Enlarge image

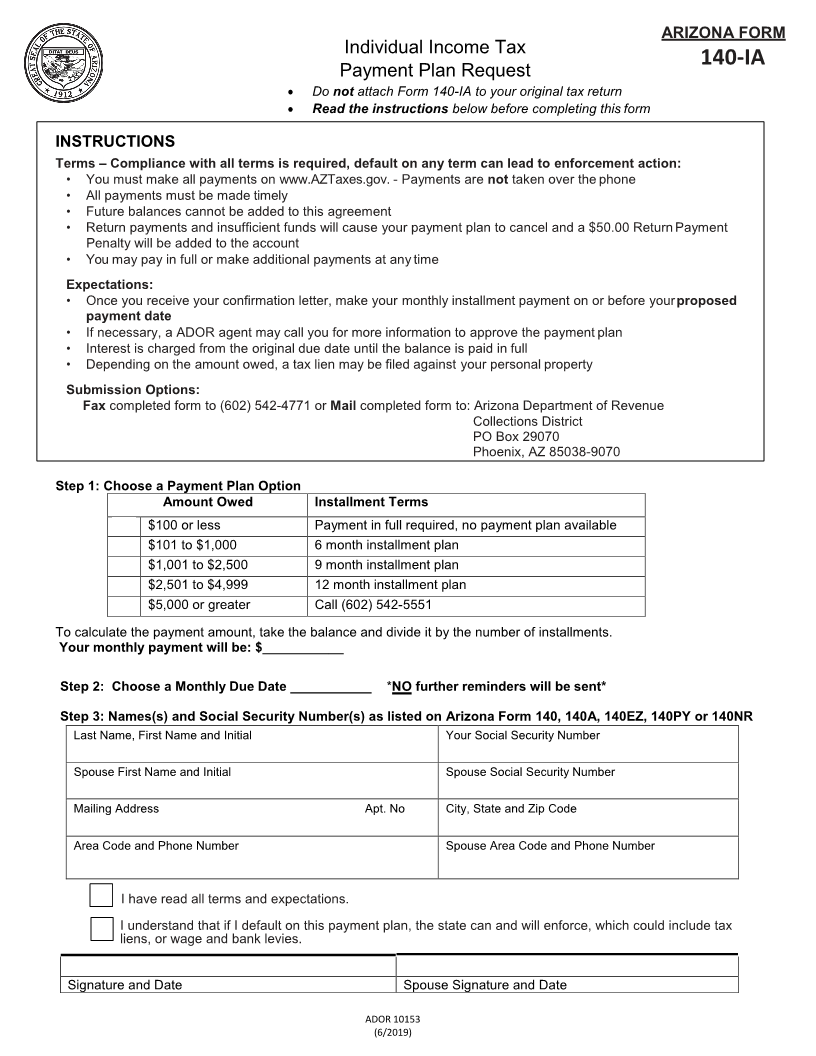

ARIZONA FORM

Individual Income Tax

140-IA

Payment Plan Request

Do not attach Form 140-IA to your original tax return

Read the instructions below before completing this form

INSTRUCTIONS

Terms – Compliance with all terms is required, default on any term can lead to enforcement action:

• You must make all payments on www.AZTaxes.gov. - Payments are not taken over the phone

• All payments must be made timely

• Future balances cannot be added to this agreement

• Return payments and insufficient funds will cause your payment plan to cancel and a $50.00 Return Payment

Penalty will be added to the account

• You may pay in full or make additional payments at any time

Expectations:

• Once you receive your confirmation letter, make your monthly installment payment on or before your proposed

payment date

• If necessary, a ADOR agent may call you for more information to approve the payment plan

• Interest is charged from the original due date until the balance is paid in full

• Depending on the amount owed, a tax lien may be filed against your personal property

Submission Options:

Fax completed form to (602) 542-4771 or Mail completed form to: Arizona Department of Revenue

Collections District

PO Box 29070

Phoenix, AZ 85038-9070

Step 1: Choose a Payment Plan Option

Amount Owed Installment Terms

$100 or less Payment in full required, no payment plan available

$101 to $1,000 6 month installment plan

$1,001 to $2,500 9 month installment plan

$2,501 to $4,999 12 month installment plan

$5,000 or greater Call (602) 542-5551

To calculate the payment amount, take the balance and divide it by the number of installments.

Your monthly payment will be: $___________

Step 2: Choose a Monthly Due Date ___________ *NO further reminders will be sent*

Step 3: Names(s) and Social Security Number(s) as listed on Arizona Form 140, 140A, 140EZ, 140PY or 140NR

Last Name, First Name and Initial Your Social Security Number

Spouse First Name and Initial Spouse Social Security Number

Mailing Address Apt. No City, State and Zip Code

Area Code and Phone Number Spouse Area Code and Phone Number

I have read all terms and expectations.

I understand that if I default on this payment plan, the state can and will enforce, which could include tax

liens, or wage and bank levies.

Signature and Date Spouse Signature and Date

ADOR 10153

(6/2019)