Enlarge image

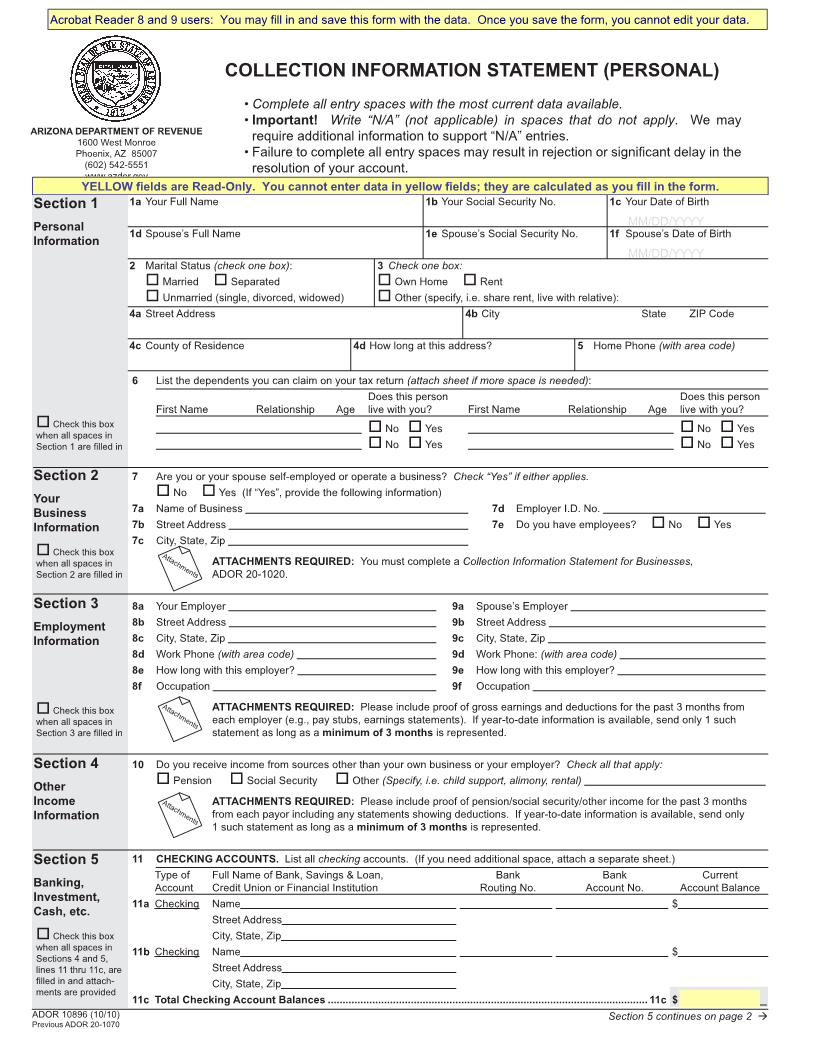

Acrobat Reader 8 and 9 users: You may fill in and save this form with the data. Once you save the form, you cannot edit your data.

COLLECTION INFORMATION STATEMENT (PERSONAL)

• Complete all entry spaces with the most current data available.

• Important! Write “N/A” (not applicable) in spaces that do not apply. We may

ARIZONA DEPARTMENT OF REVENUE

1600 West Monroe require additional information to support “N/A” entries.

Phoenix, AZ 85007 • Failure to complete all entry spaces may result in rejection or signifi cant delay in the

(602)542-5551 resolution of your account.

