Enlarge image

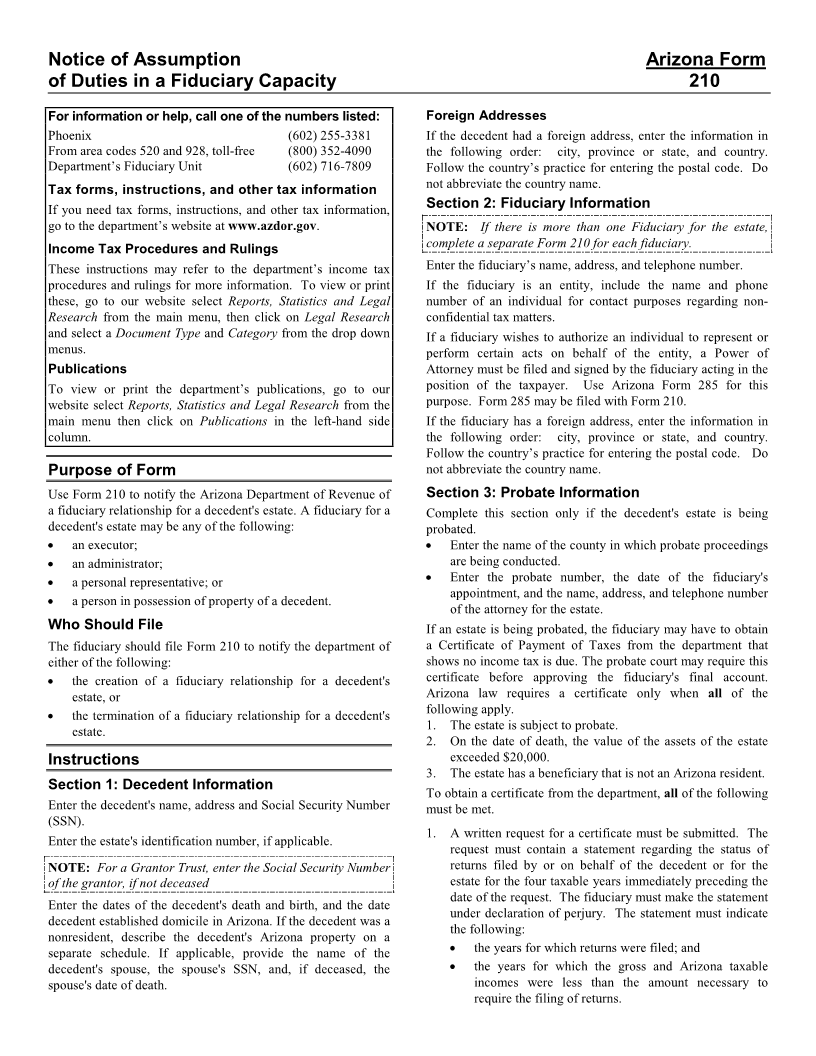

Notice of Assumption Arizona Form

of Duties in a Fiduciary Capacity 210

For information or help, call one of the numbers listed: Foreign Addresses

Phoenix (602) 255-3381 If the decedent had a foreign address, enter the information in

From area codes 520 and 928, toll-free (800) 352-4090 the following order: city, province or state, and country.

Department’s Fiduciary Unit (602) 716-7809 Follow the country’s practice for entering the postal code. Do

not abbreviate the country name.

Tax forms, instructions, and other tax information

If you need tax forms, instructions, and other tax information, Section 2: Fiduciary Information

go to the department’s website at www.azdor.gov. NOTE: If there is more than one Fiduciary for the estate,

complete a separate Form 210 for each fiduciary.

Income Tax Procedures and Rulings

These instructions may refer to the department’s income tax Enter the fiduciary’s name, address, and telephone number.

procedures and rulings for more information. To view or print If the fiduciary is an entity, include the name and phone

these, go to our website select Reports, Statistics and Legal number of an individual for contact purposes regarding non-

Research from the main menu, then click on Legal Research confidential tax matters.

and select a Document Type and Category from the drop down If a fiduciary wishes to authorize an individual to represent or

menus. perform certain acts on behalf of the entity, a Power of

Publications Attorney must be filed and signed by the fiduciary acting in the

To view or print the department’s publications, go to our position of the taxpayer. Use Arizona Form 285 for this

website select Reports, Statistics and Legal Research from the purpose. Form 285 may be filed with Form 210.

main menu then click on Publications in the left-hand side If the fiduciary has a foreign address, enter the information in

column. the following order: city, province or state, and country.

Follow the country’s practice for entering the postal code. Do

Purpose of Form not abbreviate the country name.

Use Form 210 to notify the Arizona Department of Revenue of Section 3: Probate Information

a fiduciary relationship for a decedent's estate. A fiduciary for a Complete this section only if the decedent's estate is being

decedent's estate may be any of the following: probated.

• an executor; • Enter the name of the county in which probate proceedings

• an administrator; are being conducted.

• a personal representative; or • Enter the probate number, the date of the fiduciary's

appointment, and the name, address, and telephone number

• a person in possession of property of a decedent.

of the attorney for the estate.

Who Should File If an estate is being probated, the fiduciary may have to obtain

The fiduciary should file Form 210 to notify the department of a Certificate of Payment of Taxes from the department that

either of the following: shows no income tax is due. The probate court may require this

• the creation of a fiduciary relationship for a decedent's certificate before approving the fiduciary's final account.

estate, or Arizona law requires a certificate only when all of the

• the termination of a fiduciary relationship for a decedent's following apply.

estate. 1. The estate is subject to probate.

2. On the date of death, the value of the assets of the estate

Instructions exceeded $20,000.

3. The estate has a beneficiary that is not an Arizona resident.

Section 1: Decedent Information To obtain a certificate from the department, all of the following

Enter the decedent's name, address and Social Security Number must be met.

(SSN).

1. A written request for a certificate must be submitted. The

Enter the estate's identification number, if applicable.

request must contain a statement regarding the status of

NOTE: For a Grantor Trust, enter the Social Security Number returns filed by or on behalf of the decedent or for the

of the grantor, if not deceased estate for the four taxable years immediately preceding the

date of the request. The fiduciary must make the statement

Enter the dates of the decedent's death and birth, and the date

under declaration of perjury. The statement must indicate

decedent established domicile in Arizona. If the decedent was a

the following:

nonresident, describe the decedent's Arizona property on a

separate schedule. If applicable, provide the name of the • the years for which returns were filed; and

decedent's spouse, the spouse's SSN, and, if deceased, the • the years for which the gross and Arizona taxable

spouse's date of death. incomes were less than the amount necessary to

require the filing of returns.