Enlarge image

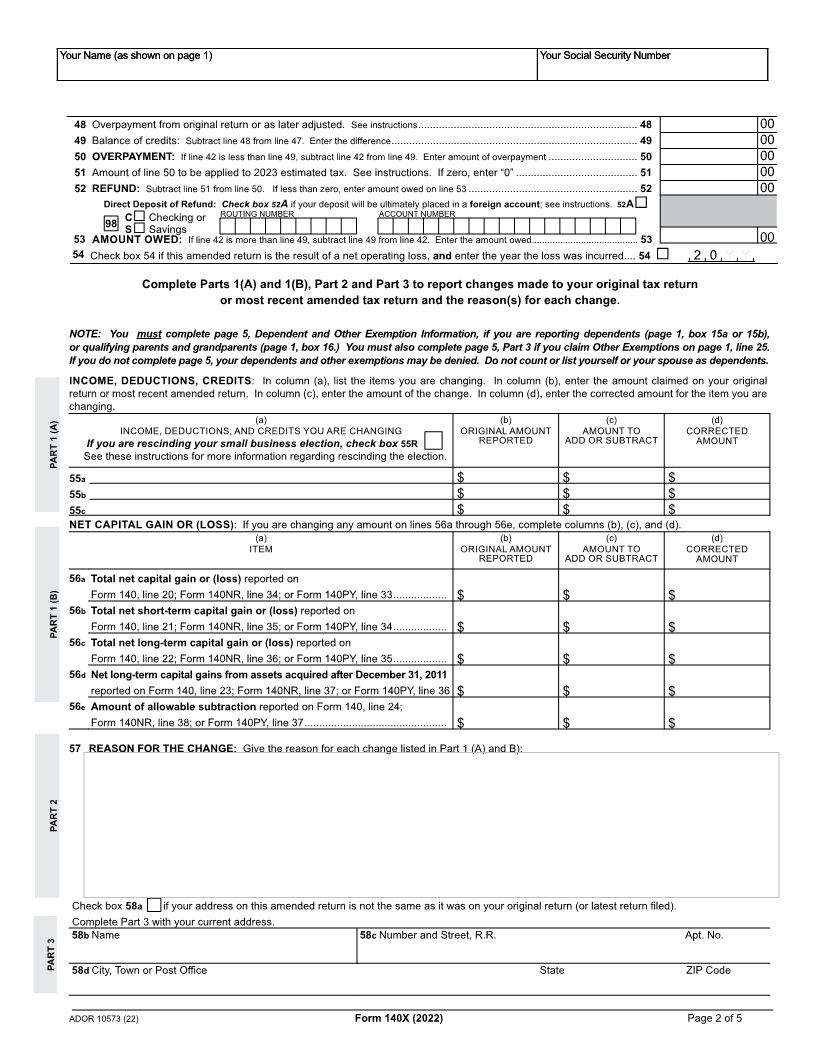

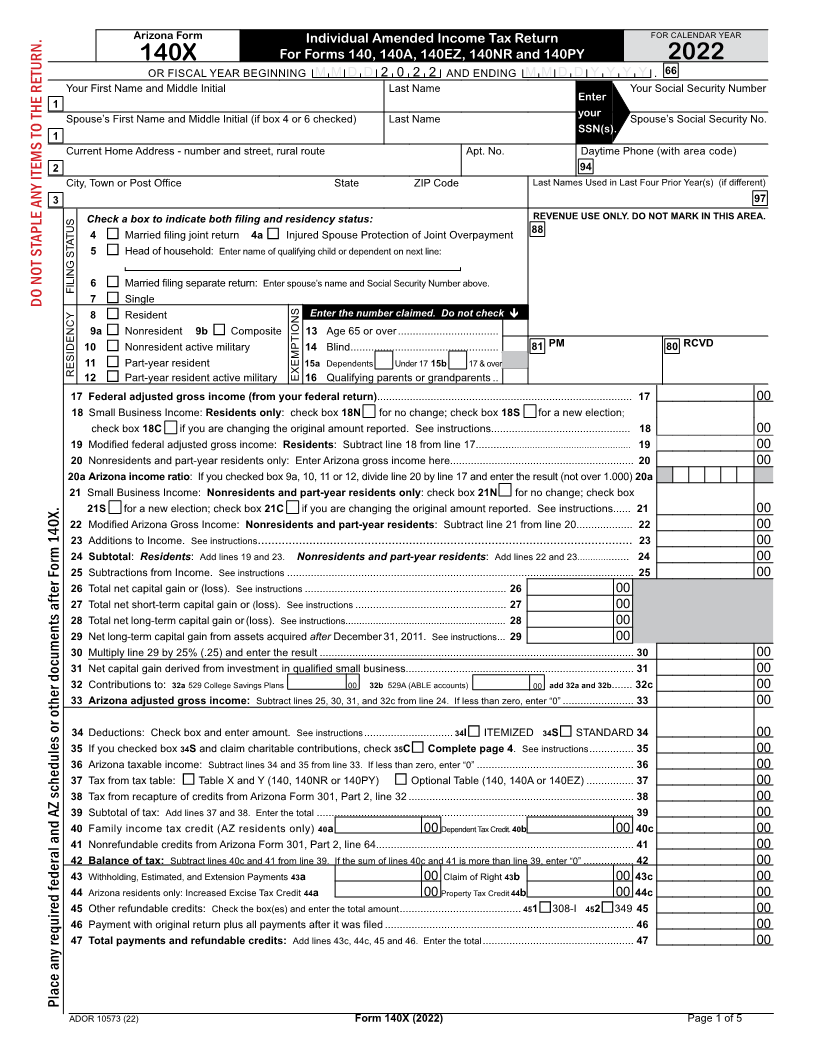

Arizona Form Individual Amended Income Tax Return FOR CALENDAR YEAR

140X For Forms 140, 140A, 140EZ, 140NR and 140PY 2022

OR FISCAL YEAR BEGINNING M M D D 2 0 2 2 AND ENDING M M D D Y Y Y Y . 66

Your First Name and Middle Initial Last Name Your Social Security Number

Enter

1

your

Spouse’s First Name and Middle Initial (if box 4 or 6 checked) Last Name Spouse’s Social Security No.

SSN(s).

1

Current Home Address - number and street, rural route Apt. No. Daytime Phone (with area code)

2 94

City, Town or Post Office State ZIP Code Last Names Used in Last Four Prior Year(s) (if different)

3 97

Check a box to indicate both filing and residency status: REVENUE USE ONLY. DO NOT MARK IN THIS AREA.

4 Married filing joint return 4a Injured Spouse Protection of Joint Overpayment 88

5 Head of household: Enter name of qualifying child or dependent on next line:

FILING STATUS 6 Married filing separate return: Enter spouse’s name and Social Security Number above.

DO NOT STAPLE ANY ITEMS TO THE RETURN. 7 Single

8 Resident Enter the number claimed. Do not check

9a Nonresident 9b Composite 13 Age 65 or over ..................................

