Enlarge image

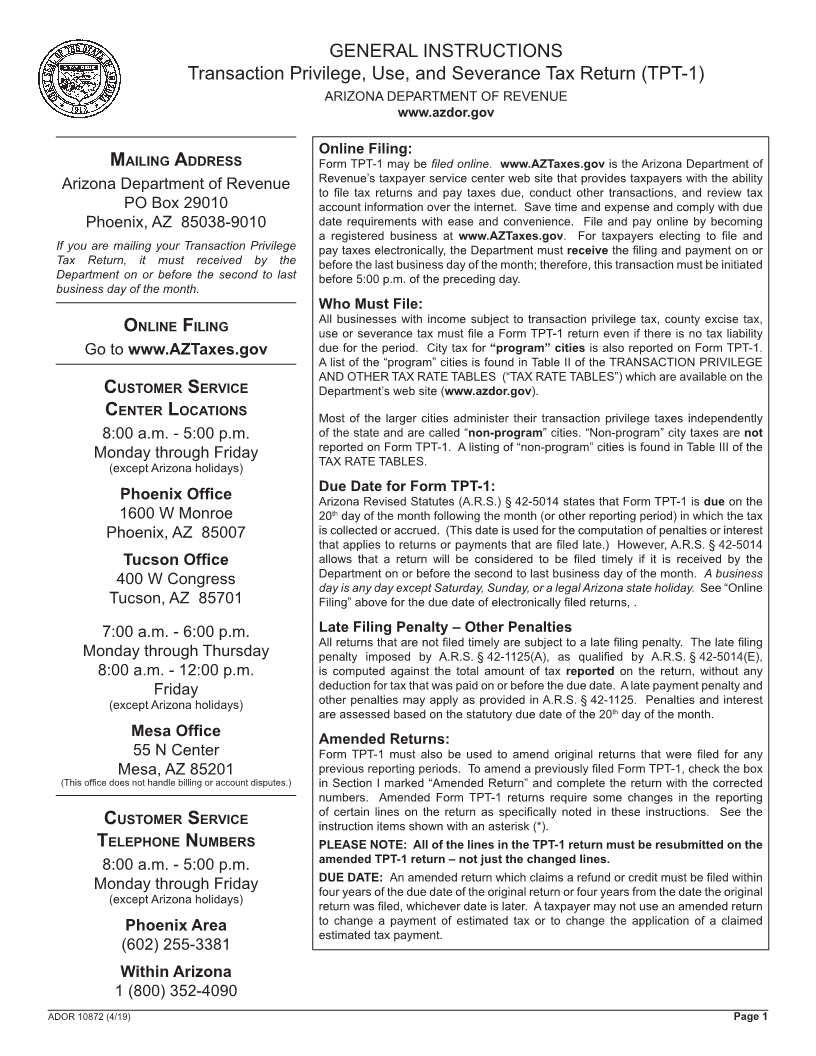

GENERAL INSTRUCTIONS

Transaction Privilege, Use, and Severance Tax Return (TPT‑1)

ARIZONA DEPARTMENT OF REVENUE

www.azdor.gov

Online Filing:

Mailing address Form TPT‑1 may be filed online. www.AZTaxes.gov is the Arizona Department of

Revenue’s taxpayer service center web site that provides taxpayers with the ability

Arizona Department of Revenue to file tax returns and pay taxes due, conduct other transactions, and review tax

PO Box 29010 account information over the internet. Save time and expense and comply with due

Phoenix, AZ 85038‑9010 date requirements with ease and convenience. File and pay online by becoming

a registered business at www.AZTaxes.gov. For taxpayers electing to file and

If you are mailing your Transaction Privilege pay taxes electronically, the Department must receive the filing and payment on or

Tax Return, it must received by the before the last business day of the month; therefore, this transaction must be initiated

Department on or before the second to last before 5:00 p.m. of the preceding day.

business day of the month.

Who Must File:

All businesses with income subject to transaction privilege tax, county excise tax,

Online Filing use or severance tax must file a Form TPT‑1 return even if there is no tax liability

Go to www.AZTaxes.gov due for the period. City tax for “program” cities is also reported on Form TPT‑1.

A list of the “program” cities is found in Table II of the TRANSACTION PRIVILEGE

AND OTHER TAX RATE TABLES (“TAX RATE TABLES”) which are available on the

CustOMer serviCe Department’s web site (www.azdor.gov).

Center lOCatiOns Most of the larger cities administer their transaction privilege taxes independently

8:00 a.m. ‑ 5:00 p.m. of the state and are called “non-program” cities. “Non‑program” city taxes are not

reported on Form TPT‑1. A listing of “non‑program” cities is found in Table III of the

Monday through Friday TAX RATE TABLES.

(except Arizona holidays)

Due Date for Form TPT-1:

Phoenix Office Arizona Revised Statutes (A.R.S.) § 42‑5014 states that Form TPT‑1 is due on the

1600 W Monroe 20 thday of the month following the month (or other reporting period) in which the tax

Phoenix, AZ 85007 is collected or accrued. (This date is used for the computation of penalties or interest

that applies to returns or payments that are filed late.) However, A.R.S. § 42‑5014

Tucson Office allows that a return will be considered to be filed timely if it is received by the

Department on or before the second to last business day of the month. A business

400 W Congress day is any day except Saturday, Sunday, or a legal Arizona state holiday. See “Online

Tucson, AZ 85701 Filing” above for the due date of electronically filed returns, .

7:00 a.m. ‑ 6:00 p.m. Late Filing Penalty – Other Penalties

All returns that are not filed timely are subject to a late filing penalty. The late filing

Monday through Thursday penalty imposed by A.R.S. § 42‑1125(A), as qualified by A.R.S. § 42‑5014(E),

8:00 a.m. ‑ 12:00 p.m. is computed against the total amount of tax reported on the return, without any

Friday deduction for tax that was paid on or before the due date. A late payment penalty and

(except Arizona holidays) other penalties may apply as provided in A.R.S. § 42‑1125. Penalties and interest

are assessed based on the statutory due date of the 20th day of the month.

Mesa Office

Amended Returns:

55 N Center Form TPT‑1 must also be used to amend original returns that were filed for any

Mesa, AZ 85201 previous reporting periods. To amend a previously filed Form TPT‑1, check the box

(This office does not handle billing or account disputes.) in Section I marked “Amended Return” and complete the return with the corrected

numbers. Amended Form TPT‑1 returns require some changes in the reporting

of certain lines on the return as specifically noted in these instructions. See the

CustOMer serviCe instruction items shown with an asterisk (*).

telephOne nuMbers PLEASE NOTE: All of the lines in the TPT-1 return must be resubmitted on the

amended TPT‑1 return – not just the changed lines.

8:00 a.m. ‑ 5:00 p.m.

DUE DATE: An amended return which claims a refund or credit must be filed within

Monday through Friday four years of the due date of the original return or four years from the date the original

(except Arizona holidays)

return was filed, whichever date is later. A taxpayer may not use an amended return

to change a payment of estimated tax or to change the application of a claimed

Phoenix Area estimated tax payment.

(602) 255‑3381

Within Arizona

1 (800) 352‑4090

ADOR 10872 (4/19) Page 1