Enlarge image

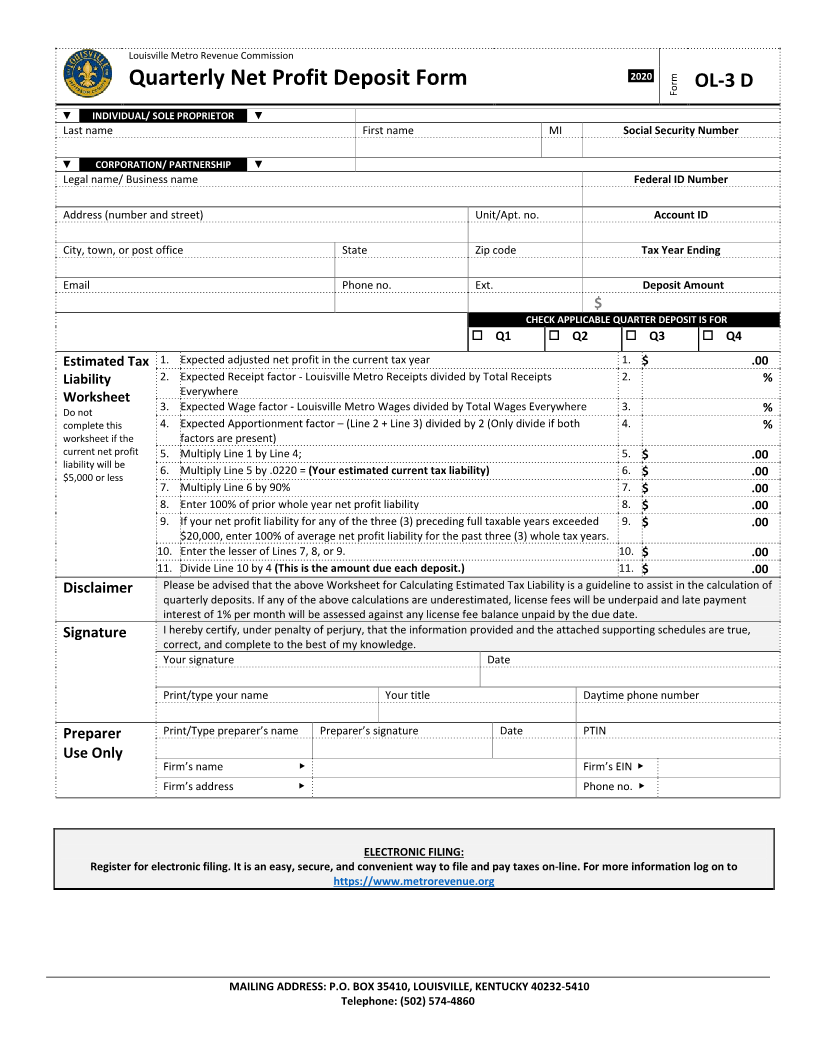

Louisville Metro Revenue Commission

2020

Quarterly Net Profit Deposit Form Form OL-3 D

▼ INDIVIDUAL/ SOLE PROPRIETOR ▼

Last name First name MI Social Security Number

▼ CORPORATION/ PARTNERSHIP ▼

Legal name/ Business name Federal ID Number

Address (number and street) Unit/Apt. no. Account ID

City, town, or post office State Zip code Tax Year Ending

Email Phone no. Ext. Deposit Amount

$

CHECK APPLICABLE QUARTER DEPOSIT IS FOR

Q1 Q2 Q3 Q4

Estimated Tax 1. Expected adjusted net profit in the current tax year 1. $ .00

Liability 2. Expected Receipt factor - Louisville Metro Receipts divided by Total Receipts 2. %

Everywhere

Worksheet

Do not 3. Expected Wage factor - Louisville Metro Wages divided by Total Wages Everywhere 3. %

complete this 4. Expected Apportionment factor – (Line 2 + Line 3) divided by 2 (Only divide if both 4. %

worksheet if the factors are present)

current net profit 5. Multiply Line 1 by Line 4; 5. $ .00

liability will be 6. Multiply Line 5 by .0220 = (Your estimated current tax liability) 6. $ .00

$5,000 or less

7. Multiply Line 6 by 90% 7. $ .00

8. Enter 100% of prior whole year net profit liability 8. $ .00

9. If your net profit liability for any of the three (3) preceding full taxable years exceeded 9. $ .00

$20,000, enter 100% of average net profit liability for the past three (3) whole tax years.

10. Enter the lesser of Lines 7, 8, or 9. 10. $ .00

11. Divide Line 10 by 4 (This is the amount due each deposit.) 11. $ .00

Disclaimer Please be advised that the above Worksheet for Calculating Estimated Tax Liability is a guideline to assist in the calculation of

quarterly deposits. If any of the above calculations are underestimated, license fees will be underpaid and late payment

interest of 1% per month will be assessed against any license fee balance unpaid by the due date.

Signature I hereby certify, under penalty of perjury, that the information provided and the attached supporting schedules are true,

correct, and complete to the best of my knowledge.

Your signature Date

Print/type your name Your title Daytime phone number

Preparer Print/Type preparer’s name Preparer’s signature Date PTIN

Use Only

Firm’s name ▶ Firm’s EIN ▶

Firm’s address ▶ Phone no. ▶

ELECTRONIC FILING:

Register for electronic filing. It is an easy, secure, and convenient way to file and pay taxes on-line. For more information log on to

https://www.metrorevenue.org

MAILING ADDRESS: P.O. BOX 35410, LOUISVILLE, KENTUCKY 40232-5410

Telephone: (502) 574-4860