Enlarge image

Arizona Booklet

Individual Estimated

2 23 140ES Tax Payment

This booklet contains:

Form 140ES

Worksheet

Enlarge image |

Arizona Booklet

Individual Estimated

2 23 140ES Tax Payment

This booklet contains:

Form 140ES

Worksheet

|

Enlarge image | THIS PAGE INTENTIONALLY LEFT BLANK |

Enlarge image |

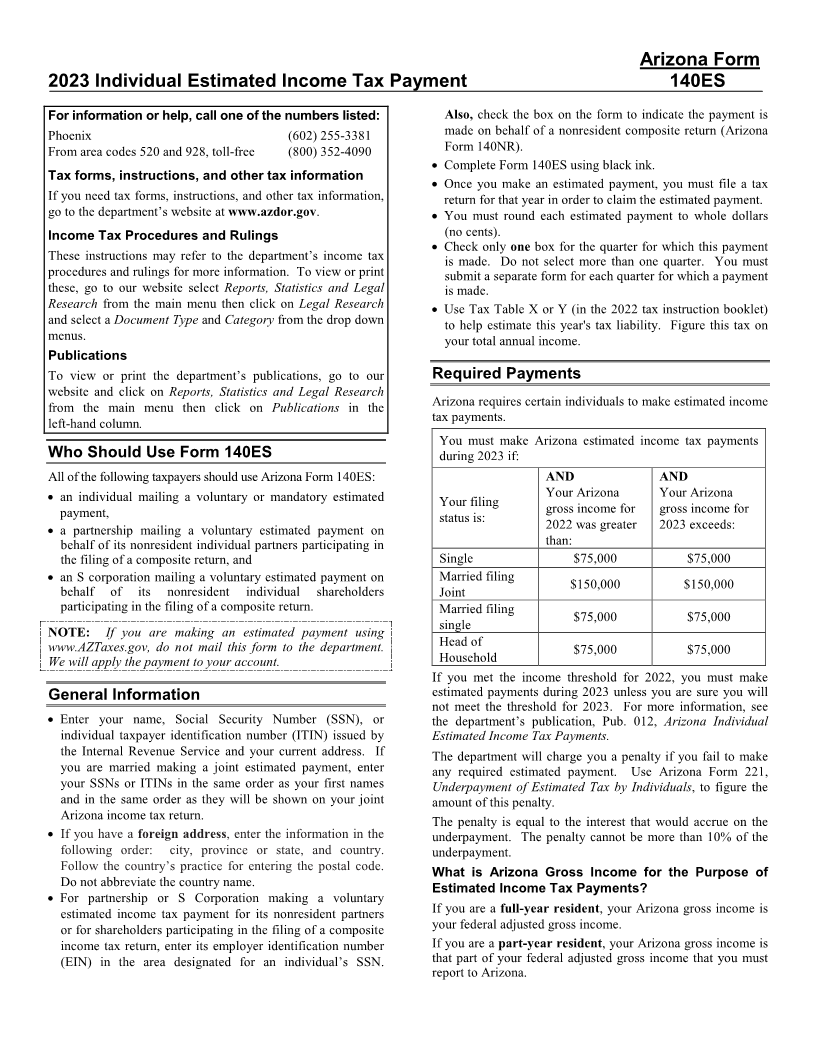

Arizona Form

2023 Individual Estimated Income Tax Payment 140ES

For information or help, call one of the numbers listed: Also, check the box on the form to indicate the payment is

Phoenix (602) 255-3381 made on behalf of a nonresident composite return (Arizona

From area codes 520 and 928, toll-free (800) 352-4090 Form 140NR).

• Complete Form 140ES using black ink.

Tax forms, instructions, and other tax information • Once you make an estimated payment, you must file a tax

If you need tax forms, instructions, and other tax information, return for that year in order to claim the estimated payment.

go to the department’s website at www.azdor.gov. • You must round each estimated payment to whole dollars

Income Tax Procedures and Rulings (no cents).