10 Nonresident active military 14 Blind .................................................. 81 PM 80 RCVD

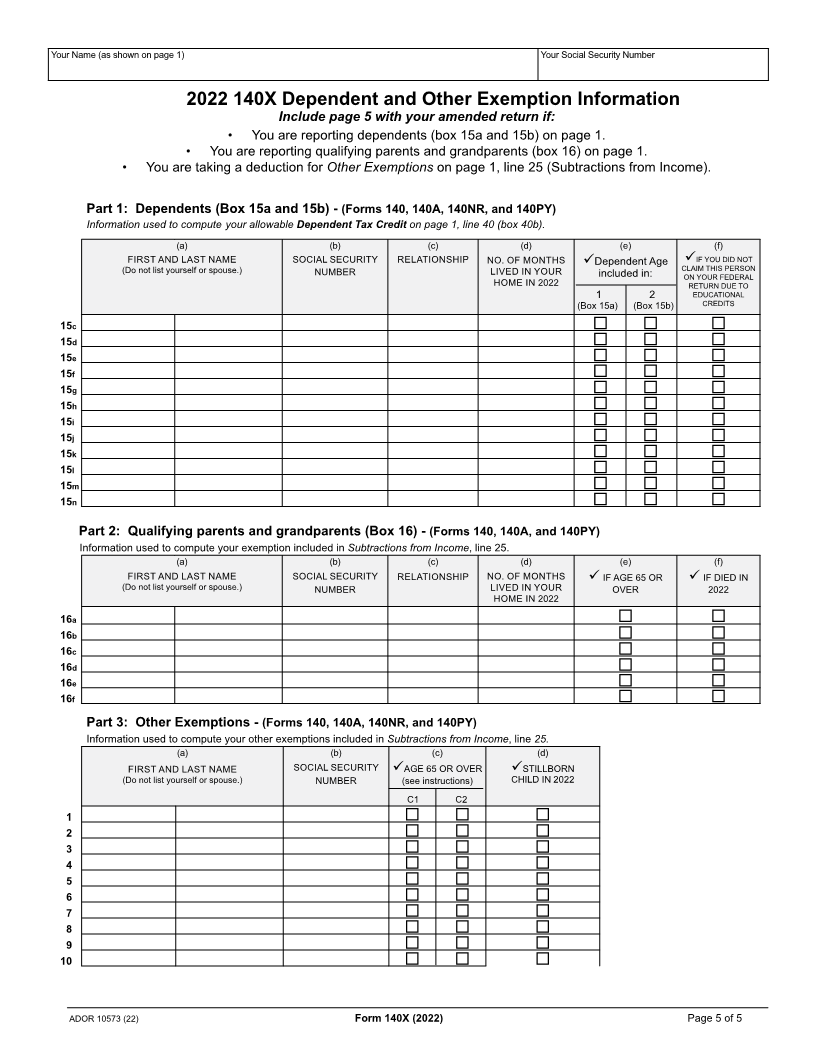

11 Part-year resident 15a Dependents Under 17 15b 17 & over

RESIDENCY 12 Part-year resident active military EXEMPTIONS 16 Qualifying parents or grandparents ..

17 Federal adjusted gross income (from your federal return)...................................................................................... 17 00

18 Small Business Income: Residents only: check box18N for no change; check box 18S for a new election;

check box 18C if you are changing the original amount reported. See instructions............................................... 18 00

19 Modified federal adjusted gross income: Residents: Subtract line 18 from line 17.......................................................... 19 00

20 Nonresidents and part-year residents only: Enter Arizona gross income here.............................................................. 20 00

20a Arizona income ratio: If you checked box 9a, 10, 11 or 12, divide line 20 by line 17 and enter the result (not over 1.000) 20a

21 Small Business Income: Nonresidents and part-year residents only: check box 21N for no change; check box

21S for a new election; check box 21C if you are changing the original amount reported. See instructions...... 21 00

22 Modified Arizona Gross Income: Nonresidents and part-year residents: Subtract line 21 from line 20................... 22 00

23 Additions to Income. See instructions............................................................................................................. 23 00

24 Subtotal: Residents: Add lines 19 and 23. Nonresidents and part-year residents: Add lines 22 and 23................... 24 00

25 Subtractions from Income. See instructions ..................................................................................................................... 25 00

26 Total net capital gain or (loss). See instructions .................................................................... 26 00

27 Total net short-term capital gain or (loss). See instructions ...................................................27 00

28 Total net long-term capital gain or(loss). See instructions..........................................................28 00

29 Net long-term capital gain from assets acquired after December 31, 2011. See instructions ... 29 00

30 Multiply line 29 by 25% (.25) and enter the result .......................................................................................................... 30 00

31 Net capital gain derived from investment in qualified small business............................................................................. 31 00

32 Contributions to: 32a 529 College Savings Plans 00 32b 529A (ABLE accounts) 00 add 32a and 32b....... 32c 00

33 Arizona adjusted gross income: Subtract lines 25, 30, 31, and 32c from line 24. If less than zero, enter “0” ........................ 33 00

