Enlarge image

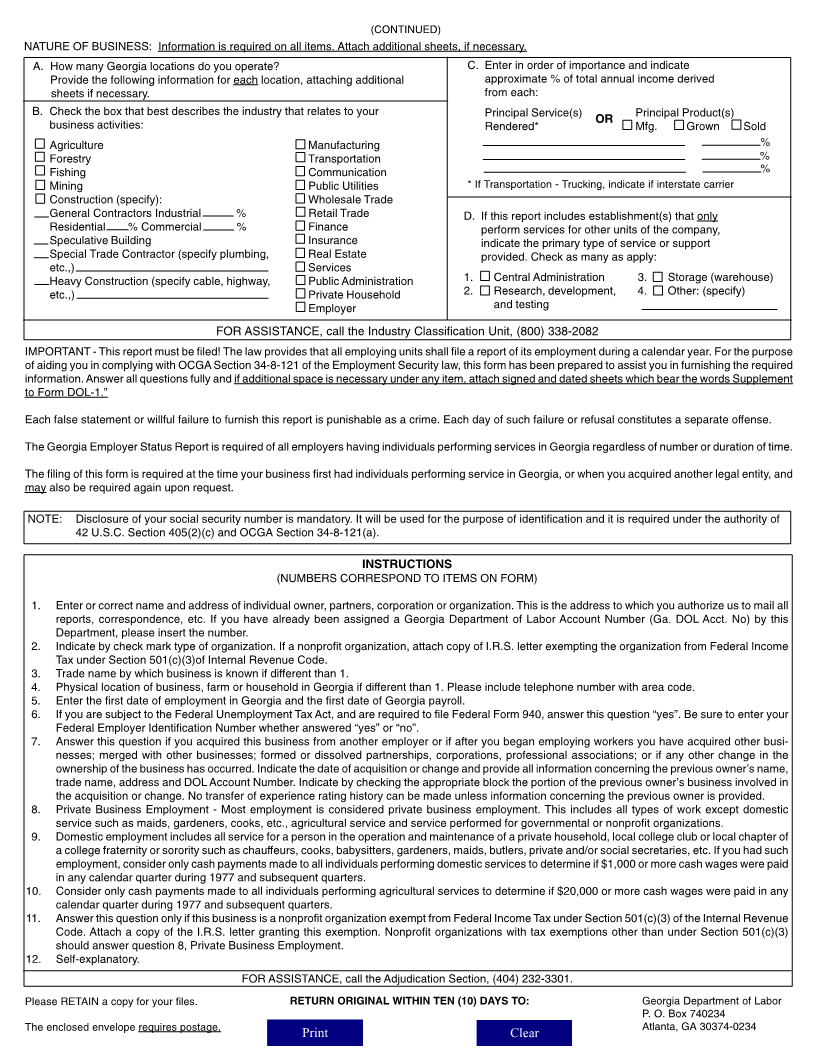

GEORGIA DEPARTMENT OF LABOR

SUITE 850 - 148 ANDREW YOUNG INTERNATIONAL BLVD NE - ATLANTA, GA 30303-1751

EMPLOYER STATUS REPORT

READ INSTRUCTIONS ON REVERSE SIDE

BEFORE COMPLETION OF FORM

1. ENTER OR CORRECT BUSINESS NAME AND ADDRESS

RETURN ORIGINAL WITHIN 10 DAYS

GEORGIA DOL

ACCOUNT NUMBER

3. TRADE NAME (If already assigned)

2. TYPE OF ORGANIZATION

Individual Partnership Corporation Nonprofit org.

4. PRINCIPAL BUSINESS, Street Address Limited Liability CO. (LLC)

FARM OR

HOUSEHOLD Other (specify)

LOCATION IN

GEORGIA City Zip Code County Telephone Number

(Do not use a

P. O. Box number) GA ( )

5. DATE FIRST BEGAN DATE OF 6. ARE YOU LIABLE FEDERAL

EMPLOYING WORKERS FIRST GA. FOR FEDERAL Yes No I.D.

WITHIN STATE OF GA. PAYROLL UNEMPLOYMENT TAX? NUMBER

7. HAVE YOU... DATE ACQUIRED DID YOU ACQUIRE...

OR CHANGED

Acquired another business? Yes No All of Georgia operations?

PREDECESSOR’S

GEORGIA DOL Substantially all of Georgia operations

Merged with another business? Yes No ACCOUNT NUMBER (90% or more)

DOES THE FORMER OWNER

Formed a corporation or CONTINUE TO Part of Georgia operations (less than 90%)

partnership? Yes No HAVE EMPLOYEES? Yes No

Made any other change in the

ownership of your business? Yes No If yes, explain

FROM WHOM? (Organization name, including trade name) ADDRESS

8. IF YOU HAD PRIVATE BUSINESS EMPLOYMENT: 9. IF YOU HAD DOMESTIC EMPLOYMENT:

Did you, or do you expect to employ at least one worker Did you, or do you expect to pay cash wages

in 20 different calendar weeks during a calendar year? Yes * No of $1,000 or more in any calendar quarter? Yes* No

* If yes, show date the 20th week first occurred: * If yes, show date this first occurred:

10.IF YOU HAD AGRICULTURAL EMPLOYMENT: Yes* No

Did you, or do you expect to have a Did you, or do you expect to employ 10 or more agricultural

quarterly payroll of $1,500 or more? Yes * No workers in 20 different calendar weeks during a calendar year?

* If yes, show date this first occurred: * If yes, show date the 20th week first occurred:

11.IF YOU ARE A NONPROFIT ORGANIZATION EXEMPT Did you, or do you expect to have a gross cash agricultural

FROM INCOME TAX UNDER IRS CODE 501(C)(3): Yes * No payroll of $20,000 or more in any calendar quarter? Yes* No

Did you, or do you expect to employ four or more * If yes, show date this first occurred:

workers in 20 different calendar weeks during a

calendar year? (ATTACH COPY OF 501(C)(3) EXEMPTION LETTER) 12.HOW MANY EMPLOYEES do you have, (or anticipate

* If yes, show date the 20th week first occurred: when in full operation)?

Name

INFORMATION INFORMATION Name

ABOUT ABOUT

OWNER, Social Security PERSON

Number OR FIRM Address

ALL WHO

PARTNERS, Residence Address MAINTAINS

OR PRINCIPAL FINANCIAL City

OFFICER RECORDS

(ATTACH OF BUSINESS

City

ADDITIONAL State Zip Code Telephone

SHEET,OR ( )

SHEETS, IF State Zip Code CERTIFICATION: I hereby certify under penalties of perjury, that the foregoing statement and those contained

NECESSARY) in any attached sheets signed by me are true and correct, and that I am authorized to execute this report on

behalf of the employing unit. This report must be signed by owner, partner or principal officer.

Telephone Signature Title Date

( )

PLEASE COMPLETE INDUSTRY INFORMATION ON REVERSE SIDE. DOL-1A (R-5/05)

TA489A