Enlarge image

MailFormFormDF-3 to: 10/09

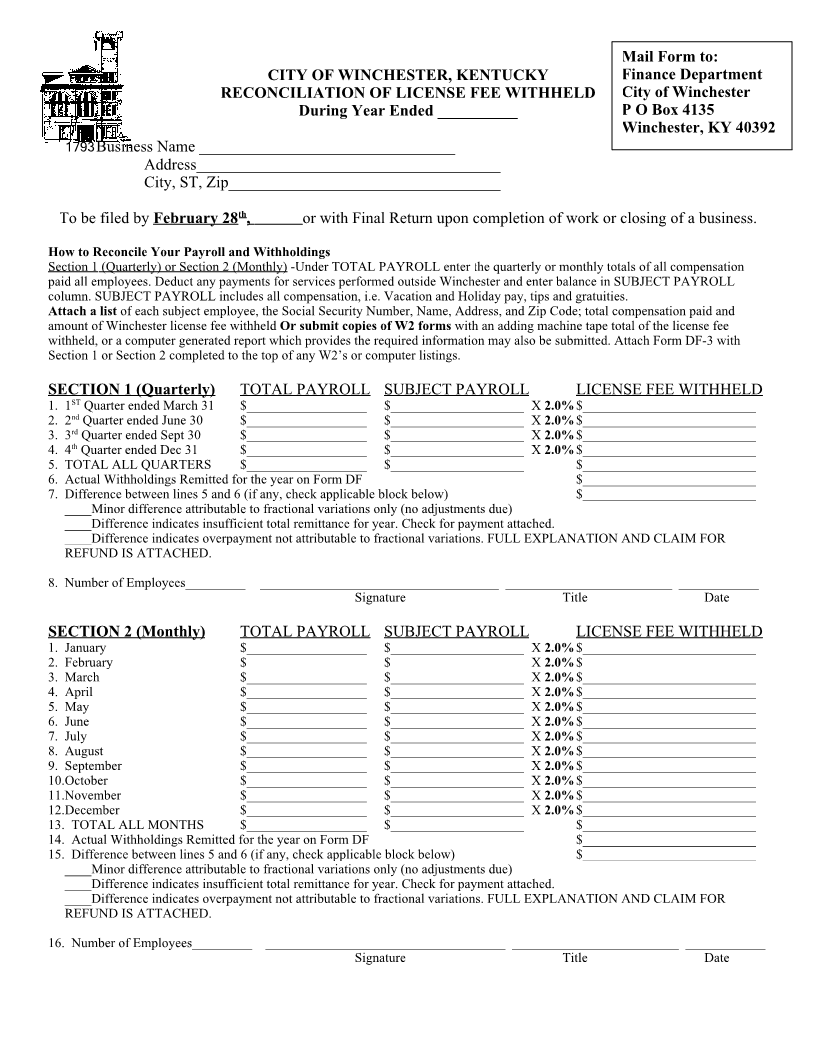

CITY OF WINCHESTER, KENTUCKY Finance Department

RECONCILIATION OF LICENSE FEE WITHHELD City of Winchester

During Year Ended __________ P O Box 4135

Winchester, KY 40392

1793 Business Name ________________________________

Address______________________________________

City, ST, Zip__________________________________

th

To be filed by February 28 , or with Final Return upon completion of work or closing of a business.

How to Reconcile Your Payroll and Withholdings

Section 1 (Quarterly) or Section 2 (Monthly) -Under TOTAL PAYROLL enter the quarterly or monthly totals of all compensation

paid all employees. Deduct any payments for services performed outside Winchester and enter balance in SUBJECT PAYROLL

column. SUBJECT PAYROLL includes all compensation, i.e. Vacation and Holiday pay, tips and gratuities.

Attach a list of each subject employee, the Social Security Number, Name, Address, and Zip Code; total compensation paid and

amount of Winchester license fee withheld Or submit copies of W2 forms with an adding machine tape total of the license fee

withheld, or a computer generated report which provides the required information may also be submitted. Attach Form DF-3 with

Section 1 or Section 2 completed to the top of any W2’s or computer listings.

SECTION 1 (Quarterly) TOTAL PAYROLL SUBJECT PAYROLL LICENSE FEE WITHHELD

1. 1 STQuarter ended March 31$__________________ $____________________ X 2.0%$__________________________

2. 2 ndQuarter ended June 30 $__________________ $____________________ X 2.0%$__________________________

3. 3 rdQuarter ended Sept 30 $__________________ $____________________ X 2.0%$__________________________

4. 4 thQuarter ended Dec 31 $__________________ $____________________ X 2.0%$__________________________

5. TOTAL ALL QUARTERS $__________________ $____________________ $__________________________

6. Actual Withholdings Remitted for the year on Form DF $__________________________

7. Difference between lines 5 and 6 (if any, check applicable block below) $__________________________

____Minor difference attributable to fractional variations only (no adjustments due)

____Difference indicates insufficient total remittance for year. Check for payment attached.

____Difference indicates overpayment not attributable to fractional variations. FULL EXPLANATION AND CLAIM FOR

REFUND IS ATTACHED.

8. Number of Employees_________ ____________________________________ _________________________ ____________

Signature Title Date

SECTION 2 (Monthly) TOTAL PAYROLL SUBJECT PAYROLL LICENSE FEE WITHHELD

1. January $__________________ $____________________ X 2.0% $__________________________

2. February $__________________ $____________________ X 2.0% $__________________________

3. March $__________________ $____________________ X 2.0% $__________________________

4. April $__________________ $____________________ X 2.0% $__________________________

5. May $__________________ $____________________ X 2.0% $__________________________

6. June $__________________ $____________________ X 2.0% $__________________________

7. July $__________________ $____________________ X 2.0% $__________________________

8. August $__________________ $____________________ X 2.0% $__________________________

9. September $__________________ $____________________ X 2.0% $__________________________

10.October $__________________ $____________________ X 2.0% $__________________________

11.November $__________________ $____________________ X 2.0% $__________________________

12.December $__________________ $____________________ X 2.0% $__________________________

13. TOTAL ALL MONTHS $__________________ $____________________ $__________________________

14. Actual Withholdings Remitted for the year on Form DF $__________________________

15. Difference between lines 5 and 6 (if any, check applicable block below) $__________________________

____Minor difference attributable to fractional variations only (no adjustments due)

____Difference indicates insufficient total remittance for year. Check for payment attached.

____Difference indicates overpayment not attributable to fractional variations. FULL EXPLANATION AND CLAIM FOR

REFUND IS ATTACHED.

16. Number of Employees_________ ____________________________________ _________________________ ____________

Signature Title Date