Enlarge image

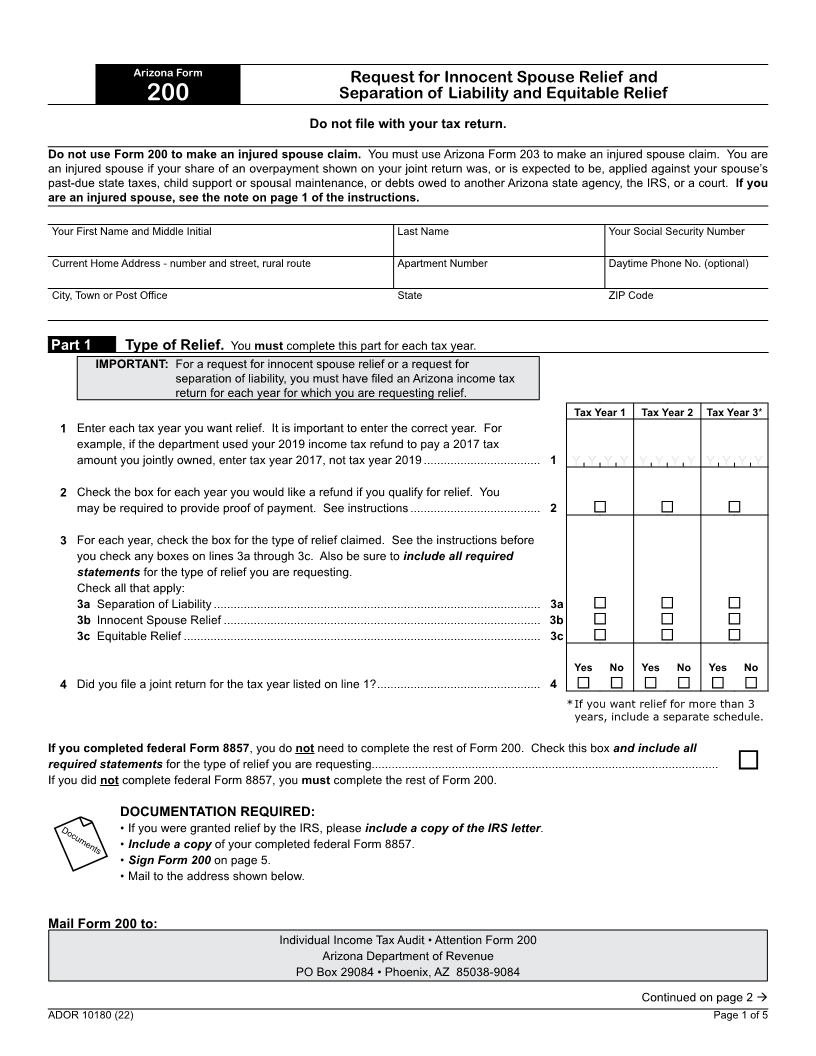

Arizona Form

Request for Innocent Spouse Relief and

200 Separation of Liability and Equitable Relief

Do not file with your tax return.

Do not use Form 200 to make an injured spouse claim. You must use Arizona Form 203 to make an injured spouse claim. You are

an injured spouse if your share of an overpayment shown on your joint return was, or is expected to be, applied against your spouse’s

past-due state taxes, child support or spousal maintenance, or debts owed to another Arizona state agency, the IRS, or a court. If you

are an injured spouse, see the note on page 1 of the instructions.

Your First Name and Middle Initial Last Name Your Social Security Number

Current Home Address - number and street, rural route Apartment Number Daytime Phone No. (optional)

City, Town or Post Office State ZIP Code

Part 1 Type of Relief. You must complete this part for each tax year.

IMPORTANT: For a request for innocent spouse relief or a request for

separation of liability, you must have filed an Arizona income tax

return for each year for which you are requesting relief.

Tax Year 1 Tax Year 2 Tax Year 3*

1 Enter each tax year you want relief. It is important to enter the correct year. For

example, if the department used your 2019 income tax refund to pay a 2017 tax

amount you jointly owned, enter tax year 2017, not tax year 2019 ................................... 1 Y Y Y Y Y Y Y Y Y Y Y Y

2 Check the box for each year you would like a refund if you qualify for relief. You

may be required to provide proof of payment. See instructions ....................................... 2

3 For each year, check the box for the type of relief claimed. See the instructions before

you check any boxes on lines 3a through 3c. Also be sure to include all required

statements for the type of relief you are requesting.

Check all that apply:

3a Separation of Liability .................................................................................................. 3a

3b Innocent Spouse Relief ............................................................................................... 3b

3c Equitable Relief ........................................................................................................... 3c

Yes No Yes No Yes No

4 Did you file a joint return for the tax year listed on line 1? ................................................. 4

* If you want relief for more than 3

years, include a separate schedule.

If you completed federal Form 8857, you do not need to complete the rest of Form 200. Check this box and include all

required statements for the type of relief you are requesting........................................................................................................

If you did not complete federal Form 8857, you must complete the rest of Form 200.

DOCUMENTATION REQUIRED:

Documents • If you were granted relief by the IRS, please include a copy of the IRS letter.

• Include a copy of your completed federal Form 8857.

• Sign Form 200 on page 5.

• Mail to the address shown below.

Mail Form 200 to:

Individual Income Tax Audit • Attention Form 200

Arizona Department of Revenue

PO Box 29084 • Phoenix, AZ 85038-9084

Continued on page 2

ADOR 10180 (22) Page 1 of 5