Enlarge image

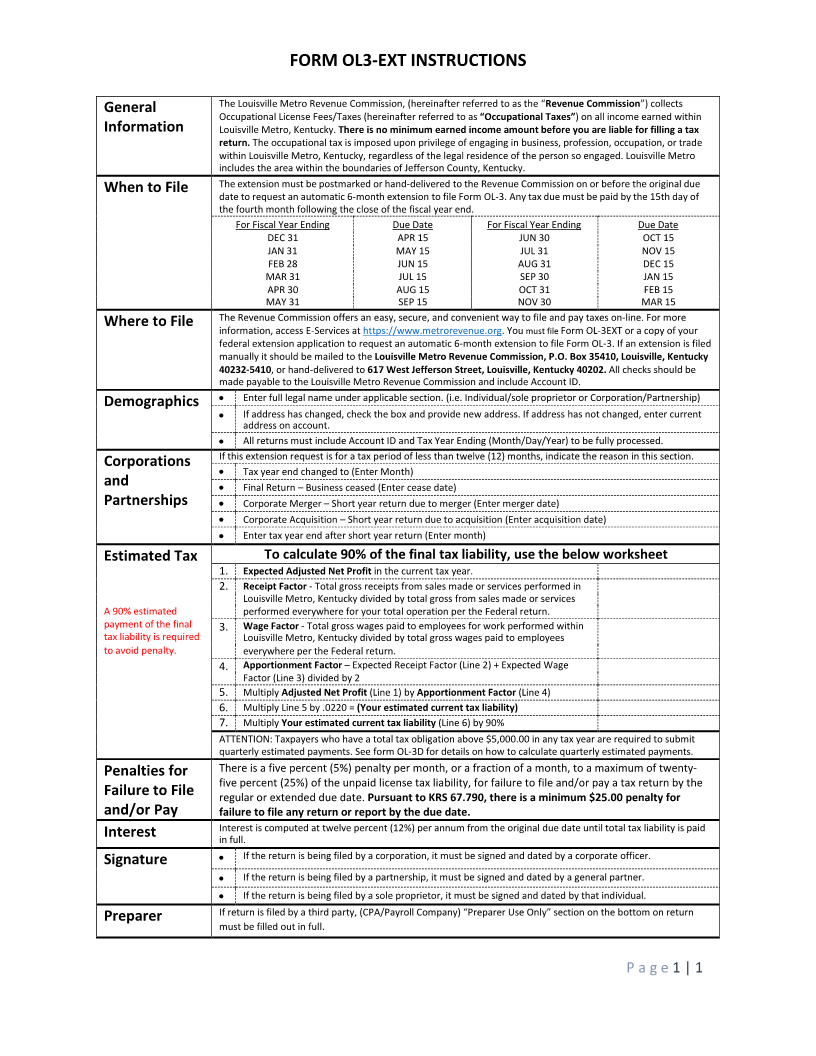

FORM OL3-EXT INSTRUCTIONS

The Louisville Metro Revenue Commission, (hereinafter referred to as the “Revenue Commission”) collects

General Occupational License Fees/Taxes (hereinafter referred to as “Occupational Taxes”) on all income earned within

Information Louisville Metro, Kentucky. There is no minimum earned income amount before you are liable for filling a tax

return. The occupational tax is imposed upon privilege of engaging in business, profession, occupation, or trade

within Louisville Metro, Kentucky, regardless of the legal residence of the person so engaged. Louisville Metro

includes the area within the boundaries of Jefferson County, Kentucky.

The extension must be postmarked or hand-delivered to the Revenue Commission on or before the original due

When to File date to request an automatic 6-month extension to file Form OL-3. Any tax due must be paid by the 15th day of

the fourth month following the close of the fiscal year end.

For Fiscal Year Ending Due Date For Fiscal Year Ending Due Date

DEC 31 APR 15 JUN 30 OCT 15

JAN 31 MAY 15 JUL 31 NOV 15

FEB 28 JUN 15 AUG 31 DEC 15

MAR 31 JUL 15 SEP 30 JAN 15

APR 30 AUG 15 OCT 31 FEB 15

MAY 31 SEP 15 NOV 30 MAR 15

The Revenue Commission offers an easy, secure, and convenient way to file and pay taxes on-line. For more

Where to File information, access E-Services at https://www.metrorevenue.org. You must file Form OL-3EXT or a copy of your

federal extension application to request an automatic 6-month extension to file Form OL-3. If an extension is filed

manually it should be mailed to the Louisville Metro Revenue Commission, P.O. Box 35410, Louisville, Kentucky

40232-5410, or hand-delivered to 617 West Jefferson Street, Louisville, Kentucky 40202. All checks should be

made payable to the Louisville Metro Revenue Commission and include Account ID.

• Enter full legal name under applicable section. (i.e. Individual/sole proprietor or Corporation/Partnership)

Demographics

• If address has changed, check the box and provide new address. If address has not changed, enter current

address on account.

• All returns must include Account ID and Tax Year Ending (Month/Day/Year) to be fully processed.

If this extension request is for a tax period of less than twelve (12) months, indicate the reason in this section.

Corporations • Tax year end changed to (Enter Month)

and • Final Return – Business ceased (Enter cease date)

Partnerships • Corporate Merger – Short year return due to merger (Enter merger date)

• Corporate Acquisition – Short year return due to acquisition (Enter acquisition date)

• Enter tax year end after short year return (Enter month)

Estimated Tax To calculate 90% of the final tax liability, use the below worksheet

1. Expected Adjusted Net Profit in the current tax year.

2. Receipt Factor - Total gross receipts from sales made or services performed in

Louisville Metro, Kentucky divided by total gross from sales made or services

A 90% estimated performed everywhere for your total operation per the Federal return.

payment of the final 3. Wage Factor - Total gross wages paid to employees for work performed within

tax liability is required Louisville Metro, Kentucky divided by total gross wages paid to employees

to avoid penalty. everywhere per the Federal return.

4. Apportionment Factor – Expected Receipt Factor (Line 2) + Expected Wage

Factor (Line 3) divided by 2

5. Multiply Adjusted Net Profit (Line 1) by Apportionment Factor (Line 4)

6. Multiply Line 5 by .0220 = (Your estimated current tax liability)

7. Multiply Your estimated current tax liability (Line 6) by 90%

ATTENTION: Taxpayers who have a total tax obligation above $5,000.00 in any tax year are required to submit

quarterly estimated payments. See form OL-3D for details on how to calculate quarterly estimated payments.

Penalties for There is a five percent (5%) penalty per month, or a fraction of a month, to a maximum of twenty-

five percent (25%) of the unpaid license tax liability, for failure to file and/or pay a tax return by the

Failure to File regular or extended due date. Pursuant to KRS 67.790, there is a minimum $25.00 penalty for

and/or Pay failure to file any return or report by the due date.

Interest is computed at twelve percent (12%) per annum from the original due date until total tax liability is paid

Interest in full.

Signature • If the return is being filed by a corporation, it must be signed and dated by a corporate officer.

• If the return is being filed by a partnership, it must be signed and dated by a general partner.

• If the return is being filed by a sole proprietor, it must be signed and dated by that individual.

If return is filed by a third party, (CPA/Payroll Company) “Preparer Use Only” section on the bottom on return

Preparer

must be filled out in full.

P a g e 1 | 1