• Check only one box for the quarter for which this payment

These instructions may refer to the department’s income tax is made. Do not select more than one quarter. You must

procedures and rulings for more information. To view or print submit a separate form for each quarter for which a payment

these, go to our website select Reports, Statistics and Legal is made.

Research from the main menu then click on Legal Research • Use Tax Table X or Y (in the 2022 tax instruction booklet)

and select a Document Type and Category from the drop down to help estimate this year's tax liability. Figure this tax on

menus. your total annual income.

Publications

To view or print the department’s publications, go to our Required Payments

website and click on Reports, Statistics and Legal Research

from the main menu then click on Publications in the Arizona requires certain individuals to make estimated income

tax payments.

left-hand column .

You must make Arizona estimated income tax payments

Who Should Use Form 140ES during 2023 if:

All of the following taxpayers should use Arizona Form 140ES: AND AND

Your Arizona Your Arizona

• an individual mailing a voluntary or mandatory estimated Your filing

gross income for gross income for

payment, status is:

• a partnership mailing a voluntary estimated payment on 2022 was greater 2023 exceeds:

behalf of its nonresident individual partners participating in than:

the filing of a composite return, and Single $75,000 $75,000

• an S corporation mailing a voluntary estimated payment on Married filing

$150,000 $150,000

behalf of its nonresident individual shareholders Joint

participating in the filing of a composite return. Married filing

$75,000 $75,000

single

NOTE: If you are making an estimated payment using

www.AZTaxes.gov, do not mail this form to the department. Head of

$75,000 $75,000

We will apply the payment to your account. Household

If you met the income threshold for 2022, you must make

General Information estimated payments during 2023 unless you are sure you will

not meet the threshold for 2023. For more information, see

• Enter your name, Social Security Number (SSN), or the department’s publication, Pub. 012, Arizona Individual

individual taxpayer identification number (ITIN) issued by Estimated Income Tax Payments.

the Internal Revenue Service and your current address. If The department will charge you a penalty if you fail to make

you are married making a joint estimated payment, enter any required estimated payment. Use Arizona Form 221,

your SSNs or ITINs in the same order as your first names Underpayment of Estimated Tax by Individuals, to figure the

and in the same order as they will be shown on your joint amount of this penalty.

Arizona income tax return. The penalty is equal to the interest that would accrue on the

• If you have a foreign address, enter the information in the underpayment. The penalty cannot be more than 10% of the

following order: city, province or state, and country. underpayment.

Follow the country’s practice for entering the postal code.

What is Arizona Gross Income for the Purpose of

Do not abbreviate the country name.

Estimated Income Tax Payments?

• For partnership or S Corporation making a voluntary

estimated income tax payment for its nonresident partners If you are a full-year resident, your Arizona gross income is

or for shareholders participating in the filing of a composite your federal adjusted gross income.

income tax return, enter its employer identification number If you are a part-year resident, your Arizona gross income is

(EIN) in the area designated for an individual’s SSN. that part of your federal adjusted gross income that you must

report to Arizona.

