Enlarge image

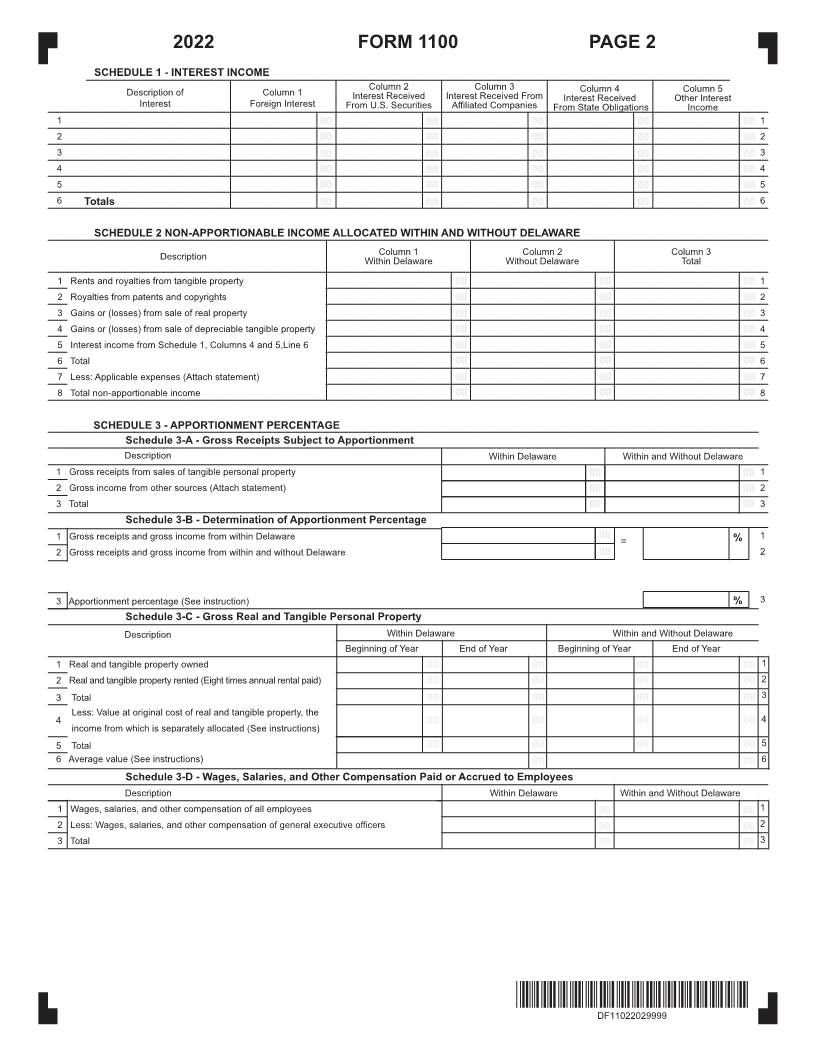

DO NOT WRITE OR STAPLE IN THIS AREA - REVENUE CODE 0042

2022 DELAWARE

CORPORATION INCOME TAX RETURN

FORM 1100

Reset Print Form

for Fiscal year beginning and ending

EMPLOYER IDENTIFICATION NUMBER

Name of Corporation

Street Address CHECK APPLICABLE BOX: Small Corporation ESOP

City State Zip Code INITIAL RETURN CHANGE OF EXTENSION

ADDRESS ATTACHED

Delaware Address if Different than Above

IF OUT OF BUSINESS, ENTER DATE HERE:

City State Zip Code

DATE OF INCORPORATION:

State of Incorporation Nature of Business:

ATTACH COMPLETED COPY OF FEDERAL FORM 1120

1. Federal Taxable Income (See Specific Instructions) ......................................................................................... 1

