Enlarge image

Arizona Form

Credit for Contributions to

323 Private School Tuition Organizations 2021

Include with your return.

• Do not use this form for cash contributions or fees paid to a public school.

• Use Form 322 for cash contributions or fees paid to public schools.

For the calendar year 2021 or fiscal year beginning M M D D 2 0 2 1 and ending M M D D Y Y Y Y .

Your Name as shown on Form 140, 140NR, 140PY or 140X Your Social Security Number

Spouse’s Name as shown on Form 140, 140NR, 140PY or 140X (if joint return) Spouse’s Social Security Number

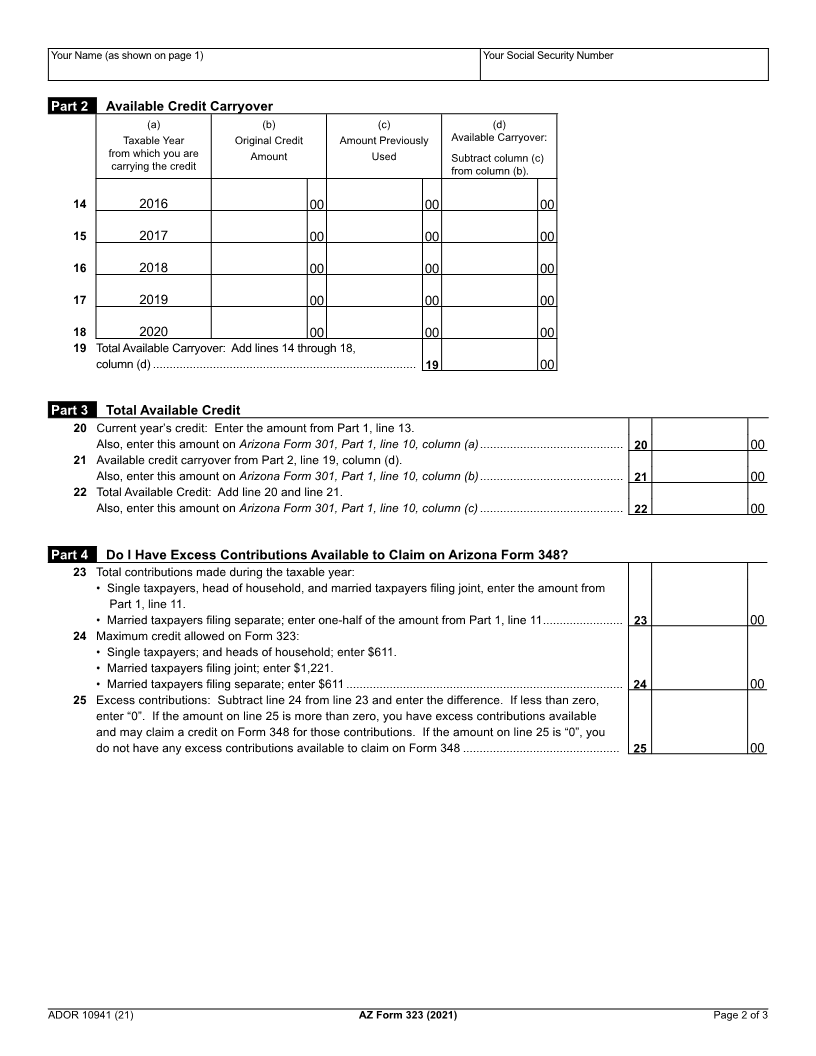

Part 1 Current Year’s Credit

A. Cash contributions made January 1, 2021 through December 31, 2021.

• If you are married and filing separate returns, be sure to include all cash contributions made by you and your spouse.

• Do not include those contributions for which you or your spouse claimed a credit on the 2020 tax return.

• If you made cash contributions to more than three private school tuition organizations, complete the Continuation Sheet on

page 3 and include it with the credit form.

(a) (b) (c) (d) (e)

Contribution Name of Private School Street Address City, State Cash

Date Tuition Organizations Contribution Made

MM/DD/2021

1 2 0 2 1 00

2 2 0 2 1 00

3 2 0 2 1 00

4 If you made contributions to more than three private school tuition organizations, enter the amount

from line 4h of the Continuation Sheet, otherwise enter “0” ................................................................................. 4 00

5 Total contributions made to private school tuition organizations during 2021: Add lines 1 through 4,

column (e) ...................................................................................................................................................................... 5 00

B. Cash contributions made January 1, 2022 through April 18, 2022, for which you or your spouse are claiming a credit on the

2021 tax return.

• If you are married and filing separate returns, be sure to include all cash contributions made by you and your spouse.

• If you made cash contributions to more than three private school tuition organizations, complete the Continuation Sheet on

page 3 and include it with the credit form.

(a) (b) (c) (d) (e)

Contribution Name of Private School Street Address City, State Cash

Date Tuition Organizations Contribution Made

MM/DD/2022

6 2 0 2 2 00

7 2 0 2 2 00

8 2 0 2 2 00

9 If you made contributions to more than three private school tuition organizations, enter the amount from

line 9h of the Continuation Sheet, otherwise enter “0” ........................................................................................... 9 00

10 Total contributions made to private school tuition organizations January 1, 2022 through April 18, 2022,

for which you are claiming a credit on the 2021 tax return. Add lines 6 through 9, column (e) ..................... 10 00

11 Add lines 5 and 10. Enter the total ........................................................................................................................... 11 00

12 Single taxpayers or heads of household, enter $611. Married taxpayers, enter $1,221 ................................ 12 00

13 Total current year’s credit: Enter the smaller of line 11 or 12. In most cases, if you are married filing a

separate return, enter one-half of the smaller of line 11 or 12. See instructions. ............................................ 13 00

You may be able to claim an additional credit for excess contributions made to school tuition organizations. Complete Part 4, on page 2 of this form.

See Arizona Form 348 for more information.

ADOR 10941 (21)