Enlarge image

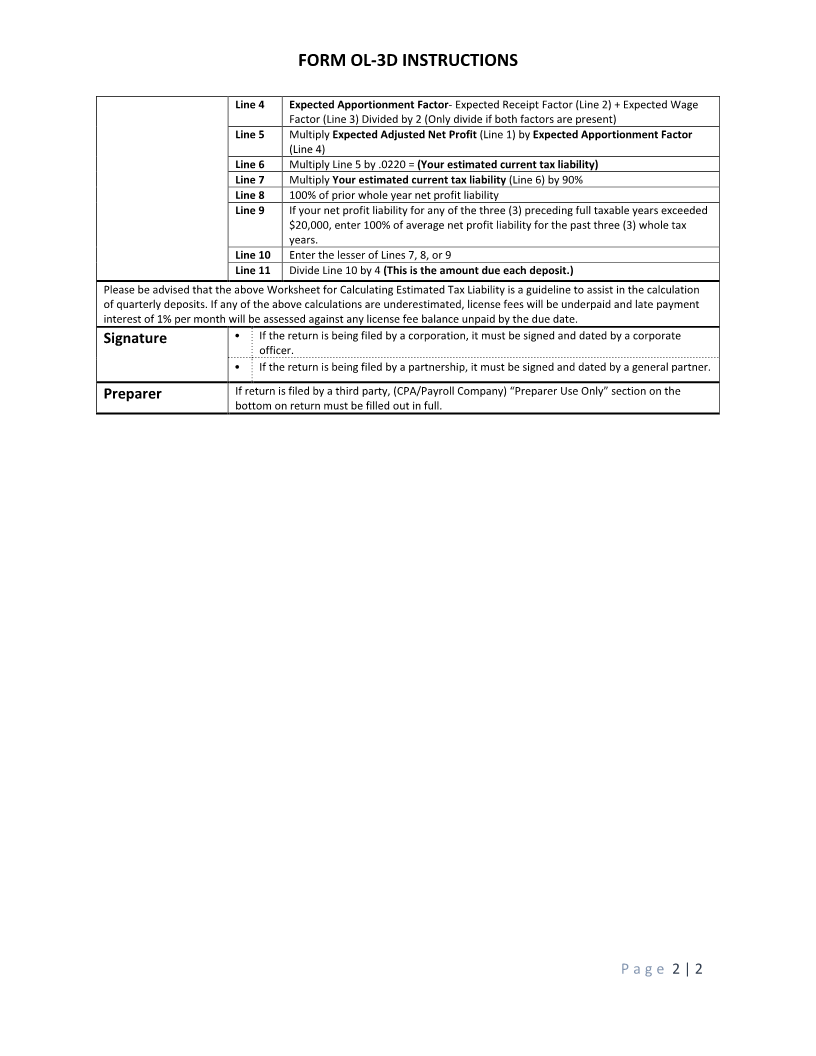

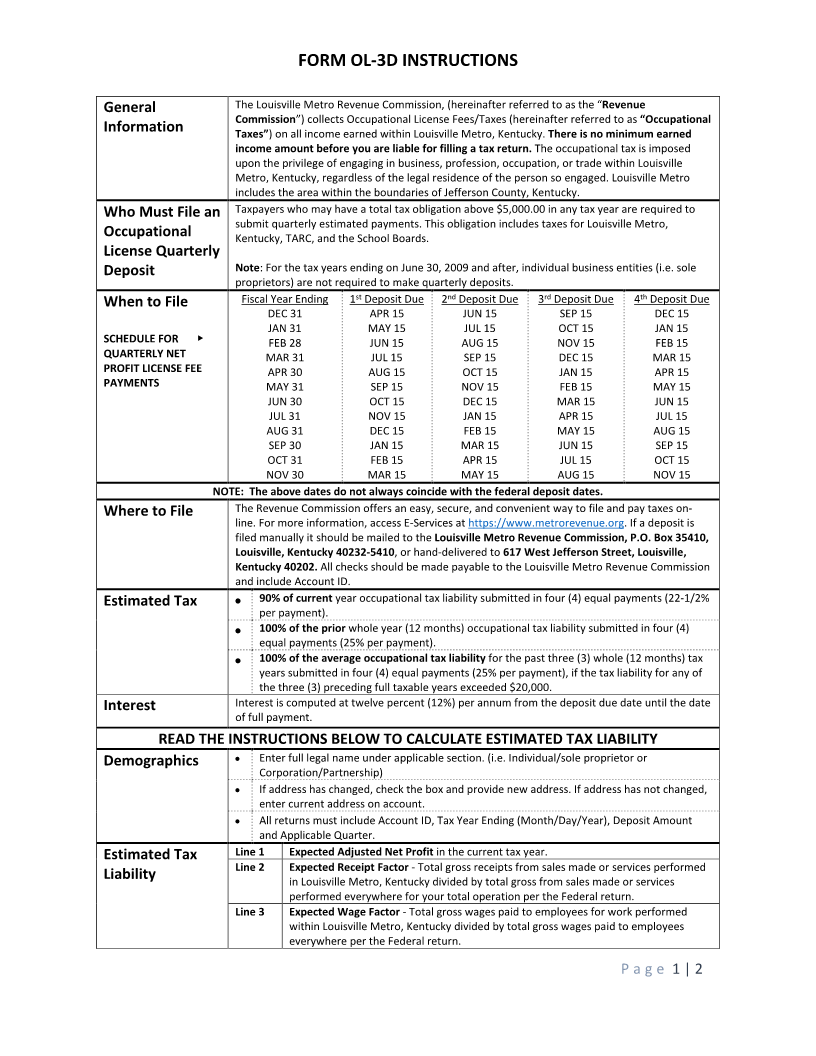

FORM OL-3D INSTRUCTIONS

General The Louisville Metro Revenue Commission, (hereinafter referred to as the “Revenue

Commission”) collects Occupational License Fees/Taxes (hereinafter referred to as “Occupational

Information Taxes”) on all income earned within Louisville Metro, Kentucky. There is no minimum earned

income amount before you are liable for filling a tax return. The occupational tax is imposed

upon the privilege of engaging in business, profession, occupation, or trade within Louisville

Metro, Kentucky, regardless of the legal residence of the person so engaged. Louisville Metro

includes the area within the boundaries of Jefferson County, Kentucky.

Who Must File an Taxpayers who may have a total tax obligation above $5,000.00 in any tax year are required to

submit quarterly estimated payments. This obligation includes taxes for Louisville Metro,

Occupational Kentucky, TARC, and the School Boards.

License Quarterly

Deposit Note: For the tax years ending on June 30, 2009 and after, individual business entities (i.e. sole

proprietors) are not required to make quarterly deposits.

When to File Fiscal Year Ending 1 stDeposit Due 2 ndDeposit Due 3 rdDeposit Due 4 thDeposit Due

DEC 31 APR 15 JUN 15 SEP 15 DEC 15

JAN 31 MAY 15 JUL 15 OCT 15 JAN 15

SCHEDULE FOR ▶ FEB 28 JUN 15 AUG 15 NOV 15 FEB 15

QUARTERLY NET MAR 31 JUL 15 SEP 15 DEC 15 MAR 15

PROFIT LICENSE FEE APR 30 AUG 15 OCT 15 JAN 15 APR 15

PAYMENTS MAY 31 SEP 15 NOV 15 FEB 15 MAY 15

JUN 30 OCT 15 DEC 15 MAR 15 JUN 15

JUL 31 NOV 15 JAN 15 APR 15 JUL 15

AUG 31 DEC 15 FEB 15 MAY 15 AUG 15

SEP 30 JAN 15 MAR 15 JUN 15 SEP 15

OCT 31 FEB 15 APR 15 JUL 15 OCT 15

NOV 30 MAR 15 MAY 15 AUG 15 NOV 15

NOTE: The above dates do not always coincide with the federal deposit dates.

Where to File The Revenue Commission offers an easy, secure, and convenient way to file and pay taxes on-

