Enlarge image

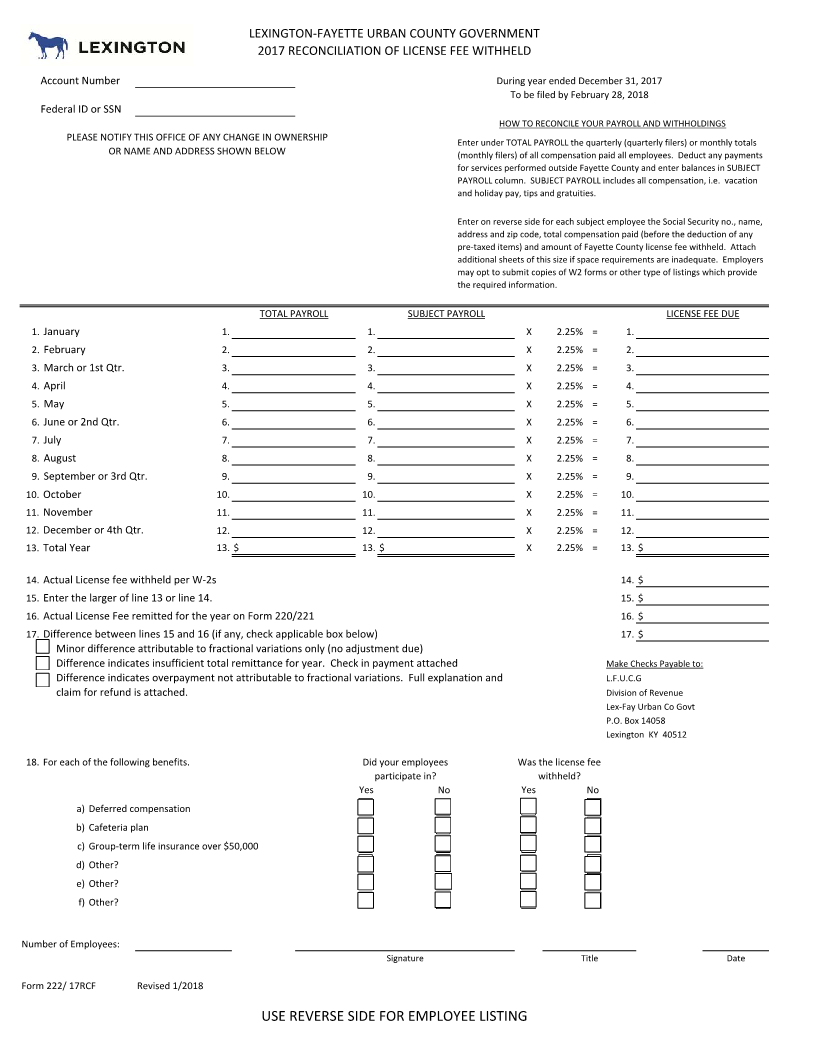

LEXINGTON-FAYETTE URBAN COUNTY GOVERNMENT

2017 RECONCILIATION OF LICENSE FEE WITHHELD

Account Number During year ended December 31, 2017

To be filed by February 28, 2018

Federal ID or SSN

HOW TO RECONCILE YOUR PAYROLL AND WITHHOLDINGS

PLEASE NOTIFY THIS OFFICE OF ANY CHANGE IN OWNERSHIP Enter under TOTAL PAYROLL the quarterly (quarterly filers) or monthly totals

OR NAME AND ADDRESS SHOWN BELOW (monthly filers) of all compensation paid all employees. Deduct any payments

for services performed outside Fayette County and enter balances in SUBJECT

PAYROLL column. SUBJECT PAYROLL includes all compensation, i.e. vacation

and holiday pay, tips and gratuities.