www.azdor.gov

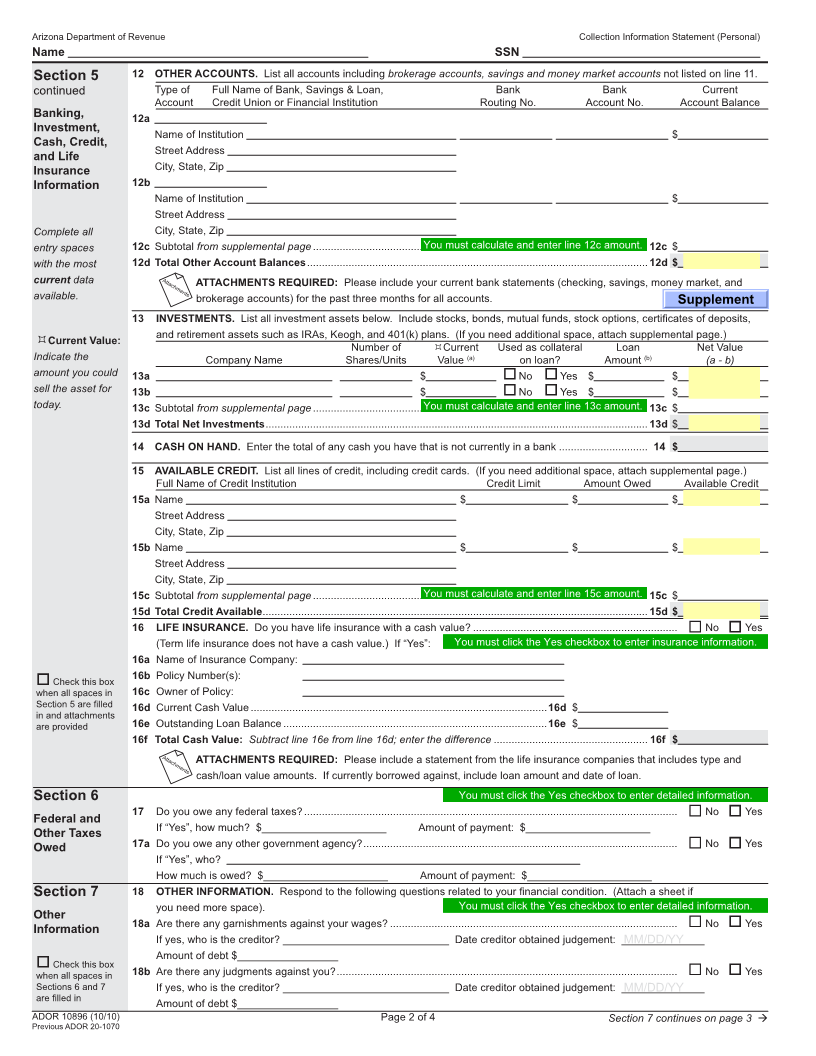

YELLOW fields are Read-Only. You cannot enter data in yellow fields; they are calculated as you fill in the form.

Section 1 1a Your Full Name 1b Your Social Security No. 1c Your Date of Birth

MM/DD/YYYY

Personal 1d Spouse’s Full Name 1e Spouse’s Social Security No. 1f Spouse’s Date of Birth

Information

MM/DD/YYYY

2 Marital Status (check one box): 3 Check one box:

Married Separated Own Home Rent

Unmarried (single, divorced, widowed) Other (specify, i.e. share rent, live with relative):

4a Street Address 4b City State ZIP Code

4c County of Residence 4d How long at this address? 5 Home Phone (with area code)

6 List the dependents you can claim on your tax return (attach sheet if more space is needed):

Does this person Does this person

First Name Relationship Age live with you? First Name Relationship Age live with you?

Check this box No Yes No Yes

when all spaces in

Section 1 are fi lled in No Yes No Yes

Section 2 7 Are you or your spouse self-employed or operate a business? Check “Yes” if either applies.

Your No Yes (If “Yes”, provide the following information)

Business 7a Name of Business 7d Employer I.D. No.

Information 7b Street Address 7e Do you have employees? No Yes

7c City, State, Zip

Check this box Attachments

when all spaces in ATTACHMENTS REQUIRED: You must complete a Collection Information Statement for Businesses,

Section 2 are fi lled in ADOR 20-1020.

Section 3 8a Your Employer 9a Spouse’s Employer

Employment 8b Street Address 9b Street Address

Information 8c City, State, Zip 9c City, State, Zip

8d Work Phone (with area code) 9d Work Phone: (with area code)

8e How long with this employer? 9e How long with this employer?

8f Occupation 9f Occupation

Check this box Attachments ATTACHMENTS REQUIRED: Please include proof of gross earnings and deductions for the past 3 months from

when all spaces in each employer (e.g., pay stubs, earnings statements). If year-to-date information is available, send only 1 such

Section 3 are fi lled in statement as long as a minimum of 3 months is represented.

Section 4 10 Do you receive income from sources other than your own business or your employer? Check all that apply:

Other Pension Social Security Other (Specify, i.e. child support, alimony, rental)

Income Attachments ATTACHMENTS REQUIRED: Please include proof of pension/social security/other income for the past 3 months

Information from each payor including any statements showing deductions. If year-to-date information is available, send only

1 such statement as long as a minimum of 3 months is represented.

Section 5 11 CHECKING ACCOUNTS. List all checking accounts. (If you need additional space, attach a separate sheet.)

Type of Full Name of Bank, Savings & Loan, Bank Bank Current

Banking, Account Credit Union or Financial Institution Routing No. Account No. Account Balance

Investment, 11a Checking Name $

Cash, etc.

Street Address

Check this box City, State, Zip

when all spaces in 11b Checking Name $

Sections 4 and 5,

lines 11 thru 11c, are Street Address

fi lled in and attach- City, State, Zip

ments are provided

11c Total Checking Account Balances ............................................................................................................ 11c $ ______________

ADOR 10896 (10/10) Section 5 continues on page 2 Æ

Previous ADOR 20-1070