|

Enlarge image |

Arizona Form 140ES

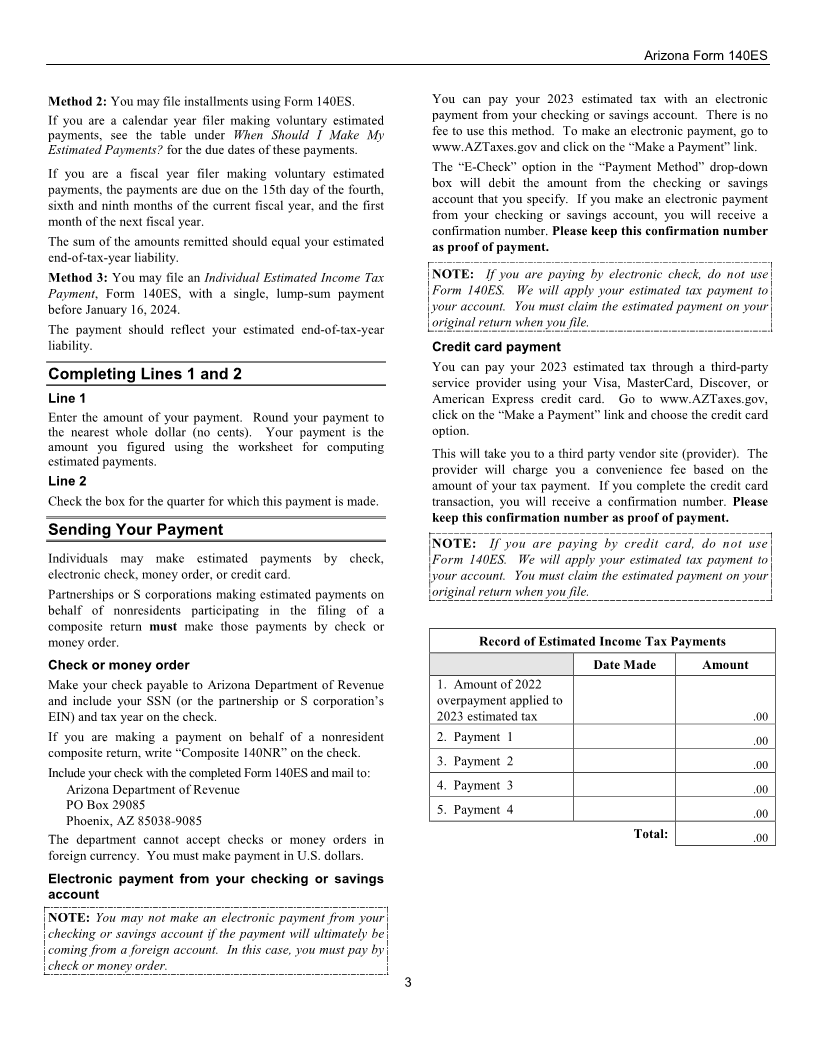

Calendar year filers - estimated payment due dates:

If you are a nonresident, your Arizona gross income is that

part of your federal adjusted gross income derived from April 15, 2023.

Because April 15, 2023 falls on a federal

Arizona sources. Payment 1 holiday, you have until April 18, 2023 to make

How Much Should My Estimated Payments Total? payment 1.

If you have to make estimated payments, your payments, Payment 2 June 15, 2023

when added to your Arizona withholding, must total either Payment 3 September 15, 2023

90% of the tax due for 2023, or 100% of the tax due for 2022. January 15, 2024. Because January 15, 2024 is a

Payment 4 holiday, you have until Tuesday, January 16,

You can use your 2022 tax to figure the amount of payments 2024 to make payment 4.

that you must make during 2023 only if you were required to

file and did file a 2022 Arizona income tax return.

If you are a fiscal year filer, the payments are due on the 15th

Worksheet for Computing Estimated day of the fourth, sixth, and ninth months of the current fiscal

Payments for Individuals year and the first month of the next fiscal year.

Use the worksheet on page 2 of this form to calculate your If any of the following applies (1 through 3), you do not have

required estimated tax payments. Follow the instructions on to make your payments in four equal installments.

the worksheet to complete Steps 1 through 5. 1. File and pay by February 1, 2024. If you file your 2023

For nonresident composite return payments, see the Arizona return by February 1, 2024 and pay in full the amount

department’s ruling, ITR 16-2, Composite Individual Income stated on the return as payable, you do not have to make the

Tax Returns, for amounts to enter on the worksheet. fourth estimated tax payment.

Fiscal year filers must file and pay by the last day of the

NOTE: Deductions (Line 15) - If you plan to itemize

month following the close of the fiscal year.

deductions for tax year 2023 enter the estimated total of your

itemized deductions on line 15 of the worksheet. If you do not 2. Farmer or fisherman. If you report as a farmer or

plan to itemize deductions, enter your total allowable 2022 fisherman for federal purposes, you only have to make one

standard deduction on line 15. To determine the allowable installment for a taxable year. The due date for this

standard deduction amount for your filing status, see the installment for a 2023 calendar year filer is January 16, 2024.

instructions for your 2022 Arizona income tax form. The due date for a fiscal year filer is the 15th day of the first

Other Exemptions (Line 16) - Enter the allowable 2022 Other month after the end of a fiscal year.

