Enlarge image

Arizona Form

Credit for Contributions Made or

322 Fees Paid to Public Schools 2021

Include with your return.

• Do not use this form for contributions to private school tuition organizations.

• Use Form 323 for contributions to private school tuition organizations.

For the calendar year 2021 or fiscal year beginning M M D D 2 0 2 1 and ending M M D D Y Y Y Y .

Your Name as shown on Form 140, 140NR, 140PY or 140X Your Social Security Number

Spouse’s Name as shown on Form 140, 140NR, 140PY or 140X (if joint return) Spouse’s Social Security Number

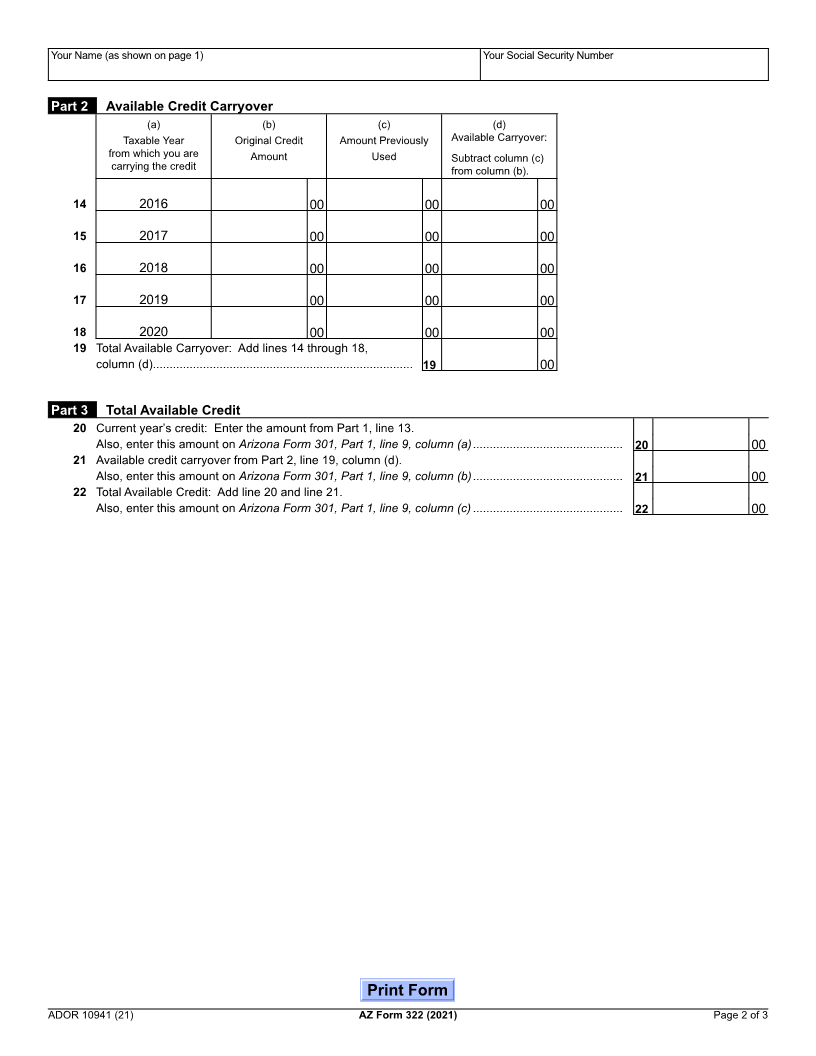

Part 1 Current Year’s Credit

A. Cash contributions made or fees paid January 1, 2021 through December 31, 2021.

• If you are married and filing separate returns, be sure to include all cash contributions or fees paid by you and your spouse.

• Do not include those cash contributions or fees paid for which you or your spouse claimed a credit on the 2020 tax return.

• If you made cash contributions or paid fees to more than three public schools, complete the Continuation Sheet on page 3 and

include it with the credit form.

(a) (b) (c) (d) (e)

Date of Public School Name of Public School School District Name or Cash

Contribution CTDS Code to which you made contributions or paid fees Charter Holder Name Contribution Made

MM/DD/2021 or Fees Paid

1 2 0 2 1 00

2 2 0 2 1 00

3 2 0 2 1 00

4 If you made contributions or paid fees to more than three public schools, enter the amount from line 4h

of the Continuation Sheet, otherwise enter “0” ........................................................................................................ 4 00

5 Total contributions made or fees paid to public schools during 2021: Add lines 1 through 4, column (e) ......... 5 00

B. Cash contributions made or fees paid January 1, 2022 through April 18, 2022, for which you or your spouse are claiming a

credit on the 2021 tax return.

• If you are married and filing separate returns, be sure to include all cash contributions or fees paid by you and your spouse.

• If you made cash contributions or paid fees to more than three public schools, complete the Continuation Sheet on page 3 and

include it with the credit form.

(a) (b) (c) (d) (e)

Date of Public School Name of Public School School District Name or Cash

Contribution CTDS Code to which you made contributions or paid fees Charter Holder Name Contribution Made

MM/DD/2022 or Fees Paid

6 2 0 2 2 00

7 2 0 2 2 00

8 2 0 2 2 00

9 If you made contributions or paid fees to more than three public schools, enter the amount from line 9h

of the Continuation Sheet, otherwise enter “0” ........................................................................................................ 9 00

10 Total contributions made or fees paid January 1, 2022 through April 18, 2022 for which you are claiming

a credit on the 2021 tax return. Add lines 6 through 9, column (e) ..................................................................... 10 00

11 Add lines 5 and 10. Enter the total ........................................................................................................................... 11 00

12 Single taxpayers or heads of household, enter $200. Married taxpayers, enter $400 ................................... 12 00

13 Total current year’s credit: Enter the smaller of line 11 or 12. In most cases, if you are married filing a

separate return, enter one-half of the smaller of line 11 or 12. See instructions. ............................................ 13 00

ADOR 10941 (21)