Enlarge image

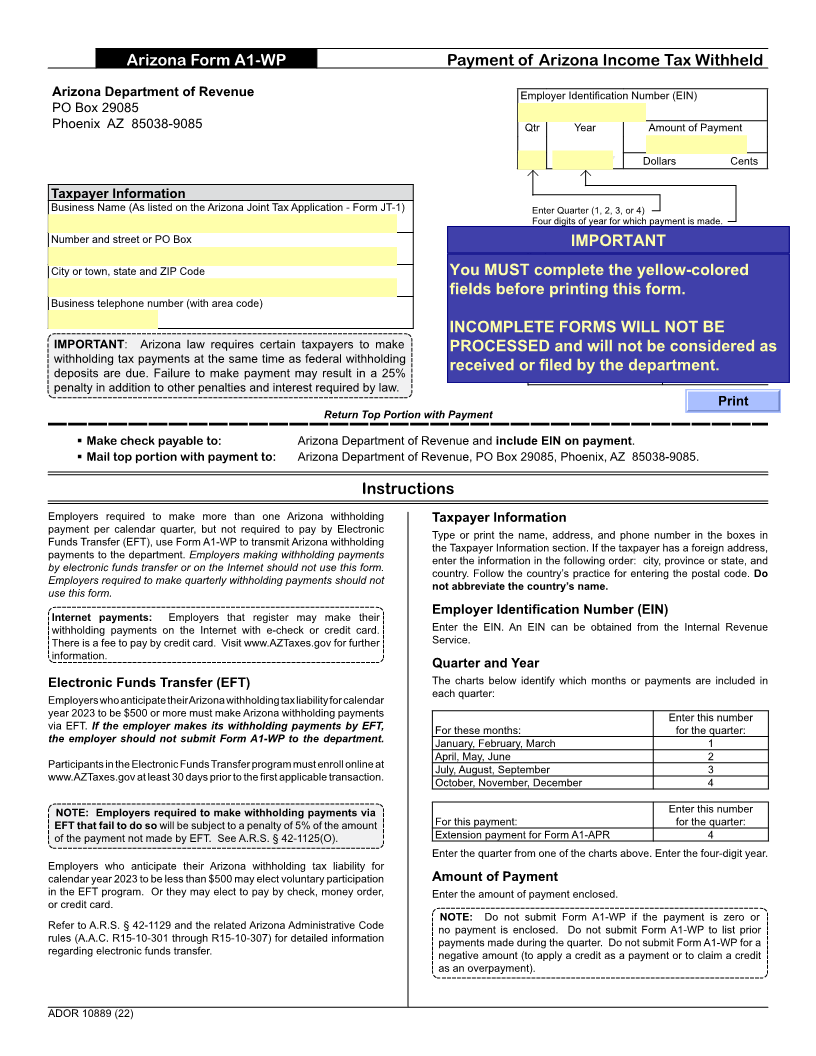

Arizona Form A1-WP Payment of Arizona Income Tax Withheld

Arizona Department of Revenue Employer Identification Number (EIN)

PO Box 29085

Phoenix AZ 85038-9085 Qtr Year Amount of Payment

QQ Y Y YY YY YYDollars Cents

Taxpayer Information

Business Name (As listed on the Arizona Joint Tax Application - Form JT-1) Enter Quarter (1, 2, 3, or 4)

Four digits of year for which payment is made.

Number and street or PO Box

REVENUEIMPORTANTUSE ONLY. DO NOT MARK IN THIS AREA.

88

City or town, state and ZIP Code You MUST complete the yellow-colored

fields before printing this form.

Business telephone number (with area code)

INCOMPLETE FORMS WILL NOT BE

IMPORTANT: Arizona law requires certain taxpayers to make PROCESSED81 PMand will not be66consideredRCVD as

withholding tax payments at the same time as federal withholding

received or filed by the department.

deposits are due. Failure to make payment may result in a 25%

penalty in addition to other penalties and interest required by law.

Print

Return Top Portion with Payment

Make check payable to: Arizona Department of Revenue and include EIN on payment.

Mail top portion with payment to: Arizona Department of Revenue, PO Box 29085, Phoenix, AZ 85038-9085.

Instructions

Employers required to make more than one Arizona withholding Taxpayer Information

payment per calendar quarter, but not required to pay by Electronic Type or print the name, address, and phone number in the boxes in

Funds Transfer (EFT), use Form A1-WP to transmit Arizona withholding the Taxpayer Information section. If the taxpayer has a foreign address,

payments to the department. Employers making withholding payments enter the information in the following order: city, province or state, and

by electronic funds transfer or on the Internet should not use this form. country. Follow the country’s practice for entering the postal code. Do

Employers required to make quarterly withholding payments should not not abbreviate the country’s name.

use this form.

Internet payments: Employers that register may make their Employer Identification Number (EIN)

withholding payments on the Internet with e-check or credit card. Enter the EIN. An EIN can be obtained from the Internal Revenue

There is a fee to pay by credit card. Visit www.AZTaxes.gov for further Service.

information.

Quarter and Year

Electronic Funds Transfer (EFT) The charts below identify which months or payments are included in

each quarter:

Employers who anticipate their Arizona withholding tax liability for calendar

year 2023 to be $500 or more must make Arizona withholding payments Enter this number

via EFT. If the employer makes its withholding payments by EFT, For these months: for the quarter:

the employer should not submit Form A1-WP to the department. January, February, March 1

April, May, June 2

Participants in the Electronic Funds Transfer program must enroll online at July, August, September 3

www.AZTaxes.gov at least 30 days prior to the first applicable transaction. October, November, December 4

NOTE: Employers required to make withholding payments via Enter this number

EFT that fail to do so will be subject to a penalty of 5% of the amount For this payment: for the quarter:

of the payment not made by EFT. See A.R.S. § 42-1125(O). Extension payment for Form A1-APR 4

Enter the quarter from one of the charts above. Enter the four-digit year.

Employers who anticipate their Arizona withholding tax liability for

calendar year 2023 to be less than $500 may elect voluntary participation Amount of Payment

in the EFT program. Or they may elect to pay by check, money order, Enter the amount of payment enclosed.

or credit card.

NOTE: Do not submit Form A1-WP if the payment is zero or

Refer to A.R.S. § 42-1129 and the related Arizona Administrative Code no payment is enclosed. Do not submit Form A1-WP to list prior

rules (A.A.C. R15-10-301 through R15-10-307) for detailed information payments made during the quarter. Do not submit Form A1-WP for a

regarding electronic funds transfer. negative amount (to apply a credit as a payment or to claim a credit

as an overpayment).

ADOR 10889 (22)