line. For more information, access E-Services at https://www.metrorevenue.org. If a deposit is

filed manually it should be mailed to the Louisville Metro Revenue Commission, P.O. Box 35410,

Louisville, Kentucky 40232-5410, or hand-delivered to 617 West Jefferson Street, Louisville,

Kentucky 40202. All checks should be made payable to the Louisville Metro Revenue Commission

and include Account ID.

Estimated Tax • 90% of current year occupational tax liability submitted in four (4) equal payments (22-1/2%

per payment).

• 100% of the prior whole year (12 months) occupational tax liability submitted in four (4)

equal payments (25% per payment).

• 100% of the average occupational tax liability for the past three (3) whole (12 months) tax

years submitted in four (4) equal payments (25% per payment), if the tax liability for any of

the three (3) preceding full taxable years exceeded $20,000.

Interest Interest is computed at twelve percent (12%) per annum from the deposit due date until the date

of full payment.

READ THE INSTRUCTIONS BELOW TO CALCULATE ESTIMATED TAX LIABILITY

Demographics • Enter full legal name under applicable section. (i.e. Individual/sole proprietor or

Corporation/Partnership)

• If address has changed, check the box and provide new address. If address has not changed,

enter current address on account.

• All returns must include Account ID, Tax Year Ending (Month/Day/Year), Deposit Amount

and Applicable Quarter.

Estimated Tax Line 1 Expected Adjusted Net Profit in the current tax year.

Line 2 Expected Receipt Factor - Total gross receipts from sales made or services performed

Liability in Louisville Metro, Kentucky divided by total gross from sales made or services

performed everywhere for your total operation per the Federal return.

Line 3 Expected Wage Factor - Total gross wages paid to employees for work performed

within Louisville Metro, Kentucky divided by total gross wages paid to employees

everywhere per the Federal return.

Page 1 | 2