Enlarge image

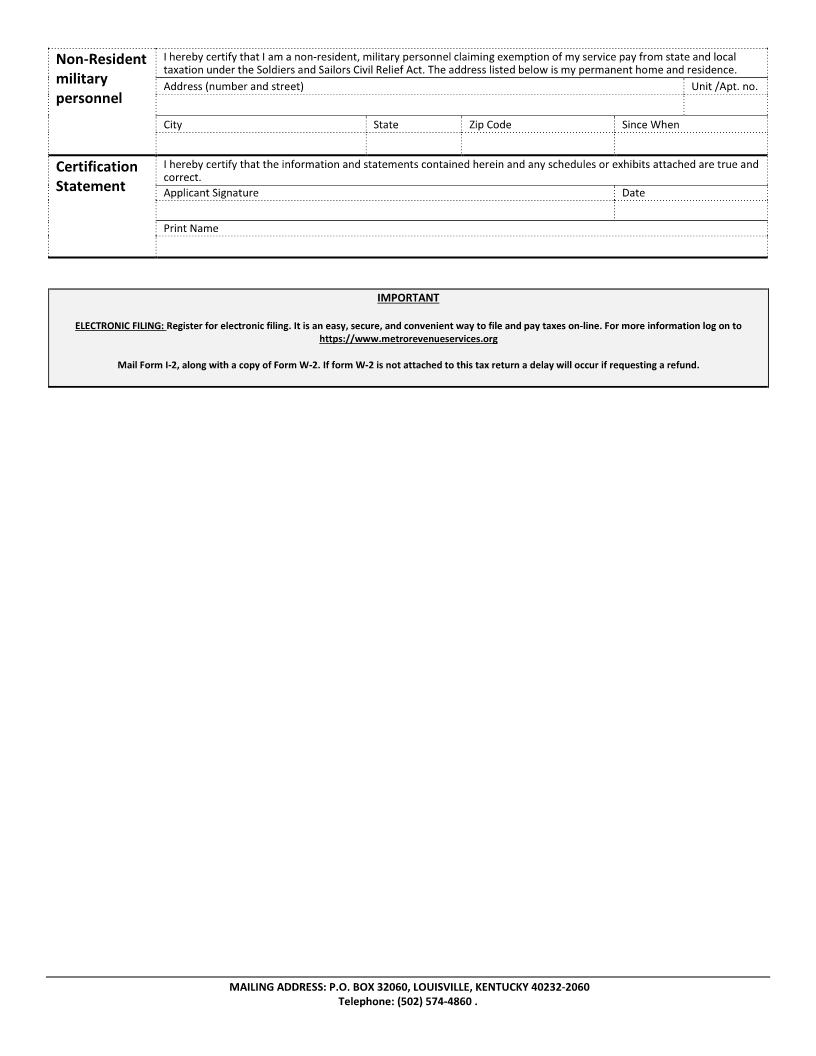

Louisville Metro Revenue Commission

Annual Federal Employee 2020

Form

Occupational License Tax Return I-2

CHECK IF CHANGE IN ADDRESS IS BELOW

Last name First name MI Employer Account ID

(only if requesting a refund)

Address (number and street) Unit/Apt. no. Your Account ID

(only if tax is due)

City, town, or post office State Zip code Social Security Number

Email Phone no. Ext. Tax Year Ending

Income Applies only if at least 5% of time worked was spent outside Louisville Metro, KY. Please use the formula below to compute

any deduction for wages earned outside of Louisville Metro, KY.

earned

A Number of days worked outside Louisville Metro, KY A

Outside

B Total number of days worked (excluding holidays, vacation, & sick days) B

Louisville

C Percentage of days worked outside Louisville Metro, KY (Divide A by B) C

Metro, KY %

D Total gross earnings (including deferred compensation and non-cash fringe benefits) D $ .00

E Income earned outside Louisville Metro, KY (Multiply D by C) E $ .00

Wage 1. Total gross wages per Box 5 or Box 18, whichever is greater on Federal Form W-2

