Enlarge image

Arizona Form

2022 Individual Amended Income Tax Return 140X

For information or help, call one of the numbers listed: What Will I Need To Complete Form 140X?

Phoenix (602) 255-3381 To complete Form 140X, you will need the following:

From area codes 520 and 928, toll-free (800) 352-4090

•

Tax forms, instructions, and other tax information A copy of the 2022 tax return you are amending, including

supporting forms, schedules, and worksheets.

If you need tax forms, instructions, and other tax information,

•

go to the department’s website at www.azdor.gov. Any notices you received from the Internal Revenue Service

(IRS) or the department for the tax year you are amending.

Income Tax Procedures and Rulings

• Instructions for the return you are amending. If you have

These instructions may refer to the department’s income tax any questions about income items, deductions, or

procedures and rulings for more information. To view or print exemptions, you should refer to the 2022 instructions for

these, go to our website select Reports, Statistics and Legal your original return. If you do not have the instructions for

Research from the main menu then click on Legal Research and the form you are amending, you can find them online at our

select a Document Type and Category from the drop down website.

menus. • If you are filing an amended return for a previously filed

Publications Composite Nonresident Income Tax Return, see the

To view or print the department’s publications, go to our instructions for Form 140NR and the department’s ruling,

website and click on Reports, Statistics and Legal Research ITR 16-2, Composite Individual Income Tax Returns, for

from the main menu then click on Publications in the guidance on how to report income items, deductions, and

left-hand side column. exemptions.

Allow 8 to 12 weeks for your Form 140X to process.

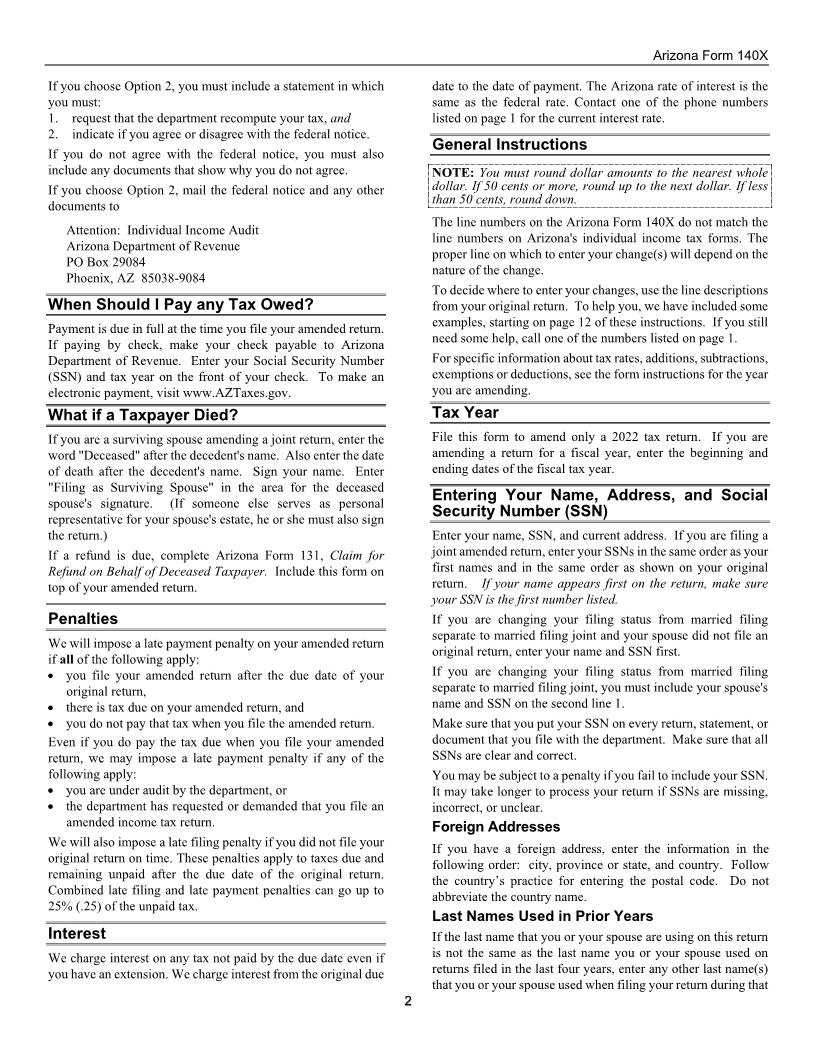

Who Should Use Form 140X?

You cannot e-file your Arizona amended tax return.

Use the 2022 Arizona Form 140X to correct an individual

You must mail your amended income tax return to the

income tax return (Arizona Form 140, 140A, 140EZ, 140PY, or

department using the address listed on Form 140X.

140NR) for taxable year 2022, only.

If you are amending a return for any other tax year, use the AVOID PROCESSING DELAYS: For the proper

amended return (Form 140X) that is available for that specific assembly order, see the mailing instructions for the return you

tax year. For example, if you are amending your return for tax are amending.

year 2018, use the 2018 Arizona Form 140X.

When Should I File an Amended Return?

The department will compute the interest and either include it

in your refund or bill you for the amount due. You can file Form 140X only after filing an original return.

Form 140X will be your new tax return. This return will change You should file your amended return after your original return

your original return to include the new information. The entries has processed. If you are filing Form 140X for a refund, you

you make on Form 140X are the entries you would have made must generally file within four years from the date you filed the

on your original return had it been done correctly. original return.

If you amend your federal return for 2022, you must also file an

NOTE: Do not use Form 140X to change an earlier filed Arizona Form 140X for 2022.

Arizona Form 140PTC. To change an earlier filed Form

140PTC, use the Form 140PTC for the year you are changing. If the IRS makes a change to your federal taxable income for

2022, you must report that change to Arizona. You must file

Do not use Form 140X to change an earlier filed Arizona Form the Form 140X within 90 days of the final determination of the

140ET. To change an earlier filed Form 140ET, use the Form IRS. You may use one of the following two options to report

140ET for the year you are changing. this change.

You cannot amend an estimated income tax payment Option 1

penalty when you reduce your tax on an amended return, You may file a Form 140X. If you choose this option, you must

unless you file your amended return after filing your amend your Arizona return within 90 days of the final

original return, and before the due date of that original determination of the IRS. Include a complete copy of the

return. federal notice with your Form 140X.

For more information, see the department’s ruling, ITR 02-4, Option 2

Amended Return's Effect on the Estimated Tax Payment You may file a copy of the final federal notice with the

Underpayment Penalty. department within 90 days of the final determination of the IRS.