Exemption amount. To determine the allowable Other There is no requirement to make this payment if you file your

Exemption amount for your filing status, see the instructions 2023 Arizona return on or before March 1, 2024 and pay in

for your 2022 Arizona income tax form. full the amount stated on the return as payable.

Credits (Line 20) – Enter the estimated amount of credits you Fiscal year filers must file and pay on or before the first day of

will be claiming on your 2023 income tax return, including the third month after the end of the fiscal year.

the Dependent Tax Credit. See the 2022 Form 140, Form 3. Nonresident alien. If you are an individual who elects to

140NR, or Form 140PY and related instructions for the types be treated as a nonresident alien on the federal income tax

of credits allowed. Do not include any income tax withholding return, you may make three estimated payments.

on line 20. The due dates for these installments are June 15, 2023,

September 15, 2023, and January 16, 2024. The first

When Should I Make My Estimated installment must equal 50% of your total required payments.

Payments?

Voluntary Payments

For the most part, you must make your payments in four equal

installments. An individual who does not have to make 2023 Arizona

estimated income tax payments may choose to make them.

NOTE: If the due date falls on a Saturday, Sunday, or legal Taxpayers who make such an election may choose one of the

holiday, you may pay by midnight on the next business day following methods to make their payments.

following that day.

Method 1: If you file federal estimated tax, you can file

Form 140ES at the same time.

The amount that you remit with Form 140ES should be 10%,

15%, or 20% of the amount that you paid on the federal

Form 1040-ES.

2

|

Enlarge image |

Arizona Form 140ES

Method 2: You may file installments using Form 140ES. You can pay your 2023 estimated tax with an electronic

If you are a calendar year filer making voluntary estimated payment from your checking or savings account. There is no

payments, see the table under When Should I Make My fee to use this method. To make an electronic payment, go to

Estimated Payments? for the due dates of these payments. www.AZTaxes.gov and click on the “Make a Payment” link.

The “E-Check” option in the “Payment Method” drop-down

If you are a fiscal year filer making voluntary estimated

box will debit the amount from the checking or savings

payments, the payments are due on the 15th day of the fourth,

account that you specify. If you make an electronic payment

sixth and ninth months of the current fiscal year, and the first

from your checking or savings account, you will receive a

month of the next fiscal year.

confirmation number. Please keep this confirmation number

The sum of the amounts remitted should equal your estimated as proof of payment.

end-of-tax-year liability.

Method 3: You may file an Individual Estimated Income Tax NOTE: If you are paying by electronic check, do not use

Payment, Form 140ES, with a single, lump-sum payment Form 140ES. We will apply your estimated tax payment to

before January 16, 2024. your account. You must claim the estimated payment on your

original return when you file.

The payment should reflect your estimated end-of-tax-year

liability. Credit card payment

You can pay your 2023 estimated tax through a third-party

Completing Lines 1 and 2 service provider using your Visa, MasterCard, Discover, or

Line 1 American Express credit card. Go to www.AZTaxes.gov,

Enter the amount of your payment. Round your payment to click on the “Make a Payment” link and choose the credit card

the nearest whole dollar (no cents). Your payment is the option.

amount you figured using the worksheet for computing

This will take you to a third party vendor site (provider). The

estimated payments.

provider will charge you a convenience fee based on the

Line 2 amount of your tax payment. If you complete the credit card

Check the box for the quarter for which this payment is made. transaction, you will receive a confirmation number. Please

keep this confirmation number as proof of payment.

