Enlarge image

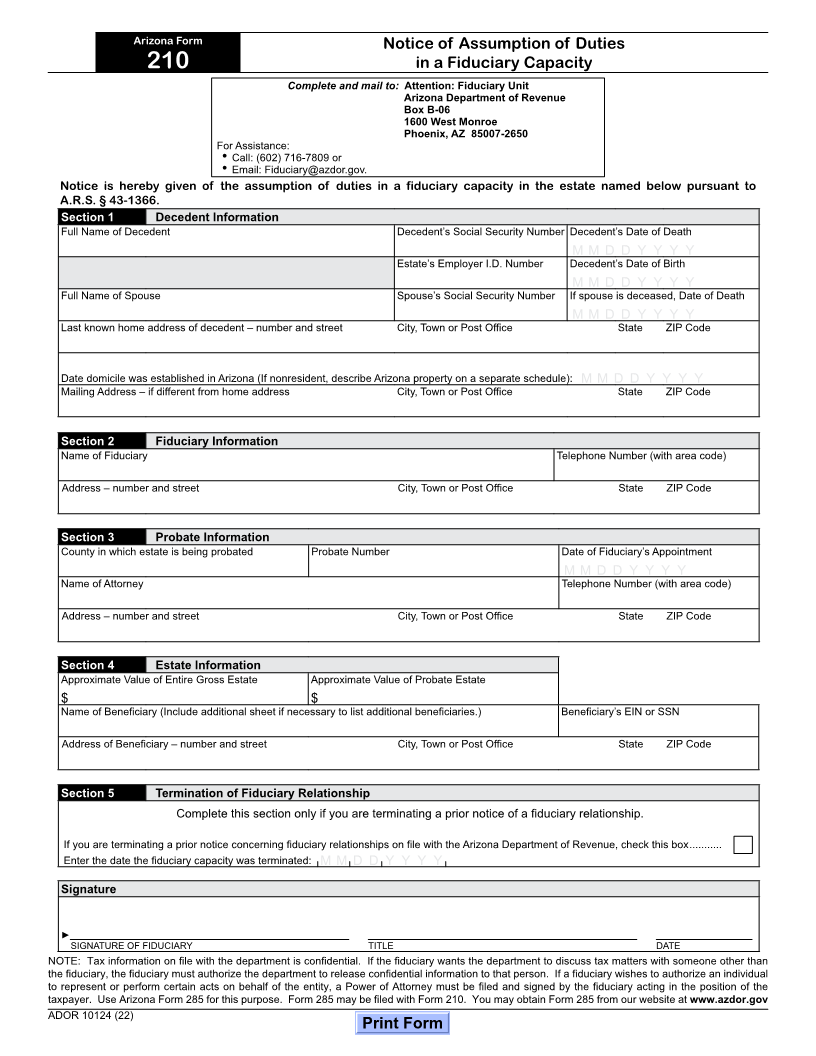

Arizona Form Notice of Assumption of Duties

210 in a Fiduciary Capacity

Complete and mail to: Attention: Fiduciary Unit

Arizona Department of Revenue

Box B-06

1600 West Monroe

Phoenix, AZ 85007-2650

For Assistance:

• Call: (602) 716-7809 or

• Email: Fiduciary@azdor.gov.

Notice is hereby given of the assumption of duties in a fiduciary capacity in the estate named below pursuant to

A.R.S. § 43-1366.

Section 1 Decedent Information

Full Name of Decedent Decedent’s Social Security Number Decedent’s Date of Death

M M D D Y Y Y Y

Estate’s Employer I.D. Number Decedent’s Date of Birth

M M D D Y Y Y Y

Full Name of Spouse Spouse’s Social Security Number If spouse is deceased, Date of Death

M M D D Y Y Y Y

Last known home address of decedent – number and street City, Town or Post Office State ZIP Code

Date domicile was established in Arizona (If nonresident, describe Arizona property on a separate schedule): M M D D Y Y Y Y

Mailing Address – if different from home address City, Town or Post Office State ZIP Code

Section 2 Fiduciary Information

Name of Fiduciary Telephone Number (with area code)

Address – number and street City, Town or Post Office State ZIP Code

Section 3 Probate Information

County in which estate is being probated Probate Number Date of Fiduciary’s Appointment

M M D D Y Y Y Y

Name of Attorney Telephone Number (with area code)

Address – number and street City, Town or Post Office State ZIP Code

Section 4 Estate Information

Approximate Value of Entire Gross Estate Approximate Value of Probate Estate

$ $

Name of Beneficiary (Include additional sheet if necessary to list additional beneficiaries.) Beneficiary’s EIN or SSN

Address of Beneficiary – number and street City, Town or Post Office State ZIP Code

Section 5 Termination of Fiduciary Relationship

Complete this section only if you are terminating a prior notice of a fiduciary relationship.

If you are terminating a prior notice concerning fiduciary relationships on file with the Arizona Department of Revenue, check this box ...........

Enter the date the fiduciary capacity was terminated: M M D D Y Y Y Y

Signature

►

SIGNATURE OF FIDUCIARY TITLE DATE

NOTE: Tax information on file with the department is confidential. If the fiduciary wants the department to discuss tax matters with someone other than

the fiduciary, the fiduciary must authorize the department to release confidential information to that person. If a fiduciary wishes to authorize an individual

to represent or perform certain acts on behalf of the entity, a Power of Attorney must be filed and signed by the fiduciary acting in the position of the

taxpayer. Use Arizona Form 285 for this purpose. Form 285 may be filed with Form 210. You may obtain Form 285 from our website at www.azdor.gov

ADOR 10124 (22)

Print Form