(including deferred compensation) 1. $ .00

Information

2. Salary, wages, and other compensation earned outside of Louisville Metro, KY

(Line E) 2. $ .00

3. Salary, wages, and other compensation subject to occupational tax

(Line 1 minus Line 2) 3. $ .00

Amount of line 3 subject to each tax (See Instructions)

Occupational

Louisville Metro & Mass Transit (Line 3 x .0145) School Board (Line 3 x .0075)

Tax Louisville Metro Residents Only

Calculations 4. A $ .00 B $ .00

Tax Due 5. Tax Due (Residents: Line 4a + 4b, Non-Residents: Line 4a) 5. $ .00

6. Amount withheld by employer or prepaid 6.

Calculations $ .00

7. Balance Due (Line 5 - Line 6) 7. $ .00

8. Penalty & Interest (see instructions) 8. $ .00

9. Total Amount Due (Line 7 + Line 8) 9. $ .00

10. Overpayment to be refunded (If Line 6 > Line 5) 10. $ .00

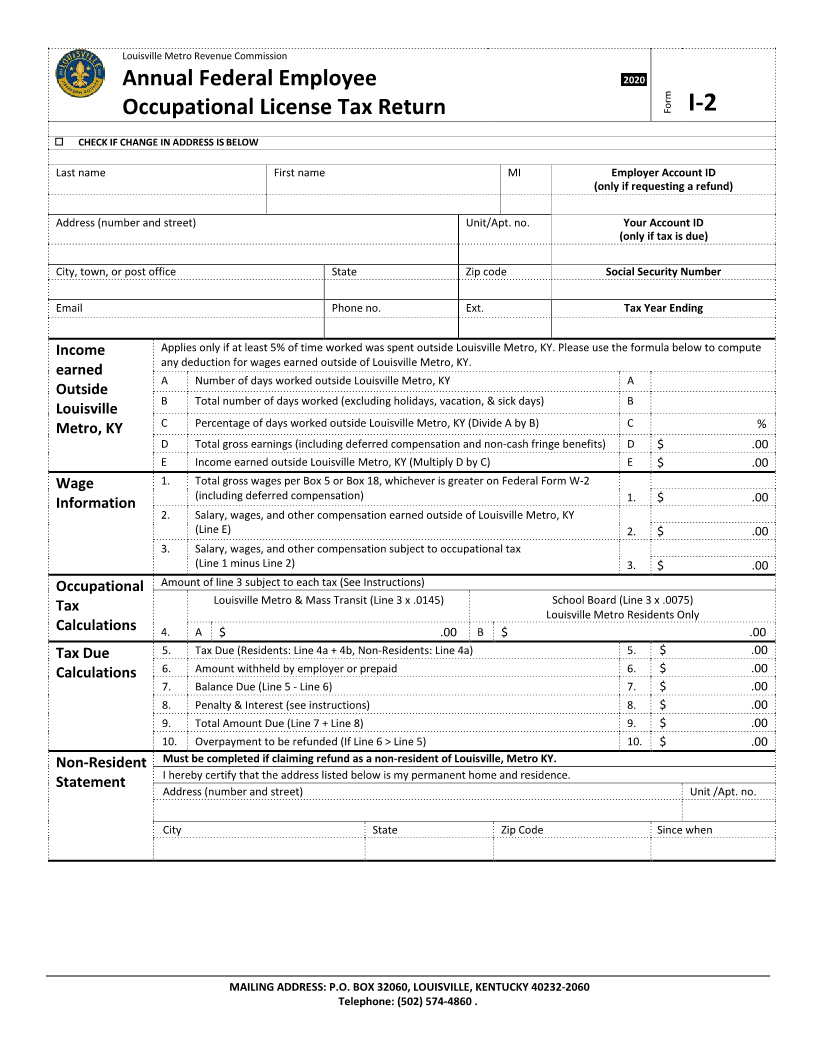

Non-Resident Must be completed if claiming refund as a non-resident of Louisville, Metro KY.

I hereby certify that the address listed below is my permanent home and residence.

Statement Address (number and street) Unit /Apt. no.

City State Zip Code Since when

MAILING ADDRESS: P.O. BOX 32060, LOUISVILLE, KENTUCKY 40232-2060

Telephone: (502) 574-4860 .