Sending Your Payment

NOTE: If you are paying by credit card, do not use

Individuals may make estimated payments by check, Form 140ES. We will apply your estimated tax payment to

electronic check, money order, or credit card. your account. You must claim the estimated payment on your

Partnerships or S corporations making estimated payments on original return when you file.

behalf of nonresidents participating in the filing of a

composite return must make those payments by check or

money order. Record of Estimated Income Tax Payments

Check or money order Date Made Amount

Make your check payable to Arizona Department of Revenue 1. Amount of 2022

and include your SSN (or the partnership or S corporation’s overpayment applied to

EIN) and tax year on the check. 2023 estimated tax .00

If you are making a payment on behalf of a nonresident 2. Payment 1 .00

composite return, write “Composite 140NR” on the check.

3. Payment 2 .00

Include your check with the completed Form 140ES and mail to:

Arizona Department of Revenue 4. Payment 3 .00

PO Box 29085 5. Payment 4 .00

Phoenix, AZ 85038-9085

The department cannot accept checks or money orders in Total: .00

foreign currency. You must make payment in U.S. dollars.

Electronic payment from your checking or savings

account

NOTE: You may not make an electronic payment from your

checking or savings account if the payment will ultimately be

coming from a foreign account. In this case, you must pay by

check or money order.

3

|

Enlarge image | THIS PAGE INTENTIONALLY LEFT BLANK |

Enlarge image |

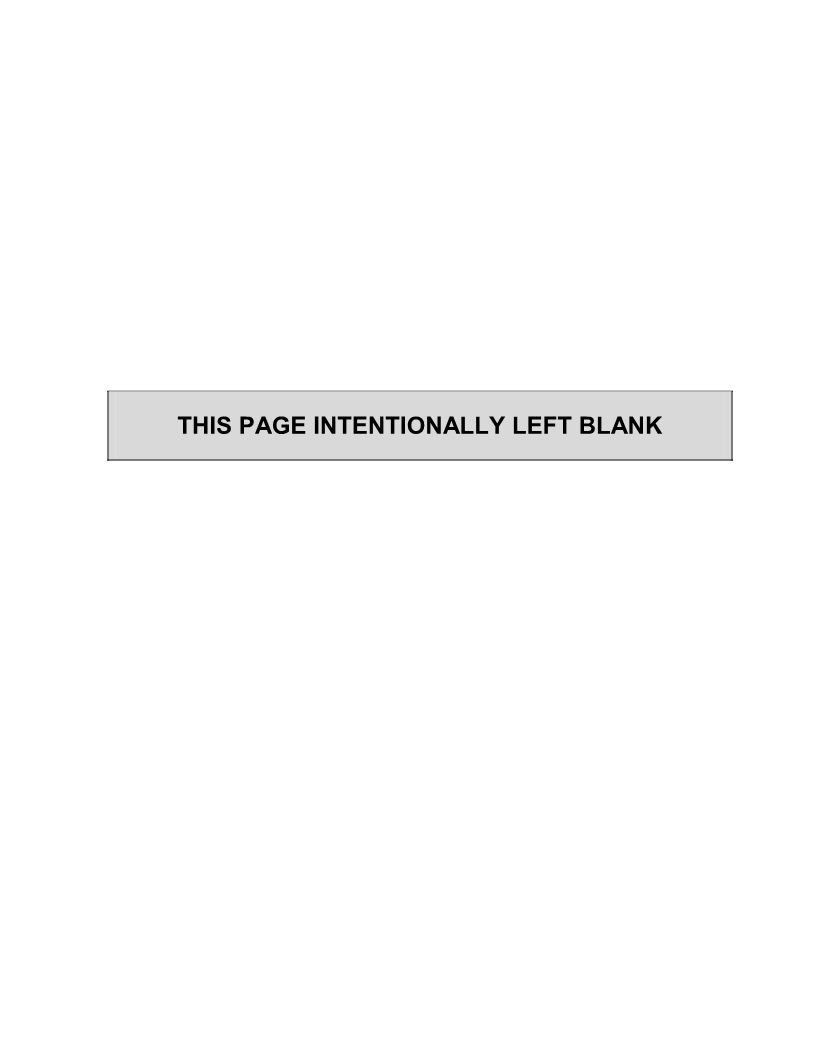

Arizona Form FOR CALENDAR YEAR

Individual Estimated Income Tax Payment

140ES 2023

This estimated payment is for tax year ending December 31, 2023, or for tax year ending: M M D D 2 0 Y Y

Your First Name and Middle Initial Last Name Your Social Security Number

Enter

1

your

Spouse’s First Name and Middle Initial (if filing joint) Last Name Spouse’s Social Security No.

