Enlarge image

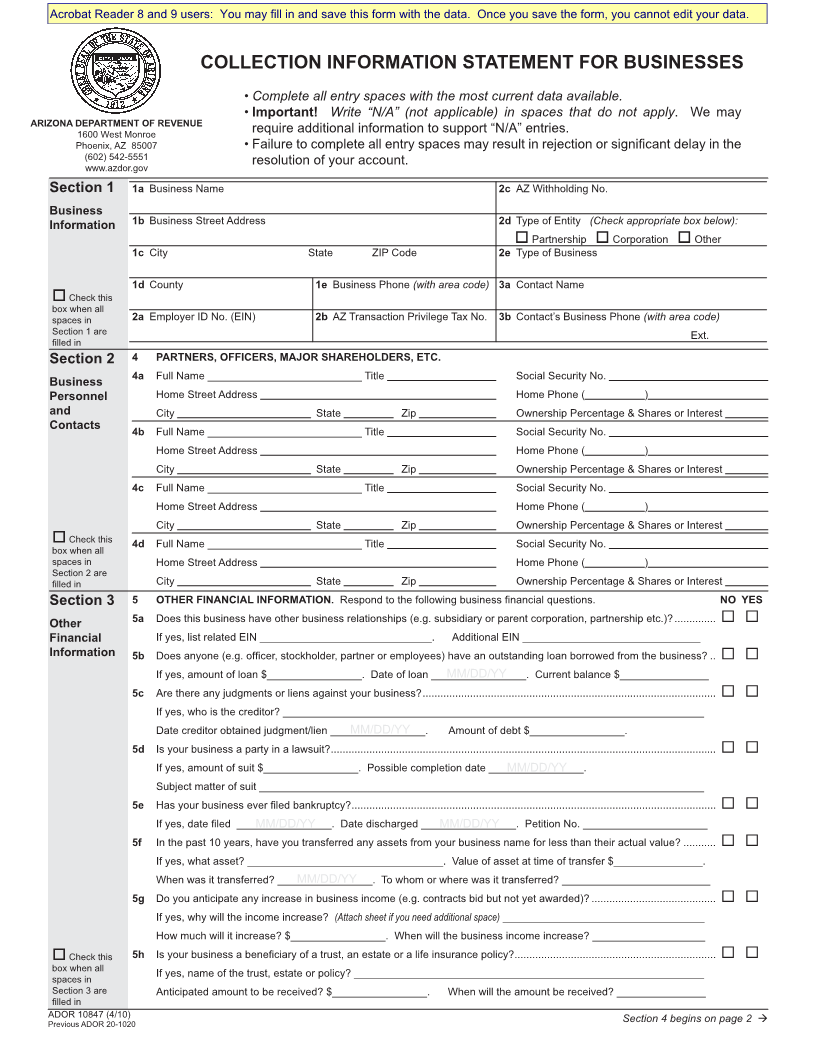

Acrobat Reader 8 and 9 users: You may fill in and save this form with the data. Once you save the form, you cannot edit your data.

COLLECTION INFORMATION STATEMENT FOR BUSINESSES

• Complete all entry spaces with the most current data available.

• Important! Write “N/A” (not applicable) in spaces that do not apply. We may

ARIZONA DEPARTMENT OF REVENUE

1600 West Monroe require additional information to support “N/A” entries.

Phoenix, AZ 85007 • Failure to complete all entry spaces may result in rejection or signifi cant delay in the

(602)542-5551 resolution of your account.

www.azdor.gov

Section 1 1a Business Name 2c AZ Withholding No.

Business

Information 1b Business Street Address 2d Type of Entity (Check appropriate box below):

Partnership Corporation Other

1c City State ZIP Code 2e Type of Business

1d County 1e Business Phone (with area code) 3a Contact Name

Check this

box when all

spaces in 2a Employer ID No. (EIN) 2b AZ Transaction Privilege Tax No. 3b Contact’s Business Phone (with area code)

Section 1 are Ext.

fi lled in

Section 2 4 PARTNERS, OFFICERS, MAJOR SHAREHOLDERS, ETC.

Business 4a Full Name __________________________ Title Social Security No.

Personnel Home Street Address Home Phone ( )

and City State Zip Ownership Percentage & Shares or Interest

Contacts 4b Full Name __________________________ Title Social Security No.

Home Street Address Home Phone ( )

City State Zip Ownership Percentage & Shares or Interest

4c Full Name __________________________ Title Social Security No.

Home Street Address Home Phone ( )

City State Zip Ownership Percentage & Shares or Interest

Check this 4d Full Name __________________________ Title Social Security No.

box when all

spaces in Home Street Address Home Phone ( )

Section 2 are

fi lled in City State Zip Ownership Percentage & Shares or Interest

Section 3 5 OTHER FINANCIAL INFORMATION. Respond to the following business fi nancial questions. NO YES

Other 5a Does this business have other business relationships (e.g. subsidiary or parent corporation, partnership etc.)? ..............

Financial If yes, list related EIN _____________________________. Additional EIN ______________________________

Information 5b Does anyone (e.g. offi cer, stockholder, partner or employees) have an outstanding loan borrowed from the business? ..

If yes, amount of loan $________________. Date of loan ________________. Current balance $_______________ MM/DD/YY

5c Are there any judgments or liens against your business? ...................................................................................................

If yes, who is the creditor? _______________________________________________________________________

Date creditor obtained judgment/lien ________________. AmountMM/DD/YYof debt $________________.

5d Is your business a party in a lawsuit? ..................................................................................................................................

If yes, amount of suit $________________. Possible completion date ________________. MM/DD/YY

Subject matter of suit ___________________________________________________________________________

5e Has your business ever fi led bankruptcy? ...........................................................................................................................

If yes, date fi led ________________. DateMM/DD/YYdischarged ________________. Petition No. _____________________ MM/DD/YY

5f In the past 10 years, have you transferred any assets from your business name for less than their actual value? ...........

If yes, what asset? _________________________________. Value of asset at time of transfer $_______________.

When was it transferred? ________________. To whomMM/DD/YYor where was it transferred? _________________________

5g Do you anticipate any increase in business income (e.g. contracts bid but not yet awarded)? ..........................................

If yes, why will the income increase? (Attach sheet if you need additional space) __________________________________

How much will it increase? $________________. When will the business income increase? ___________________

Check this 5h Is your business a benefi ciary of a trust, an estate or a life insurance policy? ....................................................................

box when all If yes, name of the trust, estate or policy? ___________________________________________________________

spaces in

Section 3 are Anticipated amount to be received? $________________. When will the amount be received? _______________

fi lled in

ADOR 10847 (4/10) Section 4 begins on page 2 Æ

Previous ADOR 20-1020