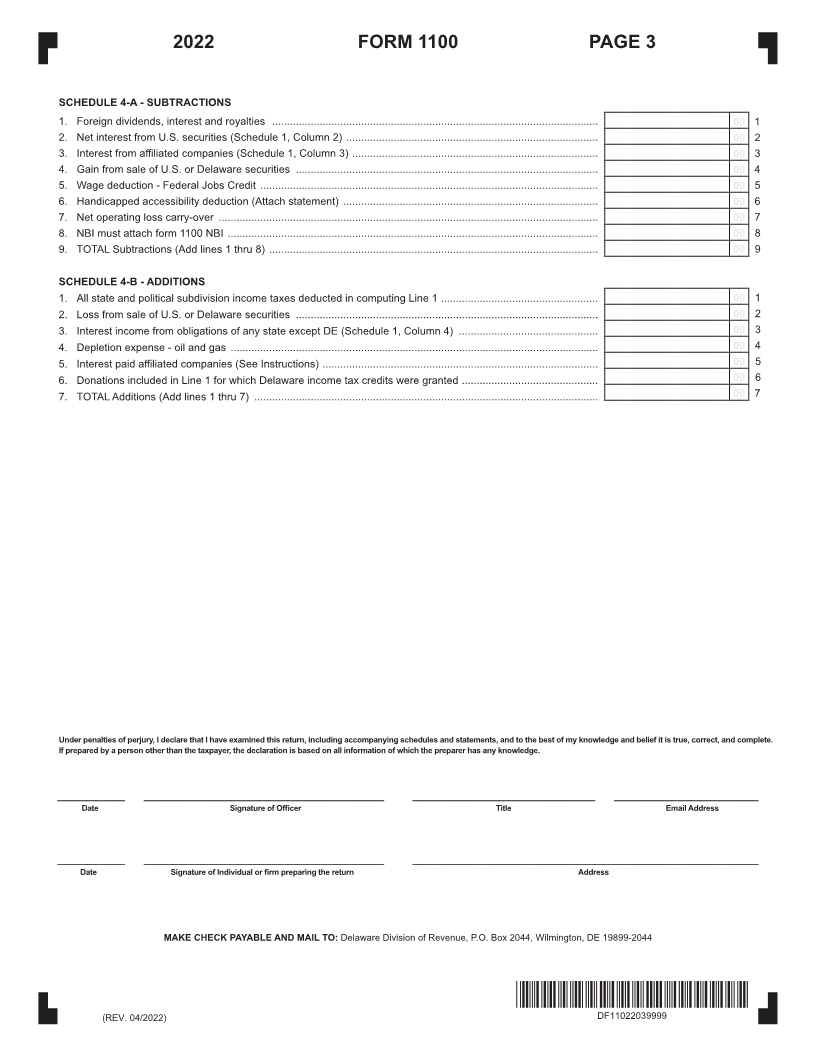

2. Total subtractions from Schedule 4A ........................................................... 2

3. Line 1 minus Line 2 ............................................................................................................................................ 3

4. Total additions from Schedule 4B ................................................................ 4

5. Entire net income. Line 3 plus Line 4 ................................................................................................................. 5

WHERE LINE 5 IS DERIVED ENTIRELY FROM SOURCES WITHIN DELAWARE, ENTER AMOUNT ON LINE 11.

WHERE THE ENTIRE INCOME IS NOT DERIVED FROM SOURCES WITHIN DELAWARE, COMPLETE ITEMS 6 TO 10 INCLUSIVE.

6. Total non-apportionable income (or loss) (Schedule 2, Column 3, Line 8) ........................................................ 6

7. Income (or loss) subject to apportionment (Line 5 minus Line 6) ...................................................................... 7

8. Apportionment percentage (Schedule 3B, Line 3) .................................... 8

9. Income (or loss) apportioned to Delaware (Line 7 multiplied by Line 8) .......................................................... 9

10. Non-apportionable income (or loss) (Schedule 2, Column 1, Line 8) ........................................................... 10

11. Total (Line 9 plus or minus Line 10) ............................................................................................................. 11

12. Delaware Taxable Income (Line 5 or Line 11, whichever is less) ................................................................. 12

13. Tax @ 8.7% .................................................................................................................................................. 13

14. Approved non-refundable tax credits ................................................... 14

15. Balance due after non-refundable tax credits ............................................................................................... 15

16. Delaware tentative tax paid .................................................................. 16

17. Credit carry-over from prior year .......................................................... 17

18. Other payments (attach statement) ....................................................... 18

19. Approved refundable income tax credits .............................................. 19

20. Total payments and credits. Add Lines 16 through 19 .................................................................................. 20

21. If Line 15 is greater than Line 20 enter BALANCE DUE AND PAY IN FULL ................................................ 21

22. If Line 20 is greater than Line 15 enter OVERPAYMENT: (a) Total OVERPAYMENT ................................. 22a

(b) to be REFUNDED ......................................... 22b

(c) to be CREDITED to 2023 TENTATIVE TAX... 22c

PLEASE SEE PAGE 3 FOR SIGNATURE LINES AND MAILING INSTRUCTIONS

*DF11022019999*

DF11022019999