SSN(s).

1

Current Home Address - number and street, rural route Apt. No. Daytime Phone (with area code)

2 94

City, Town or Post Office State ZIP Code REVENUE USE ONLY. DO NOT MARK IN THIS AREA.

3 88

Check if this payment is on behalf of a Nonresident Composite return - 140NR

DO NOT STAPLE ANY ITEMS TO THE FORM.

DO NOT USE THIS FORM TO MAKE DELINQUENT INCOME TAX PAYMENTS.

STOP Use this form only for mailing estimated payments.

1 Payment: You must round your estimated payment to a whole dollar (no cents). 81 PM 80 RCVD

Enter the amount of payment enclosed ........................... $ 00

2 Check only one box for the quarter for which this payment is made.

Do not select more than one quarter. You must submit a separate form for each quarter for which a payment is made.

Payment for calendar year filers are due as follows:

1st Quarter – January to March | Due date is April 15, 2023.

Because April 15, 2023 falls on a Saturday and April 17, 2023 is a federal holiday, you have until Tuesday, April 18, 2023 to make this payment.

2nd Quarter – April to June | Due date is June 15, 2023.

3rd Quarter – July to September | Due date is September 15, 2023.

4th Quarter – October to December | Due date is January 15, 2024.

Because Monday, January 15, 2024 is a holiday, you have until Tuesday, January 16, 2024 to make this payment.

Payment for fiscal year filers are due as follows:

1st Quarter – 15th day of the fourth month of the current fiscal year.

2nd Quarter – 15th day of the sixth month of the current fiscal year.

3rd Quarter – 15th day of the ninth month of the current fiscal year.

4th Quarter – 15th day of the first month of the next fiscal year.

If any of the due dates fall on a Saturday, Sunday, or legal holiday, you may make

the required payment for that quarter by midnight on the next business day following that day.

If you are mailing this payment:

To ensure proper application of this payment, be sure that you:

Complete and submit this form in its entirety. Do not cut this page in half.

Make your check or money order payable to Arizona Department of Revenue.

Write your SSN, “Tax Year 2023” and “140ES” on your payment.

If payment is made on behalf of a Nonresident Composite return, write “Composite 140NR”,

“Tax Year 2023” and the entity’s EIN on your payment.

Include your payment with this form.

Mail to Arizona Department of Revenue, PO Box 29085, Phoenix, AZ 85038-9085.

Be sure to review your estimated income and adjust your payments as necessary during the year.

If you are making an electronic payment

You can make this estimated payment by eCheck or credit card!

American Express Visa Discover Card MasterCard

www.AZTaxes.gov

Click on “Make a Payment” and select “140ES” as the Payment Type.

Do not mail this form. We will apply this payment to your account.

