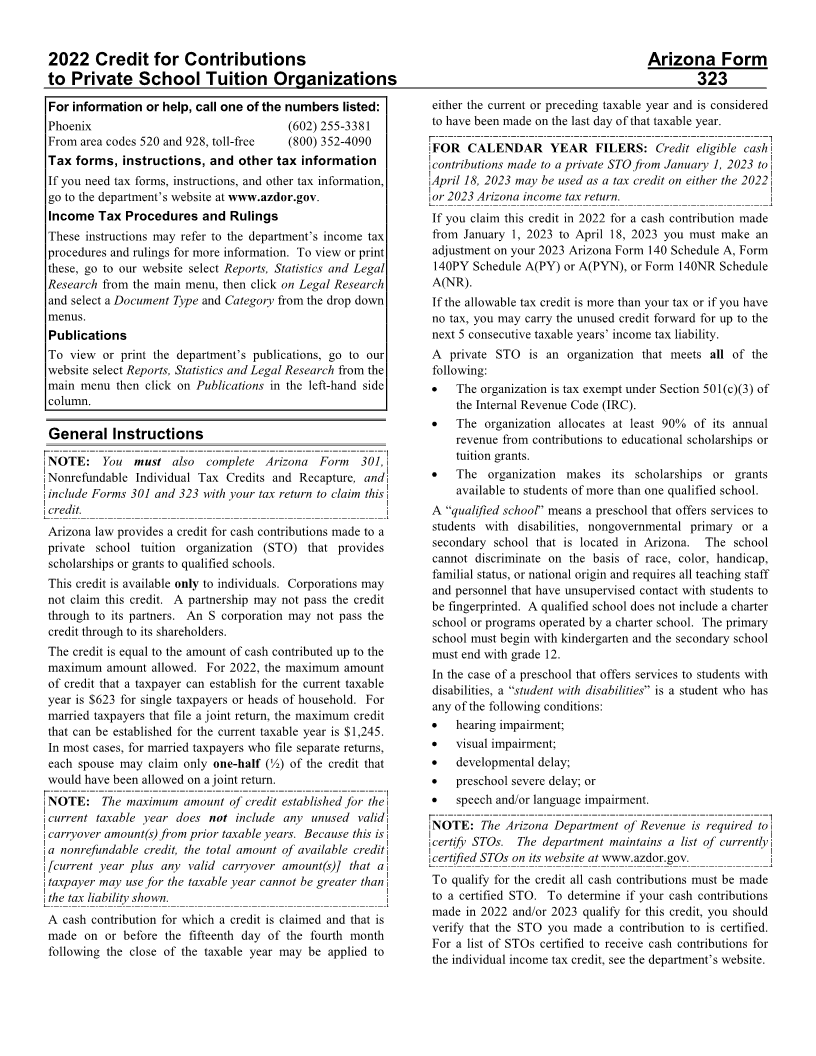

2022 Credit for Contributions Arizona Form

to Private School Tuition Organizations 323

For information or help, call one of the numbers listed: either the current or preceding taxable year and is considered

Phoenix (602) 255-3381 to have been made on the last day of that taxable year.

From area codes 520 and 928, toll-free (800) 352-4090

FOR CALENDAR YEAR FILERS: Credit eligible cash

Tax forms, instructions, and other tax information contributions made to a private STO from January 1, 2023 to

If you need tax forms, instructions, and other tax information, April 18, 2023 may be used as a tax credit on either the 2022

go to the department’s website at www.azdor.gov. or 2023 Arizona income tax return.

Income Tax Procedures and Rulings If you claim this credit in 2022 for a cash contribution made

These instructions may refer to the department’s income tax from January 1, 2023 to April 18, 2023 you must make an

procedures and rulings for more information. To view or print adjustment on your 2023 Arizona Form 140 Schedule A, Form

these, go to our website select Reports, Statistics and Legal 140PY Schedule A(PY) or A(PYN), or Form 140NR Schedule

Research from the main menu, then click on Legal Research A(NR).

and select a Document Type and Category from the drop down If the allowable tax credit is more than your tax or if you have

menus. no tax, you may carry the unused credit forward for up to the

Publications next 5 consecutive taxable years’ income tax liability.

To view or print the department’s publications, go to our A private STO is an organization that meets all of the

website select Reports, Statistics and Legal Research from the following:

main menu then click on Publications in the left-hand side • The organization is tax exempt under Section 501(c)(3) of

column. the Internal Revenue Code (IRC).

• The organization allocates at least 90% of its annual

General Instructions revenue from contributions to educational scholarships or

NOTE: You must also complete Arizona Form 301, tuition grants.

Nonrefundable Individual Tax Credits and Recapture, and • The organization makes its scholarships or grants

include Forms 301 and 323 with your tax return to claim this available to students of more than one qualified school.

credit. A “qualified school” means a preschool that offers services to

Arizona law provides a credit for cash contributions made to a students with disabilities, nongovernmental primary or a

private school tuition organization (STO) that provides secondary school that is located in Arizona. The school

scholarships or grants to qualified schools. cannot discriminate on the basis of race, color, handicap,

familial status, or national origin and requires all teaching staff

This credit is available only to individuals. Corporations may

and personnel that have unsupervised contact with students to

not claim this credit. A partnership may not pass the credit

be fingerprinted. A qualified school does not include a charter

through to its partners. An S corporation may not pass the

school or programs operated by a charter school. The primary

credit through to its shareholders.

school must begin with kindergarten and the secondary school

The credit is equal to the amount of cash contributed up to the must end with grade 12.

maximum amount allowed. For 2022, the maximum amount

In the case of a preschool that offers services to students with

of credit that a taxpayer can establish for the current taxable

disabilities, a “student with disabilities” is a student who has

year is $623 for single taxpayers or heads of household. For

any of the following conditions:

married taxpayers that file a joint return, the maximum credit

•

that can be established for the current taxable year is $1,245. hearing impairment;

In most cases, for married taxpayers who file separate returns, • visual impairment;

each spouse may claim only one-half (½) of the credit that • developmental delay;

would have been allowed on a joint return. • preschool severe delay; or

NOTE: The maximum amount of credit established for the • speech and/or language impairment.

current taxable year does not include any unused valid

NOTE: The Arizona Department of Revenue is required to

carryover amount(s) from prior taxable years. Because this is

certify STOs. The department maintains a list of currently

a nonrefundable credit, the total amount of available credit

certified STOs on its website at www.azdor.gov.

[current year plus any valid carryover amount(s)] that a

taxpayer may use for the taxable year cannot be greater than To qualify for the credit all cash contributions must be made

the tax liability shown. to a certified STO. To determine if your cash contributions

made in 2022 and/or 2023 qualify for this credit, you should

A cash contribution for which a credit is claimed and that is

verify that the STO you made a contribution to is certified.

made on or before the fifteenth day of the fourth month

For a list of STOs certified to receive cash contributions for

following the close of the taxable year may be applied to

the individual income tax credit, see the department’s website.