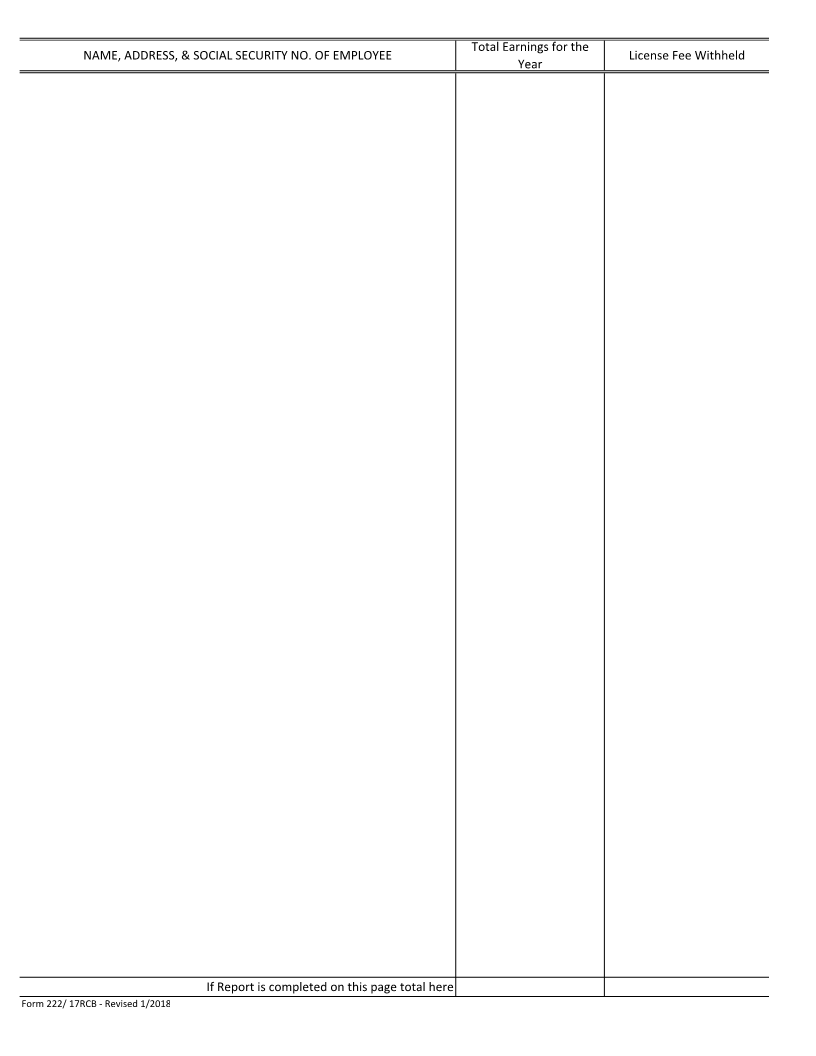

Enter on reverse side for each subject employee the Social Security no., name,

address and zip code, total compensation paid (before the deduction of any

pre-taxed items) and amount of Fayette County license fee withheld. Attach

additional sheets of this size if space requirements are inadequate. Employers

may opt to submit copies of W2 forms or other type of listings which provide

the required information.

TOTAL PAYROLL SUBJECT PAYROLL LICENSE FEE DUE

1. January 1. 1. X 2.25% = 1.

2. February 2. 2. X 2.25% = 2.

3. March or 1st Qtr. 3. 3. X 2.25% = 3.

4. April 4. 4. X 2.25% = 4.

5. May 5. 5. X 2.25% = 5.

6. June or 2nd Qtr. 6. 6. X 2.25% = 6.

7. July 7. 7. X 2.25% = 7.

8. August 8. 8. X 2.25% = 8.

9. September or 3rd Qtr. 9. 9. X 2.25% = 9.

10. October 10. 10. X 2.25% = 10.

11. November 11. 11. X 2.25% = 11.

12. December or 4th Qtr. 12. 12. X 2.25% = 12.

13. Total Year 13. $ 13. $ X 2.25% = 13. $

14. Actual License fee withheld per W-2s 14. $

15. Enter the larger of line 13 or line 14. 15. $

16. Actual License Fee remitted for the year on Form 220/221 16. $

17. Difference between lines 15 and 16 (if any, check applicable box below) 17. $

Minor difference attributable to fractional variations only (no adjustment due)

Difference indicates insufficient total remittance for year. Check in payment attached Make Checks Payable to:

Difference indicates overpayment not attributable to fractional variations. Full explanation and L.F.U.C.G

claim for refund is attached. Division of Revenue

Lex-Fay Urban Co Govt

P.O. Box 14058

Lexington KY 40512

18 For each of the following benefits.. Did your employees Was the license fee

participate in? withheld?

Yes No Yes No

a) Deferred compensation

b) Cafeteria plan

c) Group-term life insurance over $50,000

d) Other?

e) Other?

f) Other?

Number of Employees:

Signature Title Date

Form 222/ 17RCF Revised 1/2018

USE REVERSE SIDE FOR EMPLOYEE LISTING