ADOR 10575 (22) AZ Form 140ES (2023) Page 1 of 2

|

Enlarge image | THIS PAGE INTENTIONALLY LEFT BLANK |

Enlarge image |

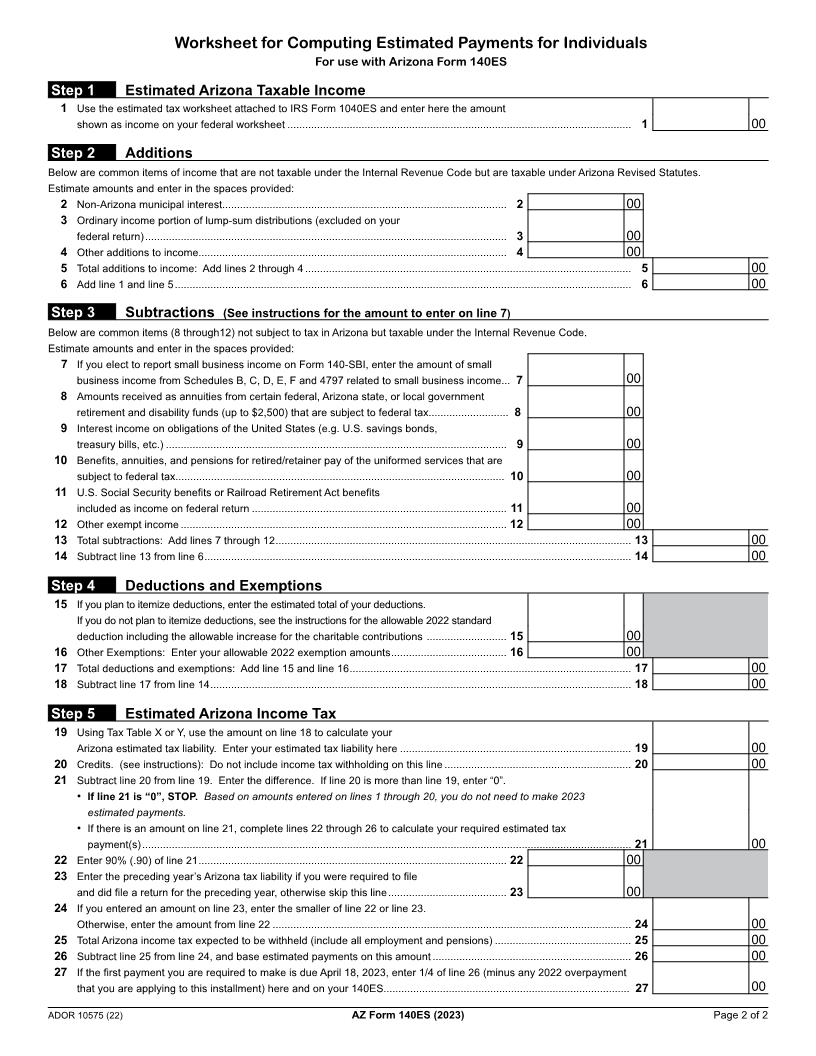

Worksheet for Computing Estimated Payments for Individuals

For use with Arizona Form 140ES

Step 1 Estimated Arizona Taxable Income

1 Use the estimated tax worksheet attached to IRS Form 1040ES and enter here the amount

shown as income on your federal worksheet .................................................................................................................... 1 00

Step 2 Additions

Below are common items of income that are not taxable under the Internal Revenue Code but are taxable under Arizona Revised Statutes.

Estimate amounts and enter in the spaces provided:

2 Non-Arizona municipal interest................................................................................................ 2 00

3 Ordinary income portion of lump-sum distributions (excluded on your

federal return) .......................................................................................................................... 3 00

4 Other additions to income........................................................................................................ 4 00

5 Total additions to income: Add lines 2 through 4 .............................................................................................................. 5 00

6 Add line 1 and line 5 .......................................................................................................................................................... 6 00

Step 3 Subtractions (See instructions for the amount to enter on line 7)

Below are common items (8 through12) not subject to tax in Arizona but taxable under the Internal Revenue Code.

