Enlarge image

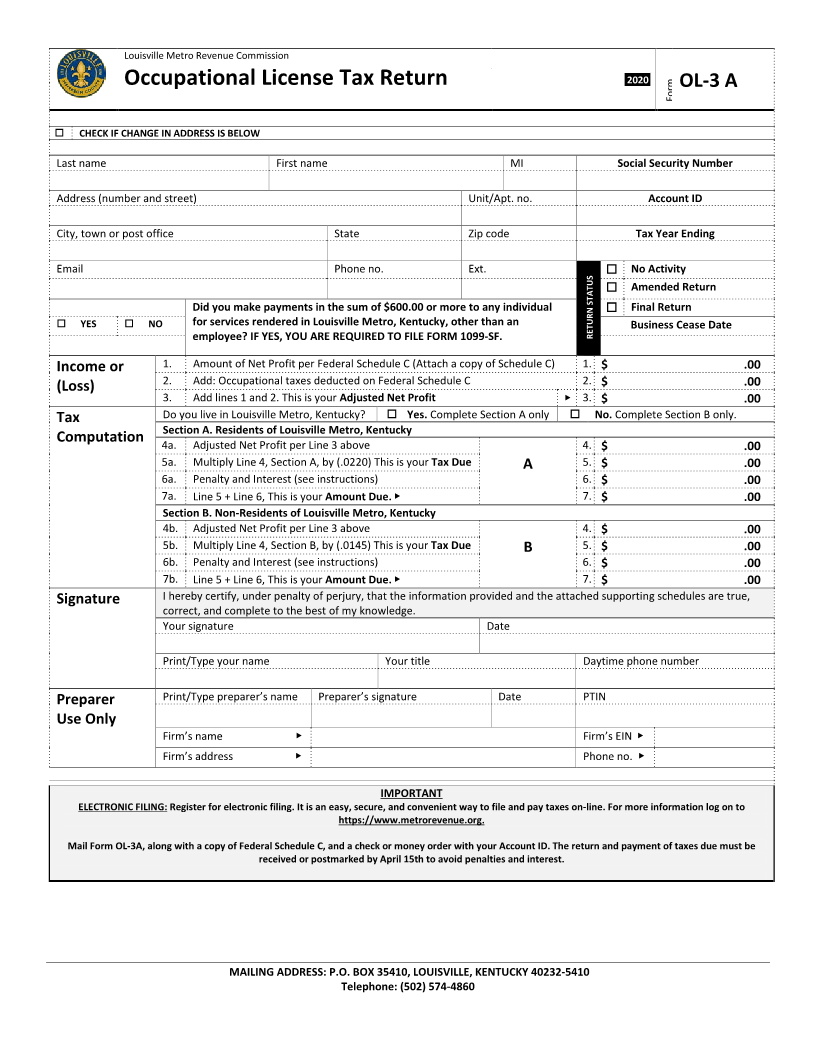

Louisville Metro Revenue Commission

2020

Occupational License Tax Return OL-3 A

Form

CHECK IF CHANGE IN ADDRESS IS BELOW

Last name First name MI Social Security Number

Address (number and street) Unit/Apt. no. Account ID

City, town or post office State Zip code Tax Year Ending

Email Phone no. Ext. No Activity

Amended Return

Did you make payments in the sum of $600.00 or more to any individual Final Return

YES NO for services rendered in Louisville Metro, Kentucky, other than an Business Cease Date

employee? IF YES, YOU ARE REQUIRED TO FILE FORM 1099-SF. RETURN STATUS

Income or 1. Amount of Net Profit per Federal Schedule C (Attach a copy of Schedule C) 1. $ .00

2. Add: Occupational taxes deducted on Federal Schedule C 2.

(Loss) $ .00

3. Add lines 1 and 2. This is your Adjusted Net Profit ▶ 3. $ .00

Tax Do you live in Louisville Metro, Kentucky? Yes. Complete Section A only No. Complete Section B only.

Section A. Residents of Louisville Metro, Kentucky

Computation 4a. Adjusted Net Profit per Line 3 above 4. $ .00

5a. Multiply Line 4, Section A, by (.0220) This is your Tax Due A 5. $ .00

6a. Penalty and Interest (see instructions) 6. $ .00

7a. Line 5 + Line 6, This is your Amount Due. ▶ 7. $ .00

Section B. Non-Residents of Louisville Metro, Kentucky

4b. Adjusted Net Profit per Line 3 above 4. $ .00

5b. Multiply Line 4, Section B, by (.0145) This is your Tax Due B 5. $ .00

6b. Penalty and Interest (see instructions) 6. $ .00

7b. Line 5 + Line 6, This is your Amount Due. ▶ 7. $ .00

Signature I hereby certify, under penalty of perjury, that the information provided and the attached supporting schedules are true,

correct, and complete to the best of my knowledge.

Your signature Date

Print/Type your name Your title Daytime phone number

Preparer Print/Type preparer’s name Preparer’s signature Date PTIN

Use Only

Firm’s name ▶ Firm’s EIN ▶

Firm’s address ▶ Phone no. ▶

IMPORTANT

ELECTRONIC FILING: Register for electronic filing. It is an easy, secure, and convenient way to file and pay taxes on-line. For more information log on to

https://www.metrorevenue.org.

Mail Form OL-3A, along with a copy of Federal Schedule C, and a check or money order with your Account ID. The return and payment of taxes due must be

received or postmarked by April 15th to avoid penalties and interest.

MAILING ADDRESS: P.O. BOX 35410, LOUISVILLE, KENTUCKY 40232-5410

Telephone: (502) 574-4860