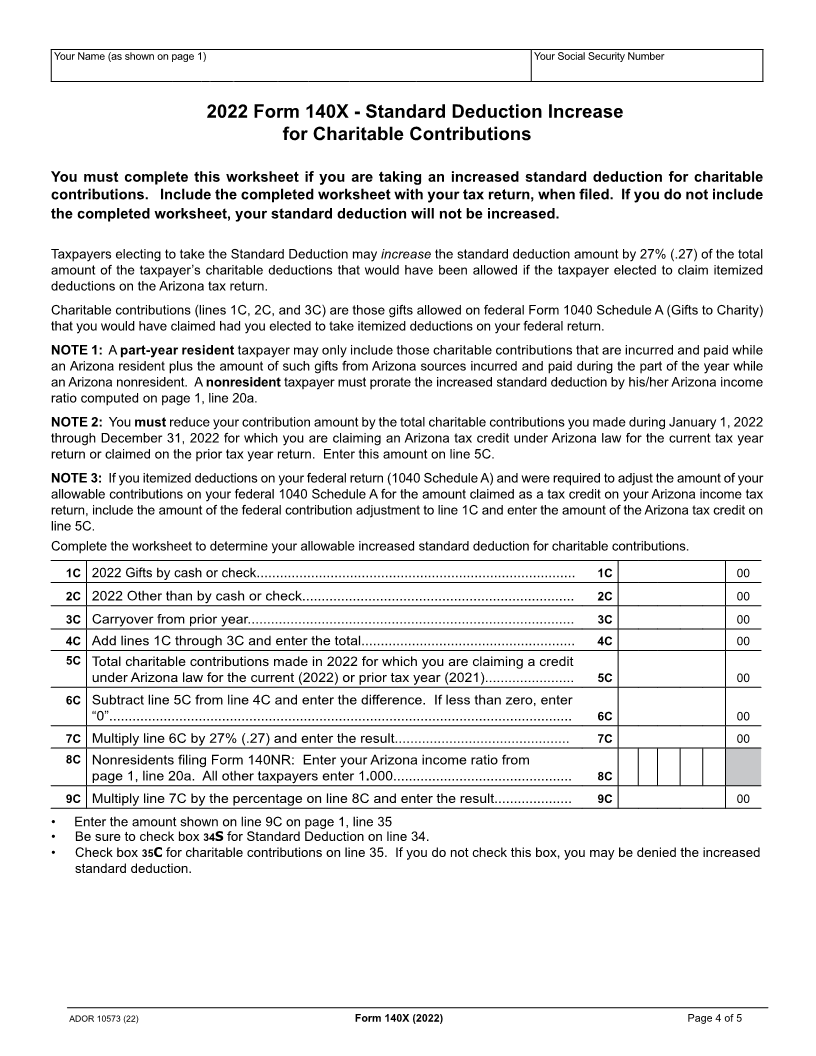

34 Deductions: Check box and enter amount. See instructions .............................. 34I ITEMIZED 34S STANDARD 34 00

35 If you checked box 34S and claim charitable contributions, check 35C Complete page 4. See instructions ............... 35 00

36 Arizona taxable income: Subtract lines 34 and 35 from line 33. If less than zero, enter “0” ..................................................... 36 00

37 Tax from tax table: Table X and Y (140, 140NR or 140PY) Optional Table (140, 140A or 140EZ) ................ 37 00

38 Tax from recapture of credits from Arizona Form 301, Part 2, line 32 ............................................................................ 38 00

39 Subtotal of tax: Add lines 37 and 38. Enter the total ........................................................................................................... 39 00

40 Family income tax credit (AZ residents only) 40a 00 Dependent Tax Credit. 40b 00 40c 00

41 Nonrefundable credits from Arizona Form 301, Part 2, line 64....................................................................................... 41 00

42 Balance of tax: Subtract lines 40c and 41 from line 39. If the sum of lines 40c and 41 is more than line 39, enter “0” ................. 42 00

43 Withholding, Estimated, and Extension Payments 43a 00 Claim of Right 43b 00 43c 00

44 Arizona residents only: Increased Excise Tax Credit 44a 00 Property Tax Credit 44b 00 44c 00

45 Other refundable credits: Check the box(es) and enter the total amount ......................................... 451308-I 452349 45 00

46 Payment with original return plus all payments after it was filed .................................................................................... 46 00

47 Total payments and refundable credits: Add lines 43c, 44c, 45 and 46. Enter the total ................................................... 47 00

Place any required federal and AZ schedules or other documents after Form 140X.

ADOR 10573 (22) Form 140X (2022) Page 1 of 5