Enlarge image

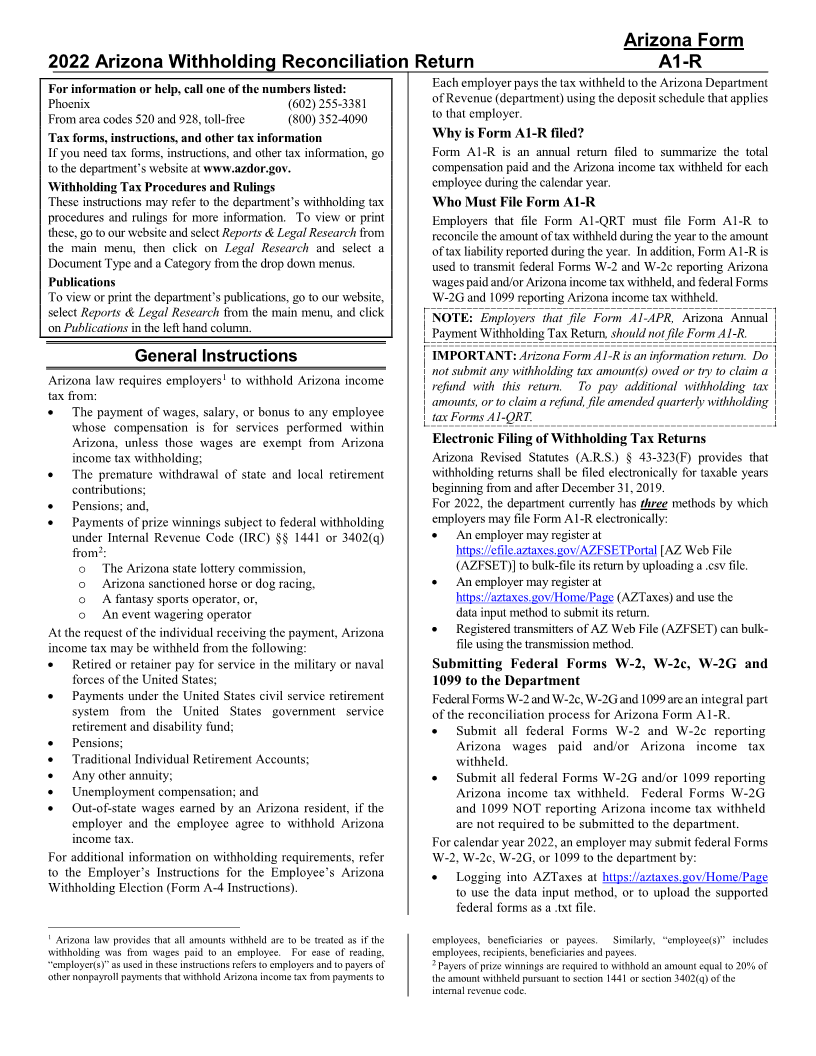

Arizona Form

2022 Arizona Withholding Reconciliation Return A1-R

For information or help, call one of the numbers listed: Each employer pays the tax withheld to the Arizona Department

Phoenix (602) 255-3381 of Revenue (department) using the deposit schedule that applies

to that employer.

From area codes 520 and 928, toll-free (800) 352-4090

Tax forms, instructions, and other tax information Why is Form A1-R filed?

If you need tax forms, instructions, and other tax information, go Form A1-R is an annual return filed to summarize the total

to the department’s website atwww.azdor.gov. compensation paid and the Arizona income tax withheld for each

Withholding Tax Procedures and Rulings employee during the calendar year.

These instructions may refer to the department’s withholding tax Who Must File Form A1-R

procedures and rulings for more information. To view or print Employers that file Form A1-QRT must file Form A1-R to

these, go to our website and select Reports & Legal Research from reconcile the amount of tax withheld during the year to the amount

the main menu, then click on Legal Research and select a of tax liability reported during the year. In addition, Form A1-R is

Document Type and a Category from the drop down menus. used to transmit federal Forms W-2 and W-2c reporting Arizona

Publications wages paid and/or Arizona income tax withheld, and federal Forms

To view or print the department’s publications, go to our website, W-2G and 1099 reporting Arizona income tax withheld.

select Reports & Legal Research from the main menu, and click NOTE: Employers that file Form A1-APR, Arizona Annual

onPublications in the left hand column. Payment Withholding Tax Return, should not file Form A1-R.

IMPORTANT: Arizona Form A1-R is an information return. Do

General Instructions not submit any withholding tax amount(s) owed or try to claim a

Arizona law requires employers 1to withhold Arizona income

refund with this return. To pay additional withholding tax

tax from: amounts, or to claim a refund, file amended quarterly withholding

• The payment of wages, salary, or bonus to any employee tax Forms A1-QRT.

whose compensation is for services performed within

Arizona, unless those wages are exempt from Arizona Electronic Filing of Withholding Tax Returns

income tax withholding; Arizona Revised Statutes (A.R.S.) § 43-323(F) provides that

• The premature withdrawal of state and local retirement withholding returns shall be filed electronically for taxable years

contributions; beginning from and after December 31, 2019.

• Pensions; and, For 2022, the department currently has three methods by which

• Payments of prize winnings subject to federal withholding employers may file Form A1-R electronically:

under Internal Revenue Code (IRC) §§ 1441 or 3402(q) • An employer may register at

from2: https://efile.aztaxes.gov/AZFSETPortal [AZ Web File

o The Arizona state lottery commission, (AZFSET)] to bulk-file its return by uploading a .csv file.

o Arizona sanctioned horse or dog racing, • An employer may register at

o A fantasy sports operator, or, https://aztaxes.gov/Home/Page (AZTaxes) and use the

o An event wagering operator data input method to submit its return.

At the request of the individual receiving the payment, Arizona • Registered transmitters of AZ Web File (AZFSET) can bulk-

income tax may be withheld from the following: file using the transmission method.

• Retired or retainer pay for service in the military or naval Submitting Federal Forms W-2, W-2c, W-2G and

forces of the United States; 1099 to the Department

• Payments under the United States civil service retirement Federal Forms W-2 and W-2c, W-2G and 1099 are an integral part

system from the United States government service of the reconciliation process for Arizona Form A1-R.

retirement and disability fund; • Submit all federal Forms W-2 and W-2c reporting

• Pensions; Arizona wages paid and/or Arizona income tax

• Traditional Individual Retirement Accounts; withheld.

• Any other annuity; • Submit all federal Forms W-2G and/or 1099 reporting

• Unemployment compensation; and Arizona income tax withheld. Federal Forms W-2G

• Out-of-state wages earned by an Arizona resident, if the and 1099 NOT reporting Arizona income tax withheld

employer and the employee agree to withhold Arizona are not required to be submitted to the department.

income tax. For calendar year 2022, an employer may submit federal Forms

For additional information on withholding requirements, refer W-2, W-2c, W-2G, or 1099 to the department by:

to the Employer’s Instructions for the Employee’s Arizona • Logging into AZTaxes at https://aztaxes.gov/Home/Page

Withholding Election (Form A-4 Instructions). to use the data input method, or to upload the supported

federal forms as a .txt file.

1 Arizona law provides that all amounts withheld are to be treated as if the employees, beneficiaries or payees. Similarly, “employee(s)” includes

withholding was from wages paid to an employee. For ease of reading, employees, recipients, beneficiaries and payees.

“employer(s)” as used in these instructions refers to employers and to payers of 2 Payers of prize winnings are required to withhold an amount equal to 20% of

other nonpayroll payments that withhold Arizona income tax from payments to the amount withheld pursuant to section 1441 or section 3402(q) of the

internal revenue code.