Estimate amounts and enter in the spaces provided:

7 If you elect to report small business income on Form 140-SBI, enter the amount of small

business income from Schedules B, C, D, E, F and 4797 related to small business income... 7 00

8 Amounts received as annuities from certain federal, Arizona state, or local government

retirement and disability funds (up to $2,500) that are subject to federal tax........................... 8 00

9 Interest income on obligations of the United States (e.g. U.S. savings bonds,

treasury bills, etc.) ................................................................................................................... 9 00

10 Benefits, annuities, and pensions for retired/retainer pay of the uniformed services that are

subject to federal tax............................................................................................................... 10 00

11 U.S. Social Security benefits or Railroad Retirement Act benefits

included as income on federal return ...................................................................................... 11 00

12 Other exempt income .............................................................................................................. 12 00

13 Total subtractions: Add lines 7 through 12 ........................................................................................................................ 13 00

14 Subtract line 13 from line 6 ................................................................................................................................................ 14 00

Step 4 Deductions and Exemptions

15 If you plan to itemize deductions, enter the estimated total of your deductions.

If you do not plan to itemize deductions, see the instructions for the allowable 2022 standard

deduction including the allowable increase for the charitable contributions ........................... 15 00

16 Other Exemptions: Enter your allowable 2022 exemption amounts ....................................... 16 00

17 Total deductions and exemptions: Add line 15 and line 16 ............................................................................................... 17 00

18 Subtract line 17 from line 14 .............................................................................................................................................. 18 00

Step 5 Estimated Arizona Income Tax

19 Using Tax Table X or Y, use the amount on line 18 to calculate your

Arizona estimated tax liability. Enter your estimated tax liability here .............................................................................. 19 00

20 Credits. (see instructions): Do not include income tax withholding on this line ............................................................... 20 00

21 Subtract line 20 from line 19. Enter the difference. If line 20 is more than line 19, enter “0”.

• If line 21 is “0”, STOP. Based on amounts entered on lines 1 through 20, you do not need to make 2023

estimated payments.

• If there is an amount on line 21, complete lines 22 through 26 to calculate your required estimated tax

payment(s) ..................................................................................................................................................................... 21 00

22 Enter 90% (.90) of line 21 ........................................................................................................ 22 00

23 Enter the preceding year’s Arizona tax liability if you were required to file

and did file a return for the preceding year, otherwise skip this line ........................................ 23 00

24 If you entered an amount on line 23, enter the smaller of line 22 or line 23.

Otherwise, enter the amount from line 22 ......................................................................................................................... 24 00

25 Total Arizona income tax expected to be withheld (include all employment and pensions) .............................................. 25 00

26 Subtract line 25 from line 24, and base estimated payments on this amount ................................................................... 26 00

27 If the first payment you are required to make is due April 18, 2023, enter 1/4 of line 26 (minus any 2022 overpayment

that you are applying to this installment) here and on your 140ES................................................................................... 27 00

ADOR 10575 (22) AZ Form 140ES (2023) Page 2 of 2

|

Enlarge image |

ARIZONA DEPARTMENT OF REVENUE

1600 W MONROE ST.

PHOENIX AZ 85007-2612

QUICK AND EASY ACCESS TO TAX HELP AND FORMS

PERSONAL COMPUTER

Access all the information you

need online at www.azdor.gov, PHONE

including:

Phoenix....................................... (602) 255-3381

• Forms and Instructions

Toll-free from

• Publications area codes 520 and 928 ............. (800) 352-4090

• Tax Rulings and Procedures

• Other General Tax Information

WALK-IN SERVICE

You may get forms and information at our Phoenix

and Tucson offices. To continue to protect the

Did You Know? health and safety of our

customers ADOR’s

When you use tax software all the hard in-person lobby services

work is done for you! The software: are by appointment only.

• Calculates Tax

• Does the Math

Visit azdor.gov for taxpayer

• Selects Forms and Schedules

support services that may be accessed by phone

• Makes Complex Returns Simple or computer.

• Checks for Errors Before You File

• E-Files the IRS and AZ Returns at

the same time We have offices at the following locations:

• Gives Proof of E-Filing

• Free E-File available for those who Phoenix

1600 West Monroe Street

qualify

Phoenix, AZ 85007

Before using paper, E-File and select Tucson

the Direct Deposit option for a 400 West Congress Street

faster refund! Tucson, AZ 85701

Forms Only:

Mesa

55 North Center Street

Reasonable accommodations for any

Mesa, AZ 85201